-

After a wild and crazy week that saw the yield curve invert for the first time in 12 years, recession talk, and record lows for muni yields — there was a much calmer tone on Friday.

August 16 -

The municipal bond market took a breather on Thursday as the last of the week’s larger deals came and went.

August 15 -

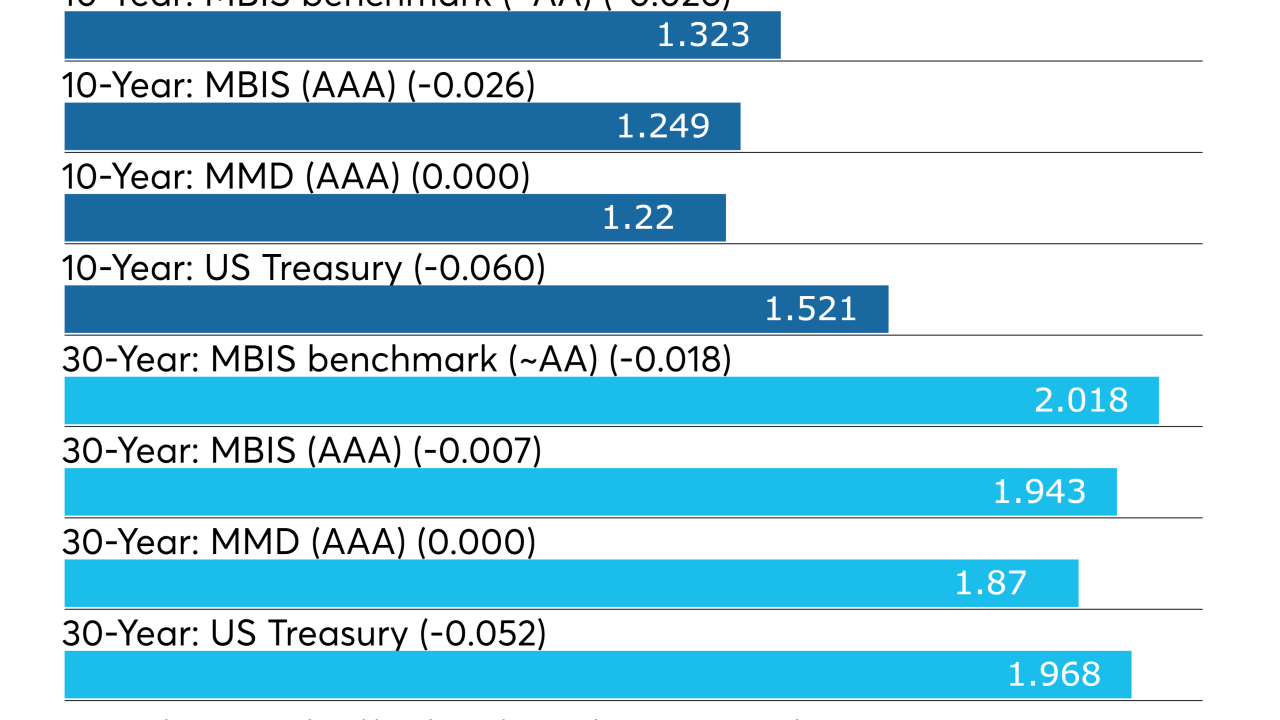

Municipal bonds continued their rally on Wednesday, and pushed tax-free yields to their lowest levels ever.

August 14 -

Deals from Texas and Virginia led the slate of new issues that hit the market on Tuesday.

August 13 -

MarketAxess Holdings will buy LiquidityEdge for $150 million.

August 13 -

Nuveen and AllianceBernstein say Warlander Asset Management may be using the lawsuit to generate an "enormous profit" from credit default swaps.

August 13 -

Issuers and buyers will both be watching the direction bond yields take this week.

August 12 -

After effortlessly taking down $13.2 billion of bonds this past week, muni buyers will see another above-average issuance week with $7.6B.

August 9 -

The market picked up right where it left off on Wednesday — with unwavering demand from investors.

August 8 -

The bond market had no problems whatsoever digesting the primary and in the process saw yields drop down ever lower, getting ever closer to all-time lows.

August 7