Kutak Rock warns tax attorneys about the Internal Revenue Service doing compliance checks as opposed to formal audits on certain multifamily bond issues as tax season is expected to add more stress to an understaffed agency.

-

The era of "announcement" is over; the era of "execution" is here.

-

The MSRB published the request for comment Nov. 3 to seek input on draft amendments to Rule D-15, which defines the term sophisticated municipal market professional.

-

Terance Walsh, a 2025 Bond Buyer rising star, was named a partner by Nixon Peabody.

-

In this third of a three-part 2026 municipal bond outlook series, Market Intelligence analyst Jeff Lipton explains how another year of heavy supply, surging ETF and SMA assets, climate and cyber risk, and growing use of bond insurance will drive muni market structure and strategy for both sell-side and buy-side stakeholders.

-

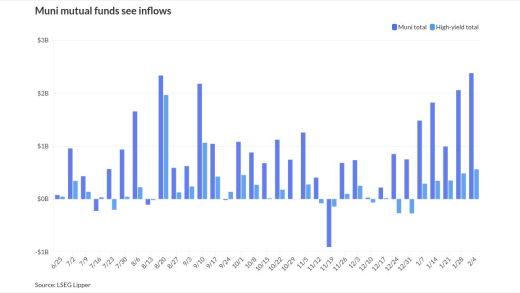

Market Intelligence analyst Jeff Lipton, in the second installment of his three-part 2026 outlook series, maps out quality-centric portfolio shifts, barbell and long-end strategies, and sector tilts across hospitals, higher education and housing as record supply and net inflows drive the muni market.

-

In the first of his three-part 2026 municipal outlook series, Market Intelligence analyst Jeff Lipton forecasts for sub-5% returns, continued demand, possibly more curve steepening as the Fed eases slowly, the economy skirts recession, and AI, tariffs and midterm politics potentially reshaping risks across public finance sectors.

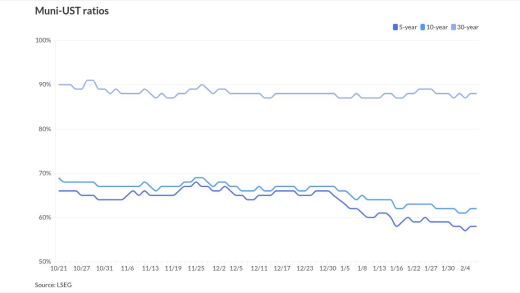

Munis enter this year with "strong credit fundamentals, elevated tax-equivalent yields, and a steeper curve that supports duration extension," said James Welch, municipal portfolio manager at Principal Asset Management.

A Senate bill would introduce public-private partnerships for transportation projects, while another would transfer ownership of roads to localities.

States have been slow to put the money to work.

Jeff Swiatek joins as CFO as the Texas toll road is looking to invest in the Austin-San Antonio corridor.

Chicago Mayor Brandon Johnson has chosen Assistant Finance Commissioner Steven Mahr as the city's acting chief financial officer, two sources confirmed.

-

While fixed-spread tenders may be a novelty for tax-exempt bonds, they have been around for over 40 years for corporate bonds.

-

With large language models parsing EMMA filings and investor relations sites, municipal issuers must modernize their disclosure so both humans and algorithms can accurately understand their credit story and avoid unintended red flags.

-

Serving on MSRB's Board of Directors over the past four years has been a privilege and an honor.

-

Introducing The Bond Buyer's newest Muni Hall of Famers who will be honored at an awards dinner in Boston on Sept. 30, 2025.

-

"I have been very fortunate to contribute to a fascinating sector of the financial industry that is full of ambiguous issues and data," said Tom Doe. "I am flattered to be included in the Hall of Fame, it is a wonderful capstone to my career."

-

Over nearly 40 years, investment banker Diana Hoadley built a legacy of far-ranging vision and collaboration that left a trail of professional admirers.

"I love solving complicated problems faced by our local governmental clients," Leslie Bacon. "We come up with strategic solutions that have a real impact on our communities."

"The intersection between the public impact and the financial markets is unique and it brings a lot of good people to the same place. I really enjoy being a part of this community," Connor Benoit said.

Roosevelt & Cross president and executive director of public finance Elaine Brennan receives the 2025 Freda Johnson Award for the private sector.

-

The rating agency cited weak operating results and high leverage.

-

The ratings agency revises the outlook to negative

-

"This would be an unnecessary change that would be difficult to administer and comply with and which would severely limit municipal entity choice," the Bond Dealers of America said in a comment letter.

-

The government plans to use surplus funds from fiscal years 2022 to 2024 to fund the payments.

-

Market Intelligence analyst Jeff Lipton analyzes how varied state funding priorities and overall charter school support, shifting enrollment patterns, policy uncertainty, charter renewal risk, and varied pension practices affect charter school bond security—and outlines what issuers, advisors and investors should be communicating to the market.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Intraday News UpdateDelivered Every WeekdayGet notified on breaking news and events.

- Primary Market ReportWeeklyRecap of articles on new issuance as well as Featured Deals on the week.

- Weekly Top 10WeeklyRecap of the 10 most read Bond Buyer articles of the past week.

Gilmore & Bell and Nixon Peabody were new entrants in the top 10, bumping Greenberg Traurig and Bracewell to the top 15.

- ON-DEMAND VIDEO

KC Mathews, executive vice president and chief market strategist at Commerce Trust breaks down the FOMC meeting.

- ON-DEMAND VIDEO

Pamela Frederick and Adam Barsky will share their views on the importance of the tax-exemption, how it benefits state and local governments, taxpayers, and U.S. retail investors -- and keeps the country competitive on a global scale.

- ON-DEMAND VIDEO

Gary Hall, President of the Infrastructure & Public Finance Division at Siebert Williams Shank & Co., joins Bond Buyer Executive Editor Lynne Funk to talk about the importance of the muni industry in financing the country's extensive infrastructure needs -- from ports and airports to bridges and energy solutions.