Jeffrey Puzzullo is the fourth person to plead guilty in the now-notorious Legacy Cares case.

-

Washington D.C.'s Chief Financial Officer is backing the city's Attorney General in defying Congressional action aimed at preventing another tax policy decoupling from the One Big Beautiful Bill Act.

-

Market Intelligence analyst Jeff Lipton distills what he heard onstage and in the hallways at The Bond Buyer's 2026 National Outlook, from policy uncertainty and the muni tax exemption to AI's growing role and credit risk hotspots.

-

The California complaint was filed 12 years ago.

-

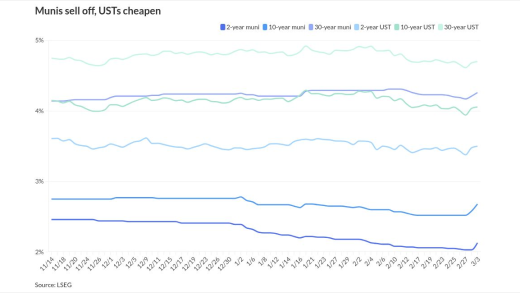

Market Intelligence analyst Jeff Lipton assesses the early impacts of Operation Epic Fury on rates, spreads, shifting inflation expectations, and flows, arguing that elevated tax-exempt income, disciplined sector allocation and a quality bias can help muni investors navigate headline-driven volatility.

-

While near-term uncertainty is inevitable, the court's decision should be accretive to growth expectations and somewhat disinflationary.

-

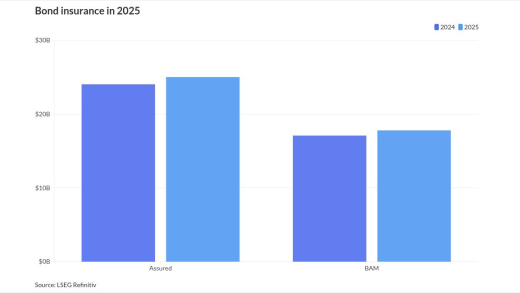

In this third of a three-part 2026 municipal bond outlook series, Market Intelligence analyst Jeff Lipton explains how another year of heavy supply, surging ETF and SMA assets, climate and cyber risk, and growing use of bond insurance will drive muni market structure and strategy for both sell-side and buy-side stakeholders.

Brightline asked S&P to withdraw its rating after the latest downgrade.

Rapidly rising property values have led many Republican legislators to back measures that would substantially reduce local government property taxes.

The New Jersey Turnpike Authority will build a bridge half the size it once planned, providing budgetary savings of $4 billion.

Washington, D.C.'s Office of the Chief Financial Officer released a revenue report showing higher than expected tax revenues and a local economy that's struggling.

Le will work out of Oppenheimer's Los Angeles office and will focus on California while also supporting clients across the west, the release noted.

-

While fixed-spread tenders may be a novelty for tax-exempt bonds, they have been around for over 40 years for corporate bonds.

-

With large language models parsing EMMA filings and investor relations sites, municipal issuers must modernize their disclosure so both humans and algorithms can accurately understand their credit story and avoid unintended red flags.

-

Serving on MSRB's Board of Directors over the past four years has been a privilege and an honor.

-

Introducing The Bond Buyer's newest Muni Hall of Famers who will be honored at an awards dinner in Boston on Sept. 30, 2025.

-

"I have been very fortunate to contribute to a fascinating sector of the financial industry that is full of ambiguous issues and data," said Tom Doe. "I am flattered to be included in the Hall of Fame, it is a wonderful capstone to my career."

-

Over nearly 40 years, investment banker Diana Hoadley built a legacy of far-ranging vision and collaboration that left a trail of professional admirers.

"I love solving complicated problems faced by our local governmental clients," Leslie Bacon. "We come up with strategic solutions that have a real impact on our communities."

"The intersection between the public impact and the financial markets is unique and it brings a lot of good people to the same place. I really enjoy being a part of this community," Connor Benoit said.

Roosevelt & Cross president and executive director of public finance Elaine Brennan receives the 2025 Freda Johnson Award for the private sector.

-

The offer was revealed in a disclosure statement and plan of reorganization in the Chapter 11 bankruptcy.

-

Moody's cited the district's narrowing financial position as its available fund balance sank to 4.8% of revenue in fiscal 2025.

-

Los Angeles' weakening fiscal picture and the city utility's exposure to lawsuit liability from the 2025 Palisades fire were cited for the downgrades.

-

Currently, the 15-member board consists of eight public representatives and seven regulated representatives.

-

Monday saw a more muted tone, but Tuesday munis are playing a little bit of a catch-up to the backup in rates, said Chris Brigati, managing director and CIO at SWBC.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Intraday News UpdateDelivered Every WeekdayGet notified on breaking news and events.

- Primary Market ReportWeeklyRecap of articles on new issuance as well as Featured Deals on the week.

- Weekly Top 10WeeklyRecap of the 10 most read Bond Buyer articles of the past week.

Gilmore & Bell and Nixon Peabody were new entrants in the top 10, bumping Greenberg Traurig and Bracewell to the top 15.

- ON-DEMAND VIDEO

KC Mathews, executive vice president and chief market strategist at Commerce Trust breaks down the FOMC meeting.

- ON-DEMAND VIDEO

Pamela Frederick and Adam Barsky will share their views on the importance of the tax-exemption, how it benefits state and local governments, taxpayers, and U.S. retail investors -- and keeps the country competitive on a global scale.

- ON-DEMAND VIDEO

Gary Hall, President of the Infrastructure & Public Finance Division at Siebert Williams Shank & Co., joins Bond Buyer Executive Editor Lynne Funk to talk about the importance of the muni industry in financing the country's extensive infrastructure needs -- from ports and airports to bridges and energy solutions.