Institutional buyers jumped at the junk-level spreads Illinois offered on its $800 million of new money, general obligation bonds Wednesday.

Illinois may have recorded a punishing new peak for its spreads for a primary outing, but the state sees the $8.4 billion of orders submitted by investors in a fragile municipal market still recovering from a tumultuous March as an accomplishment.

“We were encouraged by the size and range of the orders from more than 120 investors,” capital markets director Paul Chatalas said in a statement.

BofA Securities led the syndicate. The all-in, true interest cost of the deal settled at 5.83%.

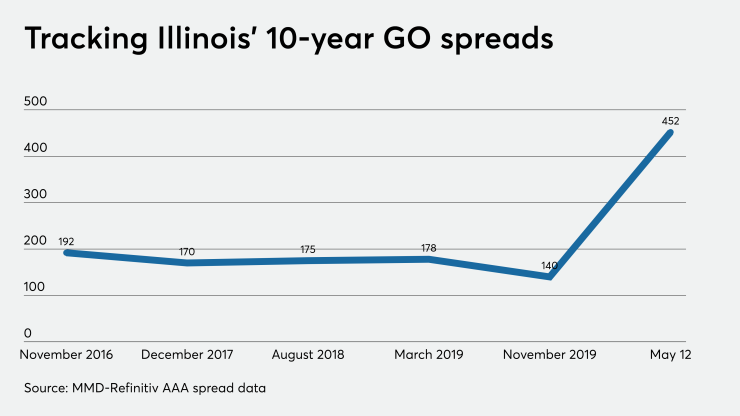

The 10-year bond in the deal landed at 5.65%, a 452 basis point spread to Municipal Market Data’s AAA benchmark and a 331 bp spread to the BBB benchmark. The state is rated at the lowest investment grade level of Baa3/BBB-minus with a negative outlook.

Illinois headed into the deal with its one-year bond at a 373 bp spread, its 10-year and 25 year at a 415 bp spread. The deal’s long bond came in below secondary levels settling at a 396 bp spread.

After the deal, MMD further widened the state’s yield curve, moving bonds 10 years and out to a 425 bp spread and the one-year to 400 bps from 373 bps.

When the state last sold bonds in November, the 10-year landed at a 140 bp spread, although the coupons differed. The stark widening highlights the pandemic’s toll on investor sentiment with the state’s structural and pension ills and threats posed to its investment grade ratings now in the forefront.

The state recently suffered one downgrade and Fitch Ratings, Moody’s Investors Service, and S&P Global Ratings all now assign a negative outlook.

Market

Market dynamics, with a preference for high-quality credits, lingering worries over liquidity, and jitters over headline risk were on display in the pricing. The market is still recovering from the dramatic fluctuations seen in March amid liquidity worries and outflows that stalled many deals and crowded the day-to-day calendar.

Some called the sale a clear success for both the state and the market, while others thought the penalty was too much to swallow.

The sovereign state’s market access was never in question just the price it would have to pay, several market participants said.

“It’s the cheapest paper out there,” said one trading desk member of the deal’s appeal, adding he expected the bonds to trade up quickly.

The deal appealed broadly to larger institutional buyers able to manage credit and headline risk.

Matt Fabian, a partner at Municipal Market Analytics, called the deal a great opportunity for the right buyer and thought it should have drawn even stronger interest given the inherent strengths in a sovereign state.

Illinois bonds claim a priority pledge on revenues, debt service is pre-funded and backstopped by non-general fund surpluses and the state enjoys broad flexibility to raise revenues, cut costs, and push its fiscal pain on to lower levels of government.

“It’s just a tremendous opportunity for a buy-and-hold investor who can bear some price volatility over the next year,” Fabian said. “This is where municipal investors should be flexing their intelligence about the strength of a state GO and put their money into this. The risk of Illinois not paying is minuscule.”

The bonds lack the benefit of a tax-exemption from state income taxes but even so it’s nearing a 10% taxable equivalence, Fabian said.

Fabian also didn’t see the yields as high enough to serve as a deterrent for state borrowing. “There’s a risk that some people will look at those prices and see them as telegraphing” trouble, but the pandemic has made “it an extremely difficult situation for everyone.”

Some believed the state should have waited. “Illinois is paying more for capital than junk taxable corporate buyers,” one Illinois-based fund manager said.

Illinois Gov. J.B. Pritzker addressed the issue of whether the penalty was worth it during his daily briefing Wednesday on the state’s management of the COVID-19 pandemic.

“Everybody’s going to get a ding in the markets as they go out to seek to borrow, but it was important for us to do so. It helps us to continue to keep people working by investing in our capital program and by lowering the overall pension liability” through the pension buyouts, Pritzker said.

The administration later added it saw risk in waiting. There’s no “guarantee of what would happen with either federal relief or the condition of the bond market. Therefore it was prudent to secure funding now for priorities such as the summer construction season and the peak retirement season for teachers in particular,” finance spokeswoman Carol Knowles said in a statement.

Other underlying market fundamentals may also have come into play.

The syndicate didn’t put out an overly aggressive scale, resulting in strong oversubscription levels with the first six maturities oversubscribed eight to 15 times, the 10-year 14 times, the 19-year 9.6 times and the 25-year 10.3 times.

While Chicago and Illinois deals are typically offered at levels that result in such oversubscriptions so there’s no question about investor interest, another factor could be at play due to the recent turmoil. With municipal prices more volatile, banks are more limited in the amount of bonds they can hold under risk management rules, so unsold balances are especially frowned upon.

The state initially intended to competitively sell $1.2 billion of one-year GO certificates last week and the long bonds — initially sized at $1 billion — Tuesday. The state delayed last week’s sale preferring to watch the market as its spread penalties widened.

The state initially said it still planned to sell the certificates before the bonds. The state shifted gears and on Monday, the syndicate sought pricing views and said it would move on the long-term deal as soon as Wednesday. The $1.2 billion of notes remains on the day-to-day calendar and the “state continues to monitor the municipal market and is prepared to enter at any time,” according to a statement.

The short-term borrowing — permitted under state statutes with an up to one-year maturity when budgeted revenues fall short — will help the state manage a $2.7 billion revenue loss in the current fiscal year that runs through June 30.

The state must repay the certificates and make up for another $4.6 billion in expected revenue losses in fiscal 2021. Lawmakers will return next week to work on a budget plan. Pritzker is hoping the next federal aid package will provide state and local governments with compensation for lost revenues.

Fabian and others believe the state should look closely at the Federal Reserve’s Municipal Liquidity Facility, given that the state is eligible for nearly $10 billion in three-year borrowing. The Fed’s pricing released this week is no bargain, with Illinois eligible to borrow at about 4%.

The administration left the door open to its future use. “The Federal Reserve, in recent days, has issued additional guidance that appears to allow them to participate in the state’s required competitive bid format. Current Illinois law requires competitive bids for short-term borrowing, thus in order for the federal government to participate it would have to be the successful bidder in a competitive offering,” the administration said.

About $575 million of the deal priced Wednesday will pay for capital projects and the other $225 million will fund ongoing pension buyouts. The state initially planned to sell $1 billion with a taxable portion but the state’s bond lawyers recently concluded tax-exempt borrowing could be used.

Spreads

The deal offered maturities between 2021 and 2026, each for $32 million, with yields from 4.87% to 5.65%. The state shaved 10 to 12 bps off in the repricing. The one-year maturity landed at a 4.875% yield, down from the preliminary 5% yield, for a 433 bp spread to the AAA scale.

The $128 million 10-year settled at a yield of 5.65%, down 15 bps in repricing, for a 452 bp spread to the AAA. The $288 million 2039 bond settled at a yield of 5.75%, down 10 bps for a 406 bp spread, and the $192 million 2045 bond paid a yield of 5.85%, down 10 bps, for a 396 bp spread.

After the first year, the bonds offered premium coupons between 5.125% and 5.75% with the pricing protections offered adding to the deal’s appeal.

The state’s deals over the last two years have benefited from its ratings’ stabilization. Pritzker’s election in 2018 over incumbent Bruce Rauner also signaled a more amicable political environment. Pritzker is a Democrat and the General Assembly is controlled by Democrats.

The state’s previous deal, in November 2019, saw the 10-year land at 2.92% with a 5% coupon, for a 140 bp spread. Illinois benefited from a strong market with a supply and demand imbalance that offered favorable yields.

The most comparable bond, a nine-year maturity, in a March 2019 sale came at a 178 bp spread. That deal also benefited from a cash-lush market.

The 10-year in a December 2017 deal landed at a 170 bp spread and an August 2018 deal landed at a 175 bp spread. That deals sold after the state’s two-year budget impasse ended. The 10-year in the previous deal that sold in the fall of 2016 amid budget gridlock came at a 192 bp spread.

Goldman Sachs, Loop Capital Markets, Ramirez & Co. and RBC Capital Markets served as co-seniors. Academy Securities, Estrada Hinojosa & Co., Huntington HSE, Melvin Securities, and Stern Brothers & Co. served as co-managers. Chapman and Cutler, LLP, and Charity & Associates PC served as co-bond counsel. Mayer Brown LLP was underwriters' counsel. Acacia Financial Group and Swap Financial Group advised the state.