Municipal bonds finished mostly stronger on Thursday as deals from issuers in Connecticut and New Jersey dominated action in the primary market.

Primary market

JPMorgan Securities priced the Connecticut Health and Educational Facilities Authority's $511.21 million of Series 2010A-4, Series S, U-1 and U-2 revenue bonds as a re-marketing for Yale University.

The deal is rated triple-A by Moody's Investors Service and S&P Global Ratings.

Citigroup priced the New Jersey Turnpike Authority’s $449.735 million of Series 2019A turnpike revenue bonds.

The deal is rated A2 by Moody’s, A-plus by S&P and A by Fitch Ratings.

UBS Financial Services priced the Board of Regents of Stephen F. Austin State University in Texas’ $110.46 million of Series 2019A and taxable Series 2019B revenue financing system bonds.

The deal is rated A1 by Moody’s and AA-minus by Fitch.

Bank of America Merrill Lynch received the official award on the city and county of Honolulu’s $250.2 million of Series 2019A and Series 2019B general obligation bonds. The deal is rated Aa1 by Moody’s and AA-plus by S&P.

BOK Financial Securities received the written award on the Lake Travis Independent School District, Texas’s $92.705 million of Series 2019 unlimited tax school building bonds.

The deal, which is backed by the Permanent School Fund Guarantee Program, is rated AAA by S&P and Fitch.

Citi received the written award on the Ohio Housing Finance Agency’s $150 million of Series 2019A residential mortgage revenue bonds not subject to the alternative minimum tax for the mortgage-backed securities program.

The deal is rated Aaa by Moody’s.

In the competitive arena, the Florida Board of Education sold $74.685 million of Series 2019A lottery revenue refunding bonds. JPMorgan won the bonds with a true interest cost of 2.162%.

The deal is rated Aa3 by Moody’s, AAA by S&P and AA by Fitch.

“We're very happy today because JPMorgan paid a big price for our bonds and a low interest rate,”

The deal sold with a true interest cost of 2.16%, and generated $13.4 million in gross savings and $10.2 million in present value savings or 10% of refunded par. The day before pricing, Watkins said he expected around 9% in present value savings.

Bond sales

Connecticut

New Jersey

Florida

Texas

Hawaii

Ohio:

Bond Buyer 30-day visible supply at $6.35B

The Bond Buyer's 30-day visible supply calendar decreased $571.6 million to $6.35 billion for Thursday. The total is comprised of $2.37 billion of competitive sales and $3.98 billion of negotiated deals.

Muni money market funds see outflows again

Tax-free municipal money market fund assets decreased $1.16 billion, lowering their total net assets to $144.59 billion in the week ended Jan. 21, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds dropped to 0.90% from 0.98% last week.

Taxable money-fund assets gained $3.86 billion in the week ended Jan. 22, bringing total net assets to $2.867 trillion.

The average, seven-day simple yield for the 804 taxable reporting funds inched up to 2.04% from 2.03% last week.

Overall, the combined total net assets of the 994 reporting money funds increased $2.69 billion to $3.015 trillion in the week ended Jan. 22.

Secondary market

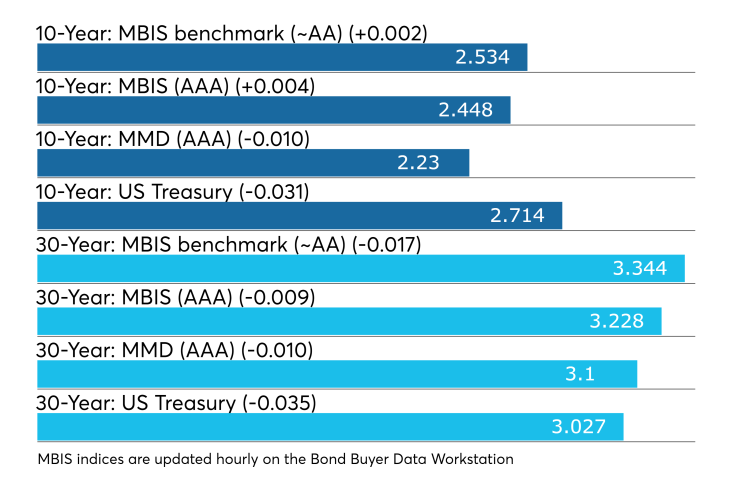

Municipal bonds were mostly stronger on Thursday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the five- to nine-year and 13- to 30-year maturities, rose as much as one basis point in the one- to four-year and 10- and 11-year maturities and remained unchanged in the 12-year maturity.

High-grade munis were also mostly stronger, with muni yields falling as much as one basis point in the five- to nine-year and 13- to 30-year maturities while rising as much as a basis point in the one- to four-year maturities.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation declining one basis point and the yield on 30-year muni maturity also dropping one basis point.

“High-grade municipal bond yields are in a holding pattern so far today,” ICE Data Services said in a Thursday market comment. “High-yield credits are faring somewhat better today. Yields are down generally in the one basis point range with positive buying metrics reported. Taxable yields are falling as well, slightly outperforming Treasuries, with yields as much as five basis point lower.”Treasury bonds were stronger as stock prices were mixed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 82.0% while the 30-year muni-to-Treasury ratio stood at 102.1%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

"It has been a slow start to the year, as supply and inventories are down and there have been some decent inflows into the funds," said one Southern trader. "However, even with Treasury firmness munis have been weaker this week."

He added that there have been some large bid lists this week that one could point to as a cause of the weakness, but the real culprit seems to be the really low ratios inside of 15 years. "It may not happen right away, but it feels like the market needs a readjustment to higher yields," he said.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,901 trades on Wednesday on volume of $12.58 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 16.895% of the market, the Empire State taking 12.863%, and the Lone Star State taking 10.795%.

ICI: Long-term muni funds see $1.69B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $1.69 billion in the week ended Jan. 16, the Investment Company Institute reported on Wednesday.

This followed an inflow of $1.95 billion from the tax-exempt mutual funds in the week ended Jan. 9.

Long-term muni funds alone saw an inflow of $1.96 billion while ETF muni funds saw an outflow of $265 million in the week ended Jan 16.

Taxable bond funds saw combined inflows of $7.63 billion in the latest reporting week after experiencing inflows of $4.35 billion in the previous week.

ICI said the total combined estimated inflows into all long-term mutual funds and exchange-traded funds were $6.35 billion for the week ended Jan. 16 after inflows of $38.35 billion in the prior week.

Treasury auctions announced

The Treasury Department on Thursday announced these auctions:

- $32 billion of seven-year notes selling on Jan. 29;

- $41 billion of five-year notes selling on Jan. 28;

- $40 billion of two-year notes selling on Jan. 28;

- $20 billion of two-year floating rate notes selling on Jan. 29;

- $26 billion of 364-day bills selling on Jan. 29;

- $39 billion of 182-day bills selling on Jan. 28; and

- $42 billion of 91-day bills selling on Jan. 28.

Treasury sells bills

The Treasury Department Thursday auctioned $45 billion of four-week bills at a 2.355% high yield, a price of 99.816833. The coupon equivalent was 2.392%. The bid-to-cover ratio was 2.78. Tenders at the high rate were allotted 9.48%. The median rate was 2.330%. The low rate was 2.300%.

Treasury also auctioned $35 billion of eight-week bills at a 2.370% high yield, a price of 99.631333. The coupon equivalent was 2.412%. The bid-to-cover ratio was 2.74. Tenders at the high rate were allotted 76.73%. The median rate was 2.345%. The low rate was 2.310%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.