-

Doña Ana County taxable industrial revenue bonds, which will be sold to participants in the project, will enable the project to access a variety of tax breaks.

September 22 -

A state lawmaker is asking the court to invalidate a 2022 nearly $700 million bond sale due to inadequate audits by the Oklahoma Corporation Commission.

August 22 -

The Port Authority of Kansas City will decide whether to authorize $10 billion of taxable revenue bonds on behalf of a data center project with Google links.

April 22 -

Harvard University braved the most volatile market in years this week to price a $750 million taxable deal. Princeton is hot on its heels.

April 10 -

Future generations will benefit if we don't give up on breakthroughs in medicine or energy. That's why research Trump is cutting should be funded with bonds.

March 6 University of California, Davis School of Law

University of California, Davis School of Law -

Something less than $400 million of the bonds will be taxable bonds.

December 12 -

The decision is expected to be appealed to the Georgia Supreme Court and the ruling could have implications for the muni bond industry.

November 19 -

The Aloha State received three rating affirmations as it prepares to sell $750 million of taxable general obligation bonds.

November 15 -

Wells Fargo Head of Municipal Markets Strategy Vikram Rai said on Monday that Illinois' bonds are underappreciated as he released a report on the state.

October 8 -

City Comptroller Brad Lander said he's optimistic about the deal, congestion pricing lawsuits and his mayoral campaign.

October 7 -

Bonds backed by hotel and restaurant bill taxes will pay for upgrades to the home of the Carolina Panthers. The team agreed to commit to the city for 15 more years.

June 27 -

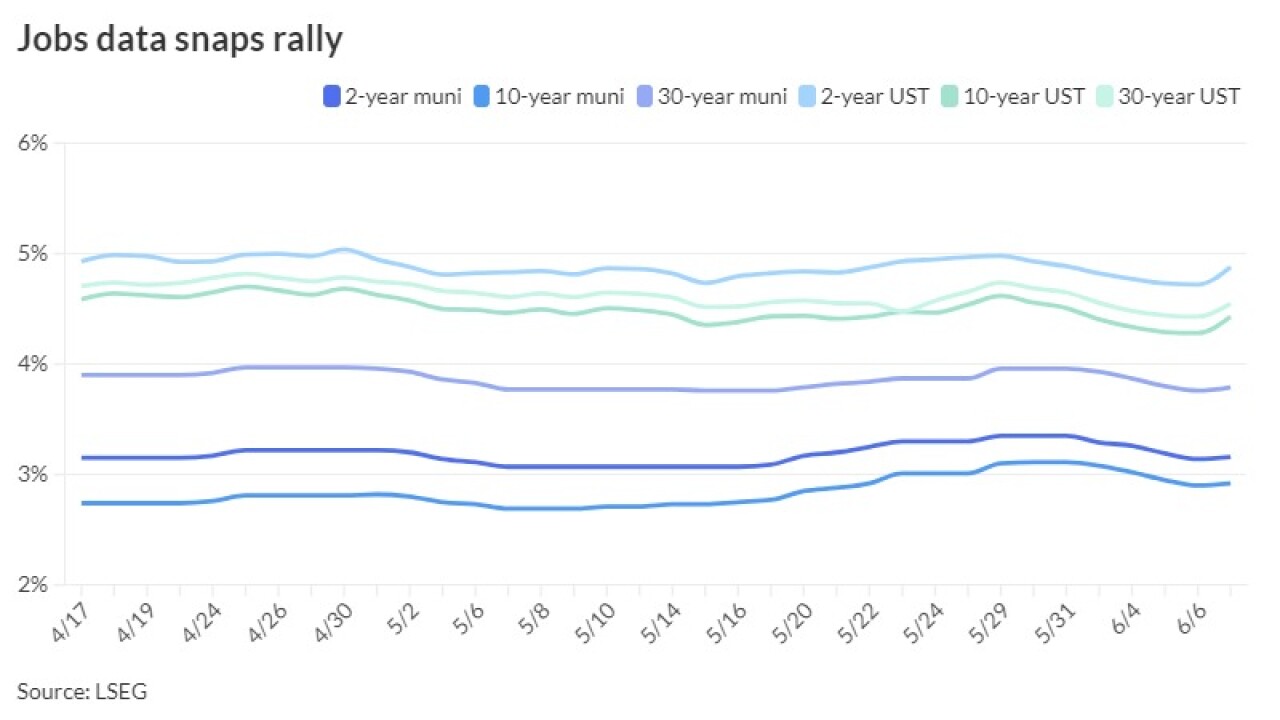

USTs spiked 17 basis points on the short end and 15 to 12 10-years and out following the release, while triple-A curves saw yields rise two to five basis points, depending on the yield curve, in a more muted and typical reaction for the asset class.

June 7 -

A $345 million taxable bond deal will support the public-private partnership arrangement that will upgrade the College Park campus district energy system.

June 7 -

More than two dozen issuers have announced plans to refund their BABs this year, despite objections from investors.

May 22 -

The debt was approved for Greensboro and Raleigh.

May 20 -

The Turnpike Authority of Kentucky expects to sell the bonds on June 6.

May 14 -

Jeffrey Scruggs, Managing Director and Head of Public Sector and Infrastructure Group at Goldman Sachs, sits down with Bond Buyer Executive Editor Lynne Funk on the state of the muni industry.

April 18 -

With a dearth of taxable muni supply and Build America Bond refundings, the university should see strong demand for this week's $500 million taxable corporate CUSIP bonds.

April 2 -

The Washington refunding deal is built on an extraordinary optional redemption of Build America Bonds despite criticism from investors who hold them.

March 22 -

Taxable munis have returned 1.48% month to date and 0.29% year-to-date while investment-grade munis have seen 0.44% returns so far in March and 0.05% year-to-date. USTs are in the black at 1.43% so far this month but returning -1.76% year-to-date while corporate bonds are returning 1.24% in March but -0.46% year-to-date.

March 12