Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

For munis, the end of the shutdown helps steady the backdrop, said James Pruskowski, an investor and market strategist.

November 13 -

"Continuing yield stability ... suggests a comfortable market that, even with the shutdown apparently close to ending, may resist/lag potential price/yield changes in taxables," said Matt Fabian, president of Municipal Market Analytics.

November 12 -

The new hires in four major offices bring expertise and regional coverage to better serve the firm's clients, and Loops plans to expand further to build on its existing strengths.

November 12 -

Some of the most active sectors have been education (+29%), GOs (+17%) and healthcare (+17%), said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

November 10 -

The muni market may see additional volatility due to "uncertainties related to the future of tariffs and stronger inflation prints," said Barclays strategists led by Mikhail Foux.

November 7 -

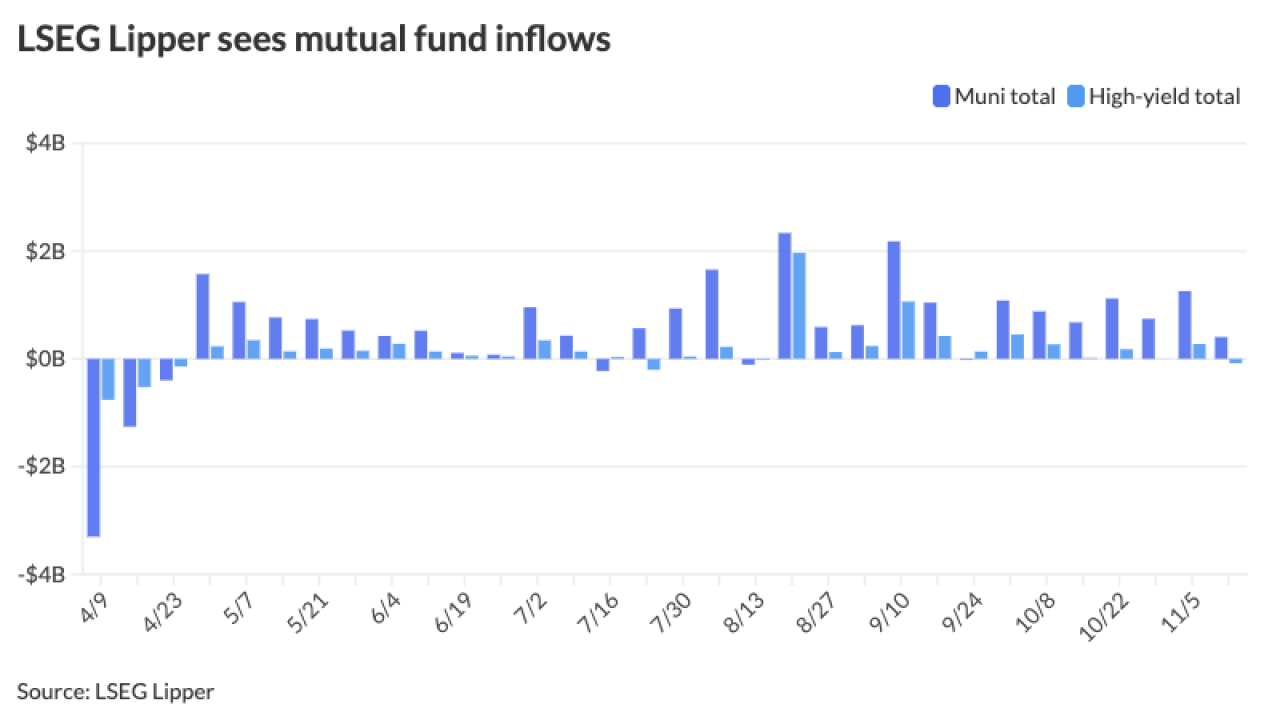

Investors added $1.266 billion to municipal bond mutual funds in the week ended Wednesday, following $744.3 million of inflows the prior week, according to LSEG Lipper data.

November 6 -

While the market navigates a surge in supply, another focus area has become elections and their potential to shift market demand, as several regional election results will likely garner greater attention over the next few months, said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

November 5 -

A rundown of the largest bond referendums.

By Gary SiegelNovember 5 -

Municipal bond insurance volume grew 17.7% year-over-year in the first three quarters of 2025, according to LSEG, outpacing the municipal market as a whole.

November 4 -

"Normalized supply, a supportive rate environment and favorable technicals propelled the municipal market to the best October performance [in decades]," said Robert J. Lind.

November 3 -

Issuance year-to-date is $493.063 billion, up 9.3% from $451.079 billion over the same period. With issuance estimated at $13.118 billion in the first week of November, 2024's $500-plus billion record should fall within the next week or two.

October 31 -

Technicals are supposed to become slightly more favorable into year-end, said Jeremy Holtz, a portfolio manager at Income Research + Management.

October 30 -

"The knee-jerk reaction of the markets to the Fed meeting (and press conference) was to sell stocks and bonds, because [Fed] Chairman Jerome Powell said that an additional rate cut in December wasn't a sure thing," said Northlight Asset Management Chief Investment Officer Chris Zaccarelli.

October 29 -

The softer-than-expected September consumer price index report, released Friday, reinforced confidence in the likelihood of a Fed rate cut at its October meeting and potentially at its December meeting, said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

October 28 -

Issuance is light this week, with $5.367 billion on tap, and it should be "easily distributed," J.P. Morgan strategists said.

October 27 -

"Investors were not disappointed," said John Kerschner, global head of securitized products and portfolio manager at Janus Henderson. "Inflation came in softer than expected, leading to a tepid bond market rally" and ensuring a rate cut at the upcoming Federal Open Market Committee meeting.

October 24 -

"We're not going to be having huge reinvestment months over the next few months, not until the beginning of the year. So we need this flow [of deals] to keep up with demand, and we expect that to continue," said Jennifer Johnston, director of municipal bonds research at Franklin Templeton.

October 23 -

The tax-exempt market is expected to be "biased higher" in the coming weeks and months as the expected heavy pace of issuance this month will not be as "oppressive" as feared, said Pat Luby, head of municipal strategy at CreditSights.

October 22 -

Prior to Dimensional's approval, only Vanguard held a patent to the ETF-as-a-share-class structure, but the patent expired in 2023.

October 22 -

Demand may strengthen as "investors anticipate the Federal Reserve's likely path of rate cuts, which would drive yields even lower," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

October 21