-

New York State’s revenue deficit deepened during the first three months of fiscal 2021, underlining how crucial federal funding is to help, according to Gov. Andrew Cuomo.

August 17 -

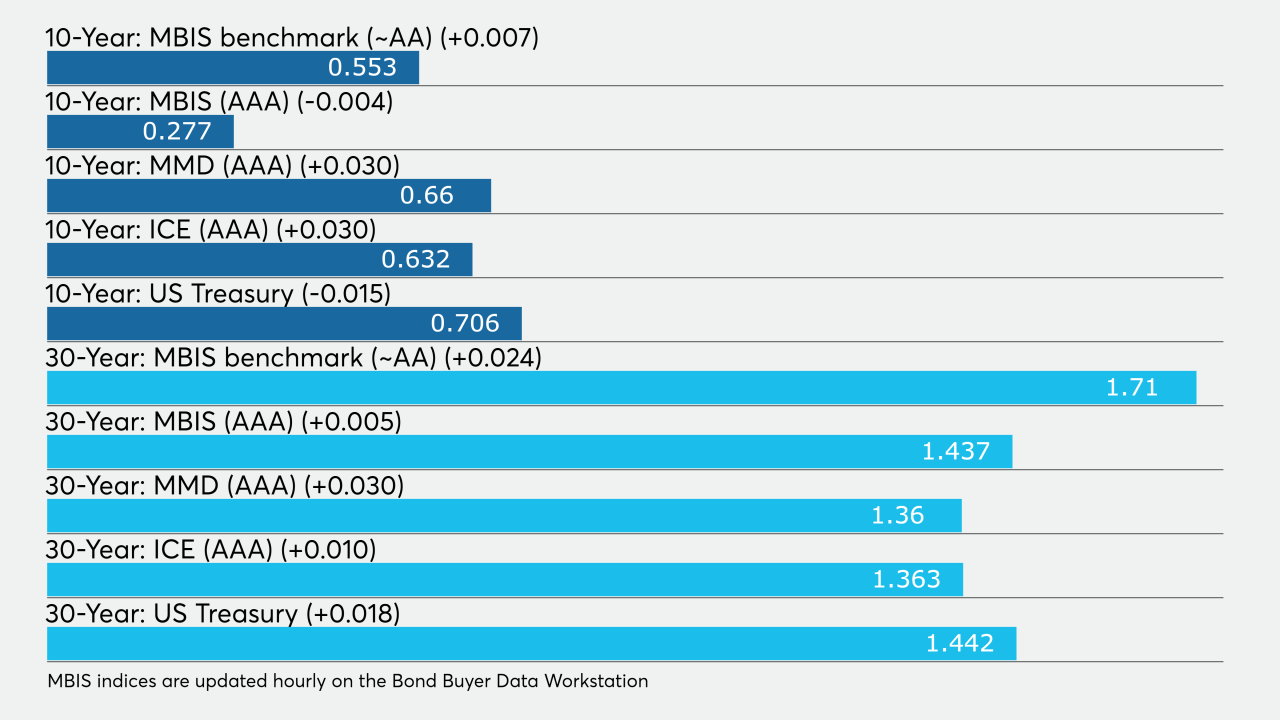

Municipals continued to correct, with yields on the AAA scales rising by as much as three basis points as signs point to investor pullback from current low yields.

August 14 -

Minority and women-owned business enterprises will now comprise 33% of city GO bond and Transitional Finance Authority book-runners and 40% for New York Water.

August 10 -

With the latest federal rescue package stalled, New York's mayor has asked state lawmakers to authorize an additional $7 billion in bonding.

May 27 -

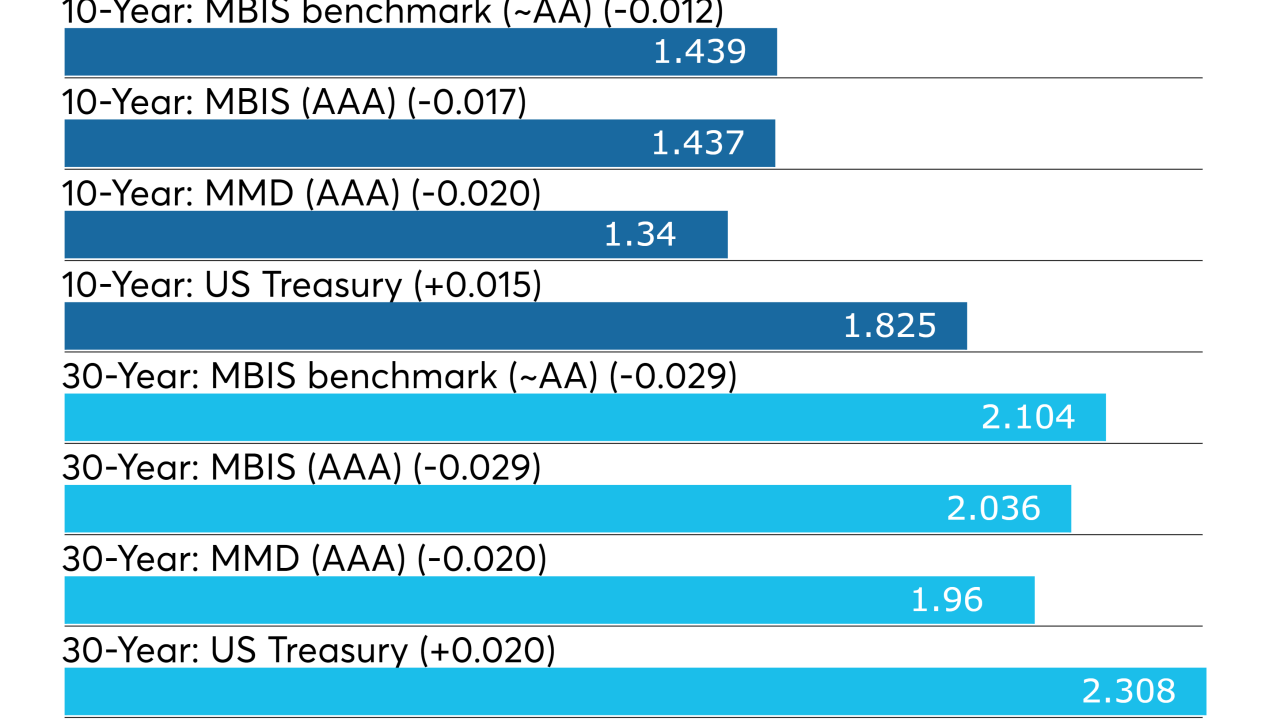

Investors are sending the message that higher-grade, longer-term issuers will fare far better than lower-rated, higher-yield ones amid a focus on credit.

May 13 -

The short end of the municipal curve again saw yields fall, but that didn't impede the productivity of the day's new-issue market.

May 12 -

The Fed on Monday essentially said it was standing 10 feet back from the market, allowing it to manage the pandemic-driven crisis itself. Lower-rated issuers may benefit most from the facility.

May 11 -

High-grade trading Friday showed the disparate credit picture that investors are facing; they now need to dig deeper into municipal financials and the backstops on certain bonds.

May 8 -

The council wants to focus on the social safety net in light of the COVID-19 pandemic.

April 8 -

If the Federal government doesn't help, the $12 billion plan could be funded by the city selling "relief bonds."

March 19 -

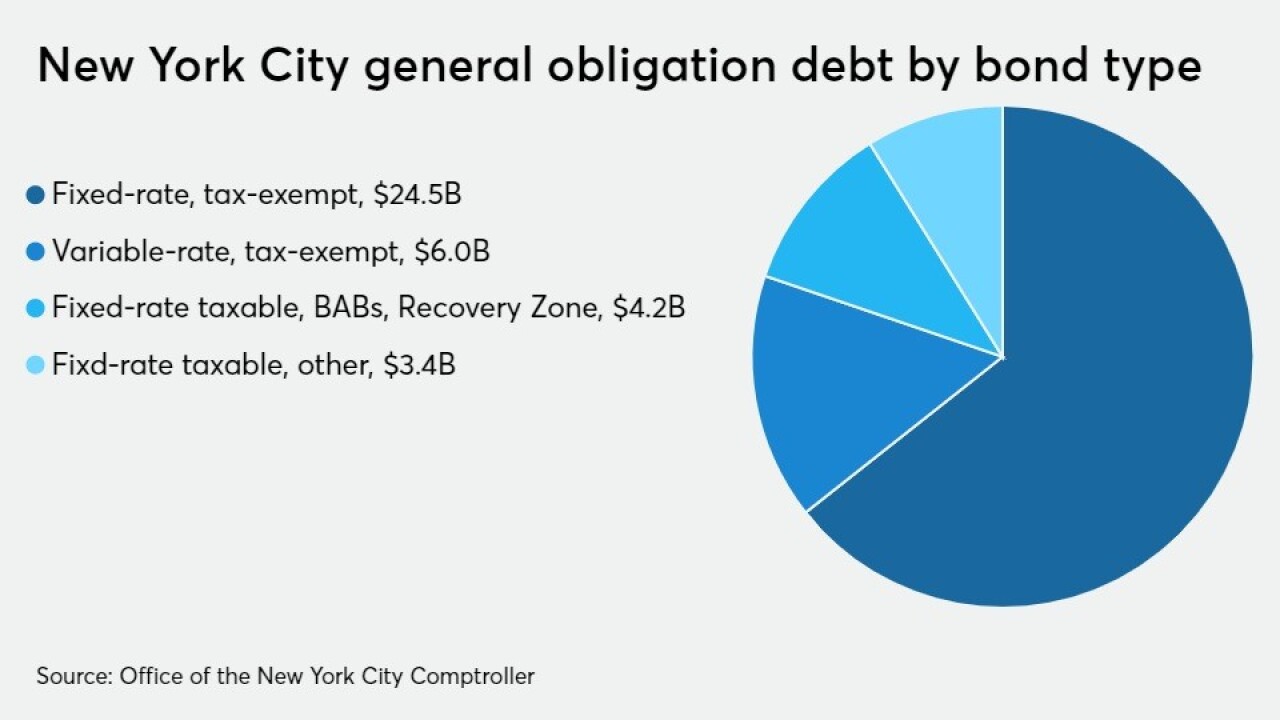

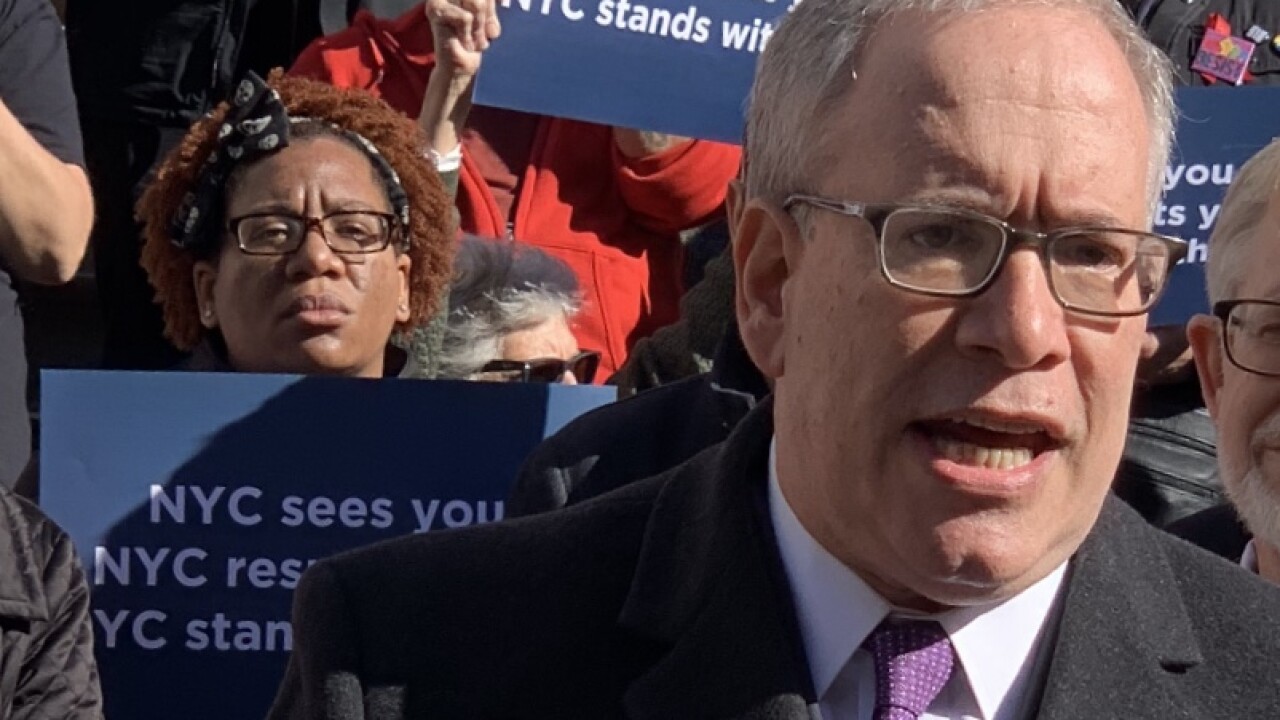

New York City has seen debt service savings in excess of $2 billion since 2014, but that the city must find more opportunities to cut costs, says Comptroller Scott Stringer.

February 25 -

Expanding housing affordability, helping small businesses, fighting climate change and improving education topped the list of new initiatives.

February 7 -

Mayor praised for restraint ahead of uncertainty about possible big cuts to city services by Albany.

January 17 -

The top municipal issuers easily surpassed their issuance totals from 2018 year, with $400.51 billion in 10,582 transactions in 2019 compared to $320.35 billion in 8,549 deals the year before. California regained control of the throne after coming in third in 2018.

January 8 -

Four large competitive deals stole the show on Tuesday, including New Jersey's first general obligation sale in a little more than three years.

January 7 -

The municipal bond market started off the week adopting a cautious tone, eyeing issuance and world events.

January 6 -

Municipals look to be well positioned entering 2020 against a strong backdrop of market technicals and stable credit outlook.

January 2 -

Muni yields rose as more bonds hit the marketplace in the last big supply rush of the week.

December 12 -

The Federal Open Market Committee left rates unchanged and looked likely to keep monetary policy on a steady course for the near term.

December 11 -

There's just no stopping the municipal momentum this holiday season. Happy shopping, investors.

December 9