Municipal yields increased for a second day and issuers prepared to continue a deluge of deals, signaling they aren't worried about the Federal Open Market Committee's meeting with the expected quarter point cut in interest rates priced in.

IHS Markit Ipreo forecasts weekly bond volume will increase to $10.32 billion from a revised total of $8.59 billion in the prior week, according to Refinitiv. The calendar is composed of $8.33 billion of negotiated deals and $1.99 billion of competitive sales.

The expected issuance dwarfs typical municipal market volume during weeks when the Federal Open Market Committee meets. The FOMC is scheduled to meet Sept. 17-18.

“Since a 25 basis point cut seems very likely next week, I believe issuers and underwriters are less concerned about disruption than might be the case if there was more uncertainty about the FOMC decision,” Alan Schankel, managing director at Janney Montgomery Scott said.

The calendar features 23 deals $100 million or larger with only two of those deals coming competitively. There are also nine deals that are either all or partially taxable.

“Taxable deals have been 10.6% of primary volume this year through August, the most in 6 years [based on Bond Buyer data],” Schankel said. “More issuers are using taxable debt for refundings since the 2017 tax reform legislation’s limits on use of tax free bonds for advance refundings. With longer term taxable and tax free yields so close, as illustrated by 30-year muni-to-Treasury ratio of 94%, crossover buyers, who may go either way depending on yields, are more active. “

Bank of America is scheduled to price the largest deal of the week, the Greater Orlando Aviation Authority’s (Aa3/AA-/AA-/AA) $1.11 billion of airport facilities revenue alternative minimum tax bonds on Thursday.

BofA is also expected to price Bay Area Toll Authority’s (Aa3/AA/AA) and (A1/AA-/AA-) $964.59 million of bridge revenue taxable and subordinate revenue taxable bonds on Thursday, with the second set of ratings attached to the subordinate bonds.

RBC Capital Markets is slated to price San Diego Community College District’s (Aaa/AAA/ ) $659.435 million of general obligation taxable refunding bonds on Monday.

The largest competitive deal will come from Gwinnet County Water and Sewer Authority, Georgia (Aaa/AAA/AAA), which will be selling $132.84 million of refunding revenue bonds on Monday.

Secondary market

Munis were weaker on the

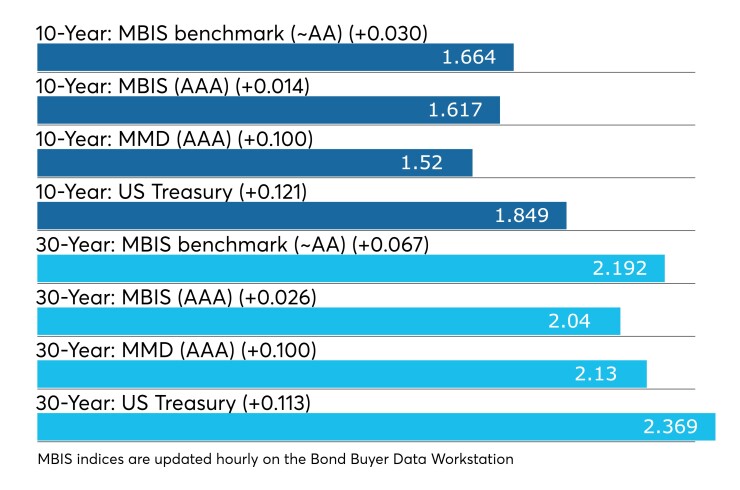

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year muni GO and 30-year GO jumped 10 basis points to 1.52% and 2.13%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 80.0% while the 30-year muni-to-Treasury ratio stood at 89.9%, according to MMD.

Treasuries were mostly trading higher and stocks were mixed, with the Dow Jones Industrial Average rising while the S&P 500 and Nasdaq were in the red. The Treasury three-month was yielding 1.961%, the two-year was yielding 1.794%, the five-year was yielding 1.746%, the 10-year was yielding 1.849% and the 30-year was yielding 2.369%.

“The ICE muni yield curve is up five to six basis points across all maturities,” ICE Data Services said in a Friday market comment. “High-yield and tobaccos are not matching the move and are only up two to three basis points. Taxables are up as much as seven basis points.”

ICE noted the high number of taxable offerings on next week’s calendar.

“Reportedly over 1/3 of the calendar will comprise taxable deals that are refunding tax-free bonds,” ICE said.

Lipper: More inflows, but less than one billion for second week in a row

For 36 weeks in a row investors have poured cash into municipal bond funds, according to the latest data released by Refinitiv Lipper on Thursday.

Tax-exempt mutual funds that report weekly received $929.944 million of inflows in the week ended Sept. 11 after inflows of $820.100 million in the previous week. This is the second week in a row and the third time in the past 12 weeks where inflows have been less than $1 billion.

“I’ve seen signs of slowing inflows,” Schankel said. “Mutual fund inflows last week per ICI were the slowest since early June and ETF flows were negative last week per ICI for first time since June. I’ll be looking for ICI’s more comprehensive data next week to validate the Lipper data.”

Exchange-traded muni funds reported inflows of $50.906 million after inflows of $44.376 million in the previous week. Ex-ETFs, muni funds saw inflows of $879.037 million after inflows of $775.724 million in the previous week.

The four-week moving average remained positive at $1.211 billion, after being in the green at $1.385 billion in the previous week.

Long-term muni bond funds had inflows of $692.700 million in the latest week after inflows of $267.661 million in the previous week. Intermediate-term funds had inflows of $218.277 million after inflows of $455.942 million in the prior week.

National funds had inflows of $669.588 million after inflows of $1.347 billion in the previous week. High-yield muni funds reported inflows of $279.835 million in the latest week, after inflows of $184.802 million the previous week.

On Wednesday, the Investment Company Institute reported long-term municipal bond funds and exchange-traded funds saw a combined inflow of $1.218 billion in the week ended Sept. 4, while long-term muni funds alone saw an inflow of $1.340 billion and ETF muni funds saw an outflow of $122 million.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Sept. 13 were from California, Texas and New Jersey issuers, according to

In the GO bond sector, the State of California 3s of 2020 traded 72 times. In the revenue bond sector, the Texas TRANs 4s of 2020 traded 35 times. In the taxable bond sector, the Rutgers University 3.915s of 2019 traded 61 times.

Week's actively quoted issues

Puerto Rico and Massachusetts bonds were among the most actively quoted in the week ended Sept. 13, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp., 5s of 2058 were quoted by 29 unique dealers. On the ask side, the Commonwealth of Massachusetts revenue 5s of 2041 were quoted by 209 dealers. Among two-sided quotes, the Puerto Rico Sales Tax Financing Corp., revenue 4.329s of 2040 were quoted by 21 dealers.

Previous session's activity

The MSRB reported 34,010 trades Thursday on volume of $12.74 billion. The 30-day average trade summary showed on a par amount basis of $11.32 million that customers bought $6.04 million, customers sold $3.29 million and interdealer trades totaled $1.98 million.

California, Texas and New York were most traded, with the Golden State taking 15.822% of the market, the Lone Star State taking 13.349% and the Empire State taking 12.699%.

The most actively traded security was the State of Texas tax anticipation notes 4s of 2020, which traded 23 times on volume of $26.62 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.