Only one day after the Federal Reserve cut interest rates, municipal bond buyers saw a plethora of new issues come to market, led by some big transportation deals, while muni yields moved lower in secondary trading.

Primary market

BofA Securities priced and repriced the Greater Orlando Aviation Authority, Florida’s (Aa3/AA-/AA-/AA) $1.135 billion of Series 2019A revenue bonds subject to the alternative minimum tax. Yields were lowered by two four basis points in selected maturities.

The deal was repriced with a short yield of 1.39% with a 5% coupon in 2020; long yields were seen in a split 2044 term maturity of 2.85% with a 4% coupon and 2.60% with a 5% coupon, a split 2049 term yielded 2.92% with a 4% coupon and 2.67% with a 5% coupon and a split 2054 term yielded 3.32% with a 3.25% coupon and 2.76% with a 5% coupon. The deal had been tentatively priced with a short yield of 1.43% with a 5% coupon in 2020 and long yields seen in a split 2044 term maturity of 2.88% with a 4% coupon and 2.63% with a 5% coupon, in a split 2049 term of 2.94% with a 4% coupon and 2.69% with a 5% coupon and in a split 2054 term of 3.36% with a 3.25% coupon and 2.78% with a 5% coupon.

BofA also priced the Bay Area Toll Authority’s $973.825 million of San Francisco Bay Area Toll Bridge Series 2019F-1 (Aa3/AA/AA) taxable revenue bonds and Series 2019S-9 (A1/AA-/AA-) taxable subordinate revenue bonds.

RBC Capital Markets priced the Dormitory Authority of the State of New York’s (A1/NR/NR) $121.07 million of Series 2019A revenue bonds for the Rochester Institute of Technology.

JPMorgan Securities priced the New York Triborough Bridge and Tunnel Authority’s (Aa3/AA-AA-AA) $102.465 million of taxable Series 2019B general revenue refunding bonds for MTA bridges and tunnels. The bonds were priced as a 2044 bullet maturity at par to yield 3.427%, about 123 basis points above the comparable Treasury security.

In the short-term sector, the Louisville and Jefferson County Metropolitan Sewer District, Kentucky, sold $226.34 million of Series 2019 sewer and drainage subordinated bond anticipation notes.

JPMorgan won the BANs with a bid of 3%, a premium of $3,881,731, an effective rate of 1.375526%. J.J.B. Hilliard, W.L. Lyons was the financial advisor; Wyatt Tarrant was the bond counsel.

Thursday’s bond sales

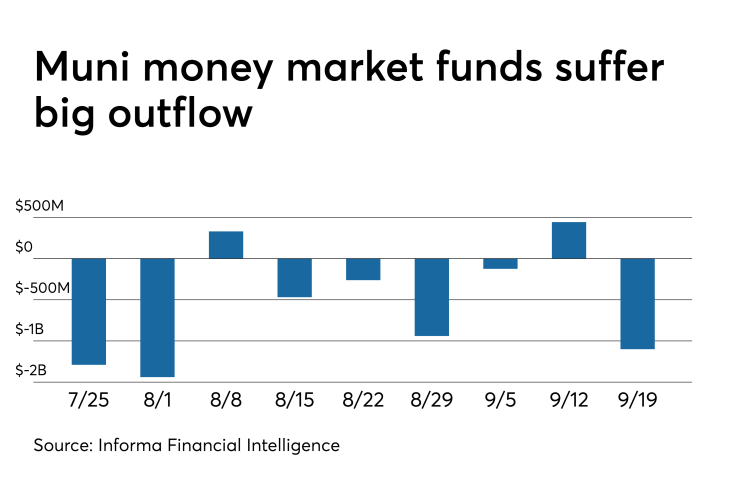

Muni money market funds see outflow

Tax-exempt municipal money market fund assets declined by $1.10 billion, lowering total net assets to $133.97 billion in the week ended Sept. 16, according to the Money Fund Report, a publication of Informa Financial Intelligence. The average seven-day simple yield for the 191 tax-free and municipal money-market funds increased to 0.92% from 0.90% from the previous week.

Taxable money-fund assets decreased by $19.45 billion in the week ended Sept. 17, bringing total net assets to $3.201 trillion, the fourteenth consecutive week that the taxable total has reached or exceeded $3 trillion. The average, seven-day simple yield for the 807 taxable reporting funds rose to 1.87% from 1.75% the prior week.

Overall, the combined total net assets of the 998 reporting money funds fell by $20.55 billion to $3.335 trillion in the week ended Sept. 17.

Secondary market

Munis were stronger on the

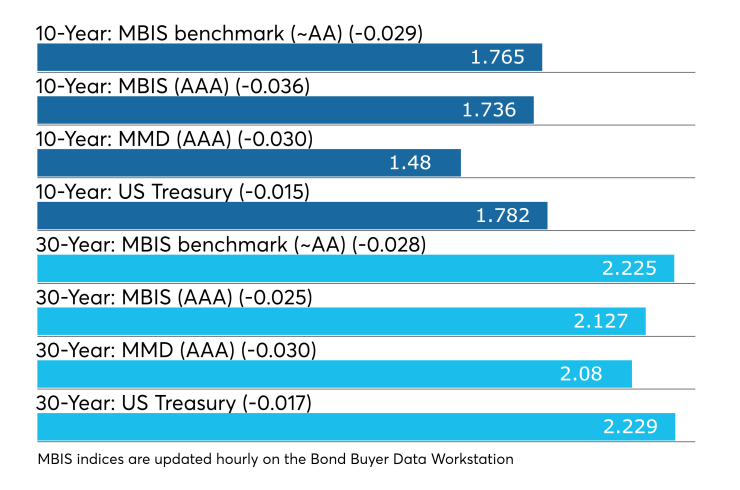

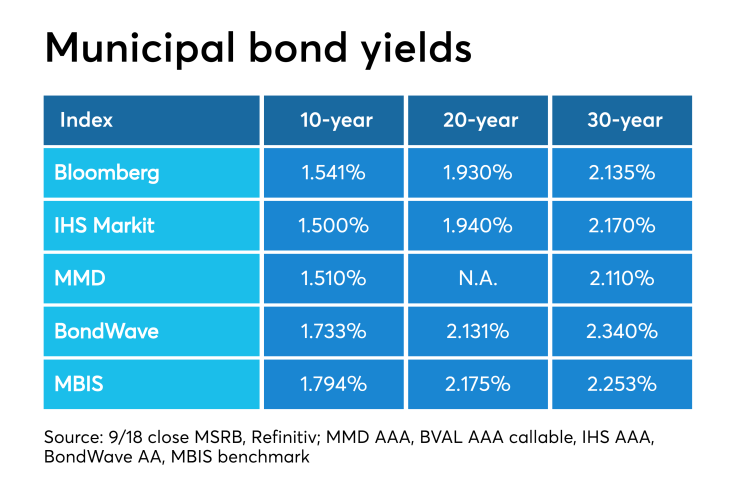

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO fell by three basis points to 1.48% while the 30-year muni dropped three basis points to 2.08%.

"The ICE muni yield curve is down about one to three basis points," ICE Data Services said in a Thursday market comment. "Tobaccos and high-yield are stable as most of the activity is in the new issue sector today."

The 10-year muni-to-Treasury ratio was calculated at 83.5% while the 30-year muni-to-Treasury ratio stood at 94.1%, according to MMD.

Treasuries were stronger as stock prices traded little changed. The Treasury three-month was yielding 1.951%, the two-year was yielding 1.750%, the five-year was yielding 1.660%, the 10-year was yielding 1.782% and the 30-year was yielding 2.229%.

“Markets gave a muted reaction to the Federal Reserve’s decision to lower the main interest rates by 25 basis points to 1.75%-2.00% range,” Ipek Ozkardeskaya, senior market analyst at London Capital Group, said in a market comment. “Fed President Jerome Powell said that ‘moderate’ interventions should suffice to overcome the economic weakness caused by trade disruptions and a slower global growth. ‘More extensive sequences of cuts’ would be considered, if needed.”

He noted that while Powell downplayed the recent repo crisis, the Fed lowered the excess reserve rate to 1.8% to release the pressure on short-term borrowing costs.

Janney weigned in on Wednesday’s ICI muni bond flow report.

“ICI reports that muni mutual funds saw inflows of $1.22 billion in the week ended Sept. 11, the least for any week since April, but this slowing of inflows must be considered in the context of historical flows,” Janney said in a Thursday market comment. “$1.22 billion is well below this year’s weekly average weekly inflow of $1.78 billion, but more than three times the average weekly inflows of the prior four years (2015-2018).”

Previous session's activity

The MSRB reported 35,312 trades Wednesday on volume of $13.97 billion. The 30-day average trade summary showed on a par amount basis of $11.22 million that customers bought $6.00 million, customers sold $3.29 million and interdealer trades totaled $1.93 million.

New York, California and Texas were most traded, with the Empire State taking 13.275% of the market, the Golden State taking 14.717% and the Lone Star State taking 9.653%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. restructured revenue A2 4.329s of 2040, which traded 25 times on volume of $52.91 million. The COFINA bonds, originally priced at 82.961 cents on the dollar were trading on Thursday at a high price of 102.25 cents on the dollar in eight trades totaling $21 million, after trading at 101.75 cents on Wednesday and 101.25 cents on Tuesday.

BB40 moves higher, rest of indexes drop

In the week ended September 19, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose to 3.63% from 3.57% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields dropped nine basis points to 2.76% from 2.85% from the week before. It is at its lowest level dating all the way back to Jan. 9, 1997. The 11-bond GO Index of higher-grade 11-year GOs fell nine basis points to 2.30% from 2.39% the previous week. It is at its lowest level dating all the way back to Jan. 9, 1997.

The Bond Buyer's Revenue Bond Index went south by nine basis points to 3.24% from 3.33% last week. It is at its lowest level since June 9, 2016, when it was at 3.18%.

The yield on the U.S. Treasury's 10-year note was unchanged from 1.79% the week before, while the yield on the 30-year Treasury decreased to 2.23% from 2.27%.

Treasury auctions announced

The Treasury Department announced these auctions:

- $32 billion seven-year notes selling on Sept. 26;

- $41 billion five-year notes selling on Sept. 25;

- $40 billion two-year notes selling on Sept. 24;

- $18 billion 1-year 10-month 0.220% floating rate notes selling on Sept. 25;

- $42 billion 182-day bills selling on Sept. 23; and

- $45 billion 91-day bills selling on Sept. 23.

Treasury auctions bills

The Treasury Department Thursday auctioned $45 billion of four-week bills at a 1.950% high yield, a price of 99.848333. The coupon equivalent was 1.986%. The bid-to-cover ratio was 2.66. Tenders at the high rate were allotted 54.61%. The median rate was 1.910%. The low rate was 1.860%.

Treasury also auctioned $40 billion of eight-week bills at a 1.950% high yield, a price of 99.696667. The coupon equivalent was 1.989%. The bid-to-cover ratio was 2.59. Tenders at the high rate were allotted 21.08%. The median rate was 1.900%. The low rate was 1.860%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.