-

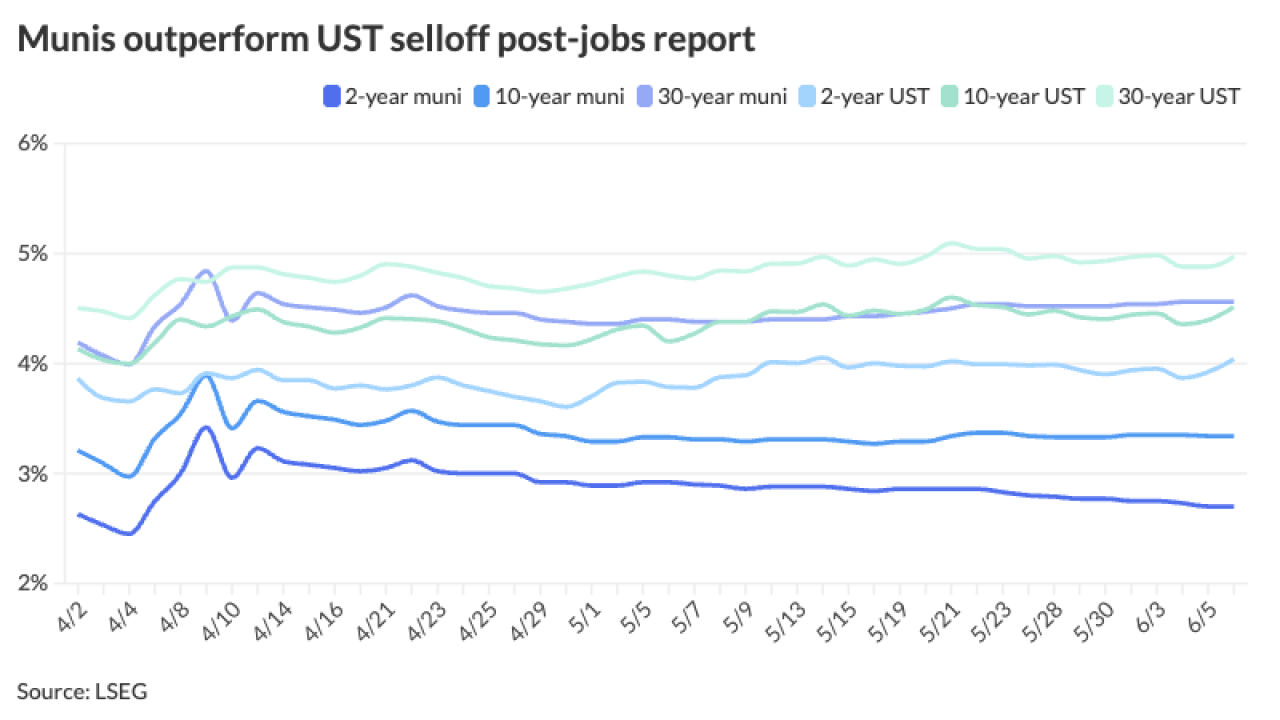

The nonfarm payrolls report shows the economy is "hanging in there," though it is slowing, said Jeff MacDonald of Fiduciary Trust International.

June 6 -

A couple of "bond-friendly" economic reports released Thursday could encourage the Federal Reserve to reduce interest rates in the near future, some analysts argued.

May 15 -

Yields have fallen over the past few weeks, so "any decent excuse that rates move up a little bit after that big rally" may have occurred as the market digested the report — which was a "little bit of a mixed bag" — after the initial headline figure, said Jeff MacDonald, EVP and head of fixed income at Fiduciary Trust International.

February 7 -

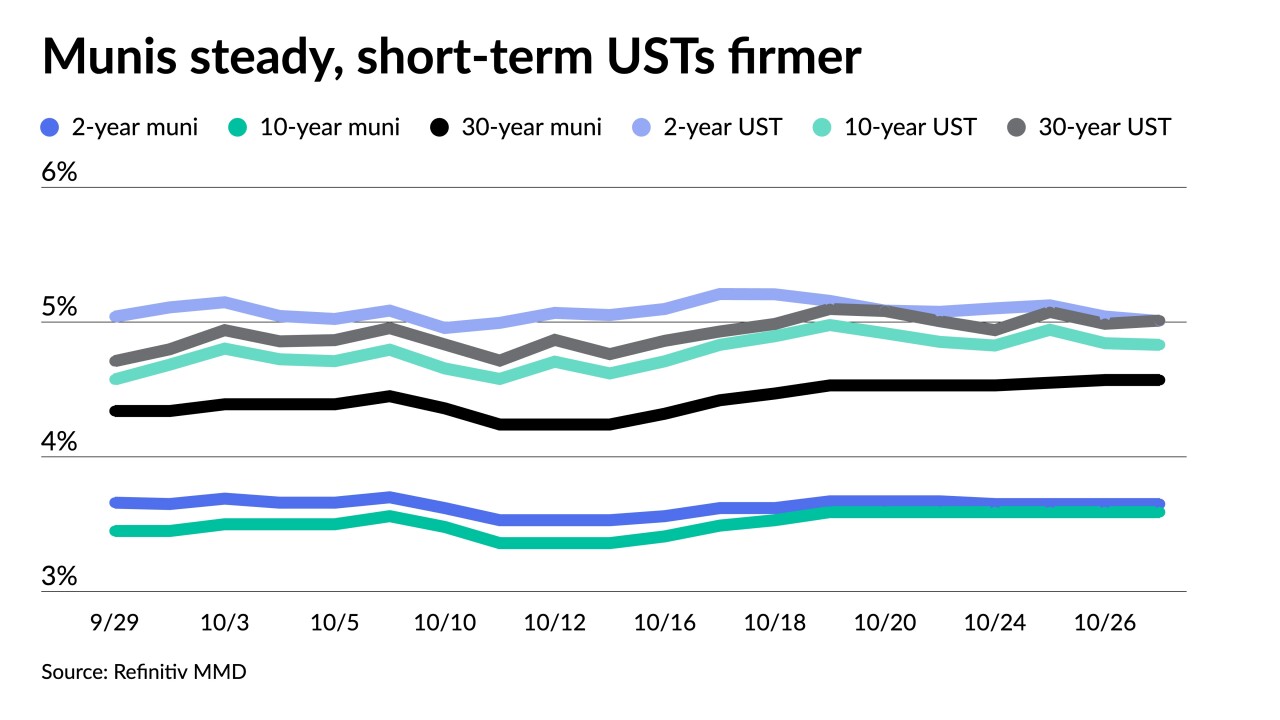

Municipals largely stayed in their own lane Wednesday, digesting the large slate of new issues as supply dwindles heading into election week, with Bond Buyer 30-day visible supply falling to $5.56 billion.

October 30 -

"The numbers are weak, but not cusp of recession weak," Chris Low, chief economist at FHN Financial, said.

September 6 -

Interest rate risk, stagnant bond volume, loss of revenue and a looming presidential election top the industry's concerns for 2024.

January 12 -

Florida outpaced the national average in overall labor force gains last month while the state's 2.8% unemployment rate was lower than the nation's 3.9% in October.

November 20 -

If Treasury rates become "more stabilized," it provides "a good reason to be somewhat constructive on munis for a while," BofA Global Research said in a report.

October 27 -

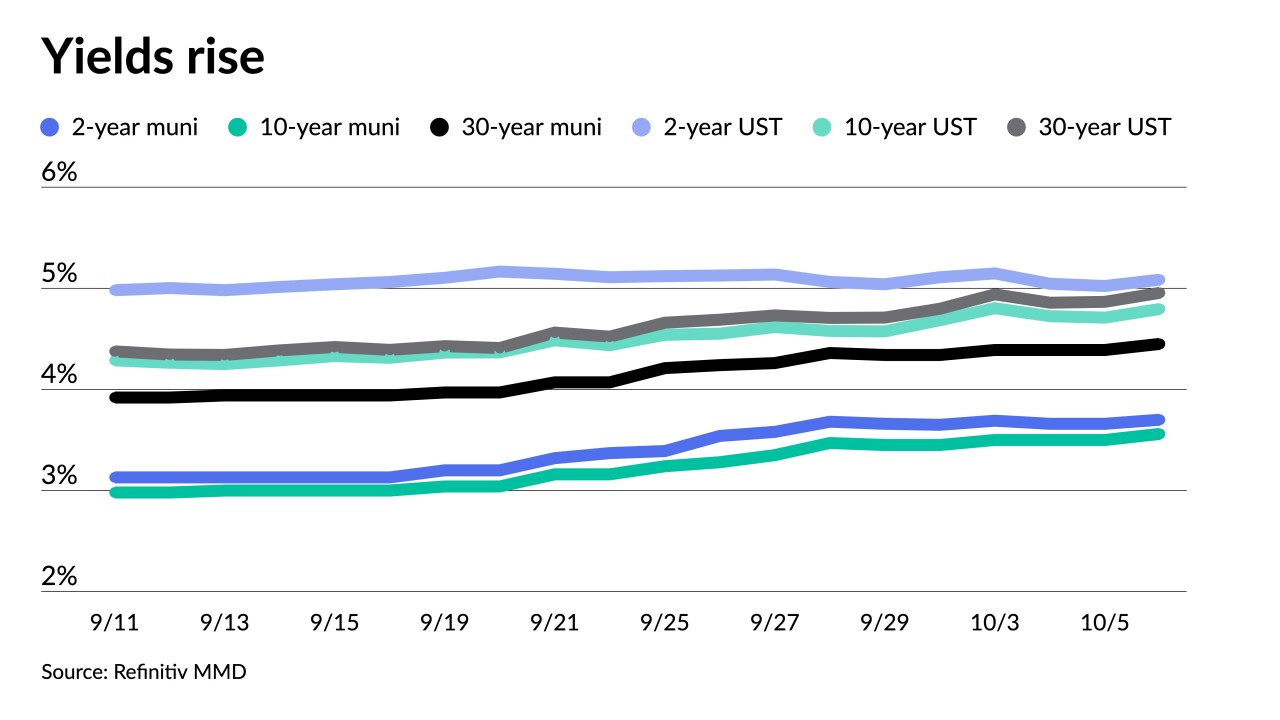

"Despite the breathtaking selloff in longer rates, Barclays' macro strategists see no clear catalyst to stem the bleeding," Barclays strategists said. "Data are unlikely to weaken quickly or enough to help bonds."

October 6 -

The state managed to grow revenues above forecast for the first two months of the fiscal year despite the delayed tax filing deadline.

September 19 -

The Miami metro area unemployment rate declined to 1.9% from the 2.9% reported in August 2022.

September 15 -

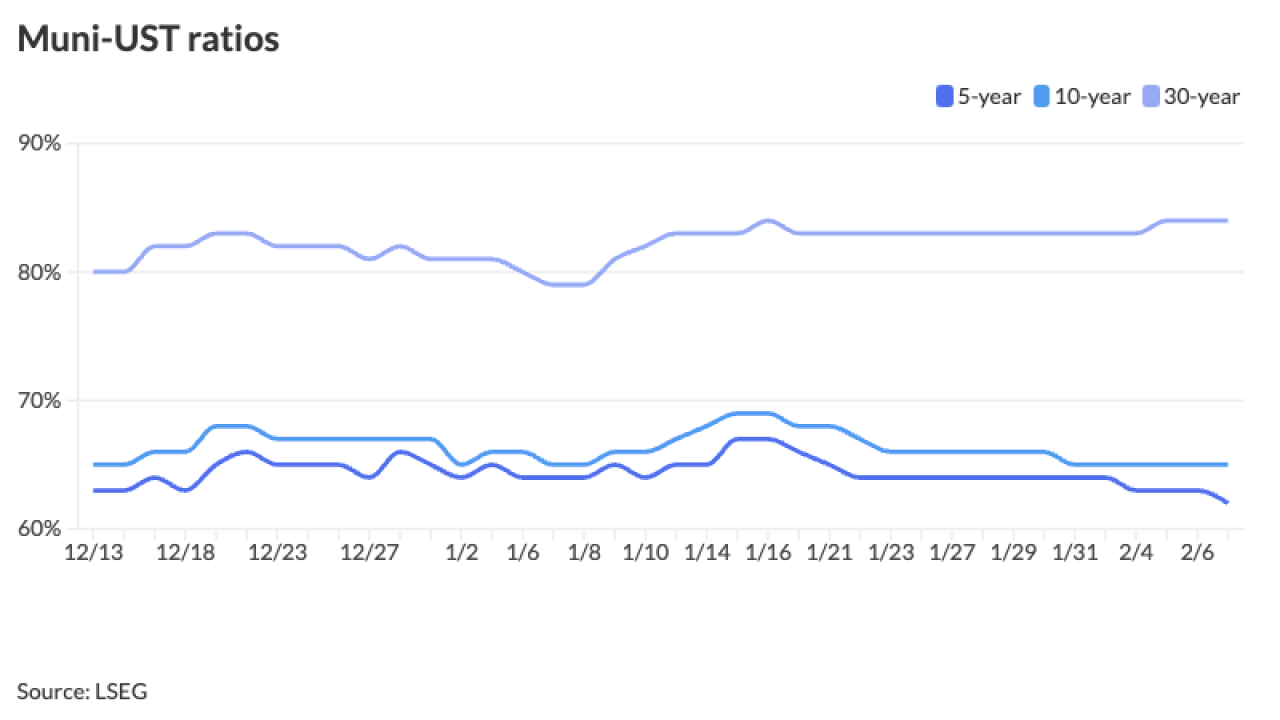

There hasn't been a huge return of capital in the muni market so far this year, with fund flows being rather anemic, said Chad Farrington, co-head of municipal bond strategy at DWS Group.

September 13 -

Tracey Manzi, senior investment strategist at Raymond James, talks with Chip Barnett about the fixed income markets today and how munis and Treasuries are doing. She says the number one issue clients are asking about is inflation. (20 minutes)

August 22 -

Florida led the nation in payroll growth in July, Wells Fargo said in a Friday report, which noted most of the upturn was in the healthcare and professional and the scientific and technical services sectors while leisure and hospitality shed jobs.

August 21 -

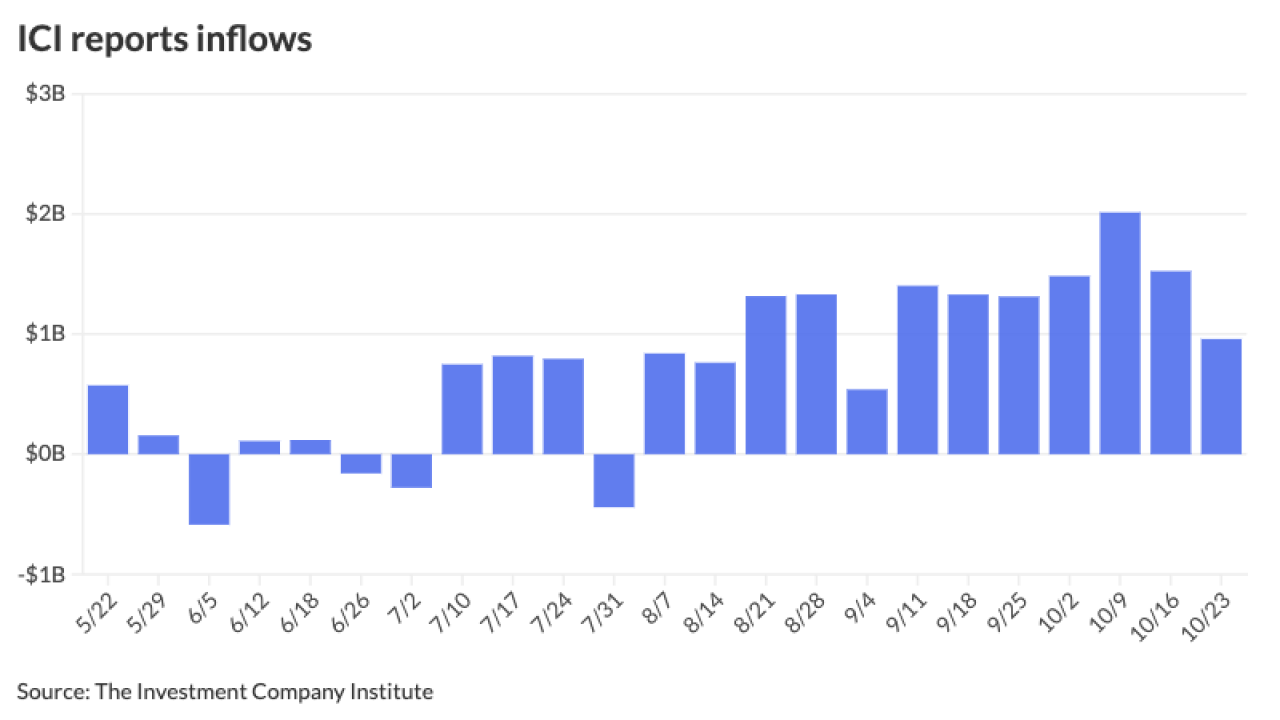

Refinitiv Lipper reported $278.559 million of inflows into municipal bond mutual funds for the week ending Wednesday, led by exchange-traded funds.

August 10 -

Economists remain guarded about the island's economic future.

August 8 -

Eric Merlis, managing director and co-head of global markets at Citizens Bank, talks with Chip Barnett about the economy and financial markets and what the Federal Reserve might do. He also discusses possible near- and long-term economic scenarios. (15 minutes)

July 25 -

Municipal bond mutual fund outflows continued as Refinitiv Lipper reported investors pulled $136.174 million from the funds for the week ending Wednesday following $855.719 million of outflows the week prior.

July 13 -

The May economic activity index showed an increase.

July 11 -

The Florida Department of Economic Opportunity said the state unemployment rate in May was steady at 2.6% for the fifth straight month, the lowest among the 10 largest states in the nation.

June 16