-

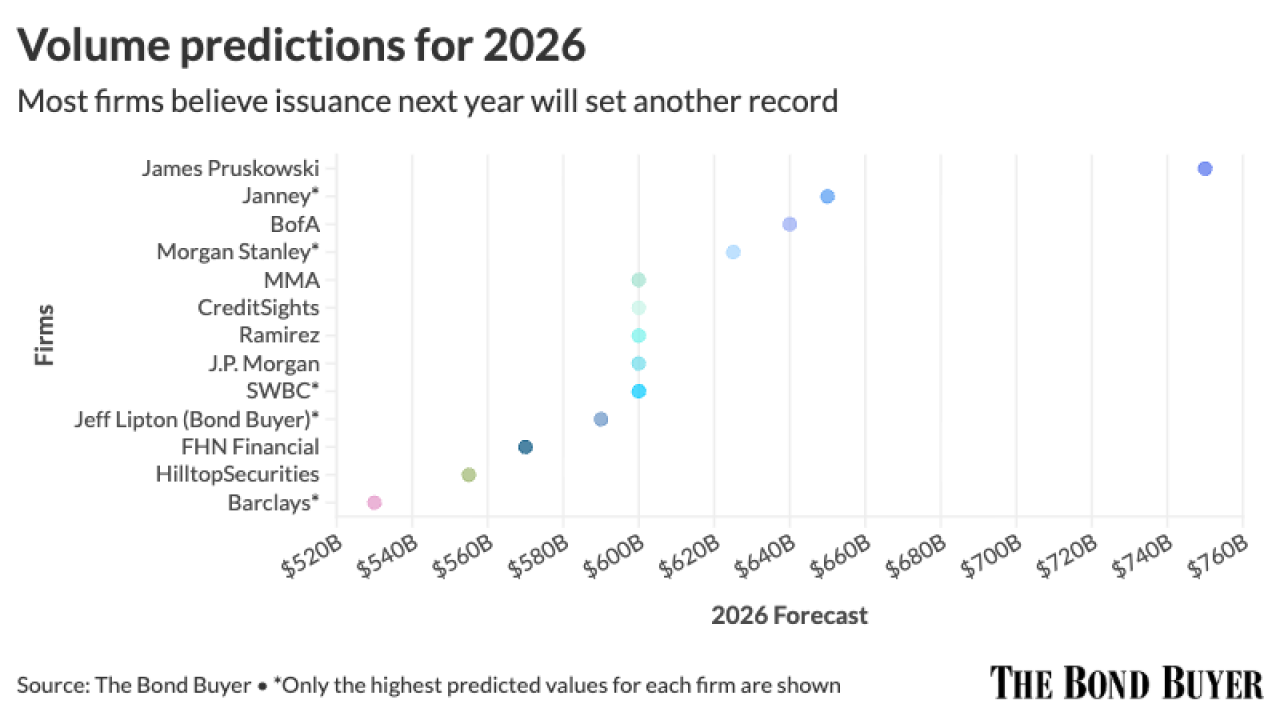

Municipal bond supply projections for next year range from a high of $750-plus billion to a low of $520 billion, with most firms expecting issuance to hover around $600 billion, easily surpassing 2025's record.

December 10 -

November volume was $38.487 billion, up 51.1% from $25.47 billion in 2024. This is above November's 10-year average of $33.743 billion.

December 1 -

Muni experts discussed how macroeconomic concerns and a volatile political environment are affecting the market as the market chalks up another record year of issuance.

November 4 -

Issuance year-to-date is $493.063 billion, up 9.3% from $451.079 billion over the same period. With issuance estimated at $13.118 billion in the first week of November, 2024's $500-plus billion record should fall within the next week or two.

October 31 -

Supply is expected to rebound in October, when BofA Securities estimates that issuance will reach $58 billion.

October 1 -

Issuance year-to-date is at $386.689 billion, up 14.9% from $336.478 billion over the same period in 2024.

September 2 -

Dan Hartman of PFM attributed the drop to fewer prepaid gas deals, one-time large transactions last year like Jefferson County's and normal timing variations.

August 21 -

Municipal bond insurance volume grew 12.6% in the first half of 2025 year-over-year, according to LSEG data.

August 18 -

Electric power bond issuance was up 47.8% and educatron issuance was up 31.6% from the first half of 2024.

August 18 -

The market saw elevated issuance, with an average of $10 billion to $12 billion of supply per week.

August 18 -

This is the fourth consecutive month where issuance has topped $50 billion.

August 1 -

Year-to-date volume stands at $310.166 billion, up 17.4% from $264.151 billion at the same time last year, prompting several firms to revisit their supply projections for the year.

July 24 -

The growth of the muni market comes as issuance surges, with the first half of the year seeing $280.64 billion of supply, up 14.3% year-over-year, according to LSEG.

July 3 -

Issuance this year has been "relentless" since the start of the year, while historically the "new-issue machine" takes a while to get rolling, said Scott Diamond, co-head of AM Municipal Fixed Income at Goldman Sachs.

July 1 -

The top five May bond financings totaled more than $5 billion.

June 9 -

Primary bond market volume was up 3.6% year-over-year to $49.9 billion, according to LSEG data.

June 2 -

April's volume was revised upward to $45.825 billion in 727 issues, up 2% from $44.945 billion in 707 issues in the same period in 2024, according to revised LSEG data.

May 1 -

April's volume was $41.178 billion in 660 issues, down 8.4% from $44.945 billion in 707 issues in the same period in 2024, according to LSEG data. This is still above the 10-year average of $35.436 billion.

April 30 -

Yields rose significantly for the fourth time this week as the aftereffects of President Donald Trump's tariffs continue to plague the financial markets.

April 11 -

"It seems like hitting last year's volumes should be within the strike zone for the marketplace," said Kyle Javes, a managing director and head of municipal fixed income at Piper Sandler.

March 31