The municipal market digested large deals out of Illinois, New York City, and a California pension obligation deal while yields fell again in the secondary.

However, despite triple-A benchmark yields falling by two or four basis points, credit concerns are increasing among investors.

The Fed, meanwhile,

Investors are signaling that higher-grade, longer-term issuers will fare far better than lower-rated, higher-yield ones, and that general obligation bonds will fare better than short-term notes, depending on the ratings and structure of the issuer.

Yields on Illinois were trimmed across the deal including 10 basis points on the long end and 15 basis points on the 10-year. The state initially intended to sell $1 billion but then dropped the taxable piece, shrinking the deal to $750 million, before later raising the size to $800 million in the re-pricing.

The deal came with coupons and yields above 5% but was re-priced to lower yields from a morning pricing wire. The deal was oversubscribed by as much as 14 times on 2021 bonds, 15 times in the 2023 maturity and 14 times in 2024. The 30-year also saw 14 times oversubscriptions and the long bond was 10.3 times oversubscribed.

Bonds in 2021 came with a 4.875% coupon priced at par. 5.125% in 2022 at par; 5.375% in 2023 at par; 5.50% in 2024 at par; 5.50% coupon to yield 5.60% in 2025; 5.50% coupon in 2026 to yield 5.65%; 5.50% coupon in 2030 to yield 5.65%; 5.50% coupon in 2039 to yield 5.75%; and, 5.75% coupon in 2045 to yield 5.85%.

Sources said that investors feel more protected with the bigger coupon payments and it also allows Illinois to collect more cash up front (a higher dollar price for bonds) and then kick the can of interest payments down the road.

The state backed off issuing the $1.2 billion short-term notes last week after hearing price talk of 7% yields.

It points to the major uncertainty of the market banking on repayments from lower-rated issuers entering the short-term notes market, generally, especially without the Fed's hands on the deals or the issuer paying a hefty yield penalty.

Longer-dated lower-rated general obligation bonds feel safer to investors instead, sources said.

“The 7% price talk was for the short competitive note deal the state was trying to push,” a Chicago trader said. “The timing of that deal, the short maturity, nestled in the heart of the COVID fallout timeline, and the lack of the ability to market is essentially what would have forced that type of yield. It’s like, would you rather own MTA zeros in 30 or MTA notes? The zeros all day because they straddle the storm.”

For instance, the New York MTA (A2/A-/A+/AA+) deal last week doubled in size to over a billion and then it rallied strongly (30 basis points better) in the secondary; well-compensated investors (+280 bps) understand the MTA as too big to fail. The New York MTA green taxable bonds sold at 5.175% in 2049 traded as low as 4.82% in massive blocks Friday. The exempt MTAs, 4.75s of 2045, traded at 4.75%-4.78%.

So although credit conditions remain in flux — and with a potentially enormous downside should even a few safe sector credits begin to consider or actually defaulting — the MTA’s performance means that that hypothetical has not yet become real, according to Municipal Market Analytics.

However, because municipal bond payment defaults are only rarely announced a few months ahead of their occurrence, actual default experience this summer is apt to be materially greater than in recent years, MMA said.

The highest summer (Jun-Aug) municipal default count on record was 27 in 2009; last year saw 11 defaults in those months.

The year-to-date impairment count — which encompasses all borrowers notifying bondholders of technical or payment defaults or of a credit threat that poses reasonable risk of near-term default — is now 66, slightly ahead of last year’s pace (which had been the fastest in six years), MMA’s Default Trends report said.

This year’s mix skews strongly toward retirement projects, which account for nearly a third of all fresh impairments. The retirement sector has never provided more than 20% of new impairments on a full-year basis. Land secured projects are next, with the most YTD impairments since 2014.

“Only four 2020 impairments are in safe sectors so far. MMA continues to expect a pandemic-linked increase in 2020’s safe sector impairment count (versus 2019’s full year total of 25), but such has not yet begun,” the report said.

A Southeast trader said there are investors on both sides of the credit quality coin that are participating in the current market, yet they are separated by their comfort or risk level, such as in the Illinois and New York Transitional Finance Authority deals.

“There are investors who will speculate for high-yield or spring for high-quality, and it seems like you need to get through one of those doors to get investors to care” in the current uncertain and volatile pandemic climate, the trader said.

There is noticeably more need and attention being paid to underlying credit in the current environment.

“Credit is king where seemingly more accounts have higher rating requirements and more stringent credit criteria,” he said.

“Liquidity is also a big premium in here,” he added.

“We are being asked particularly by retail advisors to talk about credit, where previously many brokers would put a trade in the system and buy it,” he said.

He said the TFA deal appealed to high-quality investors who liked the block size offered by a credit with a familiar, household name in the Northeast.

“Those kinds of bonds typically have gotten good reception, at least recently,” he said.

On the other hand, lower-quality paper is getting a skeptical eye from the more traditional, risk-averse investors.

“It’s the A-rated and off-the-run, $8 million ‘nowhere USA’ credit that tends to struggle in here in terms of getting an audience,” he added. “We have not seen that segment get back to the liquidity dynamic that it had prior to this mess."

Primary market

The New York City Transitional Finance Authority (Aa1/AAA/AAA/NR) came to market with $1.08 billion of tax-exempt and taxable future tax secured subordinate bonds.

The TFA said it received $553 million of retail orders Tuesday, of which about $324 million was usable. During Wednesday’s institutional order period, TFA received around $5.7 billion of orders, making the exempts 11 times oversubscribed.

“Given strong investor demand during the institutional order period, yields were reduced by three to five basis points for maturities in 2031 through 2035, 15 basis points for maturities in 2036 through 2040, 8 basis points for the 2041 maturity and 10 basis points for the 2045 maturity,” TFA said. “Final stated yields ranged from 0.76% in 2022 to 2.77% in 2045 for the 4% coupon and 3.056% in 2046 for the 3% coupon.”

There were eight bidders for the $114 million competitive sale and eight bidders for the $112 million competitive offering.

Loop Capital Markets priced the TFA’s $850 million of Fiscal 2020 Series C Subseries C-1 exempts.

The issue was upsized from the $700 million offered to retail investors on Tuesday and the $500 million originally listed on the calendar.

The deal was priced to yield from 0.76% with a 5% coupon in 2022 to 2.45% with a 5% coupon in 2041; a 2045 term bond was priced to yield 2.87% with a 4% coupon and a 2046 term was priced to yield 3.056% with a 3% coupon.

The TFA also competitively sold $226.26 million of taxable subordinate bonds, Fiscal 2020 Series C bonds in two offerings.

JPMorgan Securities won the $114.09 million of Subseries C-3 with a true interest cost of 2.3899%.

This series was priced at par to yield from 2.14% (+165 bps over UST) in 2028 to 2.55% (+190 bps) in 2032.

JPMorgan also won the $112.17 million of Subseries C-2 taxables with a TIC of 1.7649%.

This series was priced at par to yield from 1.29% (+114 bps over UST) in 2022 to 2.04% (+154 bps) in 2027.

RBC Capital Markets priced for retail the Dormitory Authority of the State of New York’s $464.805 million of revenue bonds for the school districts revenue bond financing program.

The DASNY deal is made up of four tranches consisting of $386.4 million of Series A bonds, $57.345 million of Series B bonds, $14.35 million of Series C bonds and $6.71 million of Series D bonds.

The bonds are insured under the New York State aid intercept program with the Series A and D bonds being also insured by Assured Guaranty Municipal.

The largest tranche, the Series A bonds, were priced for retail to yield from 0.89% with a 5% coupon in 2021 (+35 basis points above the MMD spread) to 3.06% with a 3% coupon in 2040 (+133 bps); a 2045 term was priced to yield 3.20% with a 3.125% coupon (+131 bps) and a 2050 term was priced to yield 3.25% with a 3.125% coupon (+131 bps).

RBC also priced the Southern California Public Power Authority’s (Aa2/NR/AA-/NR) $274.67 million of refunding revenue green bonds for the Windy Point/Windy Flats project.

The deal was priced to yield from 0.62% with a 5% coupon in 2020 to 0.09% with a 5% coupon in 2024; a 2030 term bond was priced as 5s to yield 1.22%.

HilltopSecurities received the official award on Ontario, Calif.'s (NR/AA/AA-/NR) $236.585 million of taxable pension obligation bonds.

The deal was priced at par to yield from 1.971% in 2021 to 3.379% in 2032, 3.779% in 2038, 3.829% in 2045 and 3.979% in 2050.

Citigroup received the written award on the Lower Colorado River Authority’s (NR/A/A+/NR) $261.525 million of transmission contract refunding revenue bonds for the LCRA Transmission Services Corp. project.

The deal was priced as 5s to yield from 0.75% in 2021 to 2.28% in 2040; a 2045 term was priced as 5s to yield 2.42% and a 2050 term was priced as 5s to yield 2.47%.

Secondary market

Municipals continued to rally Wednesday with yields falling all across the curve. Short trading of Maryland GOs, 5s of 2021, traded at 0.46%-0.45%. Harford MD GOs 5s of 2026 traded at 0.97%, down from the original 1.20%. Harvards, 5s of 2027, traded at 0.87%.

On Refinitiv Municipal Market Data’s AAA benchmark scale, short yields fell two basis points to 0.52% in 2021 and 0.57% in 2022.

Out longer on the MMD scale, the yield on the 10-year GO dropped four basis points to1.09% while the 30-year declined four basis points to 1.90%.

MMD’s 10-year muni-to-Treasury ratio was calculated at 167.4% while the 30-year muni-to-Treasury ratio stood at 141.8%.

The ICE AAA municipal yield curve also showed short-term maturities falling two basis points, with the 2021 maturity at 0.50% and the 2022 maturity at 0.55%.

Out longer on the ICE municipal yield curve, the 10-year yield was off three basis points to 1.099% while the 30-year declined four basis points to 1.915%.

ICE’s 10-year muni-to-Treasury ratio was calculated at 183% while the 30-year muni-to-Treasury ratio stood at 139%.

IHS Markit’s municipal analytics AAA curve showed the 2021 maturity at 0.48% and the 2022 maturity at 0.53% while the 10-year muni was at 1.11% and the 30-year stood at 1.94%.

The BVAL curved showed the 2021 maturity lower by three basis points to 0.44% and the 2022 at 0.50% three lower. BVAL also showed the 10-year muni fall three basis points to 1.10% while the 30-year fell three to 1.96%.

Munis were also little stronger on the MBIS benchmark and AAA scale, with yields falling in both the 10- and 30-year maturities.

Treasuries strengthened as equities weakened.

Late in the day, the 10-year Treasury was yielding 0.647% and the 30-year was yielding 1.341%.

The Dow was down 2.49%, the S&P 500 was off 2.28% and the Nasdaq was 2.30% lower.

ICI reports $392M muni fund inflows

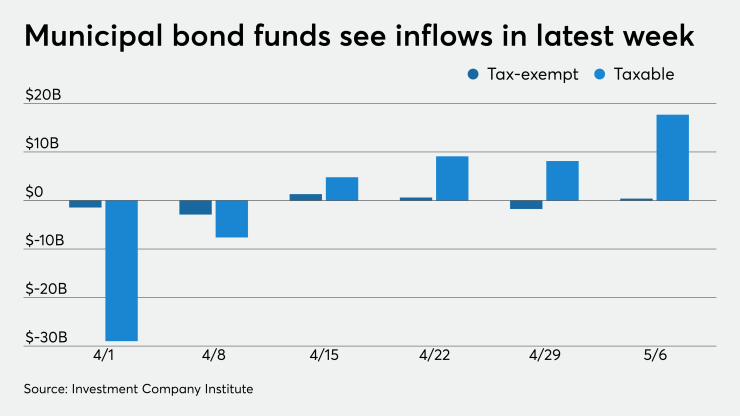

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $392 million in the week ended May 6, the Investment Company Institute reported Wednesday.

In the prior week, muni funds saw revised outflows of $1.756 billion, originally reported as a $1.739 billion outflow.

Long-term muni funds alone had an inflow of $230 million in the latest reporting week after a revised outflow of $1.590 billion in the week ended April 29, originally reported as a $1.573 billion outflows.

ETF muni funds alone saw an inflow of $162 million after an outflow of $166 million in the prior week.

Taxable bond funds saw combined inflows of $17.681 billion in the latest reporting week after revised inflows of $8.135 billion in the prior week, originally reported as an $8.435 billion inflow.

ICI said the total combined estimated outflows from all long-term mutual funds and ETFs were $3.453 billion after revised outflows of $13.794 billion in the prior week, originally reported as a $13.444 billion outflow.