Native American Tribes are working from a disadvantage in bond sales due to Securities and Exchange Commission regulations that force them to register public market issuances, which raises costs.

-

As Congress hammers away on a surface transportation bill, counties are fighting for a seat at the table while reckoning with dwindling gas tax revenues.

-

The RFC asks a number of questions about the dealer supervisory rule.

-

"BNY is pleased to have resolved this matter," a BNY spokesperson said.

-

In this third of a three-part 2026 municipal bond outlook series, Market Intelligence analyst Jeff Lipton explains how another year of heavy supply, surging ETF and SMA assets, climate and cyber risk, and growing use of bond insurance will drive muni market structure and strategy for both sell-side and buy-side stakeholders.

-

Market Intelligence analyst Jeff Lipton, in the second installment of his three-part 2026 outlook series, maps out quality-centric portfolio shifts, barbell and long-end strategies, and sector tilts across hospitals, higher education and housing as record supply and net inflows drive the muni market.

-

In the first of his three-part 2026 municipal outlook series, Market Intelligence analyst Jeff Lipton forecasts for sub-5% returns, continued demand, possibly more curve steepening as the Fed eases slowly, the economy skirts recession, and AI, tariffs and midterm politics potentially reshaping risks across public finance sectors.

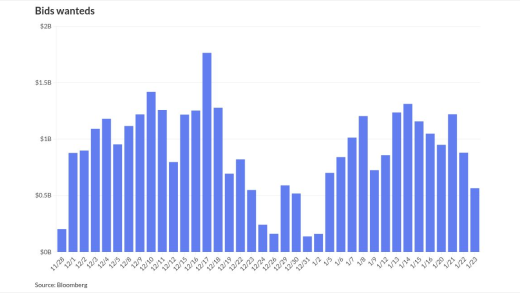

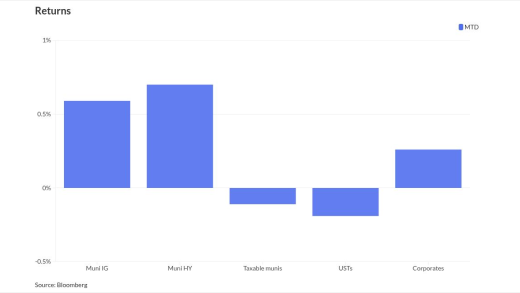

Munis were steady Monday following the large cuts the asset class saw last week, specifically on Tuesday, Jan. 20.

Boys Town, Nebraska, home of a high-profile sanctuary for troubled kids, heads into the bond market after a two-notch downgrade and recent abuse claims.

The Port Authority of New York and New Jersey has already established itself as the frontrunner in the U.S. airport P3 space.

Maryland Governor Wes Moore unveiled his $70.8 billion budget proposal that is designed to close a $1.5 billion gap via cuts, fund transfers and swaps of bonds for cash.

Logan comes to the firm from Raymond James; before that he was a longtime Citi banker.

-

The focus: municipal advisors — part of your regulatory responsibilities and duties (if you don't agree to evaluate pricing and/or structure, you must expressly disclose it to the client) and broker-dealers (fair dealing).

-

Nominations for the 10 regional and other categorical honors, all of whom will be finalists for the national Deal of the Year award, are due by Friday, October 11.

-

AHCIA has languished since 2016 — is it time to consider alternatives?

-

Introducing The Bond Buyer's newest Muni Hall of Famers who will be honored at an awards dinner in Boston on Sept. 30, 2025.

-

"I have been very fortunate to contribute to a fascinating sector of the financial industry that is full of ambiguous issues and data," said Tom Doe. "I am flattered to be included in the Hall of Fame, it is a wonderful capstone to my career."

-

Over nearly 40 years, investment banker Diana Hoadley built a legacy of far-ranging vision and collaboration that left a trail of professional admirers.

Sample didn't know she'd grow up to be a bond underwriter, but she loved her internship experience, which opened her mind to municipal finance.

Erika Smull found herself studying municipal bonds since they account for a large portion of water infrastructure project financings.

The State of Wisconsin's 2025 refinancing set a new standard for municipal tenders. Instead of a fixed price, the state executed the first fixed-spread tender for tax-exempt bonds, anchoring pricing to the AAA BVAL curve.

-

Market Intelligence analyst Jeff Lipton uses the Federal Reserve's latest Flow of Funds data to show how households still dominate municipal bond ownership even as ETFs surge and banks and insurance companies trim exposure, reshaping muni demand heading into 2026.

-

The governor, in the final year of his term, asked lawmakers to approve reforms that would fix the Virgin Islands Water and Power Authority's balance sheet.

-

The Bond Buyer has launched a new AI-powered research experience designed to give subscribers an easy way to access our latest news and research while also offering a deep, comprehensive dive into our archives.

-

After voters rejected a 2019 bond proposal, Michigan's Dearborn Public Schools is mulling a possible $500 million, $1 billion or $1.5 billion bond this year.

-

"Markets are reading this as a strategic pause, not a policy shift," said Gina Bolvin, president of Bolvin Wealth Management Group.

-

Addison is the sixth of Dallas Area Rapid Transit's 13 member cities where voters will decide in May whether to drop out of the agency.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Intraday News UpdateDelivered Every WeekdayGet notified on breaking news and events.

- Primary Market ReportWeeklyRecap of articles on new issuance as well as Featured Deals on the week.

- Weekly Top 10WeeklyRecap of the 10 most read Bond Buyer articles of the past week.

Gilmore & Bell and Nixon Peabody were new entrants in the top 10, bumping Greenberg Traurig and Bracewell to the top 15.

- ON-DEMAND VIDEO

KC Mathews, executive vice president and chief market strategist at Commerce Trust breaks down the FOMC meeting.

- ON-DEMAND VIDEO

Pamela Frederick and Adam Barsky will share their views on the importance of the tax-exemption, how it benefits state and local governments, taxpayers, and U.S. retail investors -- and keeps the country competitive on a global scale.

- ON-DEMAND VIDEO

Gary Hall, President of the Infrastructure & Public Finance Division at Siebert Williams Shank & Co., joins Bond Buyer Executive Editor Lynne Funk to talk about the importance of the muni industry in financing the country's extensive infrastructure needs -- from ports and airports to bridges and energy solutions.

- Sponsored by Assured Guaranty

-

-

- Sponsored by Ballard Spahr