-

The Miami metro area unemployment rate declined to 1.9% from the 2.9% reported in August 2022.

September 15 -

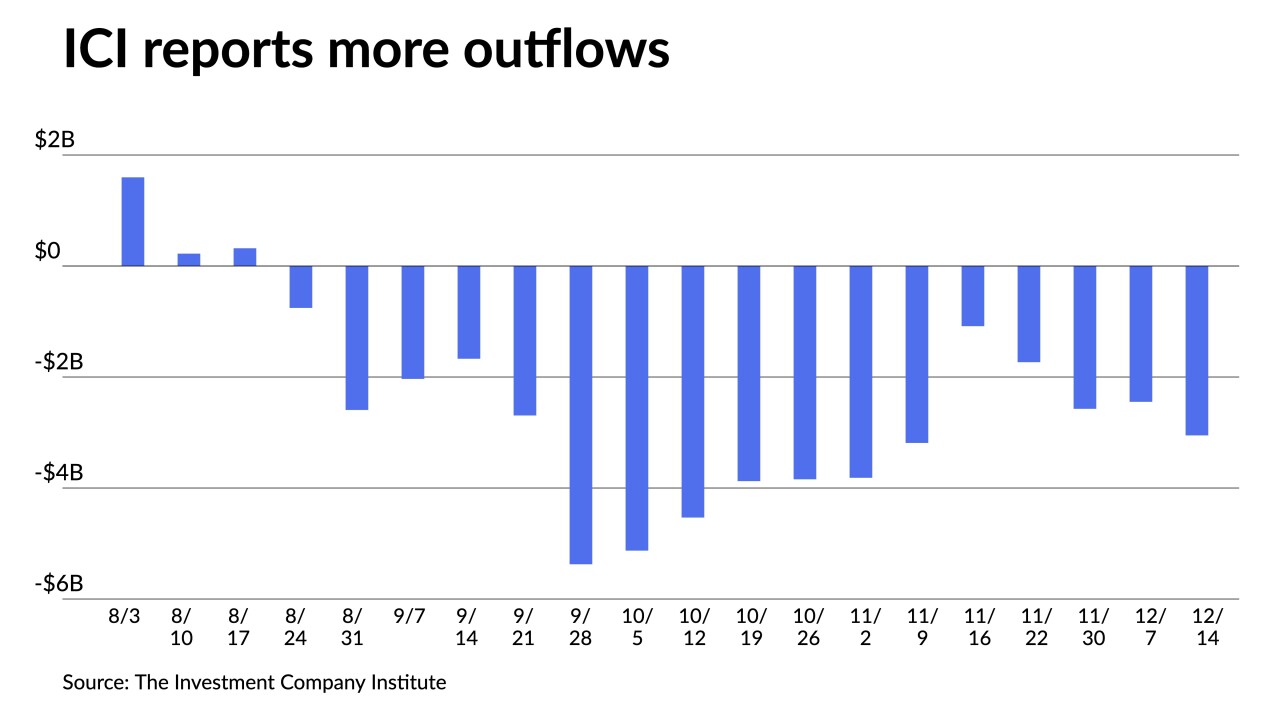

There hasn't been a huge return of capital in the muni market so far this year, with fund flows being rather anemic, said Chad Farrington, co-head of municipal bond strategy at DWS Group.

September 13 -

Tracey Manzi, senior investment strategist at Raymond James, talks with Chip Barnett about the fixed income markets today and how munis and Treasuries are doing. She says the number one issue clients are asking about is inflation. (20 minutes)

August 22 -

Florida led the nation in payroll growth in July, Wells Fargo said in a Friday report, which noted most of the upturn was in the healthcare and professional and the scientific and technical services sectors while leisure and hospitality shed jobs.

August 21 -

Refinitiv Lipper reported $278.559 million of inflows into municipal bond mutual funds for the week ending Wednesday, led by exchange-traded funds.

August 10 -

Economists remain guarded about the island's economic future.

August 8 -

Eric Merlis, managing director and co-head of global markets at Citizens Bank, talks with Chip Barnett about the economy and financial markets and what the Federal Reserve might do. He also discusses possible near- and long-term economic scenarios. (15 minutes)

July 25 -

Municipal bond mutual fund outflows continued as Refinitiv Lipper reported investors pulled $136.174 million from the funds for the week ending Wednesday following $855.719 million of outflows the week prior.

July 13 -

The May economic activity index showed an increase.

July 11 -

The Florida Department of Economic Opportunity said the state unemployment rate in May was steady at 2.6% for the fifth straight month, the lowest among the 10 largest states in the nation.

June 16 -

While "munis are set up for better performance, perhaps modest single-digit returns, the near-term outlook for fund flows will make for a challenging read," Oppenheimer's Jeff Lipton said.

June 13 -

Ellis Phifer, managing director and senior strategist in the fixed income research department at Raymond James, talks with Chip Barnett about the state of the bond markets. (Taped Feb. 16; 15 minutes)

March 7 -

The economy was boosted by COVID and hurricane relief money, one economist says.

February 16 -

Rising interest rates, market volatility and the loss of business and revenue top the public finance industry's concerns for 2023.

January 24 -

Significantly fewer households expected to be in worse shape in the coming year than was the case last summer, according to a December survey. The results are a positive sign for banks at the start of earnings season.

January 9 -

"A fade in muni prices came on the heels of sovereign debt actions, leaving ratios subject to some correction with just a few sessions remaining in 2022," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

December 21 -

"We continue to see very strong job numbers. Florida is in as good of a position as we could possibly be," said Jimmy Heckman of the state Department of Economic Opportunity.

November 18 -

Puerto Rico's employment trends are better than its fellow territory's since the onset of the COVID-19 pandemic, say Federal Reserve Bank of New York analysts.

November 14 -

Revenues were up while economic activity slipped, with some observers suggesting Hurricane Fiona may have had a negative impact on the economy.

November 8 -

Treasury Secretary Janet Yellen said that while the U.S. financial system remains resilient, the current backdrop has created the conditions where risks to its stability could appear.

October 24