Issuers are pricng deals at a record pace through the first three months of the year, as top issuers have accounted for $102.132 billion in Q1 of 2021. At this time last year, they had a total of $87.920 billion.

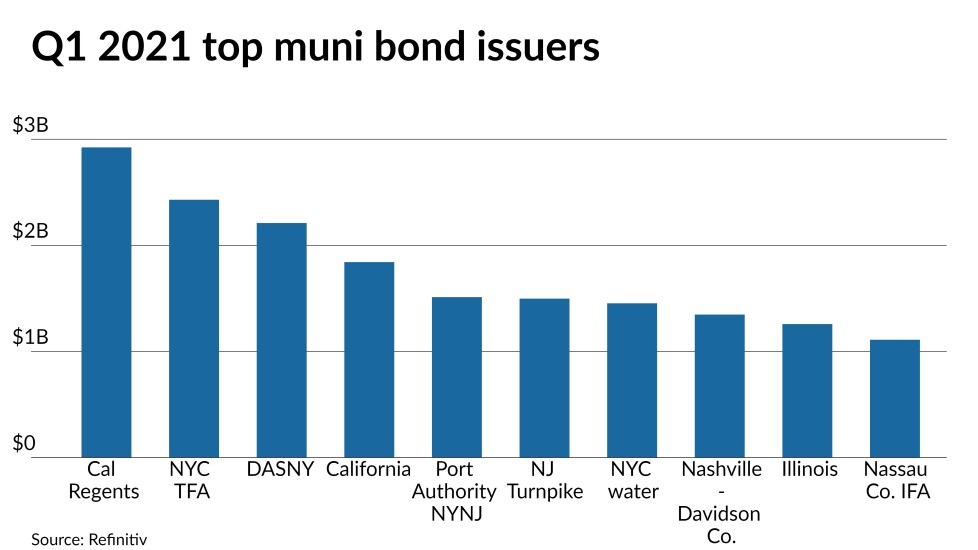

Muni issuers in the Empire State accounted for spots two, three, five and six and issuers from the Golden State landed in first and fourth.

There were seven new faces cracking the top 10 in the first quarter of 2021, six of which were not ranked at this time last year.