While investors patiently wait until next week for the first new issuance of the year, the muni asset class is well positioned entering 2020 against a compelling backdrop of market technicals and a stable credit outlook.

This will likely bring continued active buyer interest from individuals and mutual funds, according to Jeffrey Lipton, managing director and head of municipal research and strategy at Oppenheimer.

“Similar to 2019, this unique technical environment with demand as an unwavering constant should be a key driver of performance in 2020 and munis can be expected to outperform U.S. Treasuries with a continuation of net negative supply potentially extending this performance,” Lipton said.

He added that he believes that 20% of all 2020 issuance will be of the taxable variety, as the taxable muni presence should appeal to existing tax-efficient investments such retirement accounts seeking alternative investment proxies, as well as to foreign buyers seeking to add diversification and above-average credit quality to their portfolios against a backdrop of negative yielding global sovereign debt.

“Thus far, we are not concerned that taxable issuance would have a crowding-out effect on traditional tax-exempts as the core buyer base for each tends to be different,” he said. “However, this may become a larger talking point should the taxable push extend beyond expectations and we begin to see noted convergence and blurred distinctions among the investor cohorts.”

Secondary market

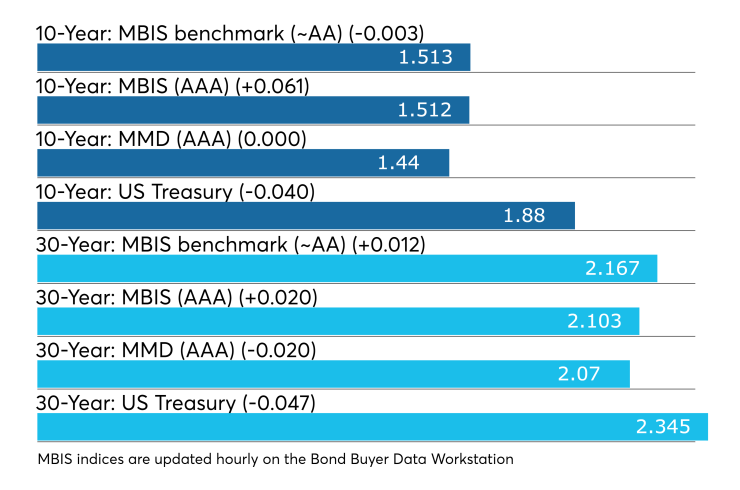

Munis were mixed on the MBIS benchmark scale, with yields falling by less than one basis point in the 10-year maturity and rising by one basis point in the 30-year maturity. High-grades were weaker, with yields on MBIS AAA scale increasing six basis points in the 10-year maturity and by two basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year of 2030 was unchanged at 1.44%, while the 30-year of 2050 was down two basis points to 2.07%.

The 10-year muni-to-Treasury ratio was calculated at 76.6% while the 30-year muni-to-Treasury ratio stood at 88.5%, according to MMD.

Treasuries were lower while stocks were in the green.

The Dow Jones Industrial Average was up about 0.81%, the S&P 500 Index gained around 0.46% and the Nasdaq was up about 1.01%.

The Treasury three-month was yielding 1.536%, the two-year was yielding 1.569%, the five-year was yielding 1.673%, the 10-year was yielding 1.880% and the 30-year was yielding 2.345%.

Primary market

It has been a few weeks since the muni bond market has seen any kind of big issuance. Despite the fact that there was almost no issuance for roughly the last two weeks of the year, muni volume still finished the year at

As of press time, there were 15 deals scheduled for next week of $100 million or larger — with only four of those negotiated deals.

“There is pent up demand and I would suspect that investors will be ready to pounce all over the new deals next week,” said one New York trader. "Next week won't be the biggest volume week, but it's better than nothing."

JPMorgan Securities is expected to price the Arizona Transportation Board’s $466.48 million of highway revenue taxable bonds.

RBC Capital Markets is scheduled to price the Commonwealth Financing Authority, Pa.’s $238.82 million of revenue refunding federally taxable bonds.

Citigroup is slated to run the books on Conroe Independent School District, Texas’ $110.8 million of school building bonds.

JPMorgan is also scheduled to price Grant County Public Utility District No. 2, Wash.’s (Aa3/AA/AA) $127.4 million of revenue refunding taxable bonds.

Topping the competitive slate next week will be the New York Metropolitan Transportation Authority, which is coming to market with around $2.4 billion of deals composed of about $940 million of green revenue bonds selling on Thursday and $1.5 billion of bond anticipation notes selling on Monday.

The New York Transitional Finance Authority is also heading to market with a competitive sale of about $109 million of Fiscal 2020 NYC recovery bonds on Tuesday.

Previous session's activity

The MSRB reported 21,997 trades Tuesday on volume of $4.26 billion. The 30-day average trade summary showed on a par amount basis of $10.85 million that customers bought $5.75 million, customers sold $3.27 million and interdealer trades totaled $1.82 million.

New York, California and Texas were most traded, with the Empire State taking 15.085% of the market, the Golden State taking 13.786% and the Lone Star State taking 9.732%.

The most actively traded CUSIP was the State of Texas tax revenue anticipation note 4s of 2020, which traded 4 times on a par amount of $10.76 million.

Bond Buyer indexes little changed

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, remained at 3.63% from the week before.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields dipped to 2.73% from 2.74% the week before.

The 11-bond GO Index of higher-grade 11-year GOs was slipped to 2.26% from 2.27% the prior week.

The Bond Buyer's Revenue Bond Index was down to 3.20% from 3.21% from the previous week.

The yield on the U.S. Treasury's 10-year note was slightly lower to 1.88% from 1.90% the week before, while the yield on the 30-year Treasury increased to 2.34% from 2.33%.

Treasury auctions bills

The Treasury Department Thursday auctioned $35 billion of four-week bills at a 1.500% high yield, a price of 99.883333. The coupon equivalent was 1.527%. The bid-to-cover ratio was 3.31.

Tenders at the high rate were allotted 10.44%. The median rate was 1.490%. The low rate was 1.465%.

Treasury also auctioned $35 billion of eight-week bills at a 1.515% high yield, a price of 99.764333. The coupon equivalent was 1.544%. The bid-to-cover ratio was 3.15.

Tenders at the high rate were allotted 92.73%. The median rate was 1.500%. The low rate was 1.470%.

Treasury auctions announced

The Treasury Department announced these auctions:

- $16 billion 29-year 10-month 2 3/8% bonds selling on Jan. 9;

- $24 billion 9-year 10-month 1 3/4% notes selling on Jan. 8;

- $38 billion three-year notes selling on Jan. 7;

- $36 billion 182-day bills selling on Jan. 6; and

- $42 billion 91-day bills selling on Jan. 6.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.