The Cities of Dallas and Fort Worth's $1.32 billion financing for Dallas Fort Worth International Airport made DFW the first U.S. airport to introduce an Extendable Commercial Paper program.

-

The era of "announcement" is over; the era of "execution" is here.

-

The MSRB published the request for comment Nov. 3 to seek input on draft amendments to Rule D-15, which defines the term sophisticated municipal market professional.

-

Terance Walsh, a 2025 Bond Buyer rising star, was named a partner by Nixon Peabody.

-

In this third of a three-part 2026 municipal bond outlook series, Market Intelligence analyst Jeff Lipton explains how another year of heavy supply, surging ETF and SMA assets, climate and cyber risk, and growing use of bond insurance will drive muni market structure and strategy for both sell-side and buy-side stakeholders.

-

Market Intelligence analyst Jeff Lipton, in the second installment of his three-part 2026 outlook series, maps out quality-centric portfolio shifts, barbell and long-end strategies, and sector tilts across hospitals, higher education and housing as record supply and net inflows drive the muni market.

-

In the first of his three-part 2026 municipal outlook series, Market Intelligence analyst Jeff Lipton forecasts for sub-5% returns, continued demand, possibly more curve steepening as the Fed eases slowly, the economy skirts recession, and AI, tariffs and midterm politics potentially reshaping risks across public finance sectors.

The top suite of firms oversaw deals amounting to more than $139 billion par value across 58% of the market.

The projects funded by the deal align with the city of Alexandria's goal to reduce community-wide greenhouse gas emissions 50% by 2030.

Teague, most recently an executive director of the municipal securities department at Morgan Stanley, will focus on surface transportation.

The Pennsylvania government is still kicking the can down the road on public transit funding. This time, it's using capital funds to plug operating gaps.

Kosmont firm has rebranded and brought on two L.A.-area heavy hitters in public finance.

-

It is critical that financial players start to pay very close attention and start reviewing their documents.

-

It's more appropriate to visualize management fees as capital that is expected to be fully recovered.

-

A new algorithm is used to examine retail markups to determine the impact of the disclosure rule.

-

Introducing The Bond Buyer's newest Muni Hall of Famers who will be honored at an awards dinner in Boston on Sept. 30, 2025.

-

"I have been very fortunate to contribute to a fascinating sector of the financial industry that is full of ambiguous issues and data," said Tom Doe. "I am flattered to be included in the Hall of Fame, it is a wonderful capstone to my career."

-

Over nearly 40 years, investment banker Diana Hoadley built a legacy of far-ranging vision and collaboration that left a trail of professional admirers.

"I love solving complicated problems faced by our local governmental clients," Leslie Bacon. "We come up with strategic solutions that have a real impact on our communities."

"The intersection between the public impact and the financial markets is unique and it brings a lot of good people to the same place. I really enjoy being a part of this community," Connor Benoit said.

Roosevelt & Cross president and executive director of public finance Elaine Brennan receives the 2025 Freda Johnson Award for the private sector.

-

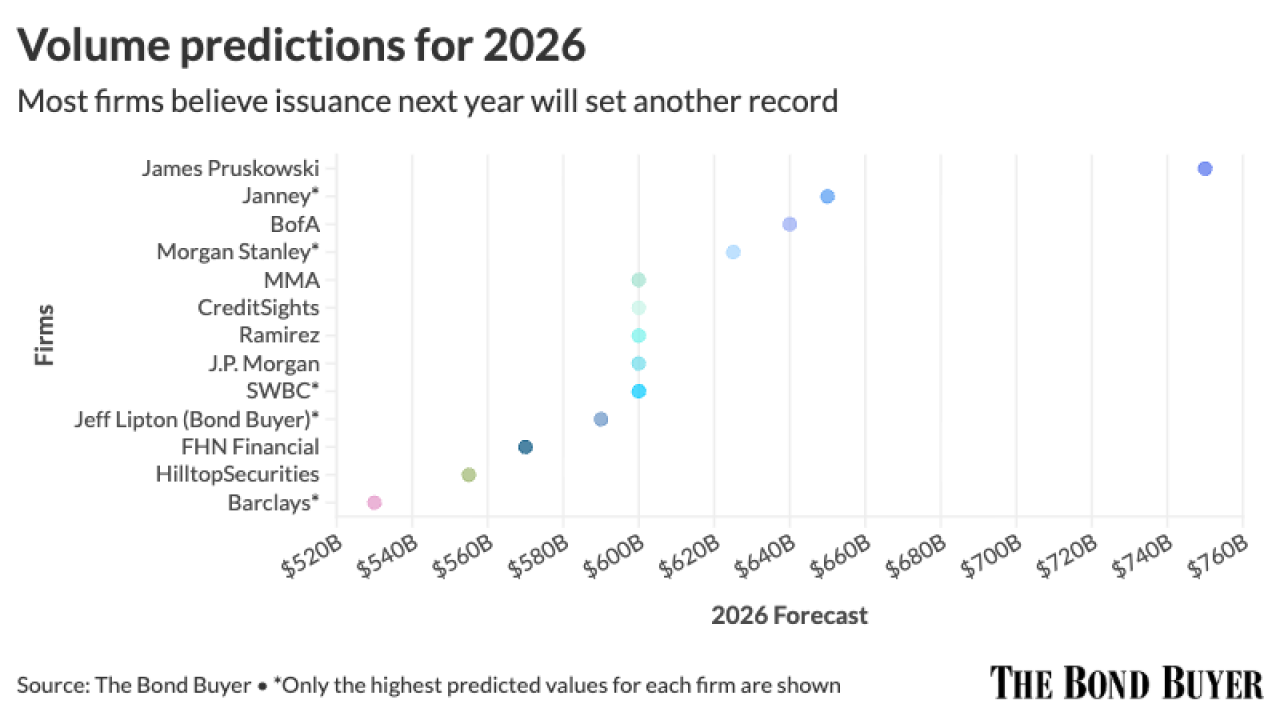

Municipal bond supply projections for next year range from a high of $750-plus billion to a low of $520 billion, with most firms expecting issuance to hover around $600 billion, easily surpassing 2025's record.

-

Stargate data centers in Michigan and Wisconsin illustrate the risks to municipalities of such projects and the growing backlash to data centers.

-

Photos from The Bond Buyer's 2025 Deal of the Year awards gala.

-

A 2025 state law prohibits cities from increasing their property tax revenue if they fail to produce a timely annual financial audit.

-

Omaha Public Power District will go to market the week of Jan. 5 with about $164 million of Series 2026A separate electric system revenue refunding bonds.

-

While muni returns moved lower last week, year-to-date returns still hover around 4%, said Jason Wong, vice president of municipals at AmeriVet Securities.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Intraday News UpdateDelivered Every WeekdayGet notified on breaking news and events.

- Primary Market ReportWeeklyRecap of articles on new issuance as well as Featured Deals on the week.

- Weekly Top 10WeeklyRecap of the 10 most read Bond Buyer articles of the past week.

Gilmore & Bell and Nixon Peabody were new entrants in the top 10, bumping Greenberg Traurig and Bracewell to the top 15.

- ON-DEMAND VIDEO

KC Mathews, executive vice president and chief market strategist at Commerce Trust breaks down the FOMC meeting.

- ON-DEMAND VIDEO

Pamela Frederick and Adam Barsky will share their views on the importance of the tax-exemption, how it benefits state and local governments, taxpayers, and U.S. retail investors -- and keeps the country competitive on a global scale.

- ON-DEMAND VIDEO

Gary Hall, President of the Infrastructure & Public Finance Division at Siebert Williams Shank & Co., joins Bond Buyer Executive Editor Lynne Funk to talk about the importance of the muni industry in financing the country's extensive infrastructure needs -- from ports and airports to bridges and energy solutions.