The municipal market closed the week with lower yields again on triple-A benchmarks while the search for high-grade bonds spurred a more active secondary than a typical Friday.

Short-term yields continued to drop to record low levels and long-term bonds also rallied.

Triple-A benchmark yields were about four basis points lower.

In the secondary market, San Francisco 5s of 2021 were trading at 0.30-0.33%. Delaware GOs, 5s of 2022 traded at 0.40%-0.39%. Cambridge Massachusetts GOs 5s of 2022 traded at 0.40%. Fairfax County, VA GOs 5s of 2024 at 0.58%. Texas A&M 5s of 2026 at 0.92%. Harford County, MD 5s of 2027 at 0.88%. Harford County, MD 5s of 2030 at 1.06%-1.05% (originally sold on 4/28 at 1.47%) Northside Texas ISD 4s of 2036 at 1.71%-1.79%. Northside Texas ISD 3s of 2047 at 2.36%-2.28%.

The primary has $7.62 billion on tap led by Connecticut’s $850 million of special tax obligation bonds for transportation infrastructure purposes.

Several large university deals are also set to price: Emory University’s $506 million, and the triple-A Board of Regents of the University of Texas System‘s $400 million of taxables and $100 million of revenue financing system exempts.

The Texas Water Development Board, also triple-A, will bring $383 million of state revolving fund revenue bonds.

Brown University has $300 million of taxables. Northwestern University with $300 million of taxable corporate CUSIPs.

A Brunswick, North Carolina $146 million enterprise systems revenue bonds deal will also price, among many other issuers from Michigan to more Texas independent school districts.

“The grind to lower yields continues. Since April 30, MMD five-, 10- and 30-year spots have dropped in yield by 33, 41, and 42 basis points, respectively,” said Greg Saulnier, Managing Analyst at Refinitiv MMD. “However, municipal to U.S. Treasury ratios continue to remain extremely attractive in a historical context and the market appears starved for AAA GO and essential service revenue paper. With the fear of the unknown and the possible credit issues coming out of Covid-19, everyone wants top quality high-grade blocks and there just isn’t much around so buyers have no choice but to reach. That said, we’ll see if rate-sensitive deals start to come off the shelf more and more as we remain at these low yields with the increased supply stepping up to meet demand.”

Other benchmarking services agreed.

“The week is coming to a close on a positive note in the muni market,” ICE Data Services said. “One-year yields fell to 0.41%, continuing a streak of new all-time lows. The 10-year is approaching 1% (1.018% at 2PM), a level last seen on March 10. The muni percent of Treasury yields are creeping lower, but are still well above 100% in all tenors. Trade volumes are strong, especially in the light that today is a Friday.”

Meanwhile, the

It was a quiet Friday for a California portfolio manager, though, who said other than minor adjustments that saw yields dip slightly, the bifurcation of the municipal market is making it a disturbing time for investors and financial advisors alike.

Many are having a hard time with the uncertainty and volatility that have caused a bifurcated market when it comes to credit and wide spread disparity between high-quality and high-yield, he said.

“With levels being back to the lows of where they had been, and a bifurcated market in terms of credit, it’s kind of a frustrating market,” he said on Friday.

“There is stuff coming that you would rather wait and see how it flushes out before you jump in,” he said, pointing to bonds for hospitals, sales tax credits, and airports.

With some existing accounts committing available cash, he has been able to buy small pieces of attractively priced bonds from select taxable municipal deals, but it’s been limited due to general market conditions, he said.

“I think that a lot of people are tired of it all and want to just wait and see what happens,” he added.

Overall investors and financial advisors, he said, are too skittish to dip their toes in the municipal waters until liquidity, issuance, credit concerns and overall uncertainty improve.

“Financial advisors would like to commit cash, but a lot of them are suffering from sticker shock,” he said.

New deals are getting done with oversubscriptions and issuers are benefitting from the timing, he said.

“It does seem there is demand, and I think a lot of issuers want to get in and get their deals done before rates move,” he said.

A Southeast trader, meanwhile, said the incremental drop in municipal rates across the curve on Friday didn’t deter demand.

“Demand was strong with little buyer’s resistance and the week closed with only modest account balances,” Rick Calhoun, first vice president of sales and trading at Crews & Associates in Little Rock, Ark.

Even though next week will be short due to the approaching Memorial Day holiday, demand will likely remain strong as they focus on the market’s planned $7 billion of new issuance, he noted.

“Many customers will not be going to the beach as usual because some beaches remain closed and many Memorial Day activities are now cancelled due to the virus,” Calhoun said.

Secondary market

Municipals finished out the week on a strong note as short-term yields continued to drop to record low levels and long-term bonds continued to rally.

On Refinitiv Municipal Market Data’s AAA benchmark scale, yields dropped by two basis points, to 0.43% in 2021 and to 0.49% in 2022.

Out longer on the MMD scale, the yield on the 10-year GO dropped four basis points to1.01% while the 30-year declined four basis points to 1.82%.

MMD’s 10-year muni-to-Treasury ratio was calculated at 158.3% while the 30-year muni-to-Treasury ratio stood at 138.3%, according to MMD.

The ICE AAA municipal yield curve showed short-term maturities falling four basis points, with the 2021 maturity dropping to a record low of 0.410% and the 2022 maturity at 0.463%.

Out longer on the ICE municipal yield curve, the 10-year yield was off four basis points to 1.015% while the 30-year decreased four basis points to 1.832%.

ICE’s 10-year muni-to-Treasury ratio was calculated at 170% while the 30-year muni-to-Treasury ratio stood at 136%.

IHS Markit’s municipal analytics AAA curve showed the 2021 maturity at 0.45% and the 2022 maturity at 0.50% while the 10-year muni was at 1.03% and the 30-year stood at 1.86%.

The BVAL curved showed the 2021 maturity fell two basis points to 0.36% and the 2022 at 0.42%. BVAL also showed the 10-year muni lower by four basis points to 1.01% while the 30-year also fell four basis points to 1.86%.

Munis were also stronger on the MBIS benchmark scale, with yields falling in both the 10- and 30-year maturities.

Treasuries strengthened as equities rose.

Late in the day, the 10-year Treasury was yielding 0.645% and the 30-year was yielding 1.326%.

The Dow was up 0.12%, the S&P 500 gained 0.08% and the Nasdaq rose 0.42%.

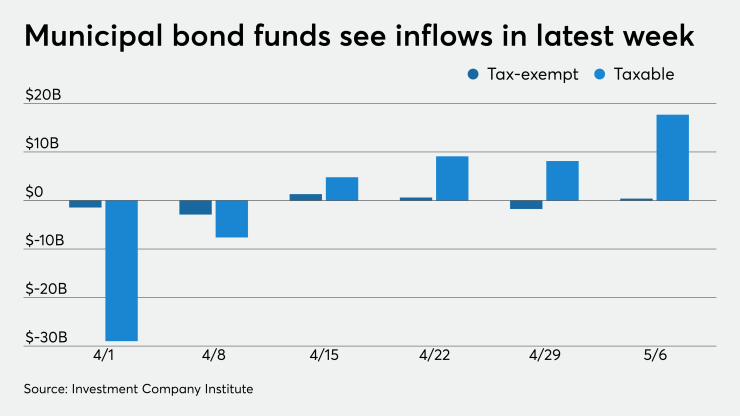

Lipper reports $582M inflows

Investors reversed course and regained some confidence as they ploughed some cash back into the municipal market.

In the week ended May 13, weekly reporting tax-exempt mutual funds saw $581.943 million of inflows, after outflows of $408.424 million in the previous week, according to data released by Refinitiv Lipper Thursday.

Exchange-traded muni funds reported inflows of $199.031 million, after outflows of $18.992 million in the previous week. Ex-ETFs, muni funds saw inflows of $382.912 million after outflows of $427.416 million in the prior week.

The four-week moving average remained negative at $252.099 million, after being in the red at $189.238 million in the previous week.

Long-term muni bond funds had outflows of $39.032 million in the latest week after outflows of $804.309 million in the previous week. Intermediate-term funds had inflows of $184.283 million after outflows of $37.521 million in the prior week.

National funds had inflows of $661.757 million after outflows of $243.507 million while high-yield muni funds reported outflows of $293.599 million in the latest week, after outflows of $736.606 million the previous week.

Bond Buyer indexes weaken

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, dropped three basis points to 3.84% from 3.87% the week before.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields fell 12 basis points to 2.48% from 2.60% in the previous week.

The 11-bond GO Index of higher-grade 11-year GOs decreased 12 basis points to 2.01% from 2.13% the prior week.

The Bond Buyer's Revenue Bond Index declined 12 basis points to 2.90% from 3.02% from the previous week.

The yield on the U.S. Treasury's 10-year note was unchanged from 0.63% the week before, while the yield on the 30-year Treasury moved slipped to 1.30% from 1.31%