Want unlimited access to top ideas and insights?

In the primary market Tuesday, the New York Metropolitan Transportation Authority's anticipated $700 million pricing was upsized to $1.125 billion and completed at spreads about 300 basis points north of AAA benchmark yields but was bumped a few basis points in repricing, while a planned $1.2 billion issuance from Illinois was put on hold.

"If there was one issuer I would say would be somewhat on par with Puerto Rico, the state of Illinois is one of them," a New York trader said. "We don't want to see any U.S. state fail but the issues preceding it would land the land of Lincoln in difficult territory. Will they default? No. Do they face a very real uphill battle? Yes."

In contrasting the Illinois deal with the MTA's, the trader said "we need to also consider that the MTA is a very integral part of the financial capital of the world."

"Chicago and the state of Illinois are not meaningless or less important," the trader said. "But right now, investors are going to put their dollars into what they consider the most long-term viable physical assets. So that's why MTA got done and Illinois is holding off."

“A lot of eyes were on the MTA deal today, which surprised us as the levels were tighter than where bonds have been bid in the secondary and the deal saw [over] subscriptions of five times on the terms and three times on the puts,” Justin Horowitz, Vice President and municipal trader at AllianceBernstein in New York, said Tuesday after the pricing.

Horowitz said the Illinois GO deal which was placed on the day-to-day calendar is another deal the market is closely following.

“It could be due to price whispers they heard, but also to further explore receiving funding via the Fed's [Municipal Liquidity Facility] program rather than tapping the market at punitive levels,” he said.

Market sources said indications from the finance team working on the deal suggested it was Thursday’s release of the state’s fiscal 2019 financial results by the comptroller and auditor general that drove the delay. The CAFR showed that the state faces far larger tax revenue shortfalls than it did prior to the COVID-19 crisis. The state now needs to address fresh questions raised by investors that could have widened the already steep yield penalties expected.

State officials denied the CAFR’s release was the cause.

“The state of Illinois is changing the date for the receipt of bids of its $1.2 billion general obligation certificates, Series May of 2020,” the state said in a statement. “The state will announce via MuniAuction a new date and time for the sale of the certificates at least 12 hours prior to such alternative date and time for receipt of bids.”

Barclays priced the Pennsylvania State University’s (Aa1/AA//) $1.07 billion of taxable bonds and $62 million of tax-exempts.

The taxables were priced to yield from 105 basis points above the comparable Treasury security in 2021 to 148 basis points above Treasuries in 2043 and 160 basis points above Treasuries in 2050.

The exempts were priced as 5s to yield from 0.81% in 2021 to 1.73% in 2031.

The Penn State deal demonstrated an opportunity to earn attractive levels, especially the $1 billion taxable portion, Horowitz said. “It looked attractive as you can pick up spread relative to high grade corporates,” he said. “It is also index eligible, helping liquidity."

The market clearly thought so as the terms were two times over for the $303 million in 2043 and four times over for the $327 million in 2050, so it appears there was ample demand.”

Meanwhile, he noted that the tax-exempt bonds were $62 million and were six to 12 times oversubscribed.

Elsewhere other market technicals are changing from the norm, Horowitz added.

“The disparity between the primary and secondary market is pretty interesting as primary deals used to come cheap to secondary and now they are coming tighter,” he noted. Similarly, he said two healthcare deals that priced Tuesday — TriHealth, which is A-plus-rated, and University Health, which is triple-B rated came at levels tighter than where similar quality credits are trading or receiving high bids in the secondary.

“While the deals got done demand was not as robust as we would see on a high grade,” Horowitz said, adding that the University Health deal was just one time oversubscribed in 10 years and two times oversubscribed in 20 years.

The MTA Deal

Jefferies priced $925 million of the New York MTA's transportation revenue green bonds (A2/A-/A+/AA+), following recent rating downgrades.

The deal was priced in three maturities: as 4.75s to yield 4.95% in 2045, as 5s to yield 5.08% in 2050, and as 5.25s to yield 5.23% in 2055.

The MTA issue — landing after recent downgrades and a pandemic-drevin ridership plunge — was increased in size from the originally reported $672 million and the pre-marketing wire’s $704 million to an ultimate $1.125 billion.

Jefferies priced and repriced the MTA transportation revenue green bonds (A2/A-/A+/AA+).

The deal was repriced to lower yields in three maturities: as 4.75s to yield 4.95% in 2045, as 5s to yield 5.08% in 2050 and as 5.25s to yield 5.30% in 2055. It had been tentatively priced as 4.75s to yield 5% in 2045, as 5s to yield 5.15% in 2050, and as 5.25s to yield 5.230% in 2055.

The issue was increased in size three times — from the originally reported $672 million, the pre-marketing wire’s $704 million and the tentative pricing’s $925 million.

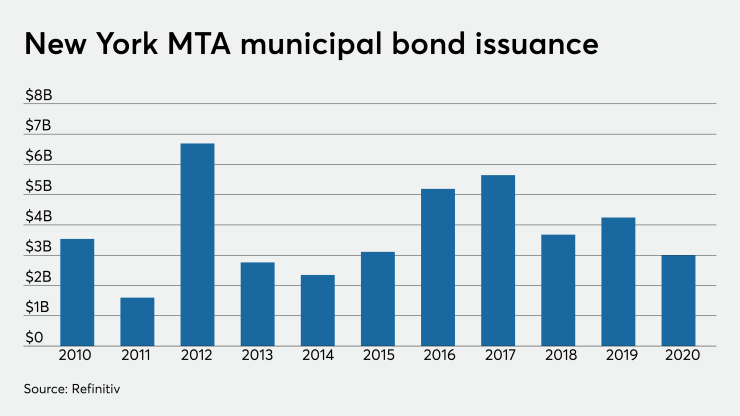

Since 2010, the N.Y. MTA has sold about $42 billion of debt.

Some have described the MTA deal as “challenging” given its timing and size — and financial losses during the COVID-19 crisis.

The Series 2020C climate-bond certified transportation revenue green bonds are part of a larger $7.3 billion borrowing program through 2023 backed by new revenue to help fund the MTA’s $51.5 billion five-year plan, its largest ever.

The authority is struggling due to loss of farebox revenues because of stay-at-home orders and other social-distancing measures, combined with a surge in sanitizing expenses.

Traders noted that the market was keenly watching to see if the MTA could clear the market, given its "considerable" credit and timing pressures, with short-term notes coming due May 15. The deal went through.

Illinois deal

The short-term general obligation certificate sales (Baa3/NR/BBB-/NR) consist of $500 million of Series of May 2020C, $350 million of Series of May 2020B and $350 million of Series of May 2020A.

“The state of Illinois has developed its plan and is positioned to enter the market very soon if needed, but with the flexibility to assess the market as it returns from unprecedented dislocation,” Carol Knowles, spokeswoman for the Governor’s Office of Management and Budget, said in an email.

“Like many issuers, we are going day-to-day and assessing conditions to determine the best time to enter the market,” Knowles said. “As we stated when we announced the state’s intention to go market last week, the size, timing, and structure of the anticipated transactions remain subject to market conditions.”

The state last month said it planned on a May 6 sale for the certificates — divided into three tranches with two callable ahead of the May 2021 maturity — that must be competitively issued under state statutes. Gov. J.B. Pritzker’s administration targeted a sale date for the following week on a $1 billion general obligation bond sale for capital and pension buyouts. That deal is being led by BofA Securities. It’s not clear whether that deal will also be moved to the day-to-day calendar.

The state’s 10-year was at 396 basis point spread to MMD’s AAA benchmark Monday and longer bonds were at a 404 basis point spread. They ended the month at a 391/394 spread. That’s a roughly 100 basis point widening since the start of April.

The state over the last month saw two outlooks move to negative from stable and it was hit with one downgrade. Fitch Ratings, Moody’s Investors Service, and S&P Global Ratings all now have the state at the lowest investment grade level with a negative outlook.

Illinois’ name took center stage last month as Senate Majority Leader Mitch McConnell pushed back against state relief to ease plummeting tax revenue in the next federal aid package saying states instead should be allowed to file bankruptcy to deal with burdensome pensions.

Market tone

On Monday, nominal strength combined with ongoing volatility and uncertainty was creating lots of cross currents.

“We were getting progressively cheaper for a week and a half and last week at the beginning of the week we had decent interest, but then Thursday and Friday the market firmed up,” a New York trader said Monday. “When the markets did better on Monday and Tuesday, the cheaper levels brought in interest. Thursday and Friday that went away and took a little of the relative value buyers off the table for the time being.”

Municipals’ tight trading range continued to be evident, according to the trader.

“There are a lot of cross currents coming together. And for a Monday, there is not much being priced and a lot of people just on the sidelines sitting and waiting,” he said.

“There are not enough buyers to hurt the market but there are not enough buyers to help the market,” he said. “Everyone is concerned about the calendar and there is a lot of credit concern.”

He said the new-issue slate in the next month could be pretty sizable if the climate is ripe for issuers to bring deals to market.

“A week ago they were pulling deals because they couldn’t get them done ... and 15 basis points in MMD doesn’t take that concern away,” he said. “Issuers that have to come to market are piling up,” he said.

This week’s calendar includes some sizable taxable offerings. But away from the focus on the new issuance, the overall market technicals are dictating the mood of the buy side arena, according to the trader.

“The market is extremely thin — the trading accounts don’t own much and the market is still pretty volatile,” he said. “Even though we cheapened up over a week ago, there’s not much supply and everyone is light.”

Primary market

.

In other early action Tuesday, BofA Securities priced the School Board of Palm Beach County, Fla.’s (Aa3/NR/AA-/NR) $104 million of certificates of participation. The COPs were priced as 5s to yield 2.13% in 2032, 2.27% in 2033 and 2.32% in 2034.

JPMorgan Securities received the written award on the West Contra Costa Unified School District, Calif.’s (Aa3/AA-NR/NR) $95 million of taxable general obligation refunding bonds. The issue was priced at par to yield from 1.184% in 2020 to 2.612% in 2032.

Secondary market

Munis continued to rally Tuesday as yields fell as much as four basis points across the curve.

Muni yields were down two- to four basis points on Refinitiv Municipal Market Data’s AAA scale from Tuesday’s final readings of 1.30% and 2.11% for the 10- and 30-year, respectively.

ICE’s Muni curve showed the 10-year down four basis points at 1.266% and the 30-year off two basis points at 2.097%.

Treasuries were weaker as equities rose.

Art mid-session, the 10-year Treasury was yielding 0.652% while the 30-year was yielding 1.323%.

Equities were higher. The Dow was up 1.64%, the S&P 500 was up 1.73% and the Nasdaq was 1.82% higher.

Lynne Funk contributed to this report.