The municipal market continued its short-end rally Tuesday with yields falling by as much as seven basis points, amid a well-functioning new-issue market that saw deals re-priced to lower yields.

Amid an otherwise quiet tone that was characterized by some firmness and strong demand for a large Connecticut pricing and a steepening yield curve, there was support for the front end of the municipal market, according to traders.

The front of the municipal yield curve is “astounding” and traders said dealers are uncharacteristically accepting the levels, likely due to the historically attractive ratios, he noted.

“Guys are buying the front end even though yields have gone through 1%, which usually holds them up,” he explained. “But, they don’t seem to be adverse to it as they had been.”

For instance, on Monday, the three-year triple-A municipal bond yielding .49% was offering 205.9% of the comparable Treasury counterpart, which yielded 0.22%, the trader noted.

The 10-year muni-to-Treasury ratio was calculated at 138.7% while the 30-year muni-to-Treasury ratio stood at 125.9%, according to Refinitiv MMD.

The 10-year muni-to-Treasury ratio was calculated at 148% while the 30-year muni-to-Treasury ratio stood at 126%, according to ICE Data Services.

Secondary trading showed:

Georgia GOs, 5s of 2021, at 0.30%-0.31%. Texas waters 5s of 2023 traded at 0.43%-0.40%. Georgia GOs, 4s of 2025, traded at 0.51%-0.50%. Maryland GOs, 5s of 2025 at 0.59%-0.60%. Harford County, MD GOs, 5s of 2027, 0.86%-0.85%. Harfords in 2029 at 0.97%-0.96%.

“The current rally is on pace to notch a 2% gain for the month should there be no reversal in the remaining sessions,” said Kim Olsan, FHN Financial senior vice president. “Generic 1- and 2-year benchmarks have rallied to levels not seen since February 2016 (when the last presidential election cycle was at a similar state), with opening yields [Tuesday] between 0.30%-0.37%.”

The two caveats are a different slope shape — about 100 basis points flatter now — and credit concerns related to issuer revenue stresses.

“As short rates push lower off early-April highs, it has become increasingly obvious the extent to which money is being placed in floating-rate and short, fixed-coupon bonds as defensive placeholders until state and regional economies are in a position to recover,” Olsan said.

Out longer in secondary trading, Washington GOs, 5s of 2038 at 1.65%. New York City TFAs, 5s of 2039, at 2.37% (originally priced at 2.52%). Northside Texas ISD 3s of 2047 traded at 2.32%-2.27% (original yield 2.55%).

Texas waters from a September 2019 sale, 4s of 2049, traded at 2.09%-2.10%. Texas Water Development Board’s (NR/AAA/AAA/NR) $352.59 million of state revolving fund revenue bonds priced Monday yielded from 0.36% with a 3% coupon in 2021 to 2.17% with a 3% coupon in 2040.

“The front end is moving the most; whereas the long end is moving, but not with the same aggression,” a trader said.

“There hasn’t been a ton of issuance, but there are favorable seasonals and a decent amount of cash coming in, so it’s kept the market pretty well bid,” he said on Tuesday afternoon.

He said the day’s activity was fairly decent, highlighted by the pricing of the Connecticut special tax deal, but less than the prior few trading sessions.

He heard the deal was priced attractively and was highly oversubscribed with 5% bonds at over 125 basis points and 4% coupon over 150 basis points to the triple-A curves.

Meanwhile, others acknowledged the positive tone and demand in the secondary market.

John Mousseau, president and director of fixed income at Cumberland Advisors said he is seeing strong secondary demand even amid the credit pandemic-impacted market.

“The follow through that the markets have seen on MTA from two weeks ago and Illinois from last week is testimony to the access to the capital markets that exists even for troubled credits,” Mousseau said Tuesday.

The Northeast trader said demand is decent in the secondary, but with some muted activity.

He cited a block of Illinois general obligation bonds, which priced in the primary market last week, whose yields firmed by 40 to 50 basis points from where the original pricing. A Chicago trader said Illinois paper saw some flow and it wasn't "too shabby."

In addition, The New York Transitional Finance Authority bonds, which also priced last week, also firmed in the secondary market Tuesday, according to the trader.

For instance, he observed a block of the bonds trading at 75 to 80 basis points, firming from last week at 82 to 85 basis points cheaper than triple-A benchmarks.

“The market in general seems to be doing a little better, but it’s not like guys are aggressively buying,” he explained.

Primary market

The drop in yields allowed several underwriters to take advantage of the record low short-term rates.

RBC Capital Markets priced and repriced Connecticut’s (NR/A/A+/AA-) $850 million of special tax obligation bonds after a one-day retail order period.

Yields were lowered by 14 basis points in the short maturities and trimmed from three to 17 basis points in longer maturities.

The deal was repriced to yield from 0.87% with a 4% coupon in 2021 to 3.17% with a 3.125% coupon and 2.71% with a 5% coupon in a split 2040 maturity.

The deal had been tentatively priced to yield from 1.01% with a 4% coupon in 2021 to 3.31% with a 3.25% coupon and 2.86% with a 5% coupon in a split 2040 maturity.

On Monday, the deal was priced for retail to yield from 1.08% with a 4% coupon in 2021 to 3.31% with a 3.25% coupon and 2.86% with a 5% coupon in a split 2040 maturity.

BofA Securities priced Brown University’s (Aa1/AA+/NR/NR) $300 million of taxable bonds at par to yield 1.914% in 2030 and 2.924% in 2050.

Citigroup priced the Houston Independent School District’s (Aaa/AAA/NR/NR) $119.22 million of variable-rate limited tax refunding bonds and schoolhouse bonds as a remarketing.

The refunding bonds were priced to yield 0.80% with a 4% coupon in 2029 with a mandatory tender of 2023; the schoolhouse bonds were priced to yield 0.80% with a 4% coupon in 2039 with a mandatory tender of 2023.

The deal is backed by the Permanent School Fund guarantee program.

Siebert Williams Shank & Co. received the written award on the Texas Water Development Board’s (NR/AAA/AAA/NR) $352.59 million of state revolving fund revenue bonds.

The deal was priced to yield from 0.36% with a 3% coupon in 2021 to 2.17% with a 3% coupon in 2040.

In the competitive arena, underwriters also took advantage of declining short yields.

The Mukilteo School District No. 6, Wash., (Aaa/NR/NR/NR) sold $111.08 million of unlimited tax general obligation bonds.

BofA won the deal with a true interest cost of 2.417%.

The issue was priced to yield 0.36%, 0.40% and 0.49% with 5% coupons in 2021-2023 and to yield from 2% with a 3% coupon in 2036 to 2.21% with a 3% coupon in 2040.

The bonds are backed by the Washington state school district credit enhancement program.

Northwest Municipal Advisors is the financial advisor; Pacifica Law group in the bond counsel.

JPMorgan Securities priced and repriced the Parish of St. James, Louisiana’s (Ba2/BB-/NR/NR) $322.14 million of revenue bonds for the NuStar Logistics LP project as a remarketing.

The deal, not subject to the alternative minimum tax, was priced in five tranches.

Secondary market

Municipals finished strong Tuesday as short-term yields once again dropped to record low levels while longer-dated securities remained relatively stable.

On Refinitiv Municipal Market Data’s AAA benchmark scale, yields dropped by seven basis points, to 0.29% in 2021, 0.35% in 2022 and 0.42% in 2023.

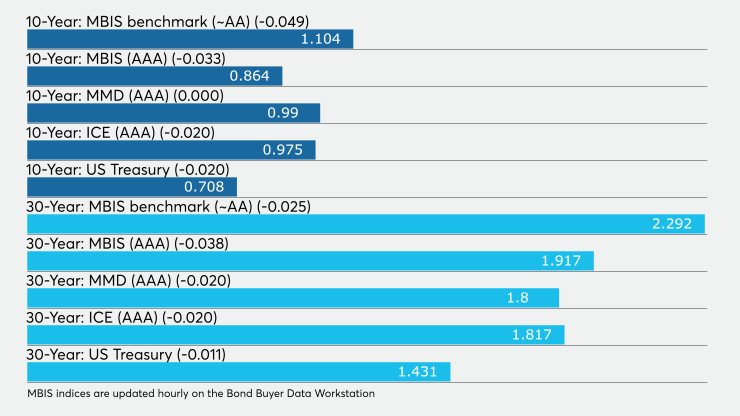

Out longer on the MMD scale, the yield on the 10-year GO fell two basis points to 0.99% while the 30-year was down two basis points to 1.80%.

The ICE AAA municipal yield curve also showed short-term maturities falling to record lows, with the 2021 maturity dropping seven basis points to 0.29% and the 2022 and 2023 maturities down eight basis points to 0.33% and 0.40%, respectively.

Out longer on the ICE municipal yield curve, the 10-year yield was off three basis points to 0.97% while the 30-year was down two basis points to 1.81%.

“With more than a dozen straight days of gains, munis are stronger again across the curve, particularly in the front end,” ICE Data Services said. “Yields on ICE muni curve are seven basis points lower in five years and shorter. The curve continues to steepen, with the two to 10 spread just over 60 basis points now, a level last seen in December 2018 when nominal yields were significantly higher.”

IHS Markit’s municipal analytics AAA curve showed the 2021 maturity at 0.32%, the 2022 maturity at 0.37% and the 2023 maturity at 0.37% while the 10-year muni was at 1.01% and the 30-year stood at 1.84%.

The BVAL curved showed the 2021 maturity was down six basis points to 0.24% and the 2022 at 0.31%. BVAL also showed the 10-year muni down three basis points to 0.98% while the 30-year fell two basis points to 1.84%%.

Munis were also stronger on the MBIS benchmark and AAA scales, with yields falling in the 10- and 30-year maturities.

“In the backdrop, participants listened closely as Fed Chair Powell and Treasury Secretary Mnuchin testify to the Senate Banking Committee today,” Refinitiv MMD’s Peter Franks said. “Powell said ‘that the Fed and Treasury may have to do more’ while Mnuchin said ‘the U.S. will emerge from this pandemic stronger than ever.’ Of note to municipal participants was Powell's comment ‘balanced budget amendments mean that a fall in revenues due to the COVID-19 pandemic will mean cuts to public-sector employment and services provided.’ ”

Treasuries strengthened as equities traded mixed.

Late in the day, the three-month Treasury was yielding 0.128%, 10-year Treasury was yielding 0.708% and the 30-year was yielding 1.430%.

The Dow was down 0.78%, the S&P 500 was off 0.28% and the Nasdaq was up 0.27%.