Want unlimited access to top ideas and insights?

The short end of the municipal yield curve was bumped seven or more basis points, but yields across the curve were lower by at least five basis points.

New issues fared well, with large universities pricing deals into a market that rewarded them with 15 basis point bumps in repricings, even though many may not hold in-person courses in the fall.

Municipal to U.S. Treasury ratios were attractive, especially on the short end, which drove secondary yields lower.

How long investors can stomach yields below 30 basis points on the short end is yet to be determined.

Every major triple-A benchmark had their one-year hovering around the twenties and teens. Bloomberg BVAL stood at 0.19%, ICE was at 0.22%, Refinitiv MMD was at 0.22% and IHS Markit was also at 0.22%.

The 10-year now has dipped below 1%.

The U.S. Treasury’s first 20-year bond sale since 1986 went off without a hitch and was received with open arms by investors on Wednesday.

The $20 billion of bonds, due May 15, 2040, went at a 1.22% high yield, an interest rate of 1.125%. The bonds were priced at 98.321703; 8.25% were allotted at the high yield. The median yield was 1.159% and the low yield was 0.088%. The bid-to-cover ratio was 2.53.

Attractive ratios of municipals to Treasuries, and recent attractive absolute yields to corporates, is continuing to draw demand to the short end of the municipal yield curve — even though yields are now back to pre-coronavirus levels, according to a New York trader.

“A number of crossover taxable investors were buying short tax-exempts instead of short corporate bonds because absolute yields were more attractive” a few weeks ago, the trader said Wednesday.

Earlier this week muni to Treasury ratios were in excess of 100% and 200% depending on maturity and credit.

“It’s like Groundhog Day in the month of May. Steady bumps almost every day this month with strength in five years and shorter continuing to lead the way,” said Greg Saulnier, Municipal Analyst at Refinitiv MMD.

“Up front, we see bonds trying to keep pace with extremely low yields for VRDs, MIG1 notes, pre-res, etc., and then you add into that the factor of crossover buyers who would rather take on munis at 165% of Treasuries as opposed to low yields in rates and taxable commercial paper.”

He said it’s somewhat of a similar story further out the curve — buyers are seeking quality Aaa/AAA paper to guard against any impending credit problems from COVID-19, yet there just isn’t much around.

“For that reason, names like Texas GO or Washington GO, both Aaa-rated that typically trade at a slight discount, are seeing spreads narrow as buyers reach for bonds,” Saulnier said.

Secondary market trading showed on the very short end New York City TFAs, 5s of 2021, trading at 0.33%-0.30%. NY Dorm Columbia University revs, 5s of 2021 at 0.33%-0.27%. Georgia GOs, 5s of 2022, at 0.26%-0.25%. Maryland GOs, 5s of 2022, at 02.9%-0.28%. Durham County, NC GOs, 5s of 2022, 0.22%-0.28%. Montgomery County, MD GOs 5s of 2023, at 0.35%-0.32%.

Fairfax County, VA 5s of 2025 at 0.56%-0.55%.

Utah 5s of 2026 traded at 0.73% (original early February level was sold at 0.97%).

Going out into the belly of the curve, Washington GOs, 5s of 2034 at 1.44%-1.41%. New York City TFAs, 5s of 2035, 2.05%-2.04%. Original yields: 2.15%.

Texas waters, 3s of 2040, yielded 2.10%-2.08%. (Original: 2.17%).

New York City TFAs out long, 4s of 2045, landed at 2.53%-2.52% (Original: 2.77%).

TFAs, 3s of 2046, traded at 3.00%-2.99% (Original: 3.06%).

The demand is still brisk even though yields in one to five years were through 1% as recent as Monday when the three-year municipal bond, for instance, yielded 0.49% and the comparable Treasury yielded 0.22%, a trader said.

"The full one- to 30-year curve is at 154 basis points, relatively steep but even more so given the low absolute yield levels. The muni percent of Treasury yields remain in the triple digits, but all points on the curve have dropped to levels last seen in early March,” according to ICE Data Services.

Crossover buyers continue to buy and hold short munis for the value while others are selling and taking profit since they do not need tax-exemption.

“The Fed’s [Municipal Liquidity Facility] program being put in place last week helped short-end munis” attractiveness compared to other fixed-income asset classes, the trader added.

The market has signaled that it is functioning, for at least high-grade paper, without the Fed’s help.

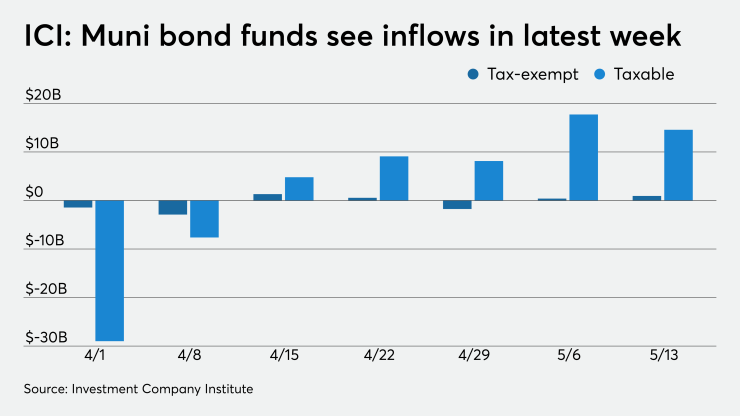

The Investment Company Institute also reported nearly a billion dollars of inflows on Wednesday.

Primary market

Morgan Stanley priced and repriced the Private College and Universities Authority, Ga.’s (Aa2/AA/NR/NR) $486.47 million of revenue bonds for Emory University to lower yields by as much as 15 basis points.

The deal was repriced to yield 0.81% with a 5% coupon in 2025 and to yield from 1.35% with a 5% coupon in 2030 to 2.18% with a 4% coupon in 2041.

The deal had been tentatively priced to yield 0.91% with a 5% coupon in 2025 and to yield from 1.40% with a 5% coupon in 2030 to 2.33% with a 4% coupon in 2041.

“This week's projected $6.3 billion tax-exempt calendar has increased to $7.3 billion with the likes of $400 million Triborough Bridge and Tunnel Authority hitting the docket to be priced [Thursday],” said Peter Franks, senior market analyst at Refinitiv MMD. He added that the Emory University deal came in downsized and was tentatively priced “with 5s 9/2025 at 0.91% +33 bps, 5s 9/2033 (30c) at 1.75% +45 bps and 4s 9/2041 (30c) at 2.33% +70 bps (+46 bps to the MMD 4% coupon curve).”

Goldman Sachs priced Northwestern University's (Aa1/AA+/AA+/NR) $300 million of taxable corporate CUSIP fixed-rate bonds.

The bonds were priced at par to yield 2.64% in 2050, about 125 basis points over the comparable Treasury security.

Barclays Capital priced Marquette University’s (A2/NR/NR/NR) $150 million of taxable corporate CUSIP fixed-rate bonds.

The bonds were priced at par to yield from about 165 basis points over the comparable Treasury in 2023 to 253 basis points over Treasury in 2033, 237 over in 2030 and 245 over in 2050.

BofA Securities received the written award on Brown University’s (Aa1/AA+/NR/NR) $300 million of taxable bonds. The Rhode Island school’s bonds were priced at par to yield 1.914% in 2030 and 2.924% in 2050.

BofA Securities priced the Virginia Housing Development Authority's (Aa1/AA+/NR/NR) $425 million of taxable rental housing bonds.

JPMorgan Securities received the official award on the Metropolitan Water District of Southern California's (NR/A1+/F1+/NR) $271.255 million of subordinate water revenue and revenue refunding bonds SIFMA index mode as a remarketing.

On Thursday, the Triborough Bridge & Tunnel Authority, N.Y. (MTA Bridges and Tunnels) is set to hit the market with $400 million of general revenue bonds.

Looking ahead to next week, the Guam Waterworks Authority is coming to market with $134 million of water and wastewater system revenue bonds. Citigroup is lead underwriter on the deal.

Secondary market

Short-term muni yields continued their march lower, dropping once again as longer-dated securities remained relatively stable.

On Refinitiv Municipal Market Data’s AAA benchmark scale, yields dropped by seven basis points, to 0.22% in 2021, 0.28% in 2022 and 0.35% in 2023.

Out longer on the MMD scale, the yield on the 10-year GO fell five basis points to 0.94% while the 30-year was off five basis points to 1.75%.

The 10-year muni-to-Treasury ratio was calculated at 137.6% while the 30-year muni-to-Treasury ratio stood at 124.6%, according to MMD.

The ICE AAA municipal yield curve also showed short-term maturities falling seven basis points, with the 2021 maturity at 0.220%, the 2022 at 0.270% and 2023 at 0.345%.

Out longer on the ICE municipal yield curve, the 10-year yield was off five basis points to 0.932% while the 30-year was down six basis points to 1.762%.

“Municipal bonds are on a tear once again,” ICE Data Services said. “The rally has pushed the yield on the one-year tenor down to a mere 22 basis points; the 10-year tenor’s yield has fallen to 93 basis points."

The one-year muni-to-Treasury ratio was calculated at 121%, the 10-year at 1.44% while the 30-year muni-to-Treasury ratio stood at 126%, according to ICE Data Services.

IHS Markit’s municipal analytics AAA curve showed the 2021 maturity at 0.22%, the 2022 maturity at 0.27% and the 2023 maturity at 0.36% while the 10-year muni was at 0.96% and the 30-year stood at 1.79%.

The BVAL curve showed the 2021 maturity fall six basis points to 0.18% and the 2022 at 0.25%. BVAL also showed the 10-year muni fall five basis points to 0.93% while the 30-year fall five to 1.79%.

Munis were also stronger on the MBIS benchmark and AAA scales, with yields falling in the 10- and 30-year maturities.

Treasuries strengthened as equities rose.

The Treasury’s first 20-year bond sale since 1986 went off without a hitch and was received with open arms by investors on Wednesday.

The $20 billion of bonds, due May 15, 2040, went at a 1.22% high yield, an interest rate of 1.125%. The bonds were priced at 98.321703; 8.25% were allotted at the high yield. The median yield was 1.159% and the low yield was 0.088%. The bid-to-cover ratio was 2.53.

Bloomberg News reported that primary dealers were awarded 24.6%, indirect bidders (a group that includes foreign central banks bidding via the Federal Reserve Bank of New York) took 60.7% and direct bidders 14.7%.

Late in the day, the three-month Treasury was yielding 0.125%, 10-year Treasury was yielding 0.682% and the 30-year was yielding 1.408%.

The Dow was up 1.50%, the S&P 500 was up 1.64% and the Nasdaq was up 1.97%.

ICI: $937M flows into muni bond funds

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $937 million in the week ended May 13, the Investment Company Institute reported Wednesday.

In the previous week, muni funds saw inflows of $392 million, ICS said.

Long-term muni funds alone had an inflow of $622 million in the latest reporting week after an inflow of $230 million in the week ended May 6.

ETF muni funds alone saw an inflow of $315 million after an inflow of $162 million in the prior week.

Taxable bond funds saw combined inflows of $14.572 billion in the latest reporting week after revised inflows of $17.726 billion in the prior week, originally reported as a $17.681 billion inflow.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $4.045 billion after revised outflows of $3.409 billion in the prior week, originally reported as a $3.453 billion outflow.

MuniForum of N.Y. honors Alan Anders

The Municipal Forum of New York has

Anders commitment to public service and dedication to advancing the careers of underserved New York City youth were widely recognized by all in the municipal bond community.

Geoff Proulx, president of the Muni Forum and managing director in Morgan Stanley’s fixed-income division, said the association would deliver a tribute to Anders at the annual meeting to be held remotely at the end of June.