It was a bonanza for municipal bond buyers on Thursday as deals swarmed into the market, with New York City leading the pack with issues totaling $1.15 billion. In the secondary, muni yields rose along with Treasuries as stock prices moved higher on positive trade negotiation news.

Primary market

JPMorgan Securities priced the New York City Transitional Finance Authority’s (Aa1/AAA/AAA/NR) $850 million of future tax-secured subordinate bonds, Fiscal 2020 Series B Sub-Series B-1 tax-exempts.

The NYC TFA also competitively sold $300 million of taxable bonds in two issues. JP Morgan won the TFA’s $172 million of taxable future tax-secured subordinate bonds, Fiscal 2020 Subseries B-2 with a true interest cost of 2.4033%.

Morgan Stanley won the TFA’s $128 million of future tax-secured subordinate bonds, Fiscal 2020 Subseries B-2 with a TIC of 2.9294%.

Citigroup priced Connecticut’s $894.64 million of Series 2020A general obligation bonds and Series 2020B GO refunding bonds.

Morgan Stanley priced the Public Utilities Commission of the City and County of San Francisco’s (Aa2/AA-/NR/NR) $657.035 million of Series 2019ABC water revenue bonds, Sub-series A taxable refunding green bonds, Sub-series B taxable refunding bonds and Sub-Series C taxable refunding bonds.

Siebert Williams Shank priced the City of Los Angeles’ $282.155 million of Department of Water and Power’s (Aa2/NR/AA/NR) Series 2019D power system revenue bonds.

Wells Fargo Securities priced the Metropolitan Washington Airport Authority’s (Aa3/AA-/AA-/NR) $355.945 million of Series 2020A forward delivery airport system revenue refunding bonds subject to the alternative minimum tax and Series 2020B forward delivery non-AMT airport system revenue refunding bonds.

In the competitive arena, the Washington Suburban Sanitary District, Md., sold $218.745 million of consolidated public improvement bonds of 2019 for Montgomery and Prince George's Counties, and improvement bonds of 2019 second series green bonds.

BofA Securities won the issue with a TIC of 2.6574%. Wye River Group was the financial advisor; McKennon Shelton was the bond counsel.

Proceeds will be used to finance various capital improvements and projects designated as green bonds.

Muni CUSIP requests tumble

Requests for municipal CUSIPs fell 15.6% in November, according to report released Thursday by CUSIP Global Services. The report tracks the issuance of new security identifiers as an early indicator of market activity over the next quarter.

The total CUSIP requests for new municipal securities, which includes municipal bonds, long-term and short-term notes, and commercial paper, fell to 1,429 from 1,693 in October.

On a year-to-date basis, total CUSIP request volume was up 14.8% to 13,755 from 11,986 in the same period in 2018. The record full-year volume for municipal CUSIP requests since CUSIP Global Services began tracking issuance activity in 2009 is 16,683, which was set in 2012

The number of requests for muni bonds fell to 1,263 in November from 1,447 in the previous month. Requests for long-term notes fell to 15 from 32 while those for short-term notes dropped to 105 from 155.

Among top state issuers, Texas, California and New York were the most active in November, with scheduled public finance offerings from Texas issuers being number one with 171.

By comparison, CUSIP requests for corporate debt dropped 1.3% in November.

Secondary market

Munis were stronger on the MBIS benchmark scale, with yields falling by one basis point in the 10-year and by less than a basis point in the 30-year. High-grades were mixed, with yields on MBIS AAA scale falling by two basis points in the 10-year maturity and rising by two basis points in the 30-year.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO rose two basis points to 1.40% while the 30-year rose four basis point to 1.98%.

“The muni market is outperforming today,” ICE Data Services said in a Thursday market comment. “The ICE muni yield curve was lower early this morning and then reversed as it started to take direction from Treasuries. Currently, the curve is one to two basis points higher. Tobacco and high-yield are holding at the prior session’s levels. Taxable yields are up 11 basis points.”

The 10-year muni-to-Treasury ratio was calculated at 75.5% while the 30-year muni-to-Treasury ratio stood at 88.3%, according to MMD.

Stocks were trading higher as Treasuries weakened.

The Dow Jones Industrial Average was up about 0.08% as the S&P 500 Index rose 0.06% while the Nasdaq gained 0.05%.

The Treasury three-month was yielding 1.577%, the two-year was yielding 1.679%, the five-year was yielding 1.744%, the 10-year was yielding 1.902% and the 30-year was yielding 2.326%.

Previous session's activity

The MSRB reported 37,065 trades Wednesday on volume of $17.36 billion. The 30-day average trade summary showed on a par amount basis of $11.78 million that customers bought $6.45 million, customers sold $3.26 million and interdealer trades totaled $2.08 million.

Texas, California and New York were most traded, with the Lone Star State taking 13.015% of the market, the Golden State taking 12.117% and the Empire State taking 10.405%.

The most actively traded security was the Texas Private Activity Board Surface Transportation Corp. taxable 3.922s of 2049, which traded 60 times on volume of $165.64 million.

Bond Buyer indexes decline

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, dipped to 3.61% from 3.62% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields fell to 2.74% from 2.77% the week before. The 11-bond GO Index of higher-grade 11-year GOs slipped to 2.27% from 2.30% in the prior week. The Bond Buyer's Revenue Bond Index declined to 3.21% from 3.24% in the previous week.

The yield on the U.S. Treasury's 10-year note rose to 1.90% from 1.80% while the yield on the 30-year Treasury increased to 2.32% from 2.24% in the prior week.

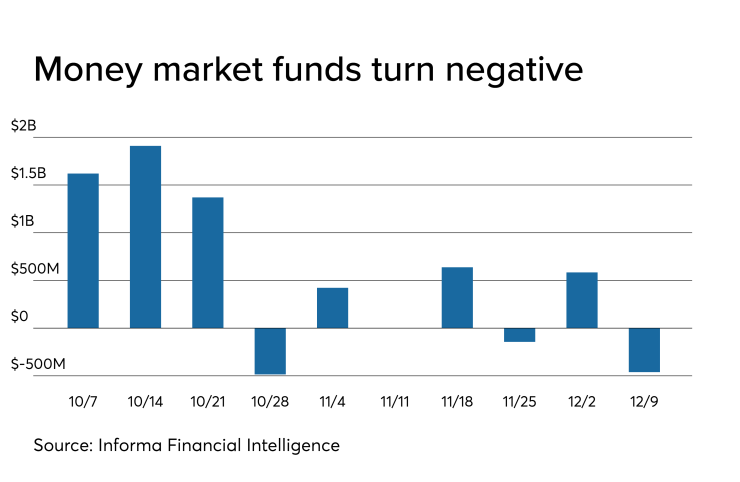

Muni money market funds see outflow

Tax-exempt municipal money market fund assets declined by $461.0 million, bringing total net assets to $138.48 billion in the week ended Dec. 9, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds fell to 0.69% from 0.72% in the previous week.

Taxable money-fund assets gained $46.39 million in the week ended Dec. 10, bringing total net assets to $3.436 trillion. The average, seven-day simple yield for the 804 taxable reporting funds dropped to 1.29% from 1.32% in the prior week.

Overall, the combined total net assets of the 991 reporting money funds increased $45.93 billion to $3.575 trillion in the week ended Dec. 10.

Treasury details upcoming auctions

Treasury announced these auctions:

- $17 billion four-year 10-month 1/8% TIPs selling on Dec. 19;

- $18 billion 1-year 10-month 0.300% floating rate notes selling on Dec. 18;

- $36 billion 182-day bills selling on Dec. 16; and

- $42 billion 91-day bills selling on Dec. 16.

Treasury auctions

The Treasury Department Thursday auctioned $16 billion of 29-year 11-month bonds with a 2 3/8% coupon at a 2.307% high yield, a price of 101.461576. The bid-to-cover ratio was 2.46.

Tenders at the high yield were allotted 22.20%. The median yield was 2.265%. The low yield was 0.880%.

Treasury also auctioned $40 billion of four-week bills at a 1.540% high yield, a price of 99.880222. The coupon equivalent was 1.568%. The bid-to-cover ratio was 2.59.

Tenders at the high rate were allotted 2.32%. The median rate was 1.505%. The low rate was 1.480%.

Treasury also auctioned $35 billion of eight-week bills at a 1.540% high yield, a price of 99.760444. The coupon equivalent was 1.569%. The bid-to-cover ratio was 2.69.

Tenders at the high rate were allotted 58.96%. The median rate was 1.505%. The low rate was 1.480%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.