The municipal primary market was somewhat stagnant this past week due to the Federal Open Market Committee meeting but things should revert back how they were before — with most deals getting put away quickly and being oversubscribed.

According to Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management, the upcoming week will be "very telling," as the trajectory of rates has stalled a bit and he thinks that if we can get through the week okay, there could be a rally of sorts.

"The pick up in supply is starting to matter, as dealers are hesitant to strongly bid bonds," Heckman said. "For the first time really all year, we saw some indigestion of sorts last week, with a few deals not getting put away quickly and oversubscribed like we have been seeing but now with the Fed out of the way, I think the deals will go back to being a food fight once again."

Heckman added that U.S. Bank has been an active buyer on any weakness in the market and he said he feels as though municipal bonds are still a good value proposition.

There are 17 deals scheduled $100 million of larger, with five of those being taxables — continuing the recent popular trend of issuing taxable bonds.

"There has been a lack of issuance in the taxable space, so this little boom is lost ground that is being made up in that regard," Heckman said. "Spreads are so tight on corporate debt, taxable munis are an attractive alternative, plus that fact that issuers get a broader investor base so they can confidently bring the deals to market."

Market Barometer

Demand and supply remain steady as the market adjusts from this week’s Federal Reserve Board cut and heads toward the end of the third quarter.

This week’s $1.1 billion Greater Orlando Aviation Authority AMT bond issue had large maturity sizes and were attractive, according to Kimberly Olsan, Senior Vice President at FTN Financial.

The 10-year at a 2.01% yield was 115% of the 10-year U.S. Treasury bond while the 5s of 2049 priced at 2.67%, or 45 basis points in excess yield to the 30-year Treasury, Olson pointed out.

The deal demonstrates that demand is steady and flows remain positive — however they are “waning a bit during survey periods that included the market pullback,” Olsan wrote.

She noted that Lipper’s figure fell to $209 million, less than 20% of the 2019 weekly average and ICI’s total fell to $1.2 billion, off from its $1.5 billion 4-week moving average.

“Both bear watching in the coming reporting cycle as to whether the fund buyer’s mindset has been altered,” Olsan wrote.

One area that may cause a diversion for mid-bracket buyers is the higher dividend yields available as the S&P 500 yield is 1.90% and DOW yield is 2.27%, she said.

Meanwhile, supply on the horizon includes the 30-day net supply figure holding above negative $10 billion, which Olsan said is “a constructive deficit for keeping inquiry engaged with commitments.”

California, New York and Florida have the largest implied negative supply projections at a combined $5.5 billion and should remain well bid, Olsan said.

New Jersey and Washington rank among the largest for positive supply among active issuers, she added.

Overall, as the market corrected in the last two weeks, fixed-rate bond yields due 2020 to 2022 trended higher and created some incentive out of floating-rate issues. “That has reversed to some degree and could continue to flip-flop in coming weeks,” Olsan predicted.

Others agreed demand is thriving and should consume new supply with no trouble — with a backdrop of strong market technicals.

“After last week’s volatility carried over into the early part of this week, munis reversed course and outperformed towards the end of the week,” Dan Urbanowicz of Ziegler Capital.

“Investors seemed to step in and take advantage of relative cheapness as 5 and 10 year ratios reached their one year highs,” he said Friday morning.

He said the extreme swings in rates over the past few weeks have led to higher coupon, defensive structures being more attractive and lower coupons underperforming.

“With inflows continuing their record pace, despite some recent slowing, and quarter end approaching, next week’s new issues should be well received."

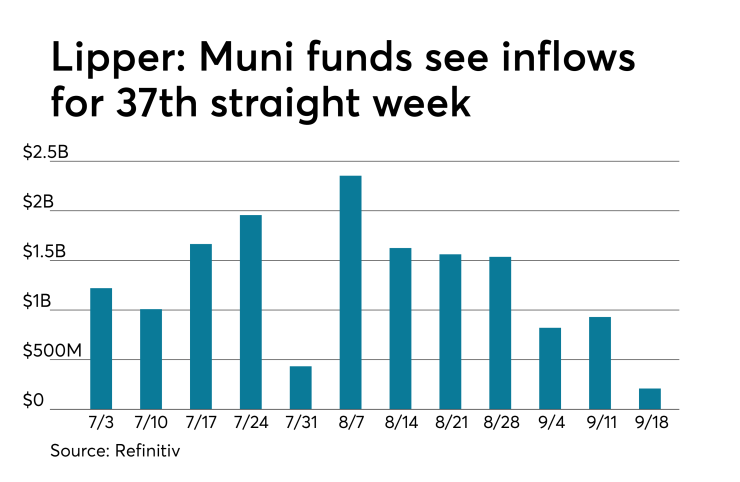

Lipper: More inflows, but smallest in 12 weeks

For 37 weeks in a row investors have poured cash into municipal bond funds, according to the latest data released by Refinitiv Lipper on Thursday.

Tax-exempt mutual funds that report weekly received $209.318 million of inflows in the week ended Sept. 18 after inflows of $929.944 million in the previous week. This is the third week in a row and the fourth time in the past 12 weeks where inflows have been less than $1 billion. It is also the smallest inflow over the past 12 weeks.

"I am not surprised to see the dwindling Lipper flows into munis," Heckman said. "With the equity market getting better, it makes sense more money would start to flow into those in lieu of munis. At this rate, we might even see an outflow next week — putting an end to this historic streak."

Exchange-traded muni funds reported outflows of $97.611 million after inflows of $50.906 million in the previous week. Ex-ETFs, muni funds saw inflows of $306.930 million after inflows of $879.037 million in the previous week.

The four-week moving average remained positive at $873.824 million, after being in the green at $1.211 billion in the previous week.

Long-term muni bond funds had inflows of $3.242 million in the latest week after inflows of $692.700 million in the previous week. Intermediate-term funds had inflows of $26.324 million after inflows of $218.277 million in the prior week.

National funds had inflows of $147.277 million after inflows of $815.592 billion in the previous week. High-yield muni funds reported outflows of $166.757 million in the latest week, after inflows of $279.835 million the previous week.

Primary market

Bank of America is set to price the largest deal of the week — Texas Water Development Board's ( /AAA/AAA) $876.935 million of state water implementation revenue fund master trust taxable bonds on Tuesday.

Wells Fargo is scheduled to price New Jersey's Transportation Trust Fund Authority's (Baa1/BBB+/A-) $800 million of program bonds on Tuesday.

Goldman Sachs is expected to price Providence St. Joseph Health's (Aa3/ /AA-) $650 million of taxable refunding corporate CUSIP bonds on Tuesday.

The largest competitive deal of the week will come from Evergreen School District No. 114, Wash., when it sells $177.30 million of unlimited taxable general obligation bonds on Tuesday.

Secondary market

Munis were mixed on the

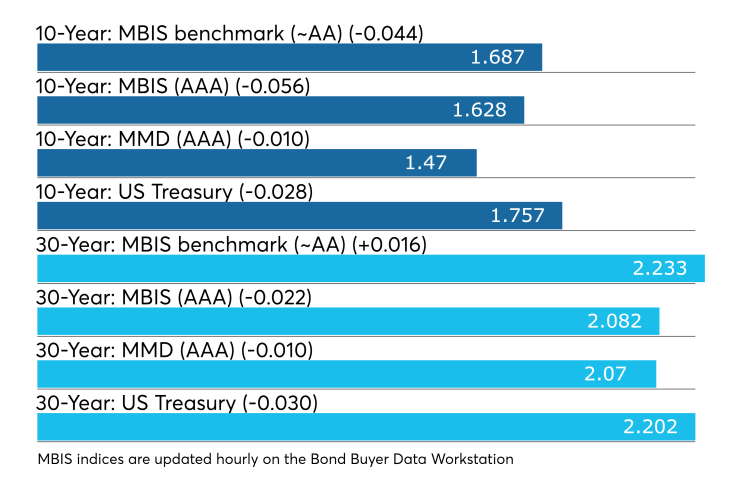

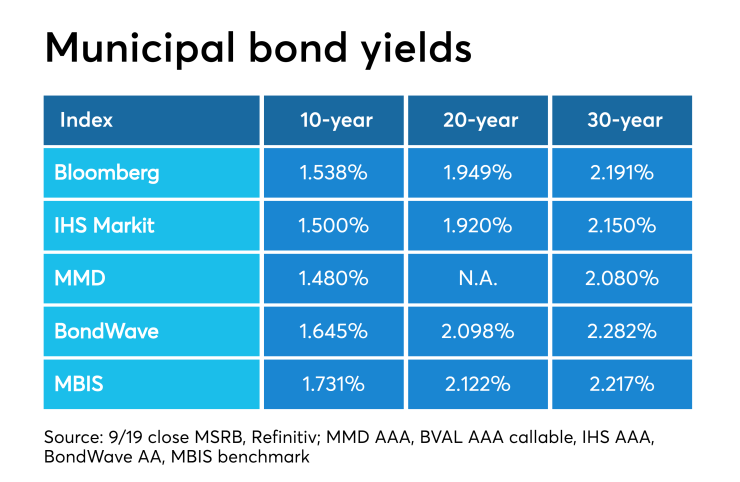

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year and 30-year muni GO fell by one basis point to 1.47% and 2.07%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 84.0% while the 30-year muni-to-Treasury ratio stood at 94.1%, according to MMD.

Treasuries were down as stock prices traded in the red. The Treasury three-month was yielding 1.910%, the two-year was yielding 1.710%, the five-year was yielding 1.635%, the 10-year was yielding 1.757% and the 30-year was yielding 2.202%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Sept. 20 were from Puerto Rico and Louisiana issuers, according to

In the GO bond sector, the Commonwealth of Puerto Rico 8s of 2035 traded 30 times. In the revenue bond sector, the St. John the Baptist Parish, Louisiana 2.1s of 2037 traded 48 times. In the taxable bond sector, the GDB Debt Recovery Authority of the Commonwealth of Puerto Rico 7.5s of 2040 traded 25 times.

Week's actively quoted issues

Puerto Rico, Texas and New York bonds were among the most actively quoted in the week ended Sept. 20, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp., revenue 5s of 2058 were quoted by 28 unique dealers. On the ask side, Temple, Texas' GO 2s of 2031 were quoted by 175 dealers. Among two-sided quotes, the New York City Transitional Finance Authority revenue 5s of 2030 were quoted by 14 dealers.

Previous session's activity

The MSRB reported 33,338 trades Thursday on volume of $12.99 billion. The 30-day average trade summary showed on a par amount basis of $11.15 million that customers bought $5.99 million, customers sold $3.27 million and interdealer trades totaled $1.89 million.

California, New York and Texas were most traded, with the Golden State taking 12.852% of the market, the Empire State taking 12.416% and the Lone Star State taking 11.123%.

The most actively traded security was the Commonwealth of Puerto Rico Sales Tax Financing Corp. restructured COFINA bonds 0s of 2051, which traded 71 times on volume of $57.84 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.