-

"The bond market breathed a sigh of relief this morning as the CPI inflation numbers came in a tad weaker than expected," said John Kerschner, global head of securitised products and portfolio manager at Janus Henderson Investors.

January 13 -

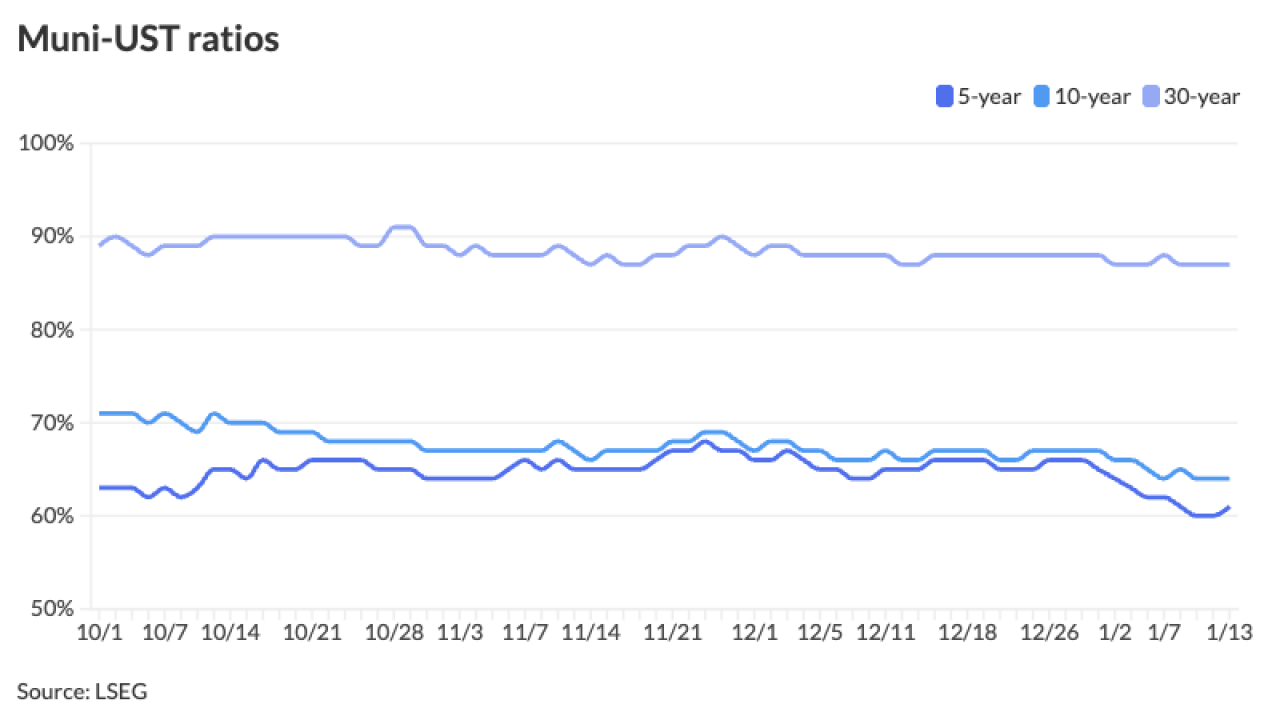

Muni yields were bumped a basis point, while UST yields fell two to four basis points.

December 18 -

"Investors were not disappointed," said John Kerschner, global head of securitized products and portfolio manager at Janus Henderson. "Inflation came in softer than expected, leading to a tepid bond market rally" and ensuring a rate cut at the upcoming Federal Open Market Committee meeting.

October 24 -

Federal Reserve Vice Chair Philip Jefferson said Friday that the economic outlook is uncertain and that he was adopting a cautious approach to gauging whether slowing growth and a softening labor market outweigh inflation pressures from tariffs.

October 3 -

Investors added $2.183 billion to municipal bond mutual funds in the week ended Wednesday, following $623.3 million of inflows the prior week, according to LSEG Lipper data.

September 11 -

Muni yields were bumped two to 12 basis points, depending on the scale, with the largest gains out long, and UST yields fell six to nine basis points, pushing the two-year UST to its lowest levels in over two years.

September 5 -

The rally stemmed from the weak nonfarm payrolls report and revisions brought down the three-month average to 29,000 jobs per month, further solidifying the chance of a rate cut in September, said Chris Brigati, managing director and CIO at SWBC.

September 5 -

The latest inflation report — the producer price index — threw a monkey wrench into expectations for a big rate cut next month, according to some economists, may put into question any easing in September.

August 14 -

"The combination of stronger core and softer headline readings has left some traders struggling for direction," said Daniela Sabin Hathorn, senior market analyst at Capital.com. "There is a reason to be both bullish and bearish depending on which CPI reading you wish to focus on."

August 12 -

As always, economists had disparate interpretations of the consumer price index, with none expecting a July rate cut. And tariff questions remain unanswered.

July 15 -

A "lighter-than-anticipated CPI report" led to UST firmness, as it "quelled fears about tariff-related inflation and boosted enthusiasm that the Fed will cut rates in the next two or three meetings," said José Torres, senior economist at Interactive Brokers.

June 11 -

Federal Reserve Vice Chair Philip Jefferson said in a speech Wednesday that elevated tariffs will likely lead to inflation, but time will tell how impactful that spike in prices might be.

May 14 -

Even with Monday's U.S.-China tariff truce and Tuesday's inflation print, the market has felt better over the past several weeks, said Jamie Iselin, managing director and head of municipal fixed income at Neuberger Berman.

May 13 -

The central bank wants to let Trump's policies play out across the economy before deciding which way to move interest rates, and it's too soon to know what the impacts will be, the Federal Reserve chair said.

April 4 -

"The supply/demand dynamic is a headwind for the muni market this week as supply is expected to be elevated," said Cooper Howard, a fixed income strategist at Charles Schwab.

March 12 -

Mass deportations and tariffs on key trade partners are expected to have a "significant" negative impact on the U.S. and California economies, according to the UCLA Anderson Forecast.

March 5 -

Inflation is front and center this week, with the consumer price index report released on Wednesday and the producer price index on Thursday.

February 12 -

Municipals are underperforming USTs month-to-date, with the Bloomberg Municipal Index showing losses of 1.02% versus 0.92% for USTs as of Tuesday, but both are outperforming losses in corporates that are seeing 1.23% losses in January.

January 15 -

The muni market also faces an elevated new-issue calendar, which may put additional pressure on muni yields. Bond Buyer 30-day visible supply sits at $17.57 billion.

January 13 -

Although a new administration means policy uncertainty, most analysts see the economy growing above trend next year, although inflation will remain a concern.

January 2