-

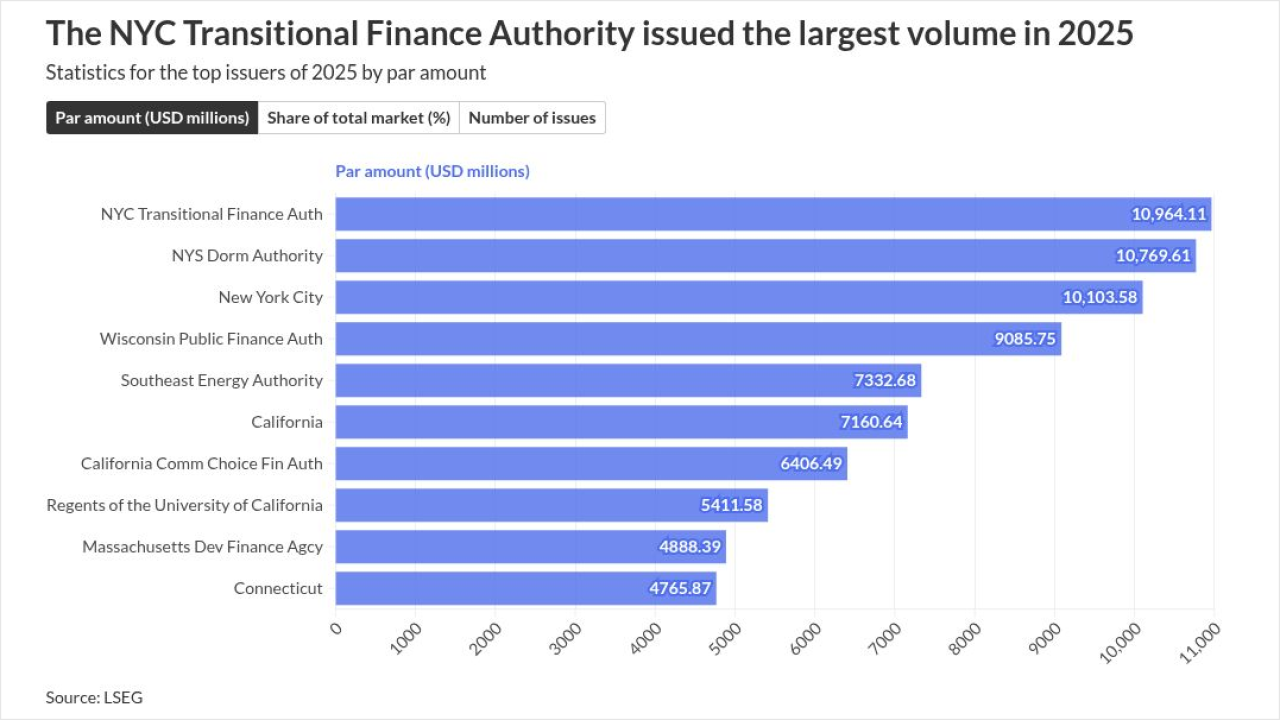

The top 10 issuers accounted for $76.889 billion of the total issuance for the year, or 13.5%.

January 15 -

The top three financial advisors have remained the same over the past several quarters: PFM in first, PRAG in second and HilltopSecurities in third.

January 14 -

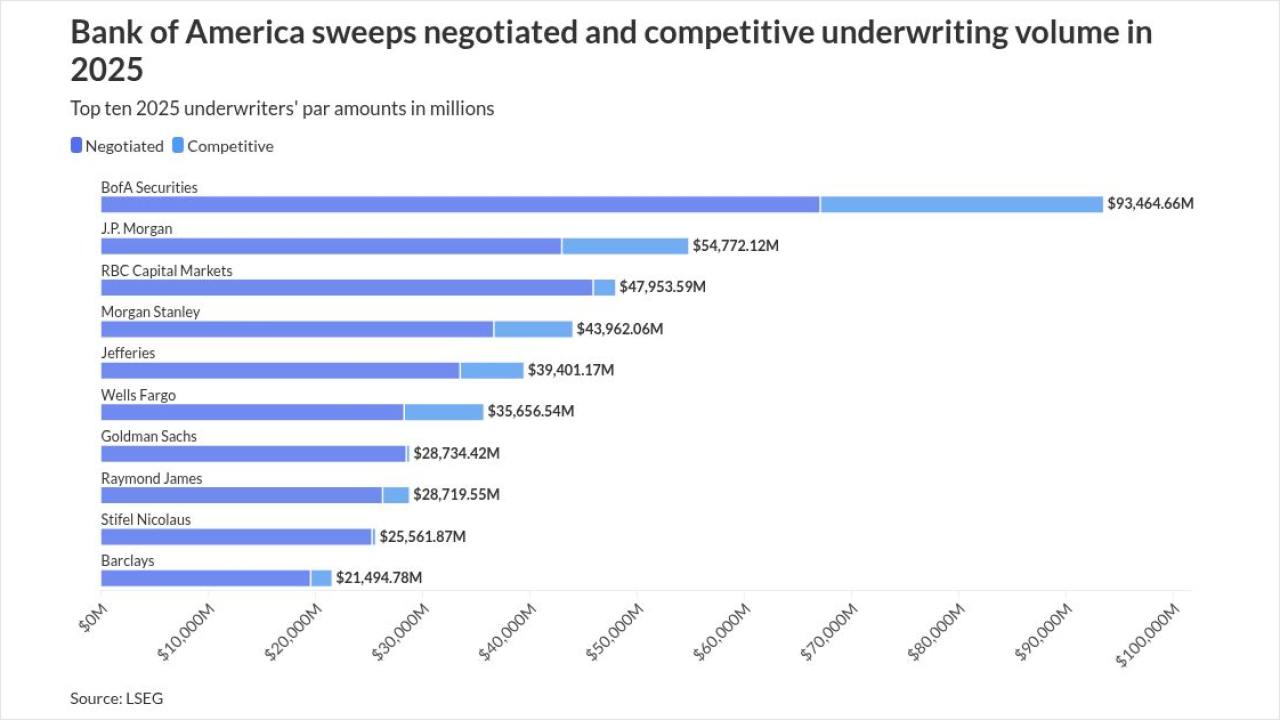

Overall, the top underwriters saw minor shuffling last year, and no new firms entered the top 10.

January 13 -

Municipal Capital Markets Group and CSG Advisors were new entrants to the top 10, kicking Caine Mitter and Estrada Hinojosa into the top 15.

October 31 -

Overall, the top underwriters saw minor shuffling in the first three quarters and no new firms entered the top 10.

October 30 -

New York boasts four of the top 10 issuers, followed by California and Alabama, each with two, and one apiece for Wisconsin and Massachusetts.

October 29 -

Gilmore & Bell and Nixon Peabody were new entrants in the top 10, bumping Greenberg Traurig and Bracewell to the top 15.

October 28 -

Bond sales in the eight-state region totaled $54.9 billion, trailing the nation with an 8.1% gain year-over-year as Texas issuance slipped 7.6%.

August 19 -

The top five May bond financings totaled more than $5 billion.

June 9 -

The top five April bond financings totaled more than $8 billion.

May 8 -

The top 10 saw some changes, with Gilmore & Bell and Squire Patton Boggs entering the top 10, while Troutman Pepper Locke and Ballard Spahr were bumped.

May 1 -

The top 10 issuers accounted for $22.12 billion of the total issuance for the year, or 18.7%

April 25 -

The top 10 advisors accounted for $59.412 billion of par.

April 23 -

Siebert Williams Shank was the only new entrant into the top 10, knocking Piper Sandler out.

April 21 -

The top five bond financings totaled more than $7 billion.

April 7 -

A review of the biggest issues in various public finance sectors in 2024.

March 17 -

The top five bond financings totaled more than $6 billion.

March 5 -

The top five bond financings totaled more than $6 billion.

February 5 -

The top 10 saw some movements in 2024, with Greenberg Traurig and Chapman and Culter entering the top 10, while Gilmore & Bell and Bracewell were bumped to the top 15.

January 28 -

The top five bond financings came in above $7 billion.

January 22