A day after roughly 80% of the Week's new issue calendar came and went, the primary muni market saw no larger deals price on Wednesday.

Municipals as an asset class resumed an upward path, despite a September supply build that has given some market participants some pause, according to Jeffery Lipton, managing director and head of muni research and strategy at Oppenheimer.

"September is not a particularly high-volume month and so there is some significance in the out-sized month-to-date supply figures," Lipton said. "We are seeing very active taxable issuance marketed to advance refund tax-exempt debt, coming as spreads remain tight on corporate debt."

Lipton went on to say issuers may feel more likely to access the market while general credit quality is still strong, but a reserved tone may make its way back if market technicals begin to weaken the bid and underwriting balances become a bit heavy.

"Although demand has been very strong throughout the year, future flow activity will be reliant upon Q4 reinvestment needs, weekly new-issue calendar size, Central Bank policy, and overall desirability of haven assets tied to geopolitical developments and growth expectations," he said. "As we navigate the fourth quarter, we advise investors to take advantage of periods of market weakness, particularly where munis underperform UST and relative value ratios offer cheaper entry points."

He added that any unexpected breakout in supply could disrupt flows and cause munis to move to cheaper ground.

"This scenario could provide investment opportunity by locking in higher yields and capturing relative value," Lipton said. "Again, given the volatility in market sentiment, an opportunistic investment strategy may work for certain investors."

Secondary market

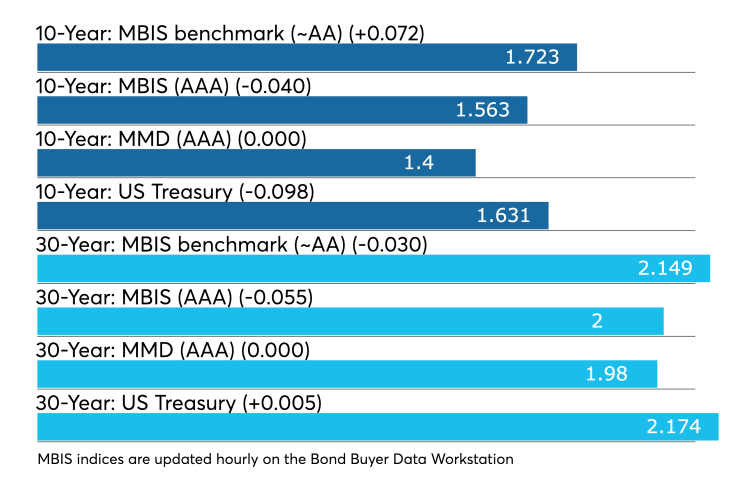

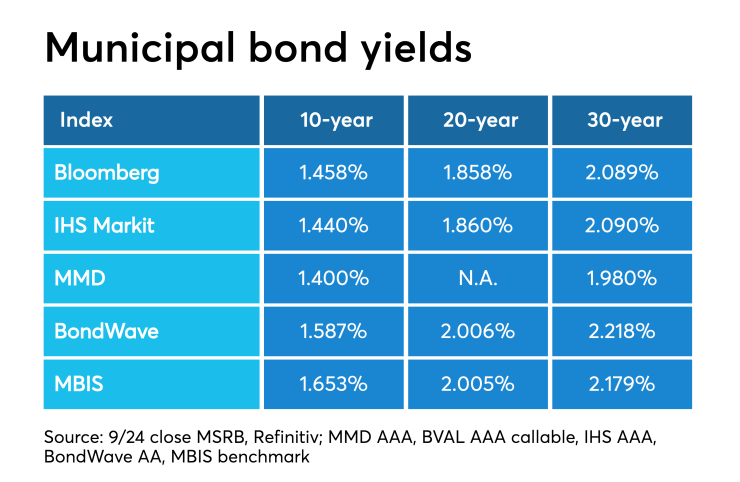

Munis were stronger on the MBIS benchmark scale, with yields falling by less than two basis points in the both 10-year and by three basis points in the 30-year maturities. High-grades were stronger, with MBIS’ AAA scale showing yields decreasing by four basis points in the 10-year maturity and by five basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year and 30-year muni GOs were unchanged at 1.40% and 1.98%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 80.9% while the 30-year muni-to-Treasury ratio stood at 90.7%, according to MMD.

Treasuries were stronger as stock prices traded in the green. The Treasury three-month was yielding 1.897%, the two-year was yielding 1.679%, the five-year was yielding 1.602%, the 10-year was yielding 1.723% and the 30-year was yielding 2.716%.

ICI: Muni funds see $382M inflow

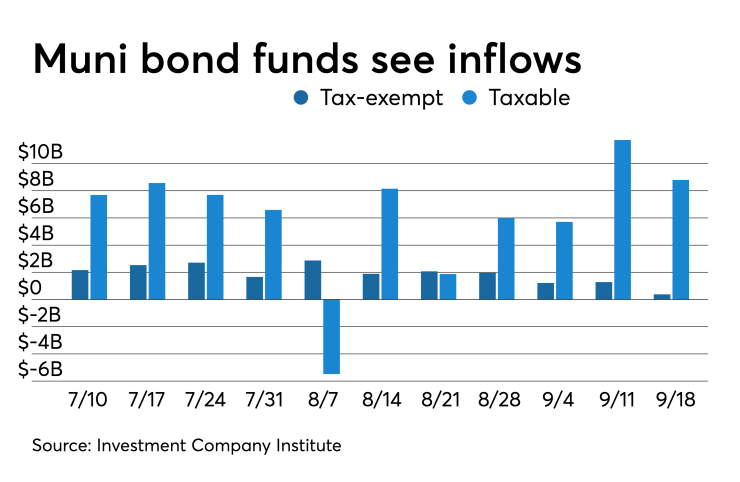

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $382 million in the week ended Sept. 18, the Investment Company Institute reported on Wednesday. It was the 38th straight week of inflows into the tax-exempt mutual funds and followed a revised inflow of $1.282 billion in the previous week.

Long-term muni funds alone saw an inflow of $424 million after a revised inflow of $1.220 billion in the previous week; ETF muni funds alone saw an outflow of $42 million after an inflow of $62 million in the prior week.

"Muni fund flows have now been positive for 38 consecutive weeks, but the pace is clearly decelerating with the most recent data showing the smallest weekly inflow year-to-date," Lipton said. "We find it amazing that overall flows remained positive during the previously sharp sell-off, but we must attribute this sustained interest to the benefits of tax efficiency."

Taxable bond funds saw combined inflows of $8.797 billion in the latest reporting week after revised inflows of $6.925 billion in the previous week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $18.742 billion after revised inflows of $19.474 billion in the prior week. World funds were the biggest losers of the week, seeing $1.771 billion of outflows.

Previous session's activity

The MSRB reported 34,424 trades Tuesday on volume of $11.465 billion. The 30-day average trade summary showed on a par amount basis of $10.99 million that customers bought $5.83 million, customers sold $3.26 million and interdealer trades totaled $1.89 million.

New York, California and Texas were most traded, with the Empire State taking 14.78% of the market, the Golden State taking 14.555% and the Lone Star State taking 9.9%.

The most actively traded security was the New Jersey Tobacco Settlement Financing Corp. 5s of 2046, which traded 10 times on volume of $39.5 million.

Treasury auctions

The Treasury Department Wednesday auctioned $41 billion of five-year notes, with a 1.50% coupon, a 1.600% high yield, a price of 99.521314.

The bid-to-cover ratio was 2.32.

Tenders at the high yield were allotted 30.48%. All competitive tenders at lower yields were accepted in full.

The median yield was 1.540%. The low yield was 0.880%.

Treasury also auctioned $18 billion of one-year 10-month floating rate notes with a high discount margin of 0.290%, at a 0.220% spread, a price of 99.871407.

The bid-to-cover ratio was 2.66.

Tenders at the high margin were allotted 75.71%.

The median discount margin was 0.255%. The low discount margin was 0.210%.

The index determination date is Sept. 23 and the index determination rate is 1.905%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.