Municipals finished strong Monday as short-term yields again fell to record low levels while long-term bonds steadied. Yields on the short end are now lower than before the March sell-off.

The 10-year is creeping lower to fall below 1% while the short end is lower than 0.40%.

Benchmarks fell by as much as seven basis points again on the short-end of the curve as the

The primary was up and running Monday with Connecticut’s (NR/A/A+/AA-) $850 million of special tax obligation bonds offered for retail investors while many Texas issuers were active. Siebert Williams Shank & Co. priced the Texas Water Development Board’s (NR/AAA/AAA/NR) $354 million of state revolving fund revenue bonds. The deal was moved up a day and got done.

For a typically quiet Monday, the municipal market had a firm tone in the backdrop of slowly declining interest rates, according to Pete Stare of Hilltop Securities.

“Interest rates have declined by 30 to 35 basis points over the last two weeks, but it has been a steady move of two to five basis points per day with no big gapping down, which I think is healthy for the market,” Stare said on Monday.

For instance, the Texas Water Development Board did well.

“TWDB saw good interest in pre-marketing this morning and escalated its institutional pricing to this afternoon,” he added, noting it got bumped in a re-pricing.

Secondary trades showed:

Georgia GOs, 5s of 2023, at 0.47%-0.46%. Maryland GOs, 5s of 2025 at 0.71%-0.70%. Utah GOs, 5s of 2027, at 0.83%-0.81%. Original levels from its deal last week priced at 0.87%. University of Texas 5s of 2029 yielded 1.07%-1.05%.

Fairfax County, VA, GOs 5s of 2032, traded at 1.23%-1.22%. New York City TFAs 4s of 2036 traded at 2.24%-2.19%.

Out long, Lubbock County, TX ISDs 4s of 2050 traded at 1.99%-1.90%.

Primary market

RBC Capital Markets priced Connecticut’s (NR/A/A+/AA-) $850 million of special tax obligation bonds for retail investors ahead of Tuesday’s institutional pricing.

Proceeds will be used for transportation infrastructure purposes including the I-95 Gold Star Memorial Bridge, a highway in Waterbury as well as adding 60 rail cars to Metro-North Railroad.

The deal was priced for retail to yield from 1.08% with a 4% coupon in 2021 (65 basis points above Friday's MMD AAA benchmark close) to 3.31% with a 3.25% coupon (+170 bps) and 2.86% with a 5% coupon (+125 bps) in a split 2040 maturity. The 10-year was priced to yield 2.21% with a 5% coupon, 120 basis points above MMD.

On Friday, Moody’s Investors Service (A1), S&P Global Ratings, Fitch Ratings and Kroll Ratings all affirmed the state’s general obligation bond ratings and stable outlooks. The agencies that rate this special tax obligation deal also affirmed the ratings and stable outlooks.

The rating agency reports cite the state’s budget reserve fund as a contributing factor to help the state weather the current economic situation.

“In these tough times, a little good news is more than welcome,” State Treasurer Shawn Wooden said. “The affirmation of the state’s credit rating with stable outlooks should help to assure bond investors that Connecticut is well managed and positioned to address its current challenges.”

Looking ahead, the state is scheduled to sell $500 million of taxable GOs by the end of this month and $400 million of tax-exempt GOs in June.

“As part of our carefully considered financing plans, my office requested the ratings reviews in advance of our three major state bond sales coming to market before the end of this fiscal year,” Wooden said. “We will continue our work to position the State to withstand the volatility and changes in the coming market cycles.”

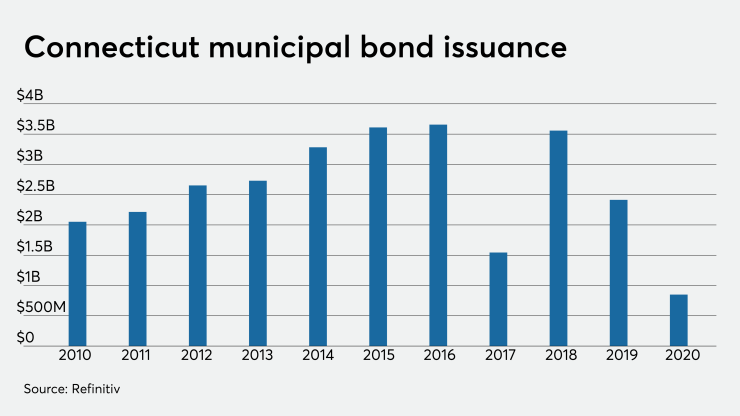

Since 2020, the state has sold about $28 billion of debt, with the most issuance occurring in 2016 when it issued $3.6 billion.

The last time the state was in the market was on Dec. 12, 2019, when it issued $895 million of exempt GO and refunding GOs. Citigroup priced that deal to yield 1.82% with a 5% coupon in the 10-year GO maturity, 38 basis points above the MMD AAA benchmark read on that day.

On Monday, Siebert Williams Shank & Co. priced the Texas Water Development Board’s (NR/AAA/AAA/NR) $354 million of state revolving fund revenue bonds. The deal was moved up a day.

The deal was priced to yield from 0.45% with a 3% coupon in 2021 to 2.21% with a 3% coupon in 2040.

Also Monday, Piper Sandler priced the Aledo Independent School District, Texas’ (NR/AAA/AAA/NR) $134 million of unlimited tax school building bonds backed by the Permanent School Fund guarantee program.

The deal was priced to yield from 0.55% with a 3% coupon in 2022 to 2.21% with a 3% coupon in 2021; a 2045 term bond was priced to yield 2.13% with a 4% coupon and a 2050 term was priced to yield 2.47% with a 3% coupon.

Also coming from Texas, Citi is expected to price the Houston Independent School District’s (Aaa/AAA/NR/NR) $122 million of variable-rate limited tax refunding bonds and schoolhouse bonds as a remarketing, backed by the PSF on Wednesday.

And UBS Financial Services is set to price Fort Bend County, Texas’ $119 million of taxable GO refunding bonds on Tuesday.

The Board of Regents of the University of Texas System (AAAe/AAAe/AAAe/NR) is waiting in the wings with a $400 million issue of taxable and exempt revenue financing system bonds to be priced by Goldman Sachs.

In the competitive arena, the Mukilteo School District No. 6, Wash., (Aaa///) is selling $115.96 million of unlimited tax GOs on Tuesday. The deal is backed by the Washington state school district credit enhancement program. Northwest Municipal Advisors is the financial advisor; Pacifica Law group in the bond counsel.

Secondary market

On Refinitiv Municipal Market Data’s AAA benchmark scale, yields dropped by seven basis points, to 0.36% in 2021 and to 0.42% in 2022.

Out longer on the MMD scale, the yield on the 10-year GO was unchanged at1.01% while the 30-year was steady at 1.82%.

The 10-year muni-to-Treasury ratio was calculated at 136.7% while the 30-year muni-to-Treasury ratio stood at 125.2%, according to MMD.

The ICE AAA municipal yield curve showed short-term maturities falling five basis points, with the 2021 maturity dropping to a record low of 0.36% and the 2022 maturity at 0.411%.

Out longer on the ICE municipal yield curve, the 10-year yield was lower by one basis point to 1.004% while the 30-year was unchanged at 1.838%.

The 10-year muni-to-Treasury ratio was calculated at 146% while the 30-year muni-to-Treasury ratio stood at 126%, according to ICE.

“Muni bonds are mixed to start the week,” ICE Data Services said in a market comment. “Yields on the ICE muni curve are lower in the front end, by five basis points and basically unchanged in longer maturities. The move is enough to nudge one-year yields below 40 basis points (0.39%) and to move the 10 year to 1%. The curve continues to steepen, with one- to 30-years at 144 basis points. The muni percent of Treasury yields continue to move lower, aided today by falling Treasury market.”

IHS Markit’s municipal analytics AAA curve showed the 2021 maturity at 0.45% and the 2022 maturity at 0.50% while the 10-year muni was at 1.03% and the 30-year stood at 1.86%.

The BVAL curve showed the 2021 maturity six basis points to 0.30% and the 2022 at 0.37% down five basis points. BVAL also showed the 10-year muni unchanged at 1.01% while the 30-year was at 1.86%.

Munis were also stronger on the MBIS benchmark scale, with yields falling in the 10- and 30-year maturities.

Treasuries strengthened as equities rose.

Late in the day, the 10-year Treasury was yielding 0.726% and the 30-year was yielding 1.444%.

The Dow was up 3.92%, the S&P 500 gained 3.36% and the Nasdaq rose 2.44%.

Christine Albano contributed to this report.