Yvette was a senior reporter, covering the Midwest. She earned a bachelors in journalism from Columbia College Chicago, began her reporting career at the storied City News Bureau of Chicago, and joined the Bond Buyer in 1997 leading Midwest coverage from her hometown Chicago.

-

Friends, colleagues, and industry professionals held Spiotto in high esteem as a consummate but humble voice in the municipal industry for his bankruptcy and restructuring expertise.

August 9 -

The measure comes after months of dire warnings over the city's looming insolvency.

July 18 -

The IFA and CWA launched a tender offer June 23 that closed Friday. The IFA and Citizens' tender invited holders of some bonds sold in 2014, 2016, and 2018 to tender their bonds as part of the water refunding.

July 14 -

Transactions announced for the second quarter rose to 20 involving $13.3 billion of revenues from 15 in the first quarter and hit a milestone in more closely resembling pre-COVID-19 mergers and acquisition activity, according to Kaufman Hall's quarterly review.

July 13 -

The proposed exchange — which extends the final maturity date by two decades but offers features like a tax levy with a direct intercept and trust estate — is the cornerstone of the consent agreement the city struck with a group of 2007 bondholders

July 12 -

Through his use of the partial veto, Gov. Evers pared down a GOP-authored income tax cut and gave school districts the power to raise a per pupil revenue limit by $325 annually for centuries.

July 11 -

Several guideposts have also already been offered as Mayor Brandon Johnson must balance his campaign pledges on funding new investments and structurally balancing the budget while holding the line on property taxes as the city deals with crime, rising costs, and end of federal COVID-19 funds.

July 7 -

The upgrade "is driven by sustained improvements in the city's income tax collections and the city's superior gap-closing capacity," Fitch said.

July 6 -

Chasse Rehwinkel most recently has held the position of director of banking for the Illinois Department of Financial and Professional Regulation.

July 5 -

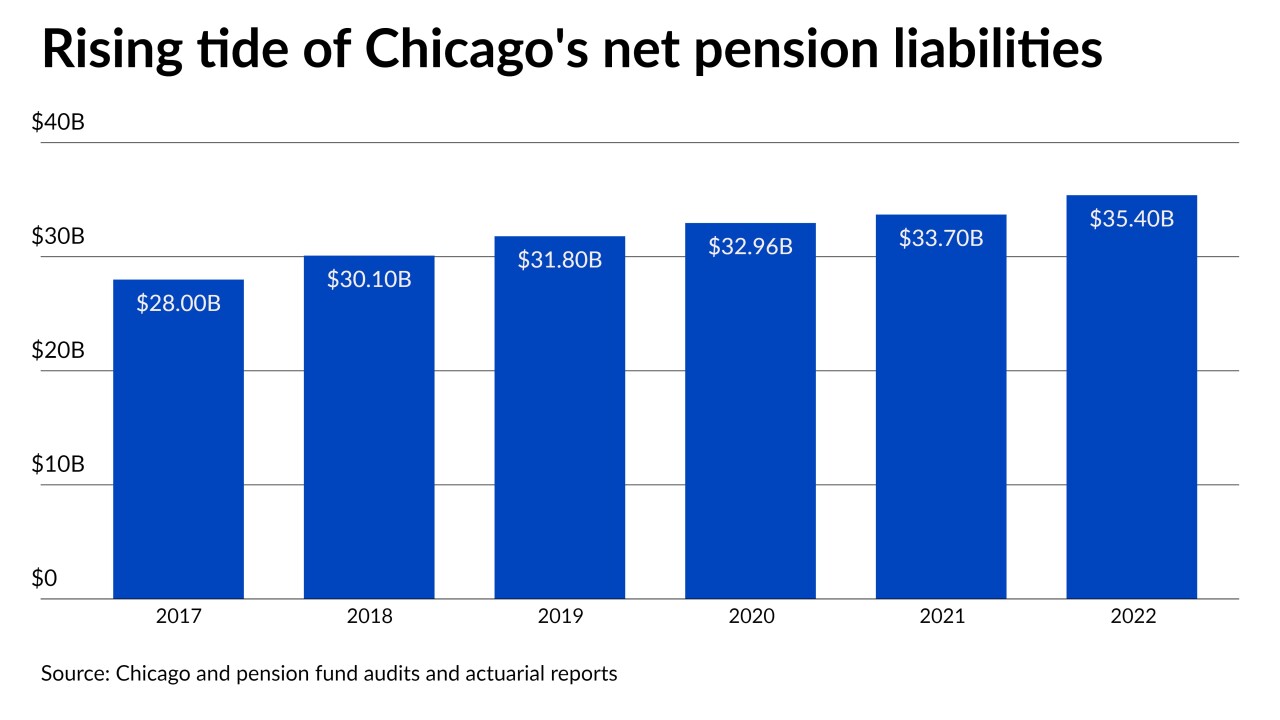

While all four of Chicago's weakly funded pension funds hit a milestone by posting modest increases in their funded ratios in 2021, they lost ground in 2022 due to investment losses driving up the city's pension burden to $35.4 billion

July 5 -

Illinois Comptroller Susana Mendoza will highlight the state's progress on key fiscal metrics during upcoming meetings with the rating agencies and has updated the fiscal 2023 interim audit as the full audited results have not yet been published.

July 3 -

S&P expects improvement although for some borrowers that simply means a reduction in losses, or breakeven to just slightly positive margins.

June 29 -

The Board of Education approved a fiscal 2024 budget amid warnings about the need for more state help to manage a gap of up to $700 million in fiscal 2026.

June 29 -

"We believe pensions have an elevated probability of stressing the state and local governments' budgets even as Illinois has made supplemental contributions above the statutorily required amounts," S&P Global Ratings analyst Joseph Vodziak said.

June 27 -

A $100 million offering of voter-authorized general obligation bonds will speed up blight removal and fund parks and transportation projects.

June 27 -

The Police and Fire Retirement System lacks authority to shift to a 20-year amortization of unfunded legacy liabilities from the 30-year term laid out in the city's bankruptcy exit plan, according to a judge's ruling that eases one fiscal pressure point for the city.

June 26 -

The early redemption plan saves the state $266 million in interest payments and allows pull-tab gambling revenue to flow to the general fund.

June 26 -

The task force expects to "form sub-groups to address specific pension issues and dedicated revenue as part of a comprehensive and balanced approach."

June 22 -

The gap next year is up from the $18.2 million shortfall projected heading into the fiscal 2023 budget season but down from the $121.4 million projection in 2022 and the expected near-record $410 million hole that loomed in 2021.

June 21 -

Jack Brofman will start at the University of Chicago July 17 as executive director of global treasury operations.

June 21