After more than two months of extreme volatility, the municipal market gained clarity as to the Fed's intentions with its news that it would charge a large premium on issuers who choose to access its Municipal Liquidity Facility. Instead, investors turned their heads to the stock market in hopes that strength in equities will continue and governments will start to reopen.

Triple-A benchmark yields fell two or three basis points in thin secondary trading.

The

Lower-rated credits, such as Illinois, may benefit though from the facility. Last week, Illinois

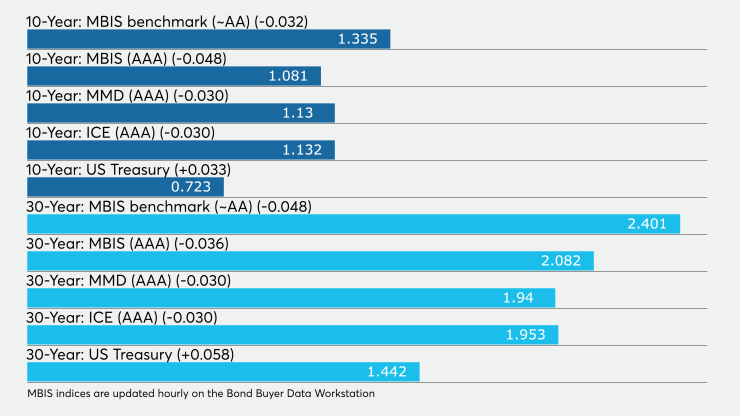

Additionally, several traders also said that Treasuries are significantly overpriced so they should fall back toward munis to make the municipal to UST ratios “more normal.” Late in the day, the 10-year Treasury was yielding 0.723% and the 30-year was yielding 1.442%. The 10-year muni-to-Treasury ratio was calculated at 156.1% while the 30-year muni-to-Treasury ratio stood at 134.6%, according to MMD. The 10-year muni-to-Treasury ratio was calculated at 170% and the 30-year muni-to-Treasury ratio stood at 134% on ICE Data Services' data.

“The muni percent of Treasury yields by continues to fall with munis rallying and Treasuries going the other way,” according to ICE.

The percentages remain elevated with all points on the curve remaining significantly above the 100% threshold, but only the front end is still above 200%.

Secondary trading showed high-grades performing in a mixed fashion. New York City Transitional Finance Authority future tax-supported bonds (which is bringing $726 million of exempt and taxables on Wednesday,

Washington GOs, 5s of 2021 traded at 0.48%-0.49%. University of Michigan 5s of 2024 traded at 0.76%-0.74%. Mecklenburg County, NC 5s of 2024 traded at 0.78%-0.80%. Harvard 5s of 2026 traded at 0.87%-0.86%. Yesterday they traded at 0.98% and were originally priced to yield 0.92%.

Utah GOs in 2027 traded at 0.95% while Friday they traded at 1.02%-1.00%. Wisconsin green bonds, 5s of 2036, traded at 1.64%.

In the primary, few smaller deals hit the screens Monday as the market gears up for taxable Tuesday, when two large corporate CUSIP deals are slated to be priced.

Tim Heaney, senior portfolio manager at Newfleet Asset Management said there is a thaw in the market and it’s improving, but it’s not uniform.”

Heaney manages institutional and separately managed tax-exempt and taxable accounts totaling $800 million.

“We have gone from arguably the best technicals in the muni market in late February to a point in the last six to seven weeks with the worst technicals,” he said.

At the same time, he said an upcoming seasonal burst of demand due to spring redemptions could offer a much-needed boost that the market needs to re-engage traditional investors — especially at a time when much of the sizable demand for new issues in recent weeks has been coming from crossover buyers.

Primary market

Barclays Capital is set to price Duke University’s (Aa1/AA+/NR/NR) $1.3 billion of taxables. The deal from the North Carolina university is tentatively structured with term bonds in 2044, 2050 and 2055.

Additionally, Morgan Stanley is expected to price Emory University’s (Aa2///) $800 million of taxables. The Georgia school will use the proceeds for construction and refunding purposes.

In the competitive arena on Tuesday, Miami-Dade County, Fla., is selling $365.3 million of general obligation bonds as a remarketing for the Building Better Communities program.

On Wednesday, the focus turns to New York, where city and state agencies have large deals on tap.

The New York City Transitional Finance Authority (Aa1/AAA/AAA/NR) is selling $726 million of future tax secured bonds consisting of tax-exempts and taxables.

Loop Capital Markets is set to price the TFA’s $500 million of exempt subordinate bonds, Fiscal 2020 Series C Subseries C-1, after a one-day retail order period.

The TFA will also competitively sell $226 million of taxable bonds in two offerings. The issues consist of $114.09 million of taxable subordinate bonds, Fiscal 2020 Series C Subseries C-3 and $112.17 million of subordinate bonds, Fiscal 2020 Series C Subseries C-2.

Proceeds will be used to fund capital projects.

Since 2020, the TFA has issued about $52 billion of bonds. The authority has about $39 billion of debt outstanding at the end of the second quarter of fiscal 2020, according to the NYC Comptroller’s Office.

“The TFA is a traditionally well known and understood credit that has liquidity and I would expect that deal to see some interest,” Heaney said, but noted that the response from individual investors during Tuesday’s retail order period ahead of the official pricing will be "interesting."

“It’s also a credit that appeals to buyers looking for tax-exempt income and a credit that potentially could appeal to crossover buyers and taxable buyers who want to take advantage of the dislocation of relative value to Treasuries and gain access to the municipal market,” Heaney said.

He added that there continues to be opportunities in both the new issue and secondary markets — depending on pricing and credit.

“Deals have to get done — and pricing might be more attractive than prior to the pandemic,” he said. “Compared to a couple of months ago, when you walk down the muni aisle there are more attractive products available than when the shelves were bare.”

Overall, Heaney described a “bifurcated” municipal market, consisting of credits that investors are comfortable with and feel will weather the pandemic storm fairly well, and other more vulnerable credits that remain a red flag, such as higher education credits.

“Market participants are differentiating among credits — and rightfully so,” he explained, adding that the virus-induced climate is hitting some credits and sectors more severely than others — and none have been totally immune to implications.

RBC Capital Markets is set to price the Dormitory Authority of the State of New York’s $465 million of revenue bonds for the school districts revenue bond financing program.

The DASNY deal comprises four tranches consisting of Series A bonds (Aa3//AA-/), Series B bonds (Aa2//AA-/), Series C bonds (/AA/AA-/) and Series D bonds (Aa3//AA-/).

Proceeds will benefit school districts throughout the state.

Secondary market

Short-term high-grades continued to show strength Monday.

The ICE municipal yield curve had the short-term maturities down two to three basis points, to 0.540% in 2021, 0.609% in 2022 and 0.692% in 2023.

The BVAL curved showed the 2021 maturity down four basis points to 0.48%.

Longer-term munis were also stronger.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO fell three basis points to 1.13% while the 30-year dropped three basis points to 1.94%.

IHS Markit’s municipal analytics AAA curve had the 10-year muni at 1.18% and the 30-year at 2.01%.

On the ICE municipal yield curve, the 10-year yield fell three basis points to 1.132% while the 30-year lost three.

BVAL showed the 10-year falling two basis points to 1.15% while the 30-year fell two basis points to 2.10%.

Munis were also stronger on the MBIS benchmark and AAA scale, with yields falling in both the 10- and 30-year maturities.

Treasuries weakened as equities traded slightly higher.

The Dow was up 0.04%, the S&P 500 was up 0.47% and the Nasdaq was 1.32% higher.