The rally in the municipal market continued in earnest Tuesday, with yields falling in anticipation of more meager supply hitting the screens later this week.

Benchmark AAA municipal yields have hit record lows at the front end of the curve. Yields on the one-year are hovering anywhere from 0.06% to 0.13%, depending on the scale.

“The market’s moves this month would have seemed implausible in March given the severity of the economic pullback across every state,” said FHN Financial Senior Vice President Kim Olsan. “And yet, 15 trading sessions into May have brought a grinding rally with successive price gains driven by a range of committed buyers. Just where it stops is anyone’s guess (in theory a 1-year AAA spot around 0.10% isn’t far away from 0%) but ample demand along the curve is overriding any local or state credit concern.”

That credit concern is being lost somewhat in pricing munis and traders said they are looking for alternative benchmarks, even turning to corporates and U.S. Treasuries to price the market.

“The influence and sustainability of benchmark levels have been reduced; trading has become more scattered as investors look for better and heterogenous comparables,” Matt Fabian, partner at Municipal Market Analytics, said in the firm’s Outlook report.

Fabian noted the June reinvestment is now upon the market, even as more issuers make public their plans to reduce near-term borrowing.

“But the recent rally in AAAs is also a function of overly focused demand, and amplified volatility; meaning, with pandemic-linked uncertainty, fewer borrowers now qualify as ‘high grade,’ and those are being more aggressively priced and purchased.”

“Rally mode continues as tax-free bonds broke away from the direction of U.S. Treasuries,” said Eric Kazatsky, senior municipal strategist at Bloomberg Intelligence. “Drilling down, longer-duration muni bonds have fared better month-to-date, with returns that outpace the short end of the curve by almost 270 bps. However, this may be giving a slightly rosier picture than what reality has been over the past month and week.”

On a year-to-date basis, the three-year portion of the curve has been the best performer, returning 1.49%, vs. minus 0.40% for the muni long-bond index.

Trading showed that clearly Tuesday.

New York City TFAs, 5s of 2021, traded at 0.39% (bonds issued in 2013). TFAs, 5s of 2021 also traded at 0.39% (a 2019 issue).

Travis County, Texas COPs, 2s of 2023, traded at 0.29%-0.27%.

Utah 5s of 2025 traded at 0.39%-0.36% (early February issue yield at 0.92%).

Harvards, 5s of 2025, traded at 0.37%-0.35%. (Original yield 0.89%.)

Loudon County, VA GOs, 5s of 2028, at 0.76% (Original yield 0.82%). Loudon County 5s of 2031 traded at 0.96% (Original 1.05%).

Out longer, Metro Southern California waters, 5s of 2049, traded at 1.66%-1.65%. Texas waters, 4s of 2049, traded at 1.92%-1.81%.

In terms of credit, it is somewhat of a mixed bag for issuers. Some revenue bonds are faring better than state issues (see Illinois vs. Puerto Rico) and some new issue deals are being purchased by corporate accounts. Municipal buyers are shifting and the market is changing. On Friday, J.P. Morgan bought a $1 billion private placement from the Dormitory Authority of New York State of short-term notes.

The larger implication for the market is that buyers’ credit analysis is “looking beyond the near-term and factoring in (for the most part) local and state revenue recoveries past the next few quarters,” Olsan said.

And Olsan and others pointed out that one date that could hold significance is July 15, when many states will expect to see an influx of tax payments being made.

It’s clear that during that time the figures will be a telltale sign of credit as more state and local governments reopen.

Primary market

Activity was sparse on Tuesday after the long holiday weekend.

Kicking off the week on Wednesday, will be Colorado’s (Aa2/AA-/NR/NR) $500 million certificates of participation deal. BofA Securities is expected to price the COPs.

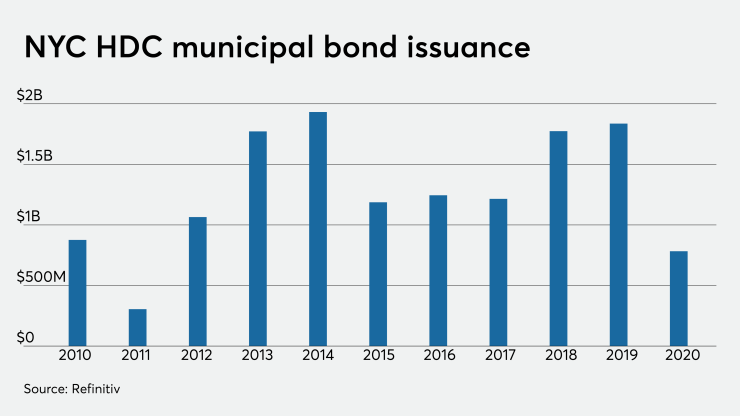

The New York City Housing Development Corp. (Aa2/AA+/NR/NR) is coming with $281 million of sustainable development bonds.

JPMorgan Securities is set to price the Series 2020A1B and A3 multi-family housing revenue bonds. Proceeds will be used to finance housing construction and refunds some outstanding debt.

Since 2020, the HDC has sold about $14 billion of bonds, with the least issuance occurring in 2011 when it offered $305 million.

Also Wednesday, Cabrera Capital Markets is slated to price Montebello, Calif.’s (/A+//) 153 million of taxable pension obligation bonds.

JPMorgan is scheduled to price the New Jersey Economic Development Authority’s (A1/A+/NR/NR) $150 million of water facilities refunding revenue bonds for the New Jersey-American Water Co.

In the competitive arena, Mercer County, N.J., (/SP-1+///) is selling $124,594 million of bond anticipation notes.

NW Financial Group in the financial advisor; Parker McCay is the bond counsel.

Belmont, Mass., (Aaa////) is selling $103.5 million of general obligation bonds.

Hilltop Securities is the financial advisor; Locke Lord is the bond counsel.

Secondary market

Municipals ended stronger on the short end as yields continued their descent and the long end stabilized.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 2021 maturity fell one basis point to 0.11% and fell by two basis points in 2022 and 2023 to 0.16% and 0.23%, respectively. The yield on the 10-year GO was unchanged at 0.84% while the 30-year was steady at 1.65%.

The 10-year muni-to-Treasury ratio was calculated at 120.3% while the 30-year muni-to-Treasury ratio stood at 114.7%, according to MMD.

The ICE AAA municipal yield curve also showed maturities declining, with the 2021 maturity off one basis point to 0.13%, the 2022 down two basis points to 0.16% and the 2023 maturity down three basis points to 0.22%. The 10-year yield was off one basis point to 0.82% while the 30-year was down one basis point to 1.65%.

“Munis are rallying to start off the week,” ICE Data Services said in a market comment. “Yields on the ICE muni curve are one to three basis points lower … one-year yields are sitting at an all-time low of 14 basis points (0.14%). The one- to 30-year yield curve is 151 basis points.”

ICE said the muni to Treasury ratios continued to fall: the 10-year muni-to-Treasury ratio was at 125% while the 30-year ratio stood at 113%.

IHS Markit’s municipal analytics AAA curve showed the 2021 maturity at 0.11%, the 2022 maturity at 0.16% and the 2023 maturity at 0.26% while the 10-year muni was at 0.87% and the 30-year stood at 1.67%.

The BVAL curve showed the 2021 maturity down two basis points to 0.06% and the 2022 at 0.13%, down 1. BVAL also showed the 10-year muni fall one basis point to 0.81% while the 30-year fell one to 1.68%.

Munis were also stronger on the MBIS benchmark scale, with yields falling in the 10- and 30-year maturities.

Treasuries weakened as equities rose.

The three-month Treasury was yielding 0.117%, 10-year Treasury was yielding 0.699% and the 30-year was yielding 1.438%.

The Dow was up 2.69%, the S&P 500 gained 1.82% and the Nasdaq was up 0.71%.

Wells Fargo Securities said that last week tax-exempts outperformed taxable munis, Treasuries and mortgage-backed securities, but still underperformed investment-grade corporates as the municipal market rally continued.

“BBBs outperformed AAAs by 44 basis points week over week as investor risk appetite has increased, though total returns for A and below credits remain negative year to date,” Wells Fargo said in a market comment Tuesday.

“High-yield munis outperformed the MBI benchmark by 37 basis points week over week amid strong high-yield fund inflows though high-yield munis continued to underperform corporate high-yields week over week,” Wells Fargo said.