It was a GO-GO sort of day as several municipal issuers came to market with big general obligation deals on Thursday.

Primary market

Jefferies priced California’s (Aa3/AA-/AA) $2.397 billion of general obligation bonds, consisting of $1.734 billion of various purpose refunding GOs, due April 1 and Oct. 1, and $662.645 million of various purpose GOs, due Oct. 1. On Wednesday, underwriters priced the deal for retail investors after having circulated a pre-marketing scale on Tuesday.

The pricing showed the refunding GO short yields at 1.07% with 3% coupons in a split 2020 maturity and long yields at 2.15% and 1.90% with 4% and 5% coupons. The pricing showed the GO short yields at 1.10% with 3% and 4% coupons in a 2023 split maturity and long yields at 2.74% and 2.09% with 3% and 5% coupons in a 2049 spilt maturity.

JPMorgan Securities priced and repriced the Chicago Board of Education’s (NR/BB-/BB/BBB) $348.567 million of dedicated revenues unlimited tax GO refunding bonds backed by dedicated revenues.

"The CPS deal was very well subscribed, particularly the CAB's that they put in at the last minute," one portfolio manager said.

In the competitive arena on Thursday, North Carolina (Aaa/AAA/AAA) sold $600 million of Series 2019B public improvement Connect NC GOs. BofA Securities won the bonds with a true interest cost of 1.9885%. Hilltop Securities and the Local Government Commission are the financial advisors. Womble Bond is the bond counsel.

After selling more than $1 billion of refunding bonds last week, Massachusetts (Aa1/AA/AA+) returned with over $800 million of GOs. On Thursday, Morgan Stanley priced the state’s $425 million of Series G consolidated loan of 2019 GOs. On Wednesday, the underwriter priced the $400 million of Series H taxable GOs.

Also, Barclays Capital priced the University of Virginia's (Aaa/AAA/AAA) taxable century bonds — $350 million of Series 2019A general revenue pledge bonds, due Sept. 1, 2119.

Raymond James & Associates received the award on the Tennessee Housing Development Agency’s (Aa1/AA+/NR) $150 million of Issue 2019-3 residential finance program bonds not subject to the alternative minimum tax.

Wednesday’s bond sales

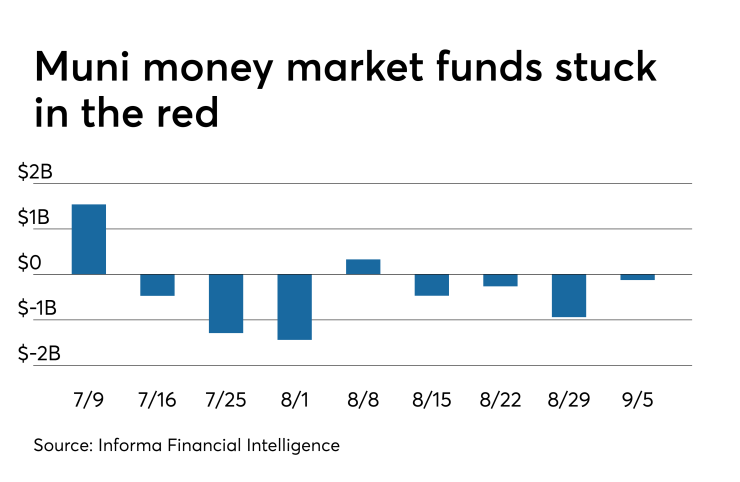

Muni money market funds stay red

Tax-exempt municipal money market fund assets fell by $124.0 million, lowering total net assets to $134.63 billion in the week ended Sept. 2, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 191 tax-free and municipal money-market funds held steady at 0.97% from the previous week.

Taxable money-fund assets increased by $14.99 billion in the week ended Sept. 3, bringing total net assets to $3.196 trillion, the 12th consecutive week that the taxable total has reached or exceeded $3 trillion. The average, seven-day simple yield for the 807 taxable reporting funds inched up to 1.76% from 1.75% the prior week.

Overall, the combined total net assets of the 998 reporting money funds rose by $14.87 billion to $3.331 trillion in the week ended Sept. 3.

Weakness surfaces

The heavy municipal new-issue calendar, as well as the volatility in Treasuries, is creating some weakness on Thursday, municipal sources said. This weakness was demonstrated by the 10-year bond at one stage falling over a point and the 30-year dropping two points amid a busy primary market.

“The bond market is so overbought that it will take a while before you can say there is ‘value’ relative to inflation,” John Mousseau, president of Cumberland Advisors said on Thursday afternoon.

He noted, however, that longer bonds with relatively short calls are one exception in the current market.

“The employment numbers show the economy is doing just fine,” Mousseau, director of fixed income, added. “The markets have been mistaking a slowing economy with a dead economy,” and it has been anything but, he noted.

The weakness is rate-driven, a Florida trader said.

“We are seeing secondary markets that are consistent with down five to seven outside of the first 10 years of the curve,” he said. “New York markets are leading the market wider with names like New York City Waters,” with 4% coupons on the 2040 maturity trading plus 50 basis points versus plus 43 basis points on bid side offers a day earlier on Wednesday.

“Customer bid lists are unusually light with most of the bids up front or with shorter calls,” he explained. “We are not seeing much pressure dealer to dealer but it is apparent that customer liquidity is taking priority over dealers,” he said.

Meanwhile, others believe the stock market is stealing some attention from the fixed income market.

“The municipal bond market has a very different and softer tone this morning as we move toward the weekend and investor focus appears to have shifted to the stock market and away from fixed income — at least for the moment,” Rick Calhoun, First Vice-President Sales & Trading at Crews & Associates,, said Thursday morning.

Crews priced a $73 million BAM-Insured Louisiana deal yesterday that was four to seven times oversubscribed in most maturities.

“I understand today however, that there are a few deals that are struggling to get done and will be forced to reprice accordingly,” he said.

Market chatter about another ministerial-level meeting on the U.S.-China tariff war has the U.S. Treasury market second-guessing about when the long negotiating process will end and of course, this affects the municipal market,” Calhoun said.

“While I do not expect strong demand for municipal bonds to let up anytime soon, we may just be taking a short break,” he said.

Secondary market

Munis were weaker on the

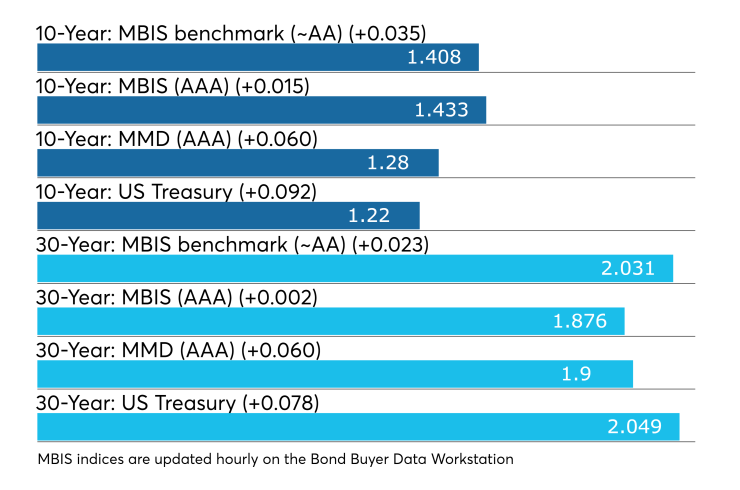

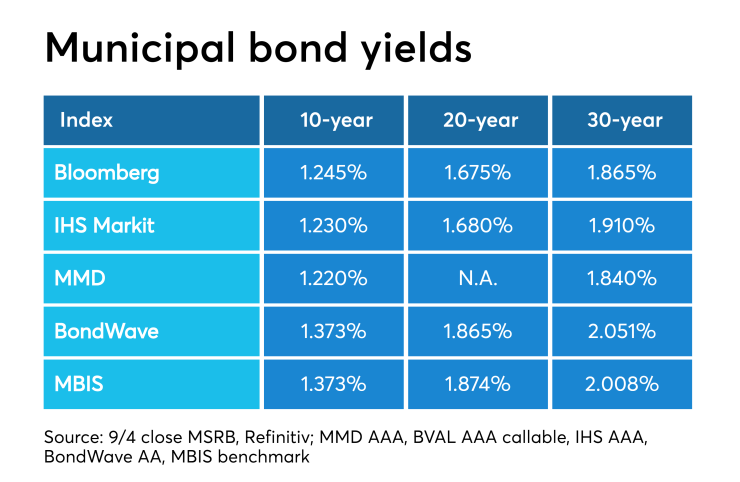

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10- and 30-year year muni GOs both rose by six basis points to 1.28% and 1.90%, respectively.

“The ICE muni yield curve is one to four basis point higher across all maturities on reduced volume,” ICE Data Services said in a Thursday market comment. “High-yield and tobaccos are up two basis points on light volume. Taxable yields are up 11 to 13 basis points.”

The 10-year muni-to-Treasury ratio was calculated at 81.5% while the 30-year muni-to-Treasury ratio stood at 92.2%, according to MMD.

Treasuries were weaker as stock prices traded higher. The Treasury three-month was yielding 1.969%, the two-year was yielding 1.548%, the five-year was yielding 1.431%, the 10-year was yielding 1.561% and the 30-year was yielding 2.049%.

Previous session's activity

The MSRB reported 33,344 trades Wednesday on volume of $13.16 billion. The 30-day average trade summary showed on a par amount basis of $11.03 million that customers bought $5.85 million, customers sold $3.18 million and interdealer trades totaled $2.00 million.

New York, Texas and California were most traded, with the Empire State taking 12.572% of the market, the Lone Star State taking 12.376% and the Golden State taking 11.469%.

The most actively traded security was the New York Metropolitan Transportation Authority 2019 BAN 5s of 2022, which traded 32 times on volume of $84.29 million.

BB40 dips while all others unchanged

In the week ended Sept. 5, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was slightly lower to 3.53% from 3.54% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields was flat at 2.97% from the week before. It is at its lowest level since Sept. 8,2016, when it was at 2.83%.

The 11-bond GO Index of higher-grade 11-year GOs stayed put at 2.51% from the previous week. It is at its lowest level since Sept. 8, 2016, when it was at 2.41%.

The Bond Buyer's Revenue Bond Index was steady at 3.45% from the last week. It is at its lowest level since Nov. 3, 2016, when it was at 3.44%.

The yield on the U.S. Treasury's 10-year note slipped to 1.57% from 1.51%, while the yield on the 30-year Treasury dipped to 2.06% from 1.97%.

Treasury auctions announced

The Treasury Department announced these auctions:

- $16 billion 29-year 11-month 2 1/4% bonds selling on Sept. 12;

- $24 billion 9-year 11-month 1 5/8% notes selling on Sept. 11;

- $38 billion three-year notes selling on Sept. 10;

- $28 billion 364-day bills selling on Sept. 10;

- $42 billion 182-day bills selling on Sept. 9; and

- $45 billion 91-day bills selling on Sept. 9.

Treasury auctions bills

The Treasury Department Thursday auctioned $55 billion of four-week bills at a 2.025% high yield, a price of 99.842500. The coupon equivalent was 2.062%. The bid-to-cover ratio was 2.69.

Tenders at the high rate were allotted 96.76%. The median rate was 2.000%. The low rate was 1.980%.

Treasury also auctioned $40 billion of eight-week bills at a 1.960% high yield, a price of 99.695111. The coupon equivalent was 1.999%. The bid-to-cover ratio was 3.18.

Tenders at the high rate were allotted 83.08%. The median rate was 1.950%. The low rate was 1.940%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.