-

New Jersey Transit CEO Kris Kolluri will keep his role under Gov.-elect Mikie Sherrill, and add a second position overseeing the state's two major toll roads.

January 9 -

The deal includes a mix of new money and refunding, with a small forward-delivery series, as the authority plows forward with capital plans.

May 19 -

The $684 million turnpike deal is one of a spate of recent forward delivery deals driven by interest rate uncertainties.

May 20 -

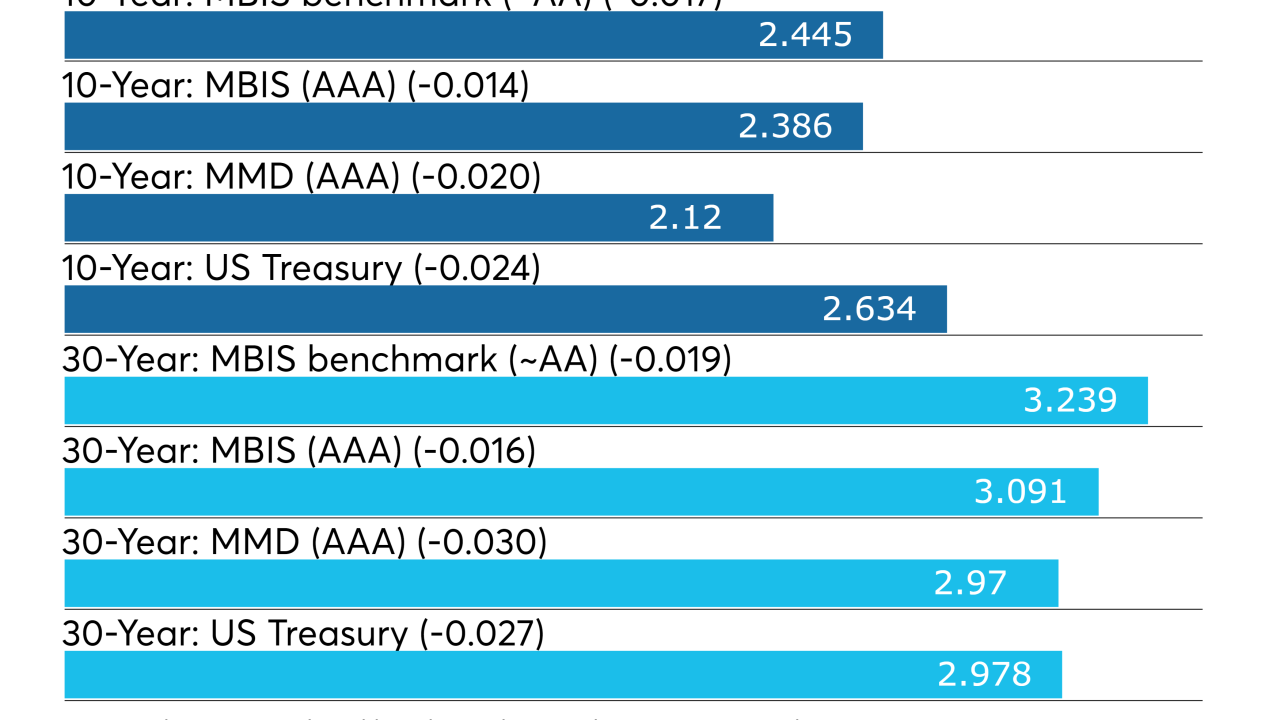

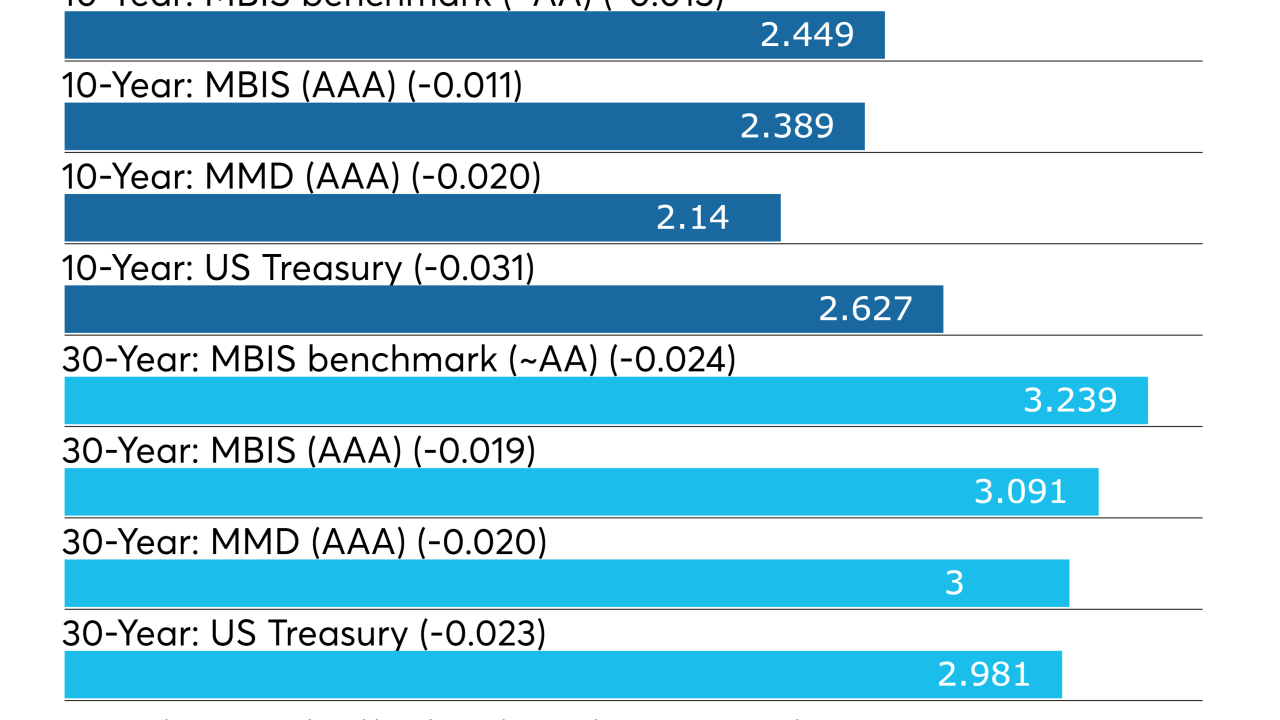

Despite several larger deals entering the primary, the vast amount of cash on hand has not allowed munis to cheapen amid UST volatility and ultra-rich ratios

March 19 -

The section of I-95 that collapsed was part of a recent $212 million reconstruction.

June 12 -

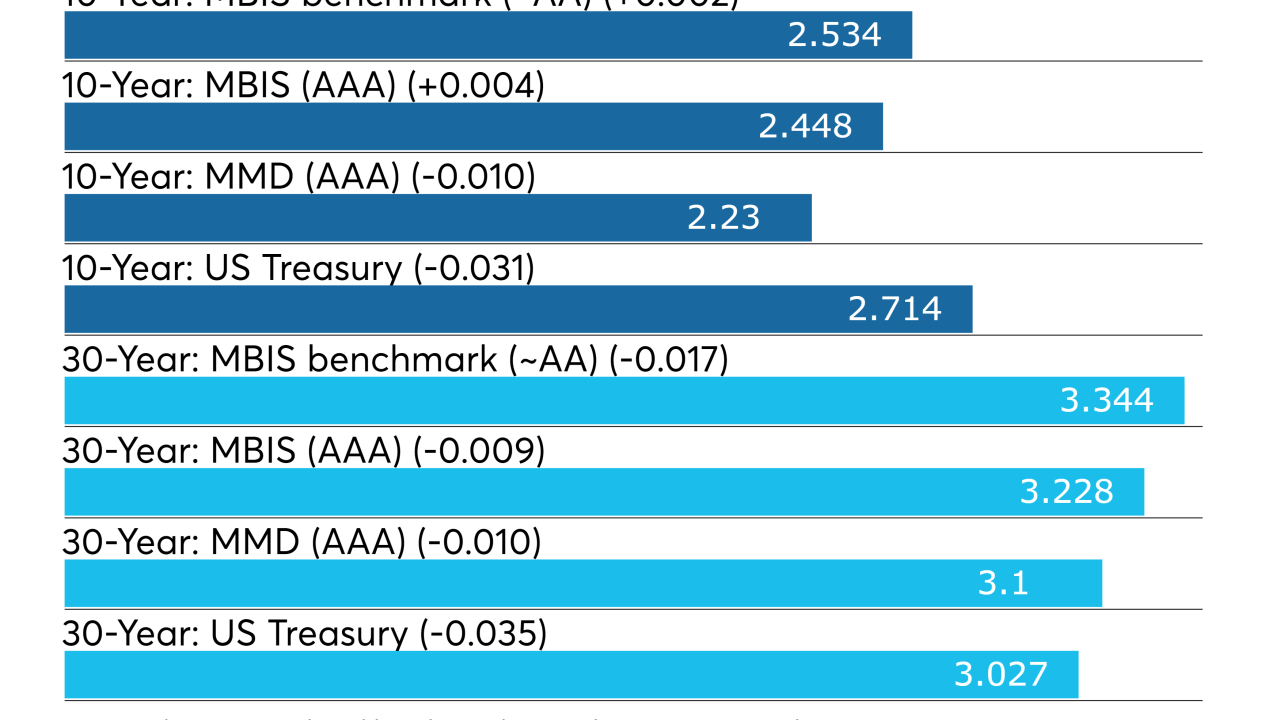

Tax-exempt munis have now regained late September levels, and November's rally has eclipsed October's selloff, MMA notes in a weekly report.

November 29 -

Credit strengths include strong market position and service area economic fundamentals and an expected continued strong finance performance.

February 17 -

Moody’s also assigned an A1 to the authority's $950 million of forward delivery refunding bonds.

January 27 -

Municipal bond issuers in the State of New York accounted for half of the top 10, while issuers from California held two of the top four spots.

April 9 -

Muni yields have been in a nine-basis point range since the beginning of the year while UST yields have fluctuated more than 20 basis points. With so little supply, muni credit spreads continue to compress.

January 20 -

The shortfall underscored advocates' calls to provide more dedicated funding to the statewide transit provider.

June 26 -

Shifting to smaller annual increases — after a 36% turnpike hike in September, the first in eight years — is credit positive, according to one rating analyst.

June 12 -

The transportation agency plans a refinancing to combat lost revenue from steep traffic declines during the COVID-19 pandemic.

May 28 -

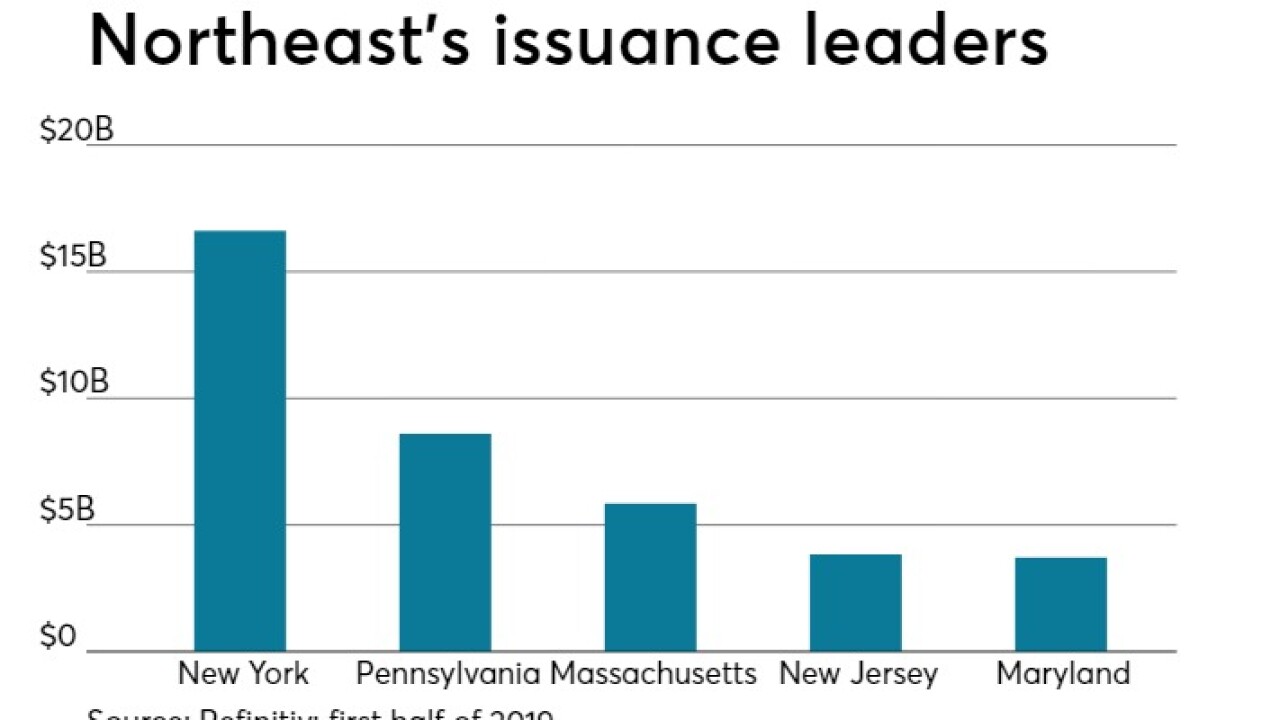

Municipal bond issuers in the Northeast sold $44.9 billion of municipal bonds in the first half of 2019, down 7% compared to the first half of 2018.

August 16 -

A warm reception is likely for the new issue supply that will be coming into the market.

February 8 -

The District of Columbia will be headlining next week's new issue slate with a $940 million deal.

February 8 -

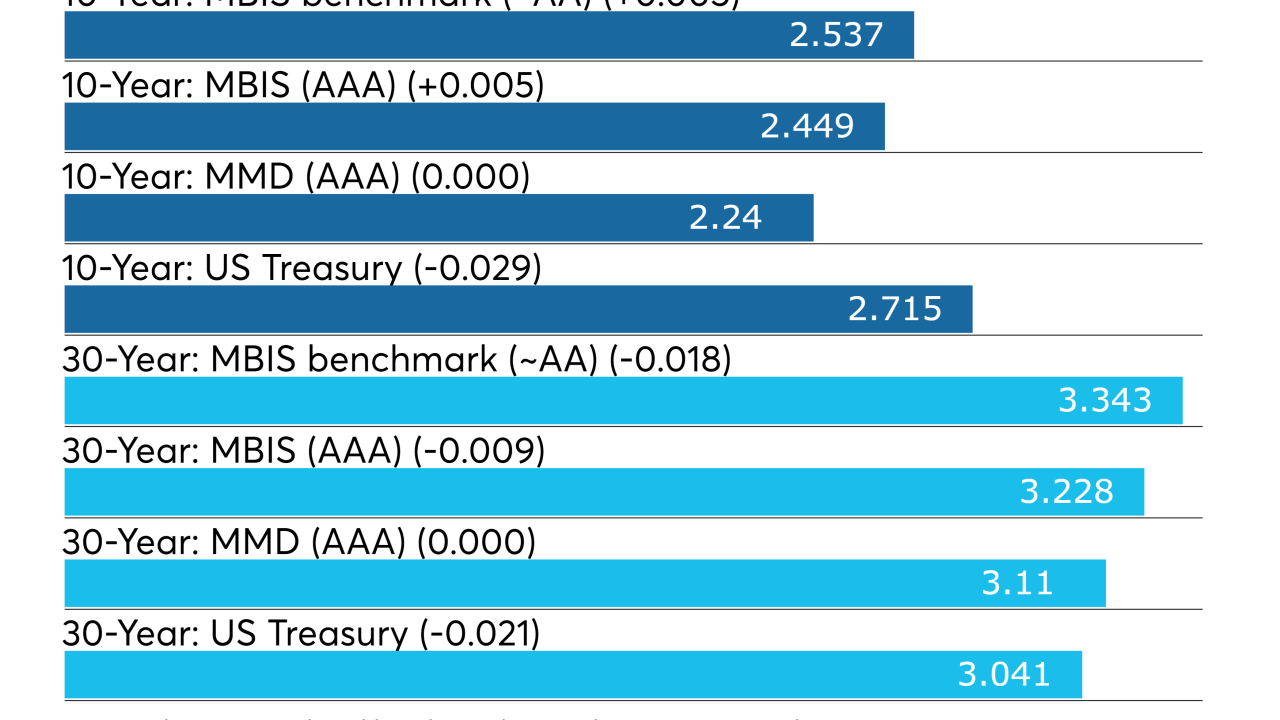

Municipal bonds finished mostly stronger on Thursday as deals from issuers in Connecticut and New Jersey dominated action.

January 24 -

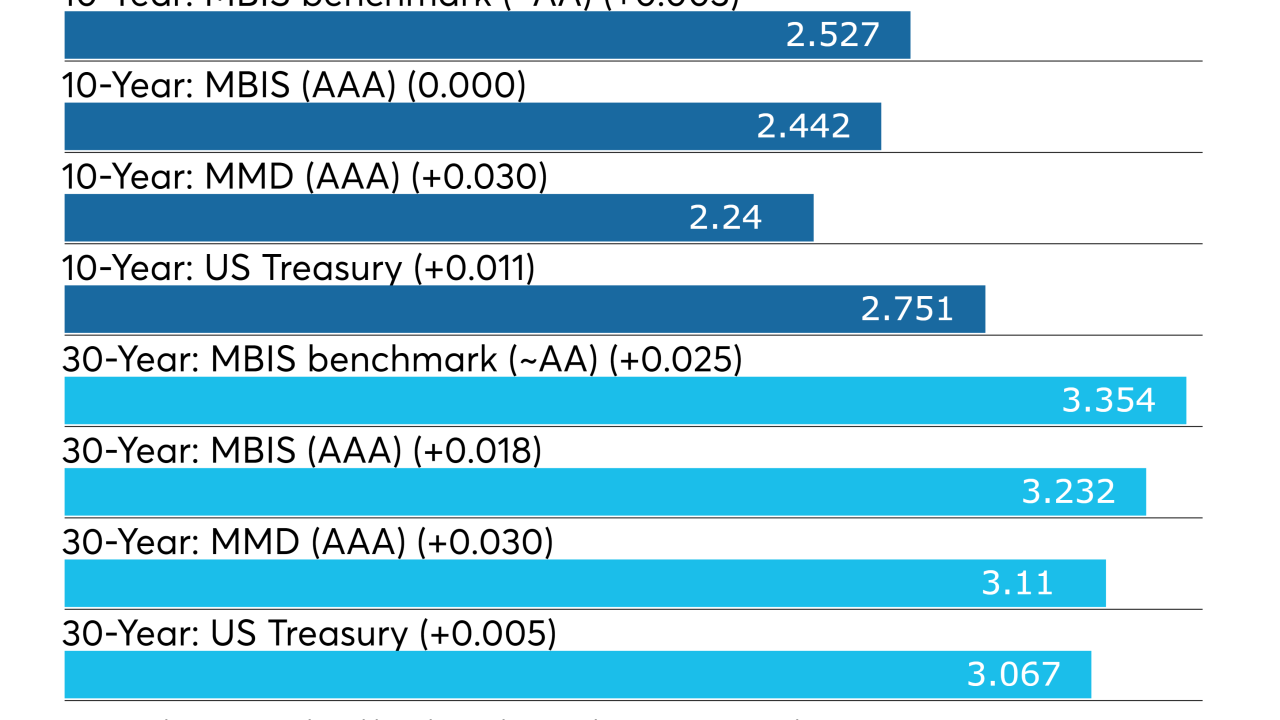

Municipal bonds were mostly stronger as action in the primary slowed.

January 24 -

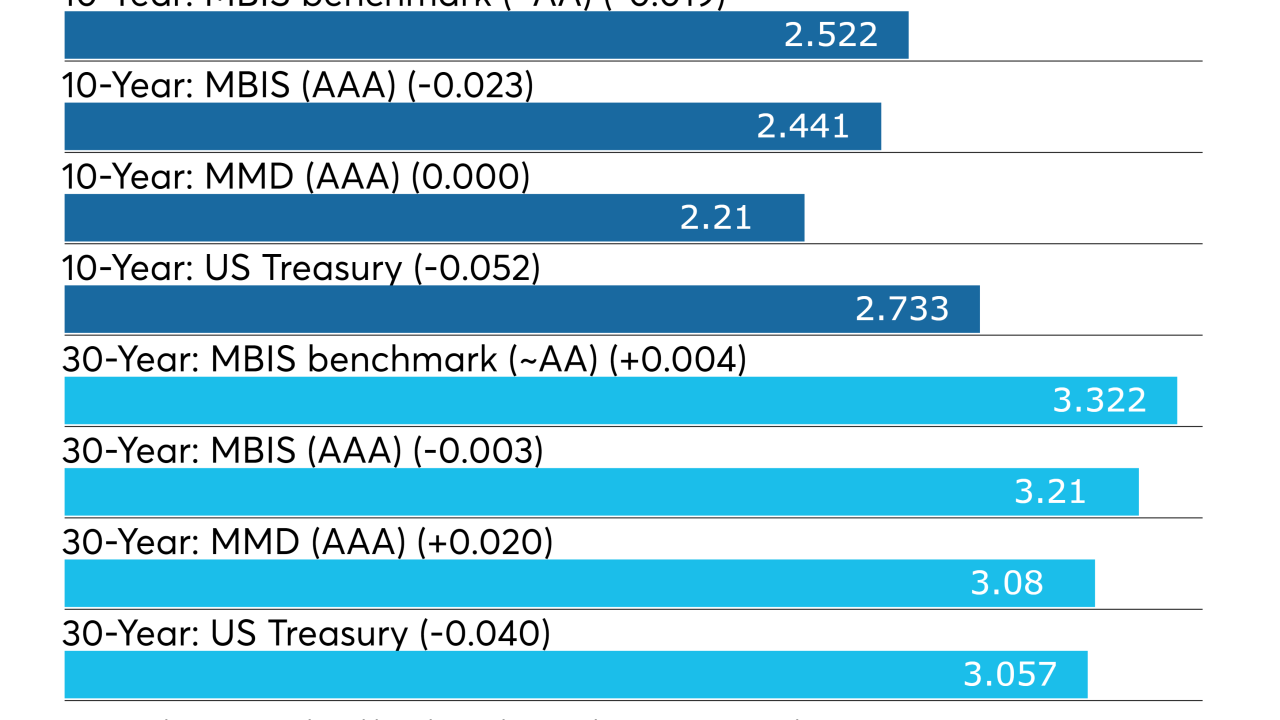

Deals from Hawaii, Colorado,and Virginia hit the market Wednesday as munis turned mostly weaker.

January 23 -

Municipal bonds lost early strength and finished mixed on Tuesday as traders returned to work after the Dr. Martin Luther King holiday.

January 22