-

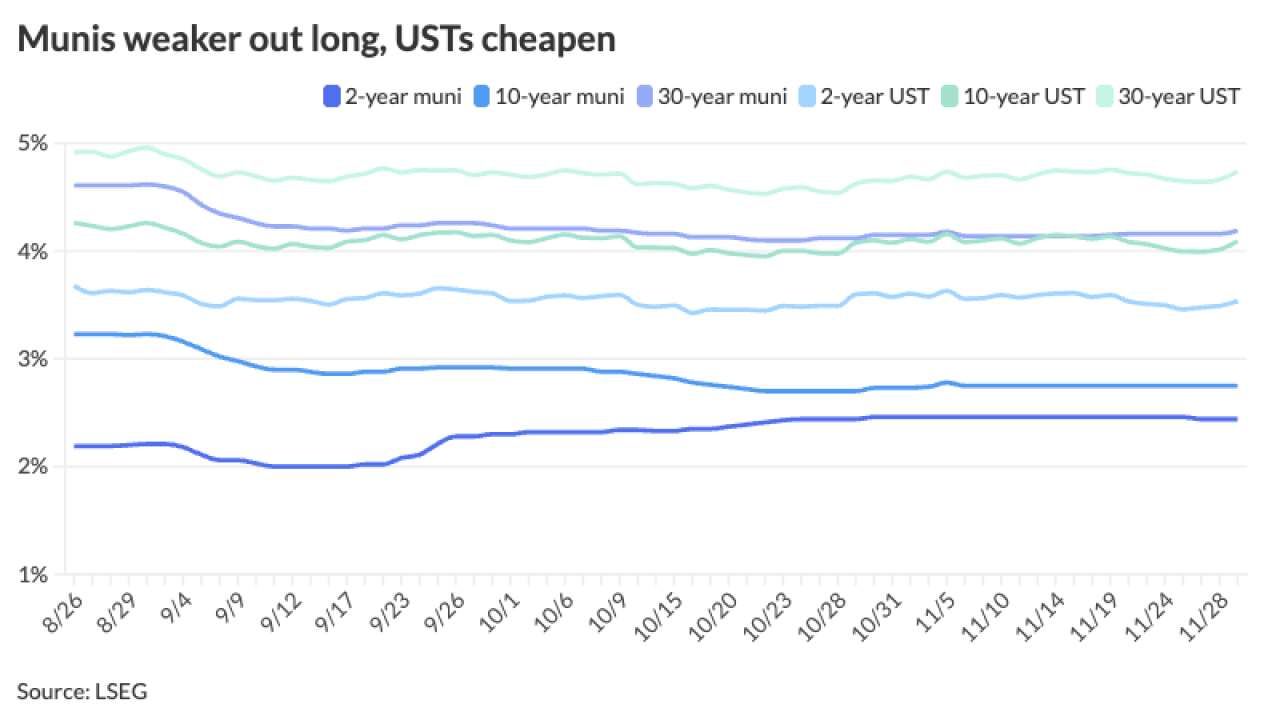

Muni yields were little changed, and have barely moved over the past several trading sessions, said Kim Olsan, senior fixed income portfolio manager at NewSquare.

December 10 -

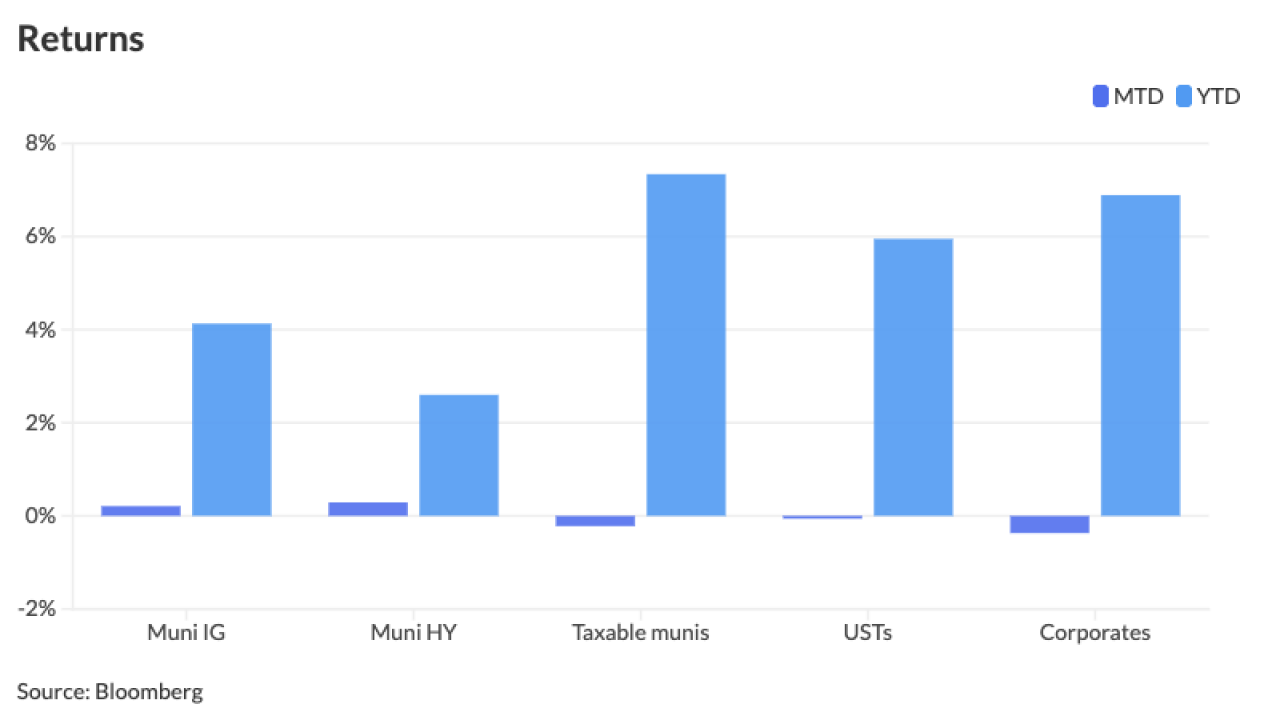

While muni returns moved lower last week, year-to-date returns still hover around 4%, said Jason Wong, vice president of municipals at AmeriVet Securities.

December 9 -

Concerns about Brightline have dragged down performance in the high yield sector this year.

December 9 -

Issuers mostly avoided pricing deals in the previous weeks the Fed met this year, but that's not the case this week, said Pat Luby, head of municipal strategy at CreditSights, and Wilson Lees, an analyst at the firm.

December 8 -

The tax-exempt muni market has performed "exceptionally well" so far this week, outperforming USTs, said J.P. Morgan strategists led by Peter DeGroot.

December 5 -

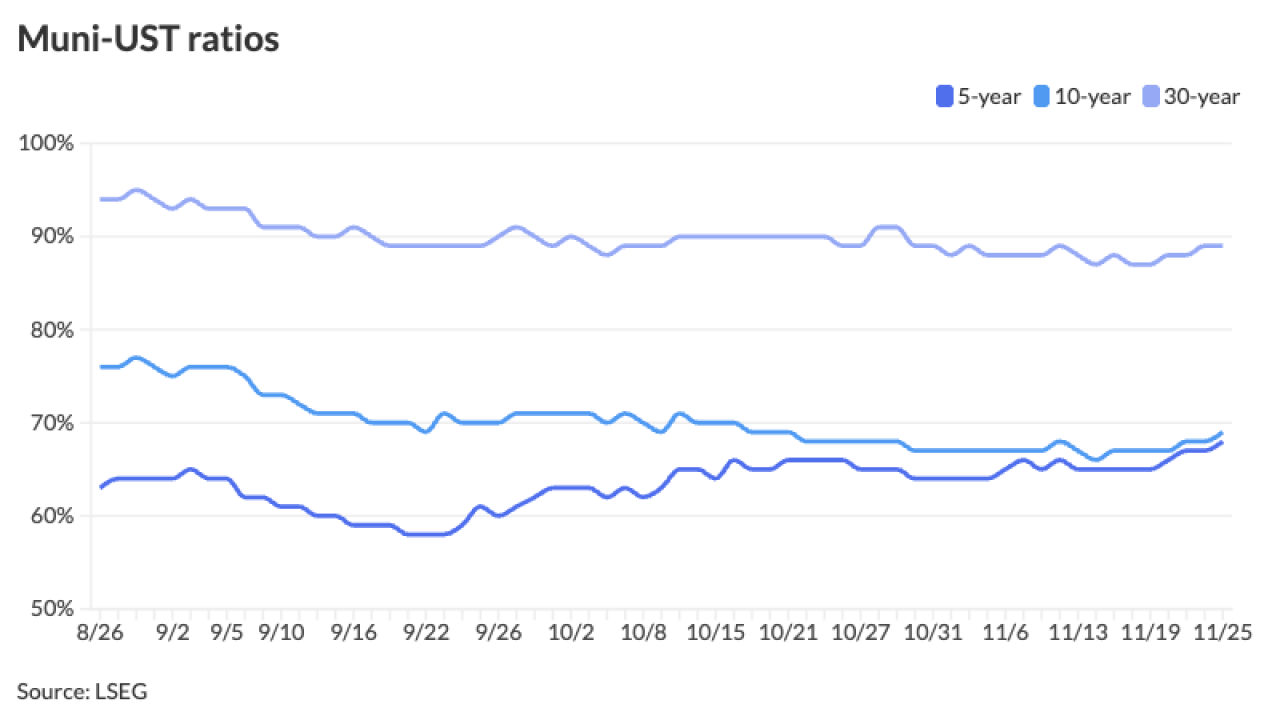

Robust issuance this year has contributed to muni underperformance relative to other asset classes, but it also has "improved after-tax relative value for investors in higher tax brackets," said Sam Weitzman of Western Asset.

December 4 -

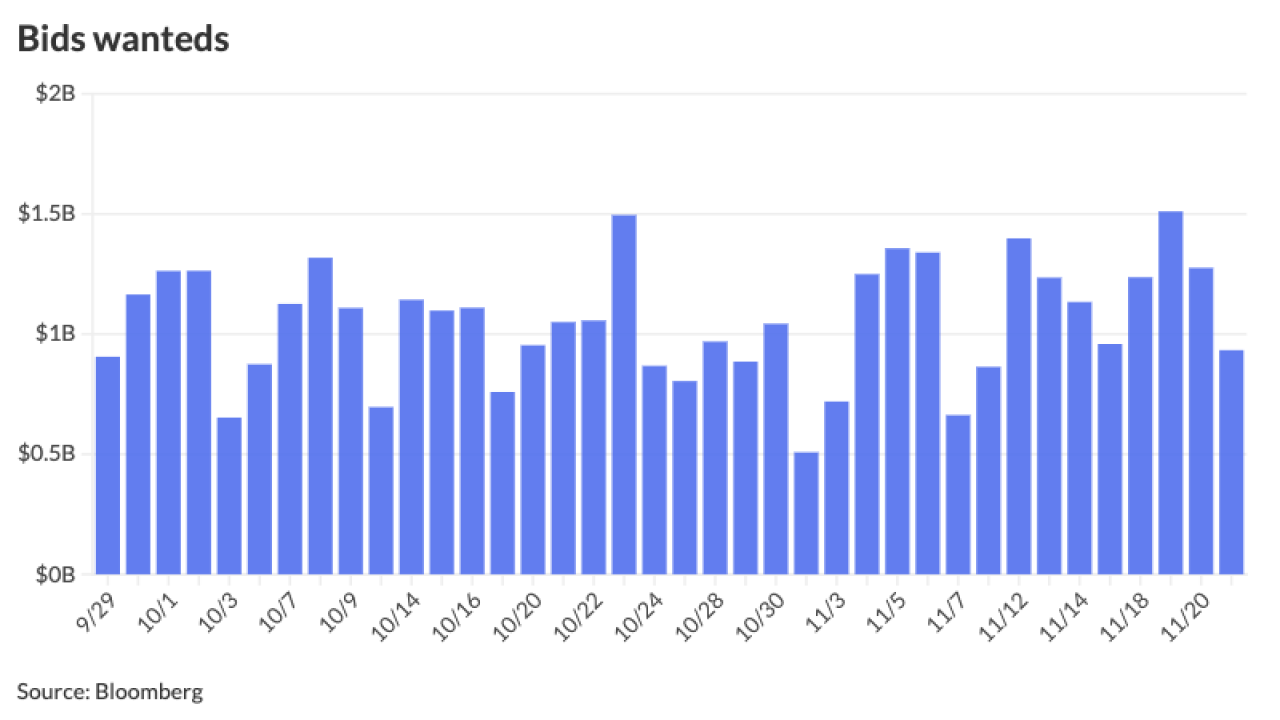

The muni market is dealing with elevated supply this week and secondary flows have "reacted in tandem," said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

-

This movement comes on the heels of muni yields remaining relatively unchanged throughout November.

December 2 -

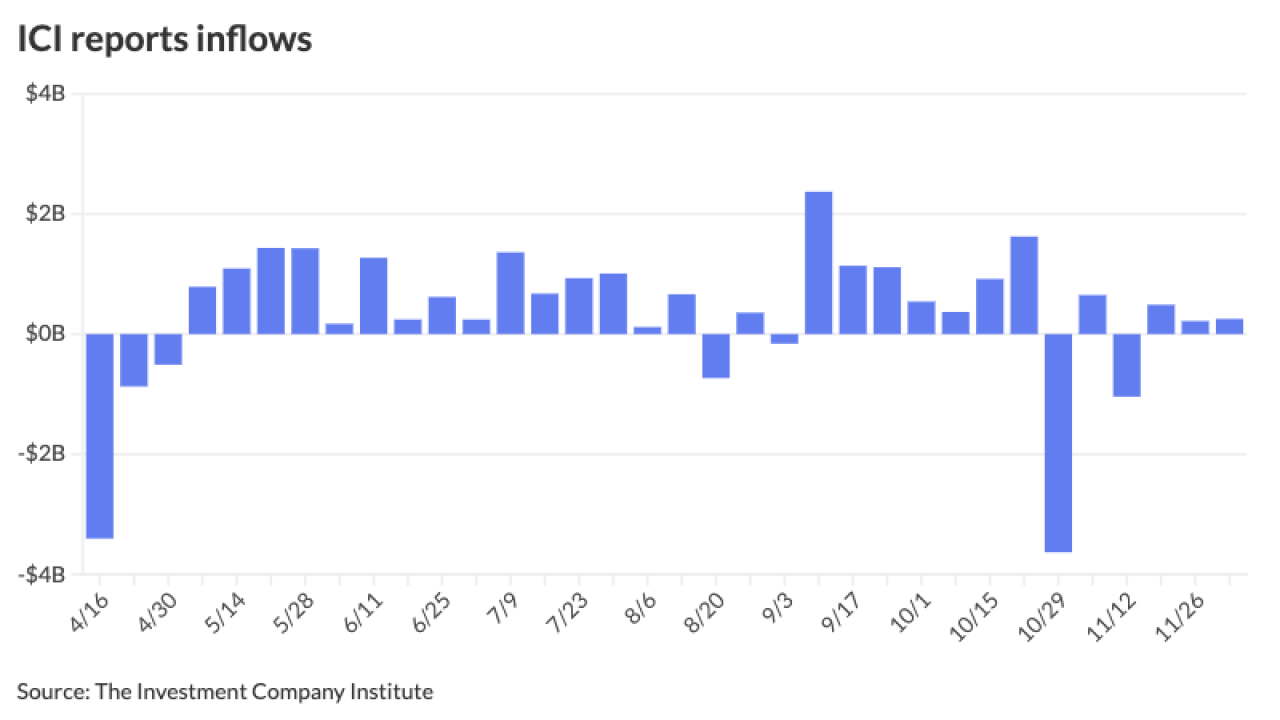

The muni market recorded its fourth straight month of positive returns in November and December is likely to keep the streak going with another strong month to round out the year.

December 1 -

Preliminary November issuance figures are at $37.054 billion, up 45.5% year-over-year, according to LSEG.

November 26 -

"Dealer inventories have grown heavier throughout [November], which could put pressure on the market if supply reverts to its weekly average of over $10 billion," said Chris Brigati, CIO and managing director of SWBC, and Ryan Riffe, SVP of capital markets at the firm.

November 25 -

"We do not expect any major weakness to take hold as the new issue calendar is beginning to dwindle with only two non-holiday or non-Federal Reserve weeks left in the year," said Birch Creek strategists.

November 24 -

Bonds have traded up since the company last week announced a tentative bondholder deal and project update and financing details.

November 24 -

The new-issue calendar falls to an estimated $1.154 billion, with $939.1 million negotiated deals on tap and $214.8 million of competitives.

November 21 -

The deal would give the company time to seek additional equity, debt and federal funds.

November 21 -

The long-awaited jobs report paints a mixed picture for market participants: nonfarm payrolls increased by a greater-than-expected119,000 in September, but the unemployment rate rose to 4.4%.

November 20 -

The market is in a bit of a lull right now as it braces for a deluge of economic data, which could spark volatility, said Jeff Timlin, a partner at Sage Advisory.

November 19 -

The muni market has "demonstrated more conviction with steady demand and appealing relative yields weighing on the long-end while shifting dynamics on the short-end have led to municipals selling-off," said Tim Iltz, fixed income credit and market analyst at HJ Sims.

November 18 -

The "data dumps" over the next several weeks could lead to market volatility, said Abdulla Begai, director and fixed income portfolio management at A&M Private Wealth Partners.

November 17 -

Issuance year-to-date is at $505.245, just shy of 2024's record of $507.585 billion, with $11.109 billion of supply on the calendar for the week of Nov. 17.

November 14