-

As we enter the fourth quarter, municipals continue their remarkable performance with the market continuing to follow trends of demand outstripping supply and inflows into the asset class.

September 27 -

Most of this week’s municipal bond deals were well received, according to Peter Delahunt of Raymond James.

September 26 -

Munis strengthened Wednesday, the day after about 80% of the week's new issue calendar came and went.

September 25 -

The debate between buy-side analysts and issuers and their underwriters flared up during a panel discussion at The Bond Buyer's California Public Finance Conference.

September 25 -

The market had no trouble absorbing Texas Water's $877 million and a $1 billion deal from New Jersey Transportation Trust.

September 24 -

Municipal bond supply will keep on keeping on this week, continuing a boom that started August.

September 23 -

The primary market was somewhat stagnant after the FOMC but things should revert back how they were before — with most deals getting put away quickly.

September 20 -

Municipal bond yields moved lower in secondary trading as some big deals were sold.

September 19 -

The market got what it expected and can now shift attention to the week's remaining deals after Fed policy makers cut interest rates by a quarter point.

September 18 -

Few deals priced, as trading was subdued before the Federal Open Market Committee’s interest rate decision.

September 17 -

Middle East unrest, oil price volatility and a Fed policy meeting all combine to weigh on this week’s $10B new-issue calendar.

September 16 -

Municipal yields and issuance plans both rose, showing market participants aren't uncertain about the meeting, with a quarter point cut in interest rates baked in.

September 13 -

Municipal traders and managers said the tax-exempt market’s early strength translated into weakness before the end of trading — due to taxable and overseas influences.

September 12 -

Los Angeles and Broward County deals were offered while some say the municipal market feels "heavy" and in retreat.

September 11 -

It was a big day for the municipal bond market as billions of dollars of new deals hit the screens.

September 10 -

Issuers jump into the market as yields remain near record low levels.

September 9 -

Fed still divided, but 25 basis point cut is a good bet.

September 9 -

With supply looking up, traders and analysts expect new issues to be well absorbed even if Treasuries correct futher.

September 6 -

The Chicago Public Schools also came to market with a $349 million GO deal.

September 5 -

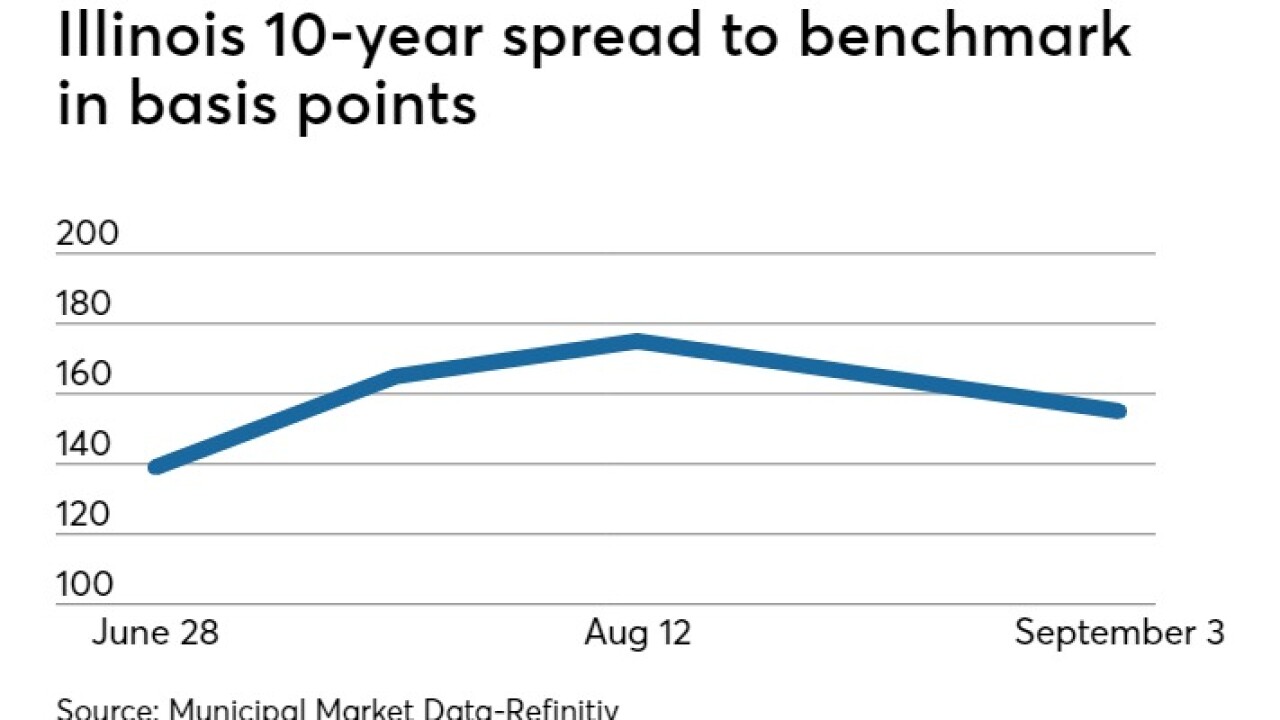

“I think there’s enough demand for Illinois bonds," said Vikram Rai, head of Citi's municipal strategy group.

September 4