-

Chicago general obligation bond prices have dropped sharply since the start of the year, according to the Center for Municipal Finance's muni indices.

January 27 -

After Mayor Brandon Johnson split the city's $260 million advance pension payment, more than 30 aldermen introduced a resolution calling for a special hearing.

January 22 -

Indiana looks to entice the National Football League's Chicago Bears to move to northwest Indiana by offering state-backed bonds to fund a new stadium.

January 20 -

Panelists diverged sharply on the outlook for 2026 at the Executives' Club of Chicago's Annual Economic Outlook panel, held at a hotel in Chicago's Loop.

January 14 -

Moody's Ratings warned some states face credit risk after the Trump administration froze $10 billion of funding to five blue states.

January 14 -

The Glenwood-Lynwood Public Library District was four weeks late on a Dec. 1 debt service payment amid delays to Cook County property tax billing.

December 31 -

Chicago's city council passed its alternative budget over the weekend. Mayor Brandon Johnson hates it, but said he would not veto it.

December 24 -

Moody's Ratings upgraded the Chicago Transit Authority to Aa3 from A1 Friday, and upgraded the Chicago-area Regional Transportation Authority to Aa2 from Aa3.

December 24 -

Illinois Gov. JB Pritzker signed a raft of major bills into law over the past week, culminating with the Northern Illinois Transit Authority Act.

December 18 -

A vote Wednesday by Chicago's city council would speed up budget hearings and signals that a majority of alders may go their own way on the budget.

December 11 -

The county treasurer's new report describing large hikes in Chicago residential tax bills effectively takes property tax hikes off the table for the city.

December 3 -

Chicago homeowners face a record property tax hike after the city's downtown office buildings and other commercial real estate values fell again.

November 17 -

Illinois lawmakers sent Gov. JB Pritzker a bill to facilitate the use of STAR bonds for economic development, which has happened only once in 15 years.

November 13 -

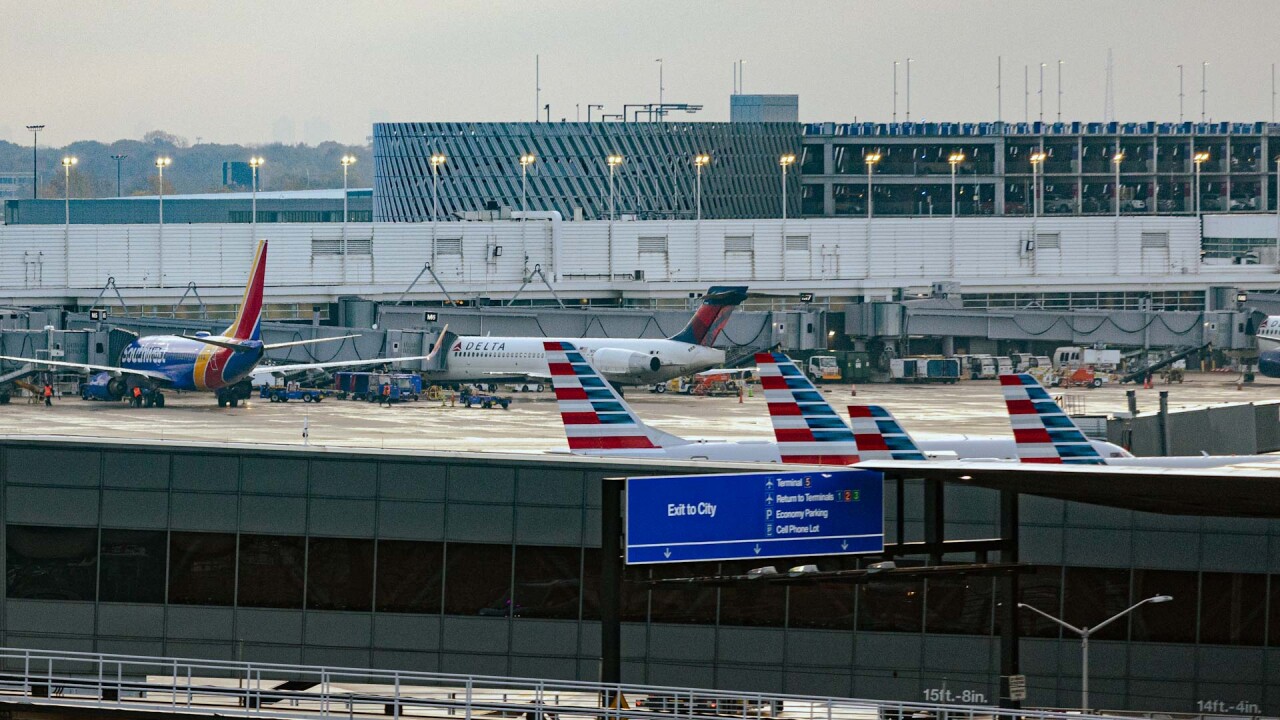

The airport's sprawling capital improvement program is expected to total $11.5 billion over the next decade, $9 billion of it bond funded.

November 12 -

Moody's revised the outlook on the Chicago Board of Education to stable from positive on Monday.

November 4 -

"Illinois is just pure mismanagement," Ryan Frost, managing director of the Reason Foundation's Pension Integrity Project, said.

October 31 -

Chicago Public Schools went to market this week with nearly $1.1 billion of refunding bonds in the largest municipal transaction the district ever completed.

October 30 -

Illinois' Grand Prairie Water Commission went to market Monday in a debut deal as it builds infrastrcture linking the Joliet area with Chicago's water system.

October 28 -

Mayor Brandon Johnson released to City Council a report from accounting firm Ernst & Young with recommendations for closing the city's structural budget gap.

October 24 -

The upgrade is driven by realized and expected improvement in the state's financial metrics, the rating agency said.

October 23