The week ahead looks promising for buyers of municipal bonds.

"The prospects seem to continue to shine pretty well," said Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management. "Demand is very strong and although issuance is decent, there is still a lack of bonds to meet the demand."

He added that he thinks the yield curve 12-years and in is starting to get expensive, while the rest of the curve is unusually cheap.

"As we get closer and closer to tax season, I think people are not looking further out enough to where there is real value," he said. "Those who are underrated duration will be scrambling to get out long."

Heckman said the market would welcome additional supply, as calling of bonds has led to a constant drumbeat of money available for reinvestment.

"The only thing that would really create a increased supply would be if we continue to see a downdraft in rates," he said. "Even if we get an infrastructure bill, it won't come with much help from the Federal government and localities and municipalities will be own there own, like it has been."

Primary market

Ipreo forecasts weekly bond volume will hit $6.4 billion up from a revised total of $6.1 billion this week, according to updated data from Refinitiv. The calendar is composed of $4.96 billion of negotiated deals and $1.4 billion of competitive sales.

Bank of America Merrill Lynch is slated to price Washington, D.C.’s $941.48 million of general obligation bonds on Wednesday.

The bonds are rated Aaa by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

Goldman Sachs is expected to price the Dormitory Authority of the State of New York’s $845.05 million of Series 2019A tax-exempt and Series 2019B taxable and taxable green bonds on Tuesday.

The deal is rated Aa2 by Moody’s and AA-minus by S&P.

Citigroup is set to price Oregon’s $519 million of GOs on Wednesday, consisting of Series 2019A tax-exempts, Series 2019B taxable sustainability bonds, Series 2019C taxable bonds and Series 2019D tax-exempts.

The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

In the competitive arena, Texas is selling $159.965 million of GO college student loan bonds subject to the alternative minimum tax on Tuesday.

The financial advisors are Hilltop Securities and YaCari Consultants; the bond counsel are McCall Parkhurst and Mahomes Bolden.

The deal is rated AAA by S&P.

The state of Delaware is selling $250 million of GOs on Wednesday.

The financial advisor is PFM Financial Advisors; the bond counsel is Saul Ewing Arnstein.

The deal is rated triple-A by Moody’s and S&P.

Bond Buyer 30-day visible supply at $7.44B

The Bond Buyer's 30-day visible supply calendar increased $1.03 billion to $7.44 billion for Friday. The total is comprised of $1.97 billion of competitive sales and $5.47 billion of negotiated deals.

Lipper: Muni bond funds see inflows

Investors in municipal bond funds put more cash into them in the latest week, according to Lipper data released on Thursday.

The weekly reporters saw $1.149 billion of inflows in the week ended Feb. 6 after inflows of $1.064 billion in the previous week.

Exchange traded funds reported outflows of $378.137 million, after outflows of $239.027 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.528 billion after inflows of $1.303 billion in the previous week.

The four-week moving average remained positive at $998.486 million, after being in the green at $1.099 billion in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $712.920 million in the latest week after inflows of $546.399 million in the previous week. Intermediate-term funds had inflows of $604.747 million after inflows of $462.466 million in the prior week.

National funds had inflows of $1.013 billion after inflows of $802.305 million in the previous week. High-yield muni funds reported inflows of $296.447 million in the latest week, after inflows of $295.001 million the previous week.

Secondary market

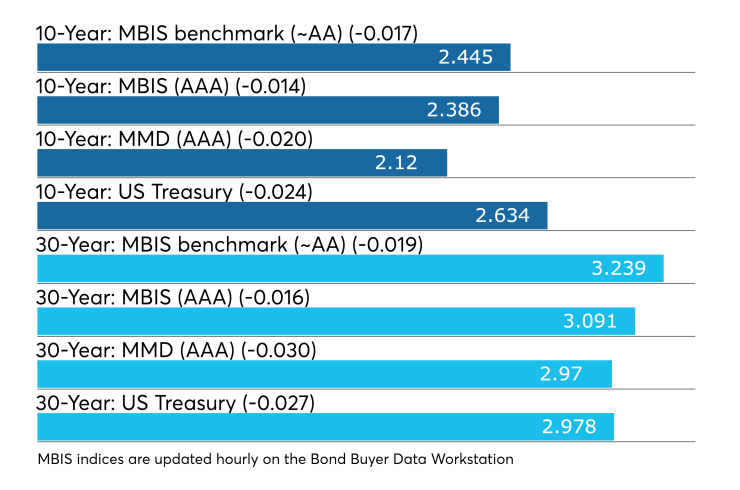

Municipal bonds were stronger Friday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as four basis points in the one- to 30-year maturities.

High-grade munis were also stronger, with muni yields falling as much as six basis points across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation dropping two basis points while the yield on the 30-year muni maturity fell three basis points.

Treasury bonds were stronger as stock prices traded lower.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 80.6% while the 30-year muni-to-Treasury ratio stood at 100.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

“The broader muni curve is yielding two basis points less from 2031 and longer with the shorter end of the curve yielding 1bp less,” ICE Data Services said in a market comment. “High-yield is also one basis point lower in yield across the curve. Tobaccos are flat to one basis point lower in yield as well. The taxable side of the market is firmer with yields down as much as 4.4 basis points in the 10-year.”

Previous session's activity

The Municipal Securities Rulemaking Board reported 44,195 trades on Thursday on volume of $18.34 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 18.765% of the market, the Empire State taking 11.449% and the Lone Star State taking 10.628%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Feb. 8 were from Puerto Rico and New York issuers, according to

In the GO bond sector, the Puerto Rico 5s of 2041 traded 19 times. In the revenue bond sector, the New York Metropolitan Transportation Authority 4s of 2020 traded 190 times. In the taxable bond sector, the Puerto Rico GDB Debt Recovery Authority 7.5s of 2040 traded 17 times.

Week's actively quoted issues

Puerto Rico, New Jersey and Illinois names were among the most actively quoted bonds in the week ended Feb. 8, according to Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 5.25s of 2041 were quoted by 89 unique dealers. On the ask side, the New Jersey Turnpike Authority revenue 4s of 2048 were quoted by 244 dealers. Among two-sided quotes, the Illinois taxable 5.1s of 2033 were quoted by 24 dealers.

Rate outlook, January review

A pause in further interest rate hikes should help the municipal market by avoiding any “premature” conclusion to the recovery cycle, and could actually support an extended duration, while at the same time reduce the risk of market dislocation, according to a new report from Oppenheimer & Co. Inc.

In addition, municipal outperformance should continue to be supported by the recent strength and upward pricing direction among tax-exempt and Treasury securities.

“We suspect that the Fed can afford to pause through the first half of 2019 in order to appropriately interpret the incoming data and provide the financial markets with sufficient breathing room,” Jeffrey Lipton, head of municipal research and strategy and municipal capital markets, wrote in a weekly report.

Wage growth and overall inflationary pressure will be on the firm’s radar screen and act as a central gauge of whether or not the Fed should resume its tightening sequence, Lipton noted.

He said municipal bond market participants were tentative ahead of last week’s Federal Open Market Committee meeting, adding that they responded favorably to both the policy statement and Powell’s “patient bias and an overall dovish tone.”

“Munis have been moving directionally with U.S. Treasury securities given the better message now being telegraphed by the Fed and the strong technical backdrop helps to support overall muni outperformance relative to UST,” his report stated.

Overall, demand is healthy and should continue given the current market climate, according to Lipton.

“Municipal bond mutual fund flows have been positive throughout January and we expect this trend to continue over the near-term,” Lipton wrote. “For the year, we expect fund flows to finish in a net-positive position.”

On the redemption front, approximately $416 billion of maturing securities and potentially callable bonds are expected throughout 2019, according to Lipton, citing Bloomberg data.

He noted that coupon reinvestment needs also help to shape demand patterns.

“Last year, gross volume totaled about $340 billion and we are forecasting 2019 new issue supply to be in a range of $350-$360 billion,” he predicted. “Based upon these numbers, the technical conundrum should be a critical determinant of muni bond performance this year,” he added.

On the political front, he said the absence of new legislation threatening the municipal tax exemption or other aspects of the asset class in 2019 will also “lend a stabilizing force to the performance trajectory.”

“If anything, we are seeing proposals from democratic presidential hopefuls that are targeting new taxes for ultra-wealthy taxpayers and while these platform items are a long way from becoming reality, if at all, this type of rhetoric could help to create intermittent performance gains,” Lipton pointed out.

He noted that the one-year maturity showed negative price return in January as a result of strong reinvestment demand from December’s maturing securities and redemptions, and the uncertainty of Central Bank policy created further deployment into short maturities.

“There was out-sized cash looking for a home, but the elevated richness of short paper made finding a viable home very difficult when looking at tax-adjusted comparisons to UST,” Lipton explained. “The SIFMA Swap Index dropped significantly during this time.”

Currently, Lipton said opportunities can be found in the healthcare sector among multi-state and multi-site systems that “demonstrate balance sheet prowess, maintain a strong and competitive geographic footprint, produce consistently positive operating margins, and that can better respond to a complete dismantling of the Affordable Care Act.”

“Under a complete repeal scenario, many not-for-profit hospitals will come under heavier operating pressure given the now greater universe of uninsured patients that will likely draw upon provider resources and the potential for a rise in bad debt expenses,” he cautioned. “The health care sector may very well demonstrate wider credit spreads in 2019 as the convergence of these various headwinds intensify.”

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.