New Jersey's first general obligation sale in a little more than three years led the primary in the competitive space with tax-exempt and taxable deals won by Morgan Stanley.

The State of New Jersey (A3/A-/A) sold two competitive deals totaling $325 million of general obligation bonds. It was the first GO bond issuance for the Garden State since 2016.

Morgan Stanley won the $175 million of taxable GO bonds for the securing our children’s future bond act of 2018 with a true interest of 2.5630%.

Morgan Stanley made it a clean sweep and also won the $150 million of tax-exempt various purpose bonds with a TIC of 3.1267%.

The tax-exempt pricings saw much tighter spreads compared to the MMD scale from its last GO deal. The long bond on the tax-exempt deal had a 2042 maturity priced as 5s to yield 2.13%. The 22-year maturity on the MMD scale as of Monday’s close was 1.85%, resulting in a spread of 28 basis points above the MMD scale.

The last time the state competitively sold GOs was on Dec. 7, 2016 when Bank of America Merrill Lynch won the $300 million offering with a TIC of 3.7579%. In that deal, the 10-year maturity of 2026 saw a spread of 84.3 basis points above the MMD scale, while the long bond (2037 maturity) was 120.6 basis points over MMD.

“The New Jersey offerings saw solid demand, stemming from retail investors in a high-tax state like NJ looking to get more in-state bonds, due to the Tax Cuts and Jobs Act,” said one New Jersey trader. “But the deal also benefited from those who are seeking yield. I think it bodes well for the negotiated NJ EDA deal coming later this week that is also high-yielding.”

Elsewhere, the Rochester Independent School District No. 535, Minnesota sold $172.610 million of GO school building bonds, backed by the Minnesota School District Credit Enhancement Program. Robert W. Baird and Co. won the deal, with a TIC of 2.248%.

The New York City Transitional Finance Authority (Aa1/AAA/AAA) sold $108.92 million of NYC recovery bonds, which were won by Morgan Stanley with a TIC of 0.9485%.

In the negotiated arena, Piper Sandler priced El Paso Independent School District, Texas’ (Aaa/ AAA) $197.07 million of unlimited tax school building bonds. The deal is insured by the Permanent School Fund Guarantee program.

The pace of deals will pick up on Wednesday and Thursday, as the biggest deals of the week are expected to price.

On Wednesday, Citi is scheduled to price the University of Massachusetts Building Authority’s (Aa2/AA-/AA) $569.12 million of tax-exempt and taxable project revenue and refunding bonds.

JP Morgan is also expected to price Duke University’s (Aa2/AA/AA) $299.352 million of taxable corporate CUSIP bonds.

Secondary market

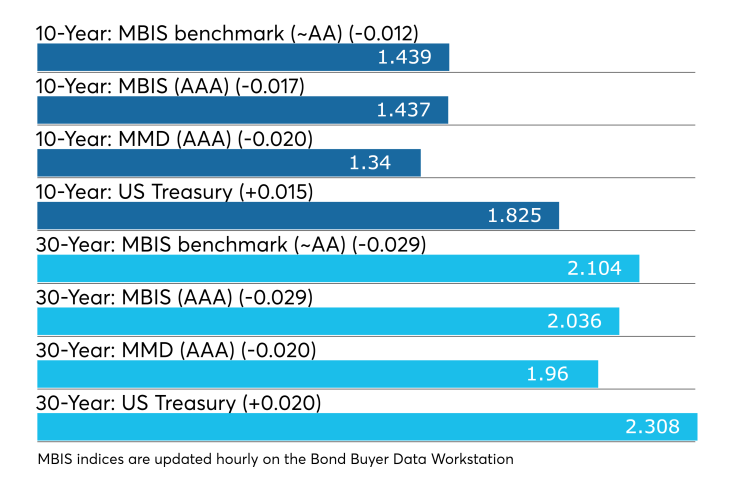

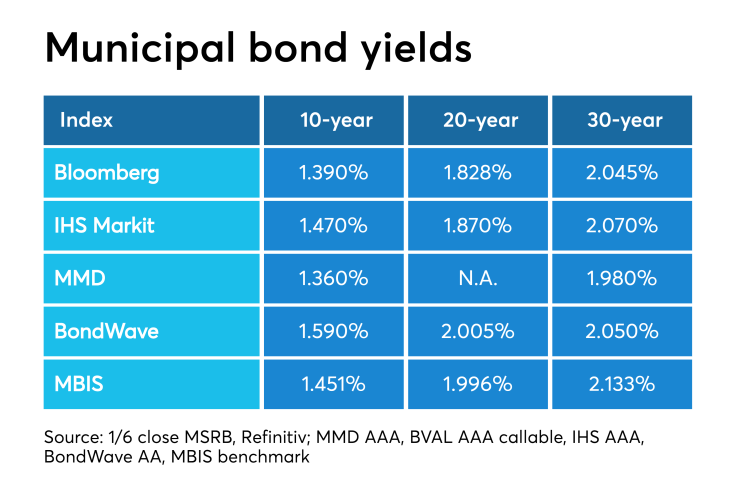

Munis were stronger on the MBIS benchmark scale, with yields falling by one basis point in the 10-year maturity and by three basis points in the 30-year. High-grades were stronger, with yields on MBIS AAA scale falling by as many as one basis point in the 10-year and by three basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the both 10-year GO and 30-year fell two basis points to 1.34% and 1.96%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 73.6% while the 30-year muni-to-Treasury ratio stood at 85.0%, according to MMD.

Stocks were mixed as Treasuries were higher. The Treasury three-month was yielding 1.544%, the two-year was yielding 1.548%, the five-year was yielding 1.619%, the 10-year was yielding 1.825% and the 30-year was yielding 2.308%.

The Dow Jones was down 0.26%, The S&P 500 was lower by about 0.21% and the Nasdaq was up 0.12%.

“The ICE muni yield curve is one to two basis points lower. Tobaccos and high-yield are one basis point lower as well,” ICE Data Services said in a Tuesday market comment. “Puerto Rico bonds are up despite a series of earthquakes that began yesterday. Reportedly the tremors killed at least one person, and left 346 homeless. Gov. Wanda Vazquez declared a state of emergency and activated the National Guard today. The benchmark 8% GO bonds are up 1 5/8 point.”

Previous session's activity

The MSRB reported 35,283 trades Monday on volume of $9.367 billion. The 30-day average trade summary showed on a par amount basis of $10.56 million that customers bought $5.62 million, customers sold $3.18 million and interdealer trades totaled $1.75 million.

California, New York and Texas were most traded, with the Golden State taking 15.718% of the market, the Empire State taking 13.892% and the Lone Star State taking 10.011%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. [COFINA] restructured revenue zeros of 2051, which traded 16 times on volume of $50.048 million.

3-year bills sold

The Treasury Department auctioned $38 billion of three-year notes with a 1 1/2% coupon at a 1.567% high yield, a price of 99.804399.

The bid-to-cover ratio was 2.45.

Tenders at the high yield were allotted 67.13%. All competitive tenders at lower yields were accepted in full.

The median yield was 1.540%. The low yield was 1.450%.

Treasury to sell $35B 4-week bills

The Treasury Department said it will sell $35 billion of four-week discount bills Thursday. There are currently $38.783 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.