-

Market Intelligence analyst Jeff Lipton analyzes how varied state funding priorities and overall charter school support, shifting enrollment patterns, policy uncertainty, charter renewal risk, and varied pension practices affect charter school bond security—and outlines what issuers, advisors and investors should be communicating to the market.

February 3 -

In this third of a three-part 2026 municipal bond outlook series, Market Intelligence analyst Jeff Lipton explains how another year of heavy supply, surging ETF and SMA assets, climate and cyber risk, and growing use of bond insurance will drive muni market structure and strategy for both sell-side and buy-side stakeholders.

January 8 The Bond Buyer

The Bond Buyer -

Market Intelligence analyst Jeff Lipton, in the second installment of his three-part 2026 outlook series, maps out quality-centric portfolio shifts, barbell and long-end strategies, and sector tilts across hospitals, higher education and housing as record supply and net inflows drive the muni market.

January 7 The Bond Buyer

The Bond Buyer -

"The steps that would be necessary to restore a sound fiscal profile are becoming increasingly drastic," the rating agency said in downgrading Jersey City.

December 15 -

Market Intelligence analyst Jeff Lipton finds that low debt burdens, stronger rainy-day funds, improved pension metrics and robust legal safeguards help states remain a core source of stability and diversification for muni portfolios despite slowing growth and fiscal headwinds.

December 9 The Bond Buyer

The Bond Buyer -

States face broadening credit challenges, and while local governments have shown resilience, school districts are more at risk, S&P Global Ratings said.

December 8 -

A mix of broader market dynamics and Chicago-specific pressures is driving the widening spreads, investors said.

September 10 -

Chicago will host its annual investor conference on Thursday as Mayor Brandon Johnson's administration faces challenges including a $1.12 billion deficit.

May 14 -

Fitch Ratings ranks the credit as AA, up from AA-minus.

November 1 -

Geography is playing a role in financial health as debt issuance rises.

October 24 -

Moody's has lifted the credit ratings on five special tax bonds.

October 8 -

The growing federal debt level may pressure lawmakers to retract or reduce the tax-exemption for munis to generate revenue, some market participants argue.

April 17 -

John Hallacy of John Hallacy Consulting and Rich Ciccarone, president emeritus of Merritt Research Services, talk with Chip Barnett about the municipal bond business over the past 40 years. They take a look back at where the industry has been, where it is and where it will be going.

April 2 -

With economic uncertainty ahead and the Federal Reserve potentially shifting to interest-rate cuts, analysts should take a closer look at individual issuers' financial disclosures.

February 26 Build America Mutual

Build America Mutual - MuniThink Property insurance: A direct link between climate risk and municipal bond creditworthiness

The current property insurance crisis in several states may dramatically shorten the climate risk horizon for municipal investors. The municipal market's relaxed attitude toward climate risk may be seriously challenged in the years ahead.

January 12 DPC Data

DPC Data -

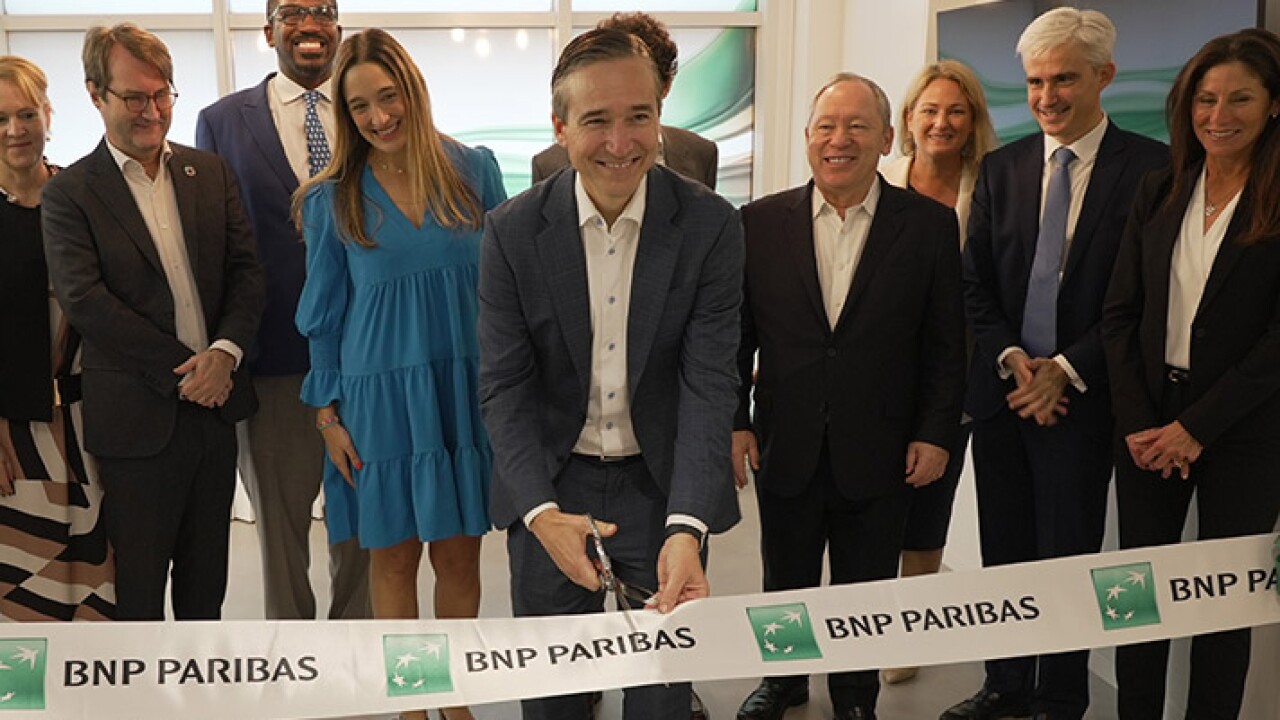

"BNP Paribas choosing Miami to open its newest office reinforces our community's status as a top financial market within the global economy," said Miami-Dade County Mayor Daniella Levine Cava.

December 7 -

Teacher shortages and enrollment declines due to growing charter and private schools are two of the problems affecting school financing.

November 6 -

"Dave has always worked hard, maintained the highest analytic integrity and role modeled independent thought," said Eden Perry, S&P head of U.S public finance. "He will be missed."

May 2 -

While some sectors have fared better than others, those requiring construction struggle as costs rise.

February 8 -

Enrollment and inflation-adjusted net tuition trends are negative.

November 23