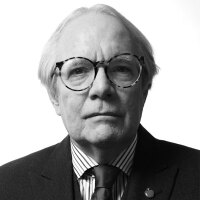

Chip Barnett is a journalist with almost 50 years of professional experience. He started his career at the Gannett Newspapers in Westchester County, N.Y., working his way up from back-shop compositor to Senior News Editor. Barnett later worked for Thomson Reuters in Manhattan, covering state and local government finance as a Reporter and later Executive Editor for TM3.com and as Editor in Charge of Municipal Finance for Reuters News. Later, he was the Editor of Municipal Finance Today at SourceMedia. Barnett has also worked for DebtWire/Municipals and has written about commercial real estate in South Florida and the Midwest for both The Real Deal and Globe Street. Barnett is currently a Reporter at The Bond Buyer.

-

Municipal to U.S. Treasury ratios have been a focus for many participants of late. Historically attractive ratios, low supply, and continued fund inflows are creating some strength in the municipal market.

By Lynne FunkMay 28 -

Richard Taormina, portfolio manager and head of tax aware strategies at JPMorgan Asset Management talks about the effects COVID-19 is having on credits in the municipal bond market and why crossover buyers think this an attractive asset class. Chip Barnett hosts.

By Chip BarnettMay 28 -

Even with the news that New York City is looking to potentially borrow $7B through its Transitional Finance Authority as it faces $9B in lower revenues, the market didn’t blink and TFAs traded firmer.

By Chip BarnettMay 27 -

Credit concern is being lost somewhat in pricing munis and traders said they are looking for alternative benchmarks, even turning to corporates and U.S. Treasuries to price the market.

By Lynne FunkMay 26 -

The primary supply for the holiday-shortened week is projected to dip to just over $4 billion, with a mix of tax-exempt and taxable issuance led by Colorado’s $500 million of certificates of participation.

By Lynne FunkMay 22 -

Taxable equivalent yields on exempts are close to converging into taxables.

By Lynne FunkMay 21 -

Clark Hill senior counsel Andrew Maher will serve a one-year term.

By Chip BarnettMay 20 -

Municipal to U.S. Treasury ratios were attractive, especially on the short end, which drove secondary yields lower.

By Lynne FunkMay 20 -

Eric Fischer returns to the firm and will focus on municipal finance and tender option bonds.

By Chip BarnettMay 20 -

The front of the municipal yield curve is 'astounding' and traders said dealers are uncharacteristically accepting the levels, likely due to the historically attractive ratios.

By Lynne FunkMay 19 -

Magalie Austin takes over from Jonnell Doris, who was named commissioner for Small Business Services.

By Chip BarnettMay 19 -

The primary was up and running Monday with Connecticut’s $850M offering for retail while many Texas issuers were active on the heels of the Fed news that it is open for business for munis.

By Chip BarnettMay 18 -

Uncertainty and volatility have caused a bifurcated market when it comes to credit, and widespread disparity between high-quality and high-yield is complicating matters for issuers.

By Lynne FunkMay 15 -

Yields on all triple-A benchmark curves out to nine years are now below 1%. The largest bumps were again on the very short end of the curve. Lipper reported $580 million of inflows.

By Chip BarnettMay 14 -

Investors are sending the message that higher-grade, longer-term issuers will fare far better than lower-rated, higher-yield ones amid a focus on credit.

By Lynne FunkMay 13 -

The short end of the municipal curve again saw yields fall, but that didn't impede the productivity of the day's new-issue market.

By Lynne FunkMay 12 -

The Fed on Monday essentially said it was standing 10 feet back from the market, allowing it to manage the pandemic-driven crisis itself. Lower-rated issuers may benefit most from the facility.

By Lynne FunkMay 11 -

High-grade trading Friday showed the disparate credit picture that investors are facing; they now need to dig deeper into municipal financials and the backstops on certain bonds.

By Lynne FunkMay 8 -

In the midst of issuer credit deterioration due to coronavirus, muni yields fell and new-deals were priced on the heels of California's $54 billion deficit news.

By Lynne FunkMay 7 -

Primary deals are now coming at tighter spreads to the secondary than they have recently. Cooler heads are appearing on the institutional side, but ICI reports $1.7 billion pulled from muni market mutual funds.

By Chip BarnettMay 6