Municipals were weaker in spots Wednesday as outflows from mutual funds intensified. U.S. Treasury yields fell, and equities ended higher.

The three-year muni-UST ratio was at 62%, the five-year at 66%, the 10-year at 69% and the 30-year at 93%, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the three at 63%, the five at 66%, the 10 at 71% and the 30 at 94% at a 4 p.m. read.

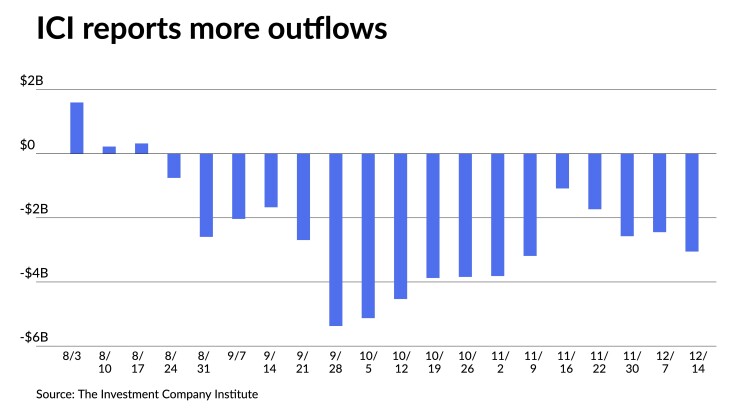

Outflows continued with the Investment Company Institute reporting investors pulled $3.052 billion from mutual funds in the week ending Dec. 14, after $2.447 billion of outflows the previous week.

Exchange-traded funds saw another week of inflows at $1.279 billion after $1.351 billion of inflows the week prior, per ICI data.

"A fade in muni prices came on the heels of sovereign debt actions, leaving ratios subject to some correction with just a few sessions remaining in 2022," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

December's price action has left the shorter end more vulnerable to inflationary themes — the 2023 MMD spot has risen 32 basis points since the end of November while the 10-year yield is lower by 19 basis points and the 30-year yield is nearly flat in that time.

The pullback following the Bank of Japan's change to its bond yield controls "presented slightly wider entry points and volumes showed that buyers took advantage of cash reserves," she said.

Secondary volume topped $10 billion Tuesday, which she notes is "an increase from recent sessions where a stagnant yield range had held."

"Supply is 100% being sourced from secondary flows, leading to an expectation that any material correction is unlikely," according to Olsan.

"Generic intermediate AA-rated revenues and Texas PSF-backed school names have shown some widening behind +20/AAA from tighter levels earlier this month," she said. "Likewise, longer 4% coupons are trading about 15 basis points behind levels of a few weeks ago, suggestive of inflation-minded bidding neutralizing some of the gains made in those structures."

For 2022, Olsan said, "a sharp and prolonged rate pullback that began in February moved major spot levels well above last year's range."

The one-year MMD yield average in 2021 was 0.10% and five-year high grades traded to an average 0.50%, she said.

With a tightening cycle in full force, the short end of the curve has seen one- to five-year yields trade within 1.80% to 2.15% averages, she said.

"Intermediate bonds that saw a 1% average last year rose to near a 2.50% median and 20-year high grades that traded below 1.50% in 2021 have offered an average above 2.75% this year," Olsan said. "At the end of the curve, long yields that held on average in the mid-1.00% range reached nearly 3% on average this year."

She said the Bond Buyer "20 GO index reflects the market's moves this year."

The average yield on the index in 2021 was 2.18%. "Its average yield this year spiked to 3.23%, reaching a high of 4.16% in late October," Olsan said.

"As a barometer of the broad market, the index reflects the market's strains at various points of weakness," she said. "Over a 10-year cycle, the index's average yield is 3.44%, within range of where 2022 is expected to close."

The premise of municipal investments is their tax-advantaged status, which became That "challenged in 2021 with ultra-low yields in the front half of the curve where TEYs traded below 3%," she said.

The 2022 yield correction, she said, "has moved the needle well higher along the entire curve."

"Short-term munis offer 4%-range TEYs and in the 10-15 year area values grow to more than 5%," Olsan said. "Long-term 4s are trading at absolute levels that throw off TEYs well into the 6% range. Should 2023 see a stable (and even slightly lower) yield range hold, TEY values will hold attention with high-net worth investors who hold the largest share of municipal bonds."

Informa: Money market munis see inflows

Tax-exempt municipal money market funds saw $80.6 million of inflows the week ending Tuesday, bringing the total assets to $103.80 billion, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for all tax-free and municipal money-market funds rose to 2.91%.

Taxable money-fund assets outflows of $30.93 billion to end the reporting week at $4.558 trillion of total net assets. The average seven-day simple yield for all taxable reporting funds rose to 3.80%.

Secondary trading

Washington 5s of 2023 at 2.82% versus 2.31%-2.71% Monday. Maryland 5s of 2023 at 2.90%-2.89%. NYC TFA 5s of 2024 at 2.68%.

Ohio 5s of 2026 at 2.60% versus 2.48% original on 12/7. Florida 5s of 2027 at 2.61%-2.59%. D.C. 5s of 2028 at 2.56%-2.54%.

Columbus, Ohio, 5s of 2034 at 2.79% versus 2.84% Tuesday. Maryland 5s of 2036 at 3.06%-3.03%.

Massachusetts 5s of 2048 at 3.76%-3.79%. LA DWP 5s of 2052 at 3.84% versus 3.66% Friday. Illinois Finance Authority 5s of 2052 at 4.55% versus 4.47%-4.49% Friday and 4.45%-4.44% Thursday.

AAA scales

Refinitiv MMD's scale was cut up to five basis points: the one-year at 2.81% (+5) and 2.57% (+3) in two years. The five-year at 2.48% (unch), the 10-year at 2.54% (unch) and the 30-year at 3.49% (unch).

The ICE AAA yield curve was weaker out long: 2.73% (flat) in 2023 and 2.58% (-1) in 2024. The five-year at 2.54% (flat), the 10-year was at 2.61% (+1) and the 30-year yield was at 3.51% (+1) at 4 p.m.

The IHS Markit municipal curve was cut on the short end: 2.79% (+5) in 2023 and 2.58% (+3) in 2024. The five-year was at 2.51% (unch), the 10-year was at 2.55% (unch) and the 30-year yield was at 3.47% (unch) at a 4 p.m. read.

Bloomberg BVAL was cut up to three basis points: 2.74% (+3) in 2023 and 2.60% (+2) in 2024. The five-year at 2.49% (unch), the 10-year at 2.57% (unch) and the 30-year at 3.50% (+1) at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.215% (-4), the three-year was at 3.990% (-3), the five-year at 3.777% (-1), the seven-year 3.764% (-2), the 10-year yielding 3.675% (-1), the 20-year at 3.921% (-2) and the 30-year Treasury was yielding 3.732% (-1) at the close.

Indicators

The consumer confidence report brought welcome news for the Federal Reserve, while housing continues to suffer.

Consumer confidence soared to 108.3 in December, up from 101.4 a month earlier, and better than the 101.0 expected by economists polled by IFR.

The present situation index jumped to 147.2 from 138.3, while the expectations index rose to 82.4 from 76.7.

"Consumer confidence bounced back in December, reversing consecutive declines in October and November to reach its highest level since April 2022," said Lynn Franco, senior director of economic indicators at The Conference Board. "Inflation expectations retreated in December to their lowest level since September 2021, with recent declines in gas prices a major impetus."

The rise was broad-based, noted Scott Anderson, chief economist at Bank of the West. "Spending plans were mixed with more consumers expecting to purchase a car over the next six months, but fewer anticipating buying a home or major appliance."

And while inflation expectations eased, he said, they are at a "still high" average of 6.7% for the coming year.

"This report will be well received by the Fed as it continues to hike interest rates to lower inflation," Anderson said.

"December's performance easily exceeded even the highest economist expectation and suggests there is material improvement in consumers' attitudes as 2022 comes to a close," said Wells Fargo Securities Senior Economist Sam Bullard and Economic Analyst Jeremiah Kohl.

But while confidence has risen since the summer, they noted, consumers "are still exhibiting more caution than was apparent in 2021."

Future confidence levels will depend "on the Fed's ability to deliver a soft landing on what could be described as a narrow runway," Bullard and Kohl said. "Substantially addressing inflation is one aspect of increased consumer confidence, but a large part of the Conference Board's measure is determined by labor market health. The potential for rising rates to pull the floor out from under the still strong labor market is a real downside risk for 2023."

Separately, existing home sales fell 7.7% to a 4.09 million annual pace in November, the tenth consecutive month of declines. Economists expected a 4.2 million read.

"The ongoing weakness in existing home sales is explained by reduced affordability due to 2022's sharp rise in mortgage rates on top of the fast run up in home prices over the past two years," said Wells Fargo Securities Economist Charlie Dougherty, Economist Jackie Benson and Economic Analyst Patrick Barley.

While prices are falling, they said, those declines will be limited by a lack of supply. However, "the combination of moderating prices and lower financing costs appears to be enticing some buyers back into the market."

Wells Fargo sees mortgage rates gradually decreasing over the next two years. "That said, we are also forecasting a recession to begin in the second half of 2023," Dougherty and the others said. "In other words, lower mortgage rates may very well improve affordability and help stabilize buyer demand in the near-term, but a challenging macroeconomic backdrop for the housing market awaits in 2023."