As we enter the fourth quarter, municipals continue their remarkable performance with the market continuing to follow trends of demand outstripping supply and inflows into the asset class.

“The classic law of physics — a body in motion stays in motion, is how I would describe the inflows,” Jim Colby, senior municipal strategist and portfolio manager at VanEck said Friday. “Our market follows trends and everything that has been in place to stimulate the inflows has not changed as we keep pushing toward the $70 billion number of inflows for the year.”

Colby noted that there is more supply on the way, as it has seemed to be never-ending the past two months.

“There is ample supply to keep the market moving, there is already roughly $13 billion to $16 billion of deals on the calendar for October and given how the market environment is for the issuers, there is sure to be more added,” he said. “It’s an opportune time to come to market, with an endless well of demand that has been making most deals do really well, with repricings occurring.”

He added that no matter how much issuance the market gets on a weekly basis, it is not enough to meet the demand.

“In the investment grade space, it’s a food fight for the bonds but it’s even more so in the-high yield space,” Colby said. “The deals are few and far between and when those new issues do come, you have to be prepared to be disappointed, as the chances of you getting the allocations you want are pretty low, due to all the participants.”

Primary market

The muni market is expected to see $9.26 billion of fresh issuance to kick off the fourth quarter, which is up from a revised total of $6.03 billion the market put away this past week. The calendar consists of $7.04 billion of negotiated deals and $2.22 billion of competitive sales. There are 29 deals scheduled $100 million or larger, with seven of them coming via the competitive route.

Jefferies is scheduled to price the largest deal of the week — New York City’s (Aa1/AA/AA) $850 million of general obligation bonds on Thursday. The city that never sleeps is also set to competitively sell $150 million of taxable GO bonds, also on Thursday.

Citi is slated to price Massachusetts Department of Transportation’s (A2/A+/A+) $491.5 million of metropolitan highway system revenue refunding senior bonds on Wednesday.

Bank of America is expected to price Community Development Administration Maryland Department of Housing and Community Development’s (Aa2/ /AA) $350 million of residential revenue bonds, featuring tax-exempt, non-alternative minimum tax and taxable bonds on Thursday.

Goldman Sachs is set to run the books on Wisconsin’s (Aa1/AA/NR) $330.005 million of taxable GO refunding bonds on Tuesday.

The largest competitive deal will be from the Maryland Department of Transportation’s (Aa1/AAA/AA+) $490 million of consolidated transportation bonds on Wednesday.

Lipper sees billion dollar inflow

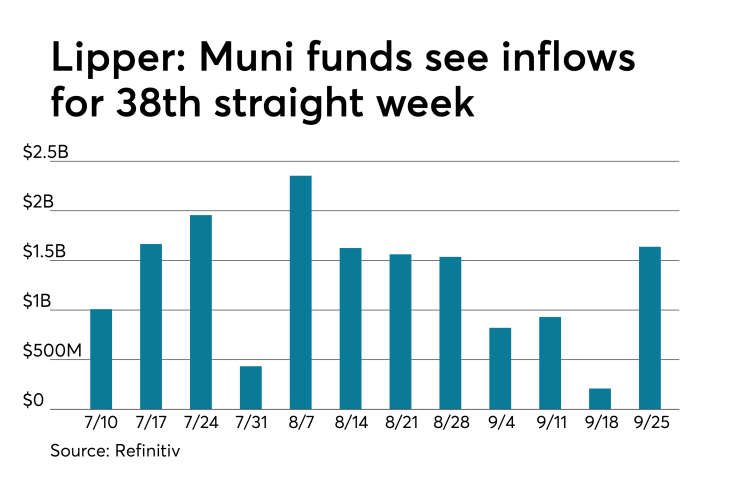

For 38 weeks in a row investors have poured cash into municipal bond funds, according to the latest data released by Refinitiv Lipper on Thursday.

Tax-exempt mutual funds that report weekly received $1.637 billion of inflows in the week ended Sept. 25 after inflows of $209.318 million in the previous week. This marks the eighth time in the past 12 weeks that inflows have exceeded $1 billion and the first time in four weeks.

"Lipper inflows year to date is at $42 billion, but that’s widely considered less accurate (albeit faster) than the ICI data," Matt Fabian, partner at Municipal Market Analytics said. "ICI does show a $66.4 billion of inflows year to date, through the first 38 weeks of the year. That’s 23% more than the prior YTD record ($53.7B in 2009) and only $5B behind the full year record of $71.7B, also in 2009."

Exchange-traded muni funds reported inflows of $275.726 million after outflows of $97.611 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.361 billion after inflows of $306.930 million in the previous week.

The four-week moving average remained positive at $899.269 million, after being in the green at $873.824 billion in the previous week.

Long-term muni bond funds had inflows of $1.516 billion in the latest week after inflows of $3.242 million in the previous week. Intermediate-term funds had inflows of $267.395 million after inflows of $26.324 million in the prior week.

National funds had inflows of $1.386 billion after inflows of $147.277 billion in the previous week. High-yield muni funds reported inflows of $427.837 million in the latest week, after outflows of $166.757 million the previous week.

Secondary market

Munis were slightly weaker on the

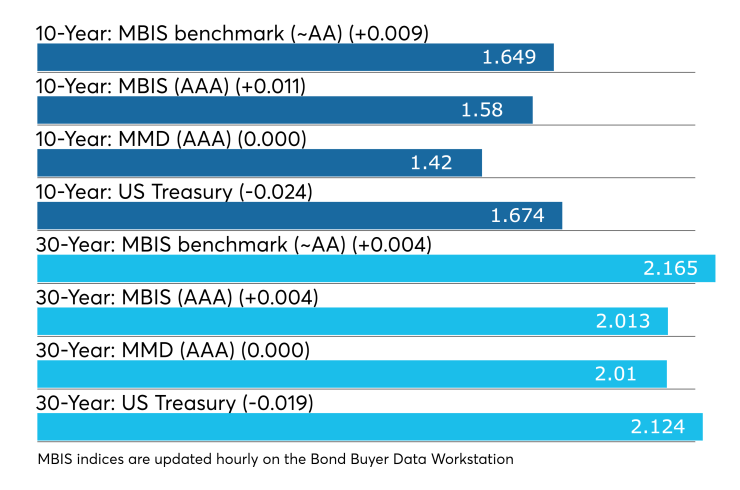

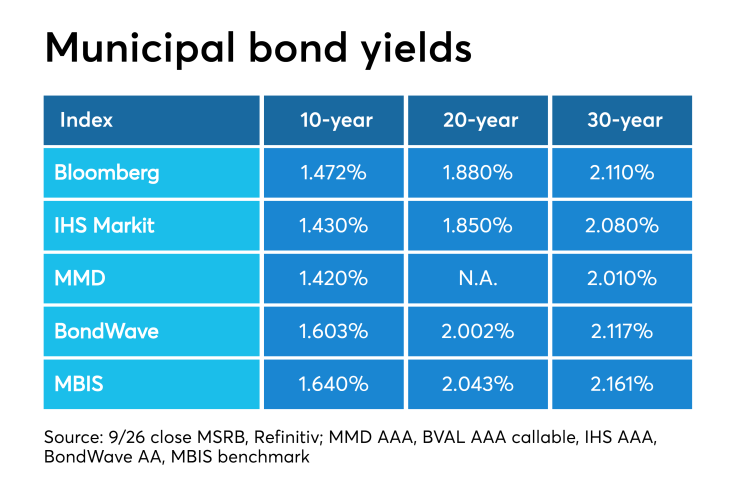

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year were steady at 1.42% and 2.01%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 84.5% while the 30-year muni-to-Treasury ratio stood at 94.5%, according to MMD.

Treasuries were trading down as stock prices were in the red. The Treasury three-month was yielding 1.792%, the two-year was yielding 1.632%, the five-year was yielding 1.557%, the 10-year was yielding 1.674% and the 30-year was yielding 2.124%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Sept. 27 were from Pennsylvania, New Jersey and California issuers, according to

In the GO bond sector, the Reading School District, Penn., 3,125s of 2042 traded 26 times. In the revenue bond sector, the New Jersey Transporation Trust Fund Authority 5s of 2044 traded 84 times. In the taxable bond sector, the Bay Area Toll Authority 2.574s of 2031 traded 50 times.

Week's actively quoted issues

Puerto Rico and New York bonds were among the most actively quoted in the week ended Sept. 27, according to IHS Markit.

On the bid side, the GDBY Debt Recovery Authority of the Commonwealth of Puerto Rico, taxables 7.5s of 2040 were quoted by 21 unique dealers. On the ask side, the Metropolitan Transportation Authority revenue 5s of 2022 were quoted by 131 dealers. Among two-sided quotes, the Puerto Rico Sales Tax Financing Corp., revenue 5s of 2058 were quoted by 13 dealers.

Previous session's activity

The MSRB reported 31,094 trades Thursday on volume of $12.61 billion. The 30-day average trade summary showed on a par amount basis of $11.05 million that customers bought $5.91 million, customers sold $3.23 million and interdealer trades totaled $1.91 million.

California, Texas and New York were most traded, with the Golden State taking 16.187% of the market, the Lone Star State taking 12.15% and the Empire State taking 9.986%.

The most actively traded security on Wednesday was the Texas Water Development Board’s implementation revenue 4s of 2049, which traded 36 times on a par of $34.52 million. The bonds, originally priced to yield 2.59%, were trading at a yield of 2.61% and a low of 2.304% on Thursday.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.