The New York City Council issued its response to Mayor Bill de Blasio's $95.3 billion fiscal 2021 preliminary budget, focusing on supporting the social safety net as the coronavirus has ravaged the city and its finances.

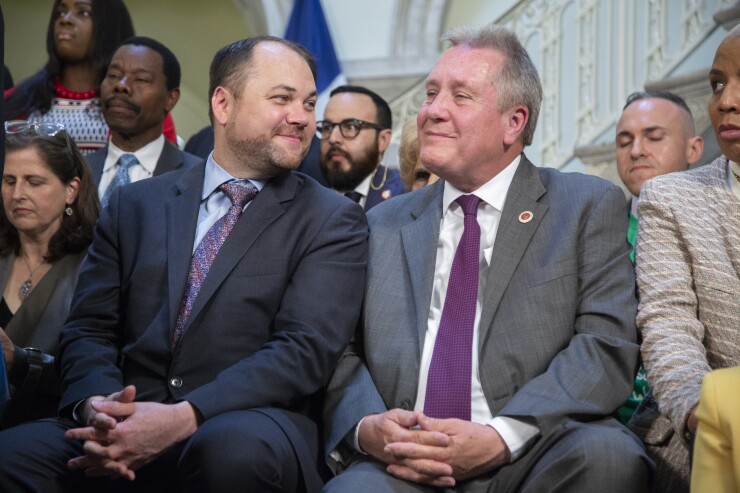

“The impact of COVID-19 on our economy has been much like the effect of the virus itself — sudden and with a quick decline,” Council Speaker Corey Johnson, Council Finance Committee Chair Daniel Dromm and Capital Budget Subcommittee Chair Vanessa Gibson said in a

The preliminary fiscal 2021 budget was released by the mayor three months ago, when the city was a drastically different place, the council members said.

The council said its response contains what it deems are essential programs and services that must be retained.

“We recognize that revenues are decreasing because of severely reduced business activity, deferred tax collections, and a sharp drop in tourism. And we understand that a substantial amount of resources will be needed to combat the spread of coronavirus and to protect the health and safety of our people and the heroic essential workers,” the Council members said. “However, as we make the tough decisions about where to find savings and efficiencies, it is imperative that the basic social safety net programs remain untouched, and in some cases expanded with additional investments.”

The Council members said it was crucial that both the city and the state continue to press the federal government for additional stimulus and recovery funding.

“The city’s ability to stabilize its economy, help the tens of thousands of newly unemployed or underemployed workers, provide loans to small businesses, and pay for the public health response to the virus hinges on federal assistance,” the Council members said.

De Blasio released the $95.3 billion fiscal 2021

The mayor will release his revised executive budget later this month. The 51-member council will hold a second round of hearings, after which they will negotiate adjustments with the mayor.

The mayor said the council’s response would be looked at closely.

"We are in an unprecedented crisis and facing billions of dollars in lost revenue. There is no doubt this budget cycle will be painful,” said Laura Feyer, the mayor’s deputy press secretary. “We are laser focused on fighting COVID-19 and protecting the health and safety of all New Yorkers. We are reviewing the Council's proposals."

By law, the council must vote on a budget by July 1. The last four budgets were all approved ahead of schedule.

Last month, the mayor said the budget will be on time despite the spread of COVID-19 forcing $1.3 billion of

The council called on the administration to:

- Continue to prioritize and maintain services that focus on the prevention and identification of infectious diseases; provide needed mental health supports; address health disparities in the city’s communities of color that cause an excess burden of ill health and premature mortality; support the full range of health services; and conduct surveillance of environmental-related diseases.

- Invest at least $25 million in food pantries, expand all feeding programs, and increase food allowances for all emergency housing programs. With the drop in employment, thousands more New Yorkers are food insecure.

- Ensure that every older adult who requests a meal receives one and to adequately fund the enhanced need for senior services.

- Fund a robust rental voucher program, move families out of shelters into vacant units, invest in homeless street solutions, and expand anti-eviction services, and preserve NYCHA’s affordable housing stock.

- Continue to support human services providers by ensuring that workers feel protected, safe, and properly compensated; that contracts reflect the increased costs associated with COVID-19; and that agencies allow flexibility in contract scope and services.

- Support a rent relief and deferral program for adversely impacted families and implement tax deferral programs for struggling homeowners and small property owners.

- Implement measures to stabilize the small business community. Businesses have certain bills that need to be paid whether or not they are operating, such as rent, utilities, loan payments, insurance costs, and taxes.

“The upcoming budget negotiations will involve many tough choices, but it is clear that there are certain basic items that should remain protected, including investments in public health and the social safety net,” Johnson said. “This is a crisis unlike any we have ever seen, but I believe in New York City.”

The council’s finance chair said average New Yorkers need the city as a backup in these trying times.

“The city must deliver for the thousands of New Yorkers who rely on our social safety net in this time of great need. The COVID-19 pandemic has presented an unprecedented challenge to our city and to the budgeting process,” Dromm said. “There is a lot of uncertainty but one thing is clear: services that keep New Yorkers housed, fed, healthy and open for business should remain strong. Because the need for many of these services will only grow in the coming months, New York City needs to prioritize them to the fullest extent possible so that no one falls through the cracks.”

The city is one of the largest issuers of municipal debt in the United States. As of the end of the second quarter of fiscal 2020, the city had about $37.7 billion of general obligation debt outstanding. That's not counting the various city authorities that issue debt.

Moody’s Investors Service rates the city's GOs Aa1, but has placed the rating on

The NYC Transitional Finance Authority has $38.9 billion of debt outstanding while the NYC Municipal Water Finance Authority has $30.8 billion of debt outstanding.