Municipal bond trading was subdued Tuesday, with just a few deals pricing the day before the Federal Open Market Committee decision on interest rates.

With a 25 basis point cut priced into the municipal market, the new Summary of Economic Projections will be carefully examined for clues as to whether the expected rate cut is part of a mid-cycle adjustment or the second step in an easing cycle.

Over the next 30 days, net muni market supply sits at negative $13.15 billion, comprised of $12.84 billion new issues, $13.71 billion maturing, and $12.28 billion announced calls, according to Peter Block, managing director, credit strategy at Ramirez.

“The states that stand to experience the largest change in outstanding debt include California (negative $2.32 billion), New York (negative $2.15 billion), Florida (negative $1.21 billion), Pennsylvania (negative $881.0 million) and Texas (negative $837.1 million),” Block said. “Muni underperformance in August and last week has created very strong value in the 2-year and 5-year parts of the curve.”

Block also noted that gross supply year to date is $255.4 billion, up 12% year-over-year and in line with Ramirez’s full-year 2019 projection of an 8% increase from last year to $341.8 billion.

“This is partially driven by a 24% year-over-year increase in taxables, mostly for advance refunding of tax exempts,” he said.

Block also said that reinvestment available from maturities and calls in September through December appears roughly balanced with expected new issue supply at about $30 billion per month.

“Fund inflows driven by taxes and safe-haven demand should also remain strong, which combined with reinvestment, should be sufficient to absorb supply.”

Citi priced Northwell Health’s (A3/A-/A-) $447.68 million of taxable bonds on Tuesday.

Bank of America priced the South Carolina State Ports Authority’s (A1/A+ / ) $381.22 million of tax-exempt alternative minimum tax and non-AMT revenue bonds. Assured Guaranty insured the entire 2059 maturity for $28.53 million on the series A bonds and is rated AA by S&P Global Ratings.

Citi priced the Dormitory Authority of the State of New York's (A3/A-/A-) $202.33 million of fixed rate and long-term interest rate revenue bonds for Northwell Health Obligated Group.

Bank of America priced the Rancho, Calif., Water District Finance Authority’s ( /AAA/AAA) $106.87 million of fixed rate refunding revenue bonds on Tuesday.

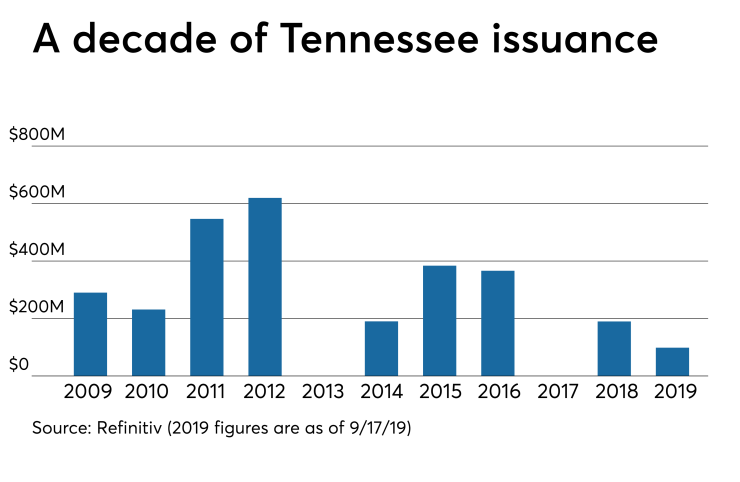

The State of Tennessee (Aaa/AAA/AAA) competitively sold $98.55 million of general obligation bonds on Tuesday. Bank of America won the bidding with a true interest cost of 2.6907%.

Since 2009, the Volunteer State has sold roughly $2.82 billion of securities, never exceeding $1 billion in issuance in a year. The highest issuance occurred in 2012 when it sold $619.6 million. The state did not issue any tax-exempt bonds in 2013 and 2017.

Bellevue School District No. 402, Wash., (Aaa/AA+/ ) sold $90.765 million of unlimited tax general obligation bonds which were won by Morgan Stanley with a TIC of 2.3805%.

Tuesday’s bond sales

Secondary market

Munis were weaker on the

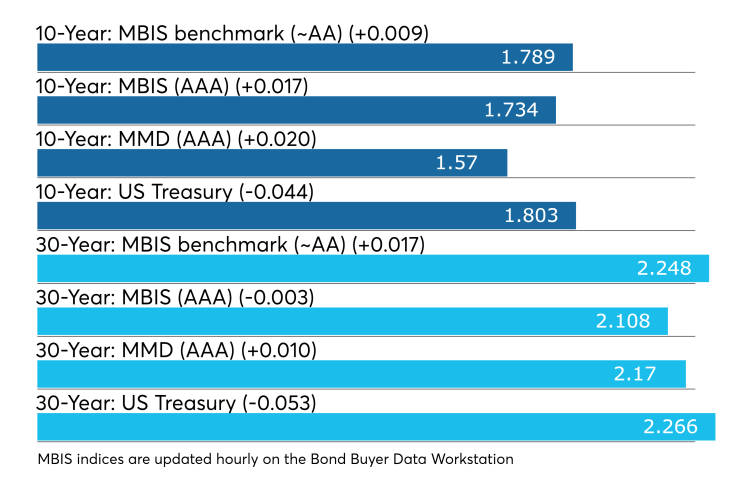

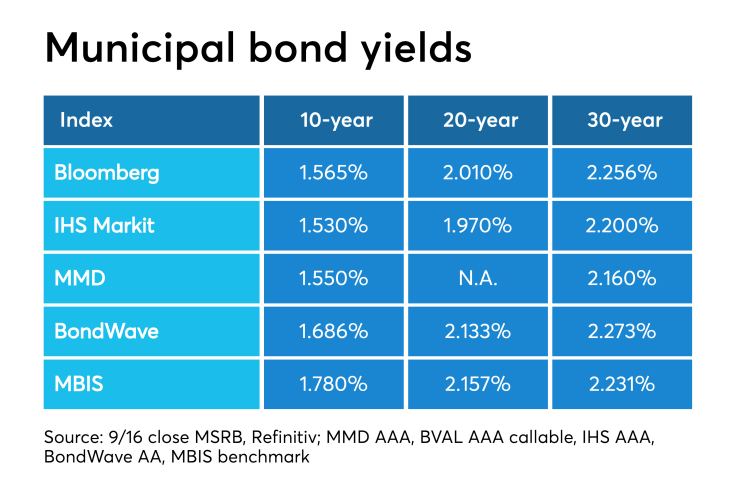

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO rose by two basis points to 1.57% while the 30-year muni rose one basis points to 2.17%.

The 10-year muni-to-Treasury ratio was calculated at 86.8% while the 30-year muni-to-Treasury ratio stood at 95.4%, according to MMD.

Treasuries were mostly lower as stock prices mostly traded higher, with the Dow the only one in the red. The Treasury three-month was yielding 1.990%, the two-year was yielding 1.733%, the five-year was yielding 1.663%, the 10-year was yielding 1.803% and the 30-year was yielding 2.266%.

Previous session's activity

The MSRB reported 33,495 trades Monday on volume of $7.95 billion. The 30-day average trade summary showed on a par amount basis of $11.13 million that customers bought $5.93 million, customers sold $3.28 million and interdealer trades totaled $1.92 million.

California, New York and Texas were most traded, with the Golden State taking 14.598% of the market, the Lone Star State taking 12.66% and the Empire State taking 11.963%.

The most actively traded security was the Commonwealth of Puerto Rico GO 8s of 2035, which traded 17 times on volume of $36.47 million. The bonds, originally priced to yield 8.727% with an 8% coupon, were trading on Monday at a high price of 56.06 cents on the dollar and a low price of 56.395 cents on the dollar.

Treasury to sell $45B 4-week bills

The Treasury Department said it will sell $45 billion of four-week discount bills Thursday. There are currently $39.995 billion of four-week bills outstanding.

Treasury also said it will sell $40 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.