A federal court decision enjoins the state from enforcing a 2021 law that penalizes investment banks and others for "boycotting" the fossil fuel industry.

-

"MSRB is committed to ensuring our regulatory framework keeps pace with an evolving market," MSRB Board Chair Natasha Holiday said.

-

Mayors across the country are taking closer looks at data center deals as a way to pay for the infrastructure they require.

-

"These municipal bond schemes improperly divert new issue bonds to bad actors at the expense of bona fide retail investors," FINRA's Meghan Ferguson said.

-

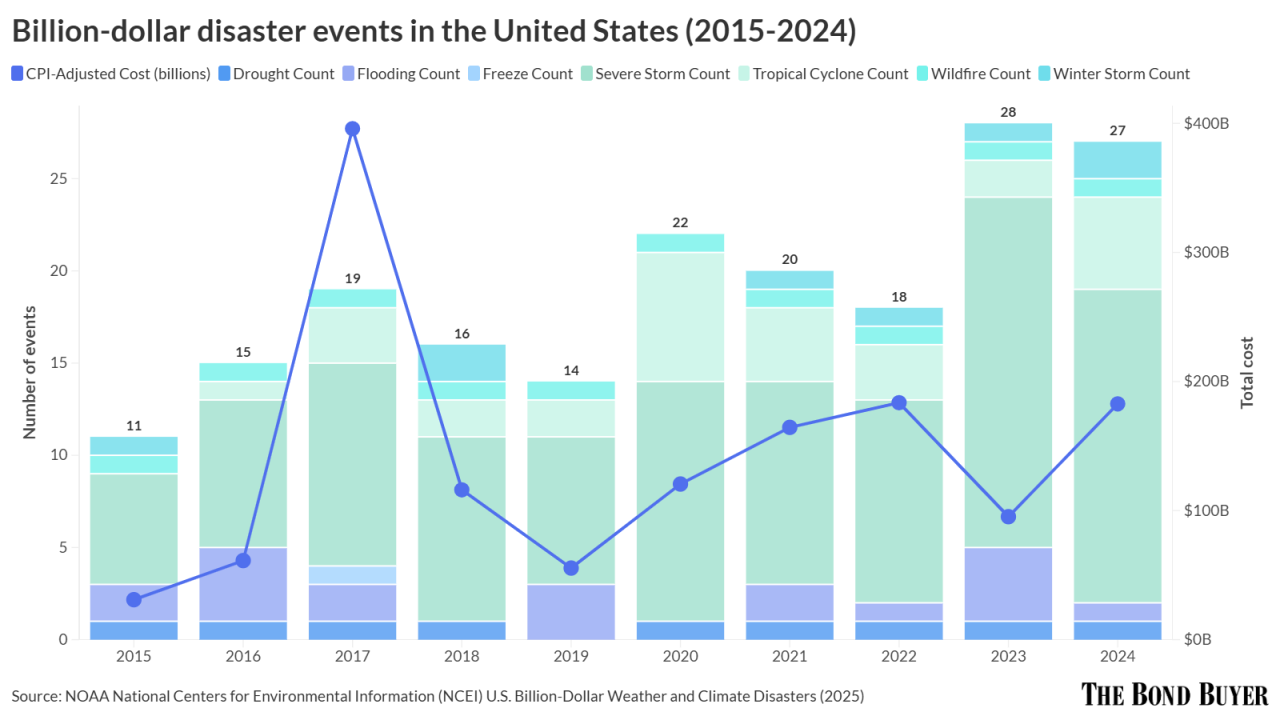

As climate and cybersecurity risks intensify, Jeff Lipton argues it's time for the legal community to lead a new era of municipal disclosure — tightening language, clarifying exposures, and ensuring investor confidence.

-

Jeff Lipton begins his role as The Bond Buyer's Market Intelligence Analyst with an examination of how evolving federal policy, shifting credit conditions and market inefficiencies shape municipal risk — and where disciplined analysis can uncover value.

Market Intelligence analyst Jeff Lipton analyzes how varied state funding priorities and overall charter school support, shifting enrollment patterns, policy uncertainty, charter renewal risk, and varied pension practices affect charter school bond security—and outlines what issuers, advisors and investors should be communicating to the market.

The governor, in the final year of his term, asked lawmakers to approve reforms that would fix the Virgin Islands Water and Power Authority's balance sheet.

Metro is considering a public-private partnership to deliver what is its largest project to date.

Public finance advocates are trying to interpret mixed signals about plans to pass a major reconciliation bill that could put the threat to the tax-exempt status of munis back on the table.

Former WMATA CFO Yetunde Olumide has joined the MSRB as its chief financial officer.

-

In the coming year, we'll find out if public pension disclosure and transparency have improved enough to protect municipal bond investors.

-

Just as the economy could become topsy turvy, so could the municipal market.

-

It is sadly not possible to prevent 100% fraud scenarios from occurring; however, reassessing your firm's processes for identifying red flags may be a good place to start.

-

"There's a tremendous amount of teamwork, both within an organization and then among all of the working group members," Eileen Heitzler said. "And the end result is a project with a public purpose."

-

Hinojosa has built a strong reputation for creative solutions to complex challenges in the public finance arena, according to a statement nominating him for the honor.

-

The deputy treasurer of the Commonwealth of Massachusetts will be inducted into The Bond Buyer's Hall of Fame of Municipal Finance in Boston on Sept. 30.

Since joining Ramirez's Texas public finance banking team six years ago, Sara Cheek has participated in more than $50 billion of bond issuances for various clients across Texas.

Conza has led multiple financings for the airport's multibillion dollar capital program as he strategically plans for future aviation needs that serve both the local community and air travelers.

Steve Thody from JFK Millennium Partners accepts the 2025 Deal of the Year award for Green Financing.

-

-

Wisconsin Republican Ron Johnson formed a Senate subcommittee to investigate the Los Angeles fires at the request of Sen. Rick Scott, R-Fla.

-

Moody's Ratings downgraded Parkview Health System's revenue bond rating one notch, to A1 from Aa3, on Friday. It also revised the outlook to stable.

-

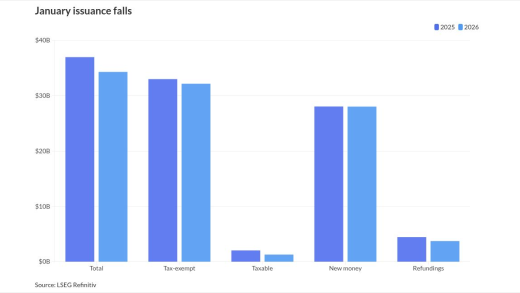

The market is well-positioned for February, after January's near-record tax-exempt supply, said J.P. Morgan strategists led by Peter DeGroot.

-

The White House releases a report that leans into ending state income tax while tax experts question the math used to make the case.

-

Issuance was $34.308 billion in 471 issues, down 7.2% year-over-year from $36.982 billion across 536 transactions in 2025. However, this was the third-highest monthly figure for January and above the month's 10-year average of $29.699 billion

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Intraday News UpdateDelivered Every WeekdayGet notified on breaking news and events.

- Primary Market ReportWeeklyRecap of articles on new issuance as well as Featured Deals on the week.

- Weekly Top 10WeeklyRecap of the 10 most read Bond Buyer articles of the past week.

- ON-DEMAND VIDEO

KC Mathews, executive vice president and chief market strategist at Commerce Trust breaks down the FOMC meeting.

- ON-DEMAND VIDEO

Pamela Frederick and Adam Barsky will share their views on the importance of the tax-exemption, how it benefits state and local governments, taxpayers, and U.S. retail investors -- and keeps the country competitive on a global scale.

- ON-DEMAND VIDEO

Gary Hall, President of the Infrastructure & Public Finance Division at Siebert Williams Shank & Co., joins Bond Buyer Executive Editor Lynne Funk to talk about the importance of the muni industry in financing the country's extensive infrastructure needs -- from ports and airports to bridges and energy solutions.