-

After voters rejected a 2019 bond proposal, Michigan's Dearborn Public Schools is mulling a possible $500 million, $1 billion or $1.5 billion bond this year.

January 28 -

Hamilton City Schools blames state funding formula changes and property tax reforms for a fiscal emergency that has prompted school closures and deep cuts.

January 28 -

New Jersey says the Lakewood Township School District failed to deliver an adequate education. The district says it is shortchanged by state funding formulas.

January 23 -

Moody's Ratings downgraded Fridley Independent School District three notches, to Ba3 from Baa3, and placed its bond ratings under review for downgrade.

January 14 -

The second-largest public school system in Texas could ask voters to approve as much as $6.24 billion of bond authorization as soon as in May.

January 13 -

Berryessa Union School District in Santa Clara County had its issuer rating downgraded to A2 from A1 by Moody's.

January 5 -

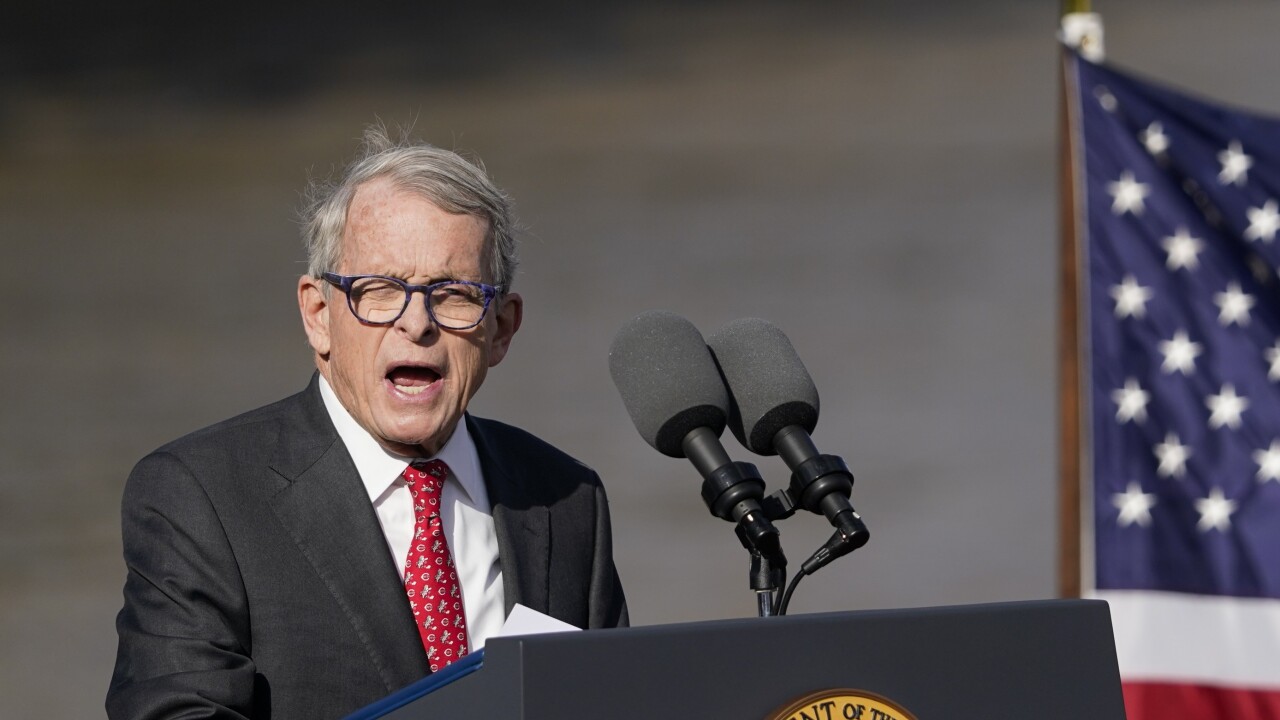

When Ohio Gov. Mike DeWine signed property tax reform bills, there was hope in Columbus it would appease voters who backed a push to abolish property taxes.

December 31 -

Enrollment began to drop in the middle of the school year as rumors about immigration raids circulated through Fresno, Aspen Public Schools told bond investors.

December 24 -

The Equitable School Revolving Fund, which has more deals in the works, has maintained its strong credit profile even as the sector has experienced headwinds.

December 19 -

The rating agency lowered the outlook to stable on its A-plus rating, saying Pennsylvania didn't do itself many favors in its fiscal 2026 budget season.

November 18 -

The long-awaited budget closely resembles the governor's original proposal, pared down by just over $1 billion.

November 17 -

Negative rating and outlook revisions for U.S. K-12 public school districts rose markedly from 2024 to 2025, according to S&P Global Ratings.

November 14 -

Moody's cited very narrow liquidity, very high leverage and concerns about delays in opening up a new campus.

November 7 -

At least $200 million of the bonds will be priced on a competitive basis.

November 6 -

Pennsylvania's budget impasse has surpassed four months. Local governments and schools that rely on state funds are getting frustrated.

November 3 -

The school system, which has an AA underlying bond rating from S&P, was targeted by the Texas Education Agency for a takeover based on academic performance.

October 31 -

Chicago Public Schools went to market this week with nearly $1.1 billion of refunding bonds in the largest municipal transaction the district ever completed.

October 30 -

After Immigration and Customs Enforcement agents arrested its superintendent, Des Moines Public Schools is taking a $265 million GO bond measure to voters.

October 29 -

Voters will decide the fate of 447 bond propositions totaling a record $83.7 billion with development-related districts accounting for most of the debt.

October 28 -

The northern California school district has been struggling for years and on several occasions abandoned plans to consolidate schools, which rating agencies say might have shored up finances.

October 24