-

An Indiana bill would address some concerns that were raised around 2025's Senate Enrolled Act 1, which created questions about local government credit quality.

February 4 -

Hamilton City Schools blames state funding formula changes and property tax reforms for a fiscal emergency that has prompted school closures and deep cuts.

January 28 -

After Mayor Brandon Johnson split the city's $260 million advance pension payment, more than 30 aldermen introduced a resolution calling for a special hearing.

January 22 -

Major cuts to property tax revenue could push cities and counties to turn to less stable forms of revenue like sales taxes, analysts say.

January 22 -

Governors plan to cut taxes and expand school vouchers across many of the Midwest's Republican-led states in fiscal year 2027.

January 21 -

The Glenwood-Lynwood Public Library District was four weeks late on a Dec. 1 debt service payment amid delays to Cook County property tax billing.

December 31 -

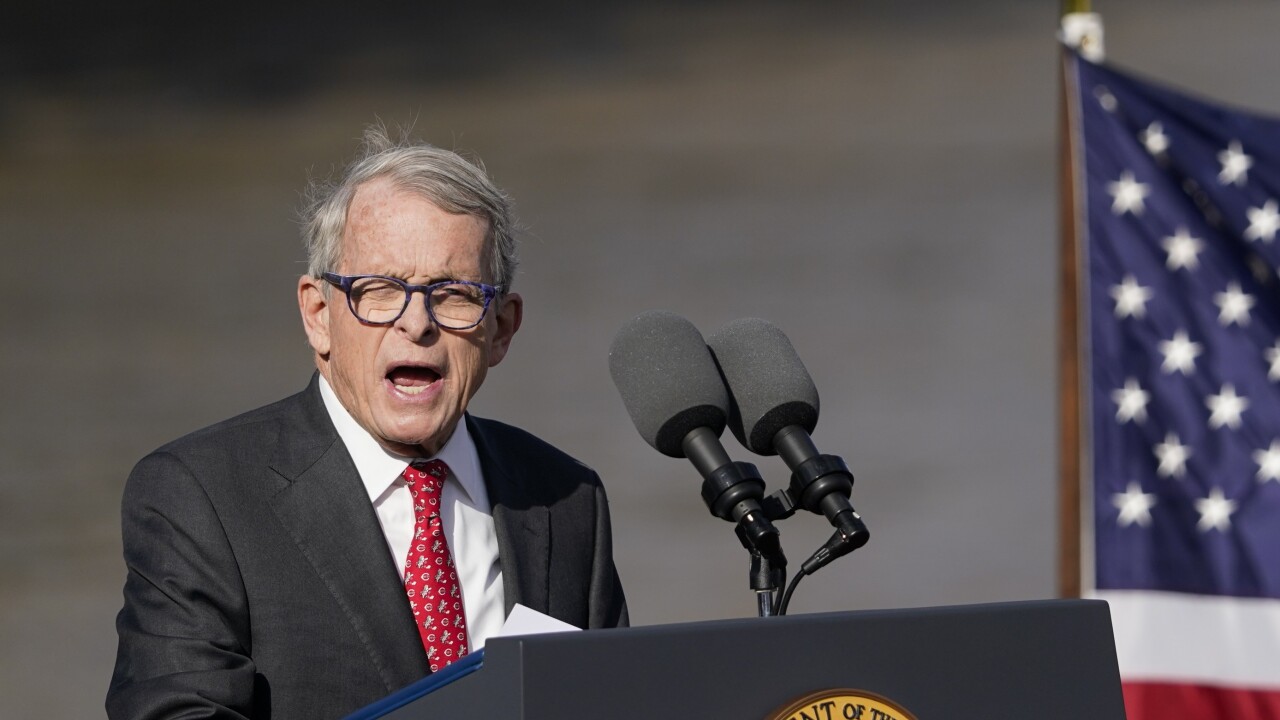

When Ohio Gov. Mike DeWine signed property tax reform bills, there was hope in Columbus it would appease voters who backed a push to abolish property taxes.

December 31 -

Property taxation is being targeted in a growing movement across the nation for cuts or elimination to address homeowner angst over rising tax bills.

December 16 -

The changing climate is increasing insurance rates for residents and cities and lowering property values in areas that face more frequent and intense disasters.

December 11 -

A 2025 state law prohibits cities from increasing their property tax revenue if they fail to produce a timely annual financial audit.

December 9 -

As South Dakota becomes the latest Midwest state to consider property tax reform, some officials are scrutinizing school districts more closely.

December 4 -

The county treasurer's new report describing large hikes in Chicago residential tax bills effectively takes property tax hikes off the table for the city.

December 3 -

Chicago homeowners face a record property tax hike after the city's downtown office buildings and other commercial real estate values fell again.

November 17 -

The city council took action to keep the property tax rate unchanged, a move that could punch a $53 million hole in the fiscal 2026 budget and drain reserves.

October 15 -

A six-notch downgrade gives the financially troubled city a non-investment grade rating of BB-plus with a negative outlook.

October 14 -

A debt restructuring by Ninnekah Public Schools aimed to reduce the impact of a court-approved settlement that will still result in a huge property tax hike.

October 7 -

La Marque's two-notch downgrade from Moody's follows a rating cut last month by S&P; both agencies put the city on review for potential further downgrades.

October 6 -

Four cities were ordered to halt recent tax hikes pending an investigation of whether they complied with a state law that enforces a deadline for annual audits.

October 2 -

Ohio Gov. Mike DeWine's property tax working group released its final recommendations on Tuesday.

October 2 -

Two months after property tax payments would normally be due, Cook County, Illinois, is still struggling to send out accurate bills for the second part of 2024.

October 1