Municipal buyers are looking ahead to a hefty new-issue calendar, which features a wide variety of deals ranging from a huge note sale out of Texas to multi-billion dollar deals from issuers in Georgia, New York City and Los Angeles.

IHS Ipreo estimates volume for the week of Aug. 17 at $11.46 billion in a calendar composed of $8.38 billion of negotiated deals and $3.08 billion of competitive sales.

Municipals continued to weaken on Friday, with yields rising by as much as three basis points on the AAA scales in what could be a market correction ahead of the new-supply slate.

Primary market

Topping the upcoming calendar is Texas’ competitive sale of $7.2 billion of tax and revenue anticipation notes on Wednesday.

Stifel is the financial advisor; Orrick is the bond counsel.

Georgia is competitively selling $1.139 billion of general obligation bonds in five offerings on Wednesday.

Public Resources Advisory Group and Terminus Municipal Advisors and the financial advisors. Gray Pannell & Woodward LLP is bond counsel. Kutak Rock LLP is disclosure counsel.

In the negotiated sector, the New York City Transitional Finance Authority (Aa1/AAA/AAA/NR) will sell $1.6 billion of future tax secured subordinate bonds on Wednesday.

The deal consists of $1.3 billion of tax-exempt fixed-rate bonds and $275 million of taxable fixed-rates.

BofA Securities is set to price the tax-exempts after a two-day retail order period. Also Wednesday, the TFA is competitively selling $275 million of taxables in two offerings.

Goldman Sachs is expected to price the Los Angeles Department of Airports’ (Aa2/AA-/AA/NR) $1 billion of bonds for the LA International Airport on Wednesday.

JPMorgan Securities is set to price the San Francisco Bay Area Rapid Transit District’s (Aaa/AAA/NR/NR) $700 million of GOs on Tuesday.

JPMorgan is also expected to price Louisiana’s (Aa2/NR/AA-/NR) $551 million of taxable gasoline and fuels tax revenue bonds on Wednesday.

“It will be interesting to see if Georgia prices as well as Minnesota did last week,” said John Hallacy, founder of John Hallacy Consulting LLC. “Rates have backed up a bit, but there is strong demand for AAA paper.”

He noted there are spate of transit issues on tap.

“The week will feature a number of transportation credits including LAX airport BART and Louisiana gas and fuel tax bonds,” Hallacy said. “This is a sector where there have been some credit concerns but the bonds are expected to do well in this strong market environment. A few New York credits including TFA round out a good slice of the supply for the week.”

It’s a borrower's market as the 10-year AAA muni real yield turned negative, BofA Securities said in a market note Friday.

“While negative real yields in the Treasury market has been the talk for a few years, the recent plunging of the 10-year Treasury real yield below -1% has gotten attention in the market,” BofA said.

BofA looked at real yields in the tax-exempt muni market and noted that the 10-year muni AAA real yield recently went to -37 basis points.

“Given these negative real rates and the failure thus far of Congress to deliver additional direct, flexible aid to state and local governments, now may be an opportune time for muni market participants to borrow,” BofA said. “We continue to see a robust issuance environment for the next several months unless there is some unexpected market disruption.”

As of Aug. 12, year-to-date issuance is up 21% to $264.6 billion from $219.1 billion in the same period last year, according to BofA Global Research statistics. Taxable issuance is up 259% so far this year, to $78.2 billion from $21.8 billion in 2019, while tax-exempt issuance is down 1% to $183.8 billion from $185 billion last year, BofA said.

Secondary market

The muni market is adjusting to a pullback in yields, a situation that not been seriously in play since late June, but one that may short lived, said FHN Financial Senior Vice President Kim Olsan.

“After reaching new lows in most major spot levels, there is a pause at the time more supply is cycling through, bid list volume has spiked and UST yields come under pressure,” she said in a market comment Friday. “The intersection of these events with a larger new issue calendar next week could be a welcome opportunity for reinvestment needs.”

She said that shorter-dated 1% high-grade yields and slightly higher yields-to-call on 3s and 4s past 10-years would attract some inquiry that has been sidelined in recent weeks.

In trading, Texas trans, 5s of 2022, traded at 0.16%-0.15%. Harris County, Texas roads 5s of 2022 traded at 0.18%. Wake County, North Carolina GOs 5s of 2024, 0.18%-0.17%. Delaware GO 4s of 2024 traded at 0.19%-0.17%. Prince Georges County, Maryland 5s of 2025 traded at 0.25%-0.24%.

Klein, Texas ISD 5s of 2031, at 0.90%. Washington GOs 5s of 2032 at 0.97%-0.94%. Montgomery County, Maryland 3s of 2033, 1.08%-1.03%.

Out longer, Oklahoma waters 4s of 2045 at 1.68%-1.67%. Texas waters 4s of 2049 at 1.75%-1.74%.

“Both primary and secondary markets are showing signs of an adjustment. Bid list makeup is indicative of some profit-taking with larger block sales coming out of earlier 2020 issuance,” Olsan said.

She added that other metrics signal a change as well.

“Relative value ratios that weren’t so relevant all of a sudden are being noticed now that levels are firmly below 100% and off more than two standard deviations from three-month averages,” Olsan said.

On Friday, municipals were weaker, according to the final readings on Refinitiv MMD’s AAA benchmark scale.

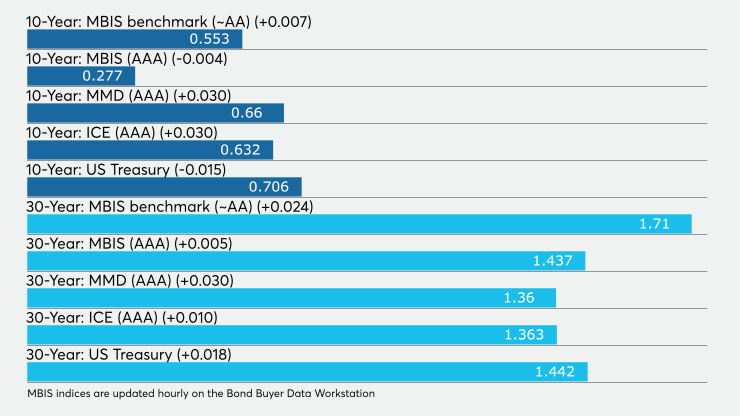

Yields rose three basis points in 2021 and 2022 at 0.13% in 2021 and 0.14%, respectively. The yield on the 10-year muni gained three basis points to 0.66% while the 30-year yield increased three basis points to 1.36%.

The 10-year muni-to-Treasury ratio was calculated at 93.0% while the 30-year muni-to-Treasury ratio stood at 94.8%, according to MMD.

“Municipal yields are giving back a bit to end the week, playing catchup to the Treasury weakness over the past few days,” ICE Data Services said. “Trade volumes are solid for a summer Friday, posting a small uptick from [Thursday].”

The ICE AAA municipal yield curve showed the 2021 maturity rising three basis points to 0.110% and the 2022 maturity rising three basis points t0 0.130%. The 10-year maturity was up three basis points to 0.632% and the 30-year gained two basis points to 1.363%.

ICE reported the 10-year muni-to-Treasury ratio stood at 93% while the 30-year ratio was also at 93%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.13% and the 2022 maturity at 0.14% while the 10-year muni was at 0.66% and the 30-year stood at 1.36%.

The BVAL AAA curve showed the 2021 maturity yielding 0.10% and the 2022 maturity at 0.12%, both up two basis points, while the 10-year muni was at 0.63% plus two, and the 30-year was up two as well at at 1.36%.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were mixed as stock prices traded down.

The three-month Treasury note was yielding 0.103%, the 10-year Treasury was yielding 0.706% and the 30-year Treasury was yielding 1.442%.

The Dow dropped 0.50%, the S&P 500 decreased 0.10% and the Nasdaq declined 0.30%.

Bond Buyer indexes turn mixed

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell three basis points to 3.49% from 3.52% the week before.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields rose three basis points to 2.05% from 2.02% in the previous week.

The 11-bond GO Index of higher-grade 11-year GOs increased three basis points to 1.58% from 1.55%.

The Bond Buyer's Revenue Bond Index gained three basis points to 2.47% from 2.44%.