-

The winners of the Freda Johnson Award are Jeanette Weldon of the Connecticut Health and Educational Facilities Authority and Elaine Brennan of Roosevelt & Cross Inc.

26m ago -

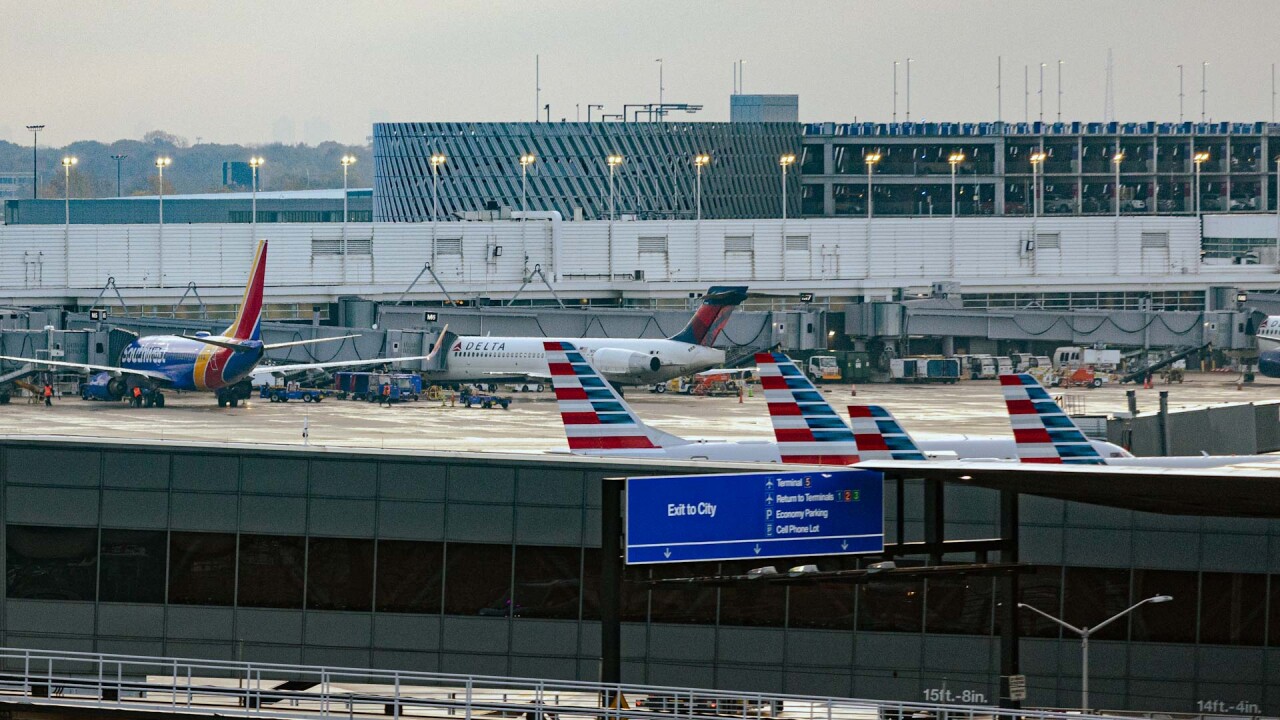

The airport's sprawling capital improvement program is expected to total $11.5 billion over the next decade, $9 billion of it bond funded.

3h ago -

Photos from The Bond Buyer's 2025 California Public Finance conference.

November 11 -

Arrington announced he will not seek reelection in 2026 after helping shepherd President Trump's first major tax bill through Congress, marking the first GOP House chairman to check out in 2026.

November 11 -

A planned vote on health insurance subsidies will be key to how Congress handles the next funding cliff at the end of January, market participants said.

November 11 -

Some of the most active sectors have been education (+29%), GOs (+17%) and healthcare (+17%), said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

November 10 -

Assured Guaranty commented on Brightline and PREPA during its third-quarter earnings call, on which the company reported a 46% increase in third quarter gross par written year over year, to $7.85 billion from $5.38 billion.

November 10 -

The Port of Long Beach cargo volumes are ahead of last year for the first 10 months, though October saw a dip in traffic.

November 10 -

Federal Reserve Governor Stephen Miran said emerging stresses in housing and private credit markets warrant a reduction to short-term interest rates. While preferring a 50 basis point cut in December, Miran said he would settle for a 25 basis point reduction.

November 10 -

Recently enacted tax policy changes will help the state's finances, Fitch said.

November 10 -

The $16,250 was part of a $150,000 total fine Wedbush agreed to pay to settle FINRA allegations.

November 10 -

As the Senate moves towards a possible deal to end the longest federal government shutdown in history, the "Big 7" of state and local lobbying groups along with the GFOA are making an urgent appeal.

November 10 -

New York will license up to three casinos in New York City. What returns can the state and expect on new entrants to an increasingly crowded gambling market?

November 10 -

The muni market may see additional volatility due to "uncertainties related to the future of tariffs and stronger inflation prints," said Barclays strategists led by Mikhail Foux.

November 7 -

The industry for years has lobbied Congress and the Treasury Department to make the changes, but the issue has taken on more urgency amid a data center boom that promises to transform the U.S. energy landscape

November 7 -

Fresno, California, received a boost to positive from stable on its senior lien airport revenue bonds.

November 7 -

Moody's cited very narrow liquidity, very high leverage and concerns about delays in opening up a new campus.

November 7 -

Federal Reserve Vice Chair Philip Jefferson said that as interest rates have moved toward a more neutral level, "it makes sense" now to proceed with caution.

November 7 -

The California Debt and Investment Advisory Commission explored public finance solutions to child sexual abuse claims this week at an event in San Diego.

November 7 -

Investors added $1.266 billion to municipal bond mutual funds in the week ended Wednesday, following $744.3 million of inflows the prior week, according to LSEG Lipper data.

November 6 -

S&P revised Chicago's outlook to negative from stable and affirmed its BBB rating on the city's outstanding general obligation debt.

November 6 -

Public transit emerged as an $11 billion winner in the 2025 elections as voters in five states approved measures to pour money into the sector.

November 6 -

At least $200 million of the bonds will be priced on a competitive basis.

November 6 -

The city plans to sell about $690 million of AMT bonds on Nov. 18 to finance facilities and refund outstanding debt for the airline.

November 6 -

Loren McDougall will help Birch Creek launch high-yield-focused separately managed accounts.

November 6 -

Louisiana State Treasurer John Fleming indicated he is open to compromise on the nature of state oversight for the city, which may have trouble making payroll.

November 6 -

While the market navigates a surge in supply, another focus area has become elections and their potential to shift market demand, as several regional election results will likely garner greater attention over the next few months, said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

November 5 -

City and state law mean it's unlikely that Mamdani will be able to enact the parts of his agenda that would have major impacts on the city's credit.

November 5 -

An uncertain financial future partially due to federal government downsizing is compounding with nearly $6 billion of unfunded capital needs that will require Washington D.C. to lean on asset management and its strong credit rating to overcome the challenges.

November 5 -

The ruling comes as the municipal bond market closely watches the administration's effort to control federal infrastructure spending.

November 5 -

The federal budget bill lowered the percentage of private-activity bonds needed for affordable housing projects to qualify for 4% tax credits, but it hasn't been the boon expected.

November 5 -

Municipal market professionals aren't confident that state and local governments will invest in resilient infrastructure over the next five years.

November 5 -

Illinois' General Assembly passed a bill that provides both governance reforms sought by lawmakers and funding to avert a Chicago transit fiscal cliff.

November 5 -

A rundown of the largest bond referendums.

November 5 -

Tuesday saw a good slate of deals, including the acceleration of Ohio's $508.865 million of GOs and Austin's $419.035 million of electric utility system revenue refunding bonds.

November 4 -

Moody's revised the outlook on the Chicago Board of Education to stable from positive on Monday.

November 4 -

Muni experts discussed how macroeconomic concerns and a volatile political environment are affecting the market as the market chalks up another record year of issuance.

November 4 -

House Republicans hope to mark up the next surface transportation bill early next year.

November 4 -

Municipal bond insurance volume grew 17.7% year-over-year in the first three quarters of 2025, according to LSEG, outpacing the municipal market as a whole.

November 4 -

Concerns over the Texas city's future water supply after a desalination project was terminated, led to negative rating outlooks from Fitch and S&P.

November 4 -

Municipal water agencies are appealing to the Environmental Protection Agency about a slowdown in the Water Infrastructure Finance and Innovation Act loan program which along with bond sales, funds improvements to water and sewer infrastructure.

November 4 -

Federal immigration and trade policies are a likely factor in the triple-A-rated state's weak job growth and pose risks for its southern border cities' budgets.

November 4 -

In her first public appearance since President Trump moved to fire her from the Federal Reserve Board of Governors, Fed Gov. Lisa Cook reiterated her commitment to bringing inflation under 2% and said that the labor market remains "solid."

November 3 -

"Normalized supply, a supportive rate environment and favorable technicals propelled the municipal market to the best October performance [in decades]," said Robert J. Lind.

November 3 -

Attorneys for the Archdiocese said it is "inevitable" bondholders will be hit with a cramdown.

November 3 -

Meanwhile, the Brightline West train project has floated a possible debt exchange ahead of its own mandatory redemption later this month.

November 3 -

As climate and cybersecurity risks intensify, Jeff Lipton argues it's time for the legal community to lead a new era of municipal disclosure — tightening language, clarifying exposures, and ensuring investor confidence.

November 3 The Bond Buyer

The Bond Buyer -

Pennsylvania's budget impasse has surpassed four months. Local governments and schools that rely on state funds are getting frustrated.

November 3 -

Next week's issuance is slated to be "substantial" — an estimated $13.1 billion — although that is expected to be met with "solid" November reinvestment capital, J.P. Morgan strategists said.

October 31 -

States have spent weeks preparing for how they would cover the $8 billion shortfall in food stamps for the month of November.

October 31 -

The rating agency expects the school to post an operating deficit this year.

October 31 -

City Manager Oliver Chi unveiled a plan to invest $60 million to change the city's current trajectory.

October 31 -

"Illinois is just pure mismanagement," Ryan Frost, managing director of the Reason Foundation's Pension Integrity Project, said.

October 31 -

Issuance year-to-date is $493.063 billion, up 9.3% from $451.079 billion over the same period. With issuance estimated at $13.118 billion in the first week of November, 2024's $500-plus billion record should fall within the next week or two.

October 31 -

The school system, which has an AA underlying bond rating from S&P, was targeted by the Texas Education Agency for a takeover based on academic performance.

October 31 -

As more states move towards resetting their Congressional districts questions arise over how redistricting will affect the balance of power and eventually tax policy.

October 31 -

Municipal Capital Markets Group and CSG Advisors were new entrants to the top 10, kicking Caine Mitter and Estrada Hinojosa into the top 15.

October 31 -

The Los Angeles Department of Water and Power will sell $977.6 million of water revenue bonds as it grapples with the impacts of January's devastating wildfire.

October 31 -

Technicals are supposed to become slightly more favorable into year-end, said Jeremy Holtz, a portfolio manager at Income Research + Management.

October 30 -

The city said it will take a wide range of measures to try to get through November and December without running out of money.

October 30 -

The one-notch upgrade to AA-minus for Oklahoma's flagship university was assigned to an upcoming approximately $160.7 million bond refunding.

October 30 -

Chicago Public Schools went to market this week with nearly $1.1 billion of refunding bonds in the largest municipal transaction the district ever completed.

October 30 -

Interest rate volatility and the Trump administration have municipal market professionals worried that funding goals won't be met.

October 30 -

Overall, the top underwriters saw minor shuffling in the first three quarters and no new firms entered the top 10.

October 30 -

The bankruptcy judge suggested Jackson Hospital and Clinic may be closed if it doesn't propose a plan of adjustment before the end of the calendar year.

October 30 -

"The knee-jerk reaction of the markets to the Fed meeting (and press conference) was to sell stocks and bonds, because [Fed] Chairman Jerome Powell said that an additional rate cut in December wasn't a sure thing," said Northlight Asset Management Chief Investment Officer Chris Zaccarelli.

October 29 -

The MSRB plans to issue the request for comment regarding MSRB Rule D-15 "within the next week or so."

October 29 -

Kutak Rock has added four veteran public finance attorneys and opened offices in Columbus and Cleveland, the firm said Tuesday.

October 29 -

The Virginia Governor's race could put Democrats in charge of all three branches in the Old Dominion, as Abigail Spanberger goes up against Winsome Earle-Sears who has floated tapping the state's rainy-day fund to prop up Medicaid.

October 29 -

Logan comes to the firm from Raymond James; before that he was a longtime Citi banker.

October 29 -

Approval by Doña Ana County of $165 billion of industrial revenue bonds for a massive data center project is being challenged in state court.

October 29 -

New York boasts four of the top 10 issuers, followed by California and Alabama, each with two, and one apiece for Wisconsin and Massachusetts.

October 29 -

After Immigration and Customs Enforcement agents arrested its superintendent, Des Moines Public Schools is taking a $265 million GO bond measure to voters.

October 29 -

The softer-than-expected September consumer price index report, released Friday, reinforced confidence in the likelihood of a Fed rate cut at its October meeting and potentially at its December meeting, said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

October 28 -

Illinois' Grand Prairie Water Commission went to market Monday in a debut deal as it builds infrastrcture linking the Joliet area with Chicago's water system.

October 28 -

Contractors that have been absorbing cost increases in fixed-price projects may insist on the more flexible pricing built into progressive design-build delivery models.

October 28 -

Jeff Lipton begins his role as The Bond Buyer's Market Intelligence Analyst with an examination of how evolving federal policy, shifting credit conditions and market inefficiencies shape municipal risk — and where disciplined analysis can uncover value.

October 28 The Bond Buyer

The Bond Buyer -

Analyst and market strategist Jeff Lipton joins the team to deliver clarity and thoughtful guidance to a market witnessing evolving complexities — connecting policy moves, credit shifts and investment behavior to help our readers navigate what comes next.

October 28 The Bond Buyer

The Bond Buyer -

Moody's cited the school's weakening liquidity levels in its downgrade.

October 28 -

The Trump administration has denied an appeal for $33.7 million in FEMA relief funds for flood damage incurred in western Maryland, which ends the possibility of aid for a state already reeling from job losses.

October 28 -

The Southeast Pennsylvania Transportation Authority is facing federal deadlines after a series of fires.

October 28 -

Gilmore & Bell and Nixon Peabody were new entrants in the top 10, bumping Greenberg Traurig and Bracewell to the top 15.

October 28 -

Voters will decide the fate of 447 bond propositions totaling a record $83.7 billion with development-related districts accounting for most of the debt.

October 28 -

Economists see the Fed ending quantitative tightening soon, but don't agree exactly when.

October 28 -

Issuance is light this week, with $5.367 billion on tap, and it should be "easily distributed," J.P. Morgan strategists said.

October 27 -

"BDA supports the proposal and we encourage the commission to approve it," its letter said.

October 27 -

The government shutdown is wreaking more havoc as air traffic controllers will miss a paycheck this week and federal payments to states for housing bonds and Grant Anticipation Revenue Vehicle bonds may stop flowing.

October 27 -

California's largest health workers union sent ballot language to state Attorney General Rob Bonta in an effort to add a wealth tax proposal to the November 2026 ballot.

October 27 -

The city comptroller says Buffalo's finances are in dire shape, and is fighting in court not to issue debt authorized by the mayor and city council.

October 27 -

The utility responded that it is not eligible to declare bankruptcy.

October 24 -

"Investors were not disappointed," said John Kerschner, global head of securitized products and portfolio manager at Janus Henderson. "Inflation came in softer than expected, leading to a tepid bond market rally" and ensuring a rate cut at the upcoming Federal Open Market Committee meeting.

October 24 -

The northern California school district has been struggling for years and on several occasions abandoned plans to consolidate schools, which rating agencies say might have shored up finances.

October 24 -

Jamie Doffermyre has worked in munis at Truist Securities, Citi and Merrill Lynch.

October 24 -

Mayor Brandon Johnson released to City Council a report from accounting firm Ernst & Young with recommendations for closing the city's structural budget gap.

October 24 -

Executing a successful bond issuance becomes simpler by combining long range planning, shorter-term timing and marshaling political support.

October 24 -

The city council president is concerned about state bond commission approval.

October 24 -

California's recent tax revenues exceeded forecasts, but the state faces structural deficits that drive budgetary borrowing and have narrowed its reserves.

October 24 -

"Over the next fiscal year, I look forward to collaborating with MSRB Board members from across our industry, and the nation," Board Chair Natasha Holiday said.

October 24 -

The upgrade is driven by realized and expected improvement in the state's financial metrics, the rating agency said.

October 23 -

"We're not going to be having huge reinvestment months over the next few months, not until the beginning of the year. So we need this flow [of deals] to keep up with demand, and we expect that to continue," said Jennifer Johnston, director of municipal bonds research at Franklin Templeton.

October 23 -

The approval of $650 million of revenue bonds comes in the wake of a recently filed petition seeking to subject the project to voter approval or delay.

October 23 -

With the advance refunding of tax-exempt munis still off the table, issuers are using existing market conditions to shed Build America Bonds and realize debt service savings through tender offers.

October 23 -

The spending cuts and reforms to Medicaid and SNAP in the One Big Beautiful Bill will be phased in through 2028, but most states will start preparing early next year.

October 23 -

"I would say don't be afraid to pick up the phone and talk to investors directly," Nuveen's Molly Shellhorn said.

October 23 -

North Carolina's triple-A ratings were affirmed ahead of plans to sell up to $506 million in general obligation and limited obligation bonds.

October 23 -

The tax-exempt market is expected to be "biased higher" in the coming weeks and months as the expected heavy pace of issuance this month will not be as "oppressive" as feared, said Pat Luby, head of municipal strategy at CreditSights.

October 22 -

The city is gearing up to sell $252 million of general obligation bonds this year and $1.5 billion of revenue bonds in 2026 for a convention center project.

October 22 -

The Cleveland City Council will decide whether to approve a deal struck by Mayor Justin Bibb with Haslam Sports Group, owners of the NFL's Cleveland Browns.

October 22 -

"Bond by bond, project by project the muni market has helped to build the spaces and places where American life unfolds," SEC Chairman Paul Atkins said in a speech delivered at the MSRB's 50th Anniversary Celebration Tuesday evening.

October 22 -

92% of the holders or insurers of Puerto Rico Electric Power Authority bonds reportedly now oppose the Oversight Board's proposed restructuring deal.

October 22 -

"I've never seen this level of hand wringing at the issuer level," said Matt Boles, managing director at RBC Capital Markets.

October 22 -

Higher interest rates are keeping arbitrage on the playing field as issuers try to play by the rules and still come out ahead.

October 22 -

Brandon Johnson released his $16.6 billion 2026 budget last week. The budget calls for new revenue sources, but avoids property tax hikes.

October 22 -

Prior to Dimensional's approval, only Vanguard held a patent to the ETF-as-a-share-class structure, but the patent expired in 2023.

October 22 -

The first part of exclusive research from The Bond Buyer finds that most industry optimists say funding needs will be met sometime after 2035.

October 22 -

Yakym praised the successful effort to preserve the tax exemption throughout One Big Beautiful Bill negotiations and encouraged market advocates to keep lobbying lawmakers.

October 21 -

Demand may strengthen as "investors anticipate the Federal Reserve's likely path of rate cuts, which would drive yields even lower," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

October 21 -

"It shows the chairman's understanding of the practical realities of firms...," Peter Chan, a partner at Baker McKenzie said.

October 21 -

This will be Charvel's second stint as the city's CFO.

October 21 -

Cities are responding to a state directive to remove symbols on crosswalks and other so-called distractions or risk losing state and federal funding.

October 21 -

Tom Falcone of the Large Public Power Council unpacks the massive infrastructure push driven by AI and manufacturing, and the policy hurdles standing in the way.

October 21 -

The city council of Harvey voted to declare the city financially distressed in a bid for state oversight, as the mayor warned of a city government shutdown.

October 20 -

The bonds are rated A-plus by three ratings agencies and are expected to have serial maturities from 2026 to 2055.

October 20 -

"The story remains the same: solid demand is more than enough to take down the sizable new issue supply," said Daryl Clements, a portfolio manager at AllianceBernstein.

October 20 -

Its triple-A bonds have recovered after cheapening earlier this year under a pressure campaign from the Trump administration.

October 20 -

The case challenges Oklahoma's authority to collect income taxes from Native Americans who live and work on tribal reservations.

October 20 -

The Roosevelt Institute rolled out a new report on munis revealing the latest trends in public finance along with critiques and recommendations for alternative ways to fund infrastructure.

October 20 -

Photos from The Bond Buyer's 2025 Infrastructure conference.

October 20 -

The Dormitory Authority of the State of New York and New York City both saw billion-dollar-plus deals oversubscribed.

October 20 -

The new-issue calendar is at $15.637 billion and boasts four mega deals.

October 17 -

State and local pension funds are "surviving but not thriving," said Equable in its State of Pensions 2025 report.

October 17 -

By delaying the bill signing, Oregon Gov. Tina Kotek shortens time opponents have to gather signatures for a measure to overturn the transportation bill.

October 17 -

Maryland's Capital Debt Affordability Committee is recommending the state stick to its guns by endorsing a plan to borrow up to $1.75 billion for capital projects in the coming fiscal year, despite the job shedding inflicted by the Trump administration's plans to shrink the federal government.

October 17 -

The bill was a response to a charter school fraud that took the state for $400 million, but Gov. Gavin Newsom said the proposed reforms were too expensive.

October 17 -

Frederick Putnam has joined Texas Capital's government, nonprofit and institutions team as managing director, senior relationship manager.

October 17 -

Among those approved is a $117 million variable rate demand bond expected to be marketed late this year.

October 16 -

Earlier Thursday, the market was "chugging along, doing OK, just kind of nothing, in between slight strength to modest upticks, but the narrative changed when that bank news came out. The market really ran pretty quickly," said Chris Brigati, managing director and CIO at SWBC.

October 16 -

"Going forward, the staff will provide the other side with at least four weeks to make Wells submissions," SEC Chairman Paul Atkins said in a recent speech.

October 16 -

The attackers did not steal any data, but the firm had to rebuild its servers to get back into operation, said Albert Rodriguez, a manager at ImageMaster.

October 16 -

"The project is not dead," said the transportation planning board chair.

October 16 -

Fitch Ratings cited the hospital's growing revenue and other factors in lifting the issuer's outlook.

October 16 -

The city plans a competitive general obligation bond sale, as well as a sales tax revenue bond issue to help finance a professional basketball arena next year.

October 16 -

R. Wade Norris has joined the Washington, D.C., office of Dinsmore & Shoal as a partner to shore up operations in the firm's work in multifamily finance and public private partnerships.

October 16 -

Federal Reserve Gov. Stephen Miran said Thursday that the central bank's forays into examining climate change and racial justice under the prior administration politicized the Fed. He also argued that Fed officials should limit their comments on economic policies such as tariffs.

October 16 -

Metra announced fare hikes in its 2026 budget, part of a broader regional policy requiring the Chicago Transit Authority, Metra and Pace to raise fares.

October 16 -

The Southeast's states rely on federal funds more than those in other regions and analysts warn those funds may be ending shortly if the shutdown continues.

October 16 -

The city council took action to keep the property tax rate unchanged, a move that could punch a $53 million hole in the fiscal 2026 budget and drain reserves.

October 15 -

"In theory at least, municipal yields should be able to stabilize here; levels remain attractive for pure income buyers while more sustainable constructive fund inflows are just enough to speak for rising issuance in the absence of meaningful reinvestment," said Matt Fabian, president of Municipal Market Analytics.

October 15 -

The Trump administration's tariff policy is affecting vulnerable pockets of the economy including the construction industry, port operations and states with a reliance on international trade.

October 15 -

"If I wanted to target municipal finance, this would be a really good place for me to start," said Omid Rahmani, public finance cybersecurity lead at Fitch Ratings.

October 15 -

The financing challenges facing both Brightline projects have translated into falling bond prices.

October 15 -

Municipal Market analytics hired Marvis Gutierrez in response to growing demand for the firm's services and plans to keep hiring.

October 15 -

Investors sued after the fund's sudden June selloff.

October 15 -

Legislators and transit groups are pushing to get transit reform across the finish line this month, lawmakers and stakeholders said Friday.

October 15 -

As the technical picture tends to turn "more favorable" during November and December, Birch Creek strategists believe "the wider new issue concessions brought about via the heavy new issue calendar will likely be rewarded."

October 14 -

A six-notch downgrade gives the financially troubled city a non-investment grade rating of BB-plus with a negative outlook.

October 14 -

California Gov. Gavin Newsom signed legislation that will place a regional sales tax measure on the November 2026 ballot to aid struggling transit agencies.

October 14 -

Public finance careers require flexibility and relationship-building, said speakers a University of Chicago Harris School of Public Policy event.

October 14 -

The Senate passed the ROAD to Housing Act, which should boost the use of mortgage revenue bonds, as a rider on the Defense Reauthorization Act.

October 14 -

"It is a big problem across the board with all types of deal participants perhaps venturing into unregistered MA activity," said Susan Gaffney.

October 14 -

The state is gearing up to grow its space industry as the federal government starts allowing tax-exempt private activity bond financing for spaceports.

October 14