The Metropolitan Transportation Authority's ability to finish projects on budget will become more crucial as federal, state and economic pressures mount.

-

In the first of his three-part 2026 municipal outlook series, Market Intelligence analyst Jeff Lipton forecasts for sub-5% returns, continued demand, possibly more curve steepening as the Fed eases slowly, the economy skirts recession, and AI, tariffs and midterm politics potentially reshaping risks across public finance sectors.

-

"The new office will be smaller, more efficient, and right sized for our future needs," an MSRB spokesperson said.

-

Kutak Rock is promoting several members of their public finance and tax teams as part of a move that sees 28 attorneys move into partnership roles in eleven offices.

-

In this third of a three-part 2026 municipal bond outlook series, Market Intelligence analyst Jeff Lipton explains how another year of heavy supply, surging ETF and SMA assets, climate and cyber risk, and growing use of bond insurance will drive muni market structure and strategy for both sell-side and buy-side stakeholders.

-

Market Intelligence analyst Jeff Lipton, in the second installment of his three-part 2026 outlook series, maps out quality-centric portfolio shifts, barbell and long-end strategies, and sector tilts across hospitals, higher education and housing as record supply and net inflows drive the muni market.

-

In the first of his three-part 2026 municipal outlook series, Market Intelligence analyst Jeff Lipton forecasts for sub-5% returns, continued demand, possibly more curve steepening as the Fed eases slowly, the economy skirts recession, and AI, tariffs and midterm politics potentially reshaping risks across public finance sectors.

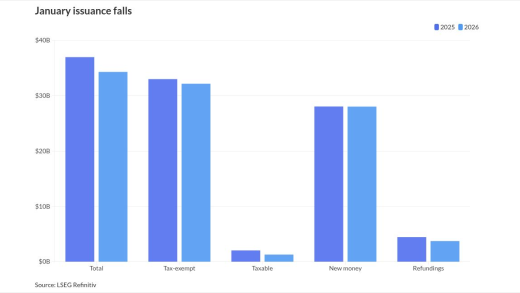

The new-issue calendar is an estimated $10.836 billion, with $6.979 billion of negotiated deals on tap and $3.857 billion of competitives.

The Equitable School Revolving Fund, which has more deals in the works, has maintained its strong credit profile even as the sector has experienced headwinds.

It is one of several P3-related recommendations the board made to Transportation Secretary Sean Duffy.

Andrew Nakahata officially takes the helm of the California Infrastructure and Economic Development Bank on Wednesday.

-

The Hall of Fame initiative celebrates individuals whose careers have left an indelible mark, while the Rising Stars program recognizes the muni finance leaders of tomorrow. Nominations for the 2024 classes will be accepted until Friday, May 31. This will be the final deadline.

-

Major headwinds for the muni market include climate change, growing federal debt, shrinkage of the workforce, the impact of remote work, cybersecurity attacks, and political polarization. And they are poised to be costly for states and municipalities.

-

While the SEC's cybersecurity rule does not apply to municipal issuers, there are a few points discussed in the Adopting Release that may be useful for municipal market participants.

-

Introducing The Bond Buyer's newest Muni Hall of Famers who will be honored at an awards dinner in Boston on Sept. 30, 2025.

-

"I have been very fortunate to contribute to a fascinating sector of the financial industry that is full of ambiguous issues and data," said Tom Doe. "I am flattered to be included in the Hall of Fame, it is a wonderful capstone to my career."

-

Over nearly 40 years, investment banker Diana Hoadley built a legacy of far-ranging vision and collaboration that left a trail of professional admirers.

"I look forward to continuing to work on interesting projects and taking on more responsibility" Bain said.

"I was a public policy major," Calabrese said. Her studies focused on the regulatory environment at different levels of government, providing "the perfect segue into munis."

The Westchester Medical Center Health Network's $286.9 million Series 2023 bond issuance supported the construction of a state-of-the-art patient tower.

-

The muni market has rebounded from the technical pressures of the first half of last year — a result of surging issuance — said John Miller, head and CIO of First Eagle's municipal credit team.

-

The city's Department of Water and Power, which saw spreads widen after last year's deadly wildfires, upsized a revenue bond deal amid strong investor interest.

-

Metro is considering a public-private partnership to deliver what is its largest project to date.

-

Bond advocates are watching the appropriations process while the possibilities of a Farm Bill and surface transportation reauthorization may offer openings for restoring advance refunding and raising the BQ cap.

-

Chicago general obligation bond prices have dropped sharply since the start of the year, according to the Center for Municipal Finance's muni indices.

-

The top two municipal bond insurers wrapped over $41.828 billion in 2025, up from $41.166 billion in 2024, data shows.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Intraday News UpdateDelivered Every WeekdayGet notified on breaking news and events.

- Primary Market ReportWeeklyRecap of articles on new issuance as well as Featured Deals on the week.

- Weekly Top 10WeeklyRecap of the 10 most read Bond Buyer articles of the past week.

Gilmore & Bell and Nixon Peabody were new entrants in the top 10, bumping Greenberg Traurig and Bracewell to the top 15.

- ON-DEMAND VIDEO

KC Mathews, executive vice president and chief market strategist at Commerce Trust breaks down the FOMC meeting.

- ON-DEMAND VIDEO

Pamela Frederick and Adam Barsky will share their views on the importance of the tax-exemption, how it benefits state and local governments, taxpayers, and U.S. retail investors -- and keeps the country competitive on a global scale.

- ON-DEMAND VIDEO

Gary Hall, President of the Infrastructure & Public Finance Division at Siebert Williams Shank & Co., joins Bond Buyer Executive Editor Lynne Funk to talk about the importance of the muni industry in financing the country's extensive infrastructure needs -- from ports and airports to bridges and energy solutions.

- Sponsor Content from Orrick

- Sponsor content from Adaje Inc

- Sponsor Content from Orrick

- Sponsor Content from Intercontinental Exchange Inc